Market Overview

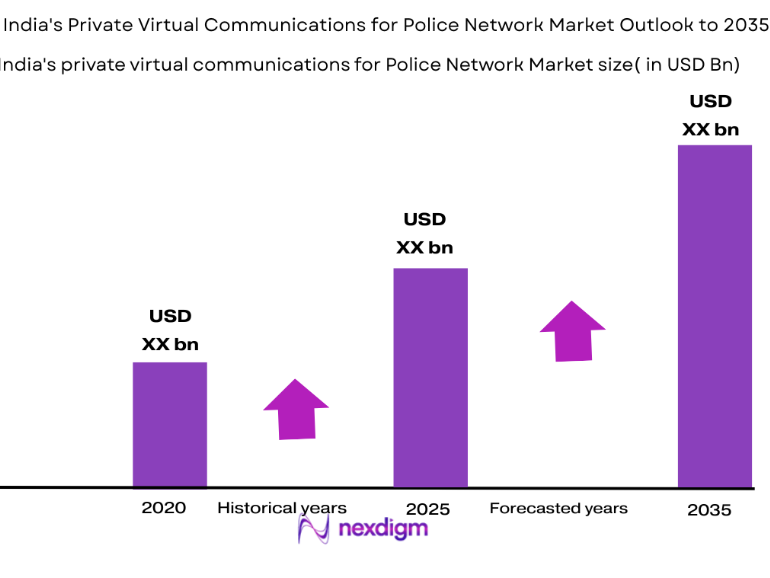

The India private virtual communications for police network market are experiencing growth, driven by increasing demand for secure, reliable, and scalable communication systems. The market size, based on a recent historical assessment, is valued at approximately USD ~ million, with substantial investments directed towards modernizing law enforcement communication infrastructure. The adoption of private 5G, LTE, and hybrid communication solutions has become critical in ensuring secure and uninterrupted police operations across urban and rural areas.

Major cities like New Delhi, Mumbai, and Bengaluru dominate the market due to their significant investments in technology and public safety. These cities have a large concentration of law enforcement agencies, which drives demand for advanced communication systems. The increasing emphasis on urbanization, smart city projects, and government initiatives like Digital India further fuel the adoption of such systems. These regions also benefit from well-established infrastructure and a growing focus on public-private partnerships in the security and telecom sectors.

Market Segmentation

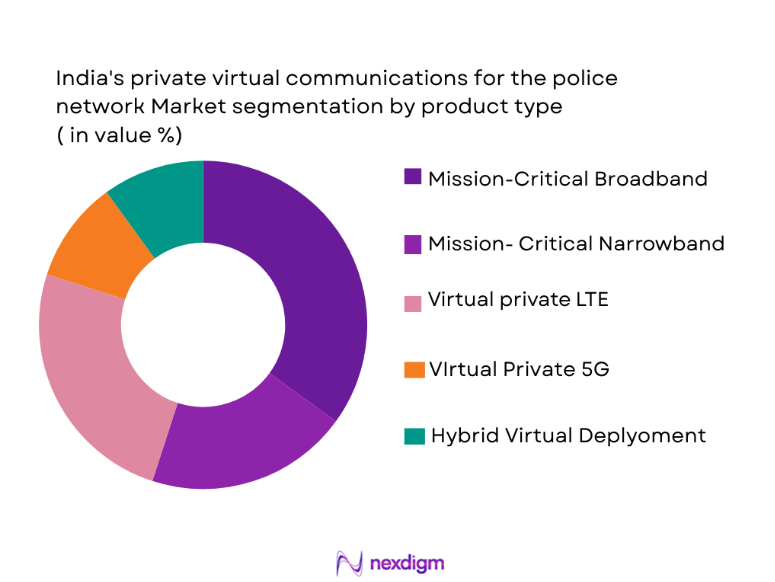

By Product Type

The India private virtual communications for police network market are segmented by product type into mission-critical broadband, mission-critical narrowband, virtual private LTE, virtual private 5G, and hybrid virtual deployments. The dominant sub-segment in this market is mission-critical broadband, which is leading the market share due to factors like growing demand for high-speed data and video services, integration with real-time analytics, and the increasing need for larger bandwidth in police operations. This sub-segment benefits from technological advancements, improved network reliability, and security, which are crucial for mission-critical police communication. The ability to support high-definition video surveillance and data transfer has become indispensable for modern law enforcement operations, further promoting the dominance of broadband solutions in this market.

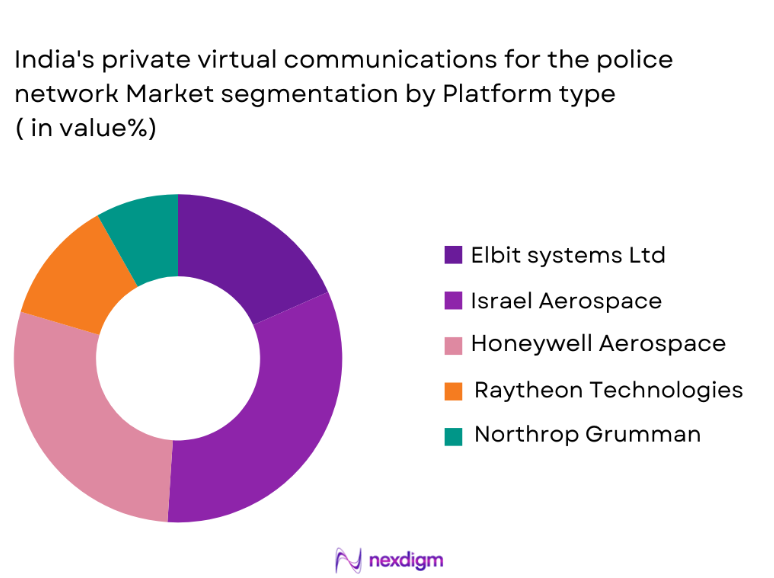

By Platform Type

The market for India private virtual communications for police networks is segmented by platform type into handheld devices, vehicular systems, body-worn cameras with comms, fixed infrastructure nodes, and command center solutions. Handheld devices dominate this segment due to their portability, ease of use, and widespread deployment in law enforcement. These devices, which are increasingly equipped with advanced communication features, enable officers to communicate securely and instantly, facilitating faster response times during emergencies. The demand for robust and durable handheld devices that can handle adverse field conditions is driving the growth of this sub-segment. With continued innovation in battery life, integration with real-time video and audio features, and enhanced security protocols, handheld devices will continue to lead the market.

Competitive Landscape

The competitive landscape for the India private virtual communications for police network market is marked by the presence of key players such as Ericsson, Huawei, and Nokia, along with several regional telecom and security companies. These players are engaged in providing comprehensive solutions ranging from private LTE and 5G networks to end-to-end integrated communication systems for law enforcement agencies. Consolidation within the market is evident, with large global players forming strategic alliances with local companies to meet the specific needs of Indian police forces, offering advanced network infrastructure and support services. The market is becoming increasingly competitive as new players introduce innovative technologies like AI-driven analytics and edge computing for enhanced police operations.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue |

| Ericsson | 1876 | Stockholm, Sweden | ~ | ~ | ~ | ~ |

| Huawei | 1987 | Shenzhen, China | ~ | ~ | ~ | ~ |

| Nokia | 1865 | Espoo, Finland | ~ | ~ | ~ | ~ |

| Tata Communications | 1986 | Mumbai, India | ~ | ~ | ~ | ~ |

| HFCL Limited | 1987 | New Delhi, India | ~ | ~ | ~ | ~ |

India Private Virtual Communications for Police Network Market Analysis

Growth Drivers

Rapid Digitalization of Law Enforcement Operations

The rapid digitalization of law enforcement operations has been a significant growth driver for the India private virtual communications for police network market. The government’s focus on modernizing police forces through the use of digital tools, including cloud computing, big data analytics, and secure communication networks, is pushing the adoption of private communication networks. As police departments adopt new technologies for managing and responding to emergencies, they need reliable communication systems to support real-time information sharing. This digital transformation is seen across the nation as police forces shift away from traditional communication methods toward modern, integrated communication platforms. This has not only led to better response times and coordination during emergencies but has also enhanced the overall effectiveness of law enforcement operations. Furthermore, digitalization aids in the seamless integration of various police departments and agencies, helping to reduce information silos. For instance, cloud-based communication systems allow for quicker dissemination of critical information across the country. Additionally, with government initiatives like the Digital India program, the entire police infrastructure is evolving towards greater automation, increasing the demand for advanced communication systems. As digital tools become more commonplace in police forces, the need for secure and robust communication networks is increasing, directly driving market growth. This shift towards modern communication methods is essential for law enforcement agencies to tackle emerging challenges such as cybercrime, terrorism, and urban crime effectively.

Government Support for Public Safety Initiatives

The government’s continued support for public safety initiatives has played a pivotal role in the growth of the India private virtual communications for police network market. With the increasing threat of terrorism, civil unrest, and natural disasters, the government has focused on improving the communication systems used by law enforcement agencies. Private virtual communication systems offer enhanced security, encryption, and speed, all of which are crucial for effective coordination in high-pressure situations. The government has been heavily involved in funding and supporting projects that modernize police communication systems across states and regions. These public safety programs ensure that police agencies can respond quickly and effectively to emergencies. The rise of smart cities, under the Smart Cities Mission, further strengthens this driver by incorporating advanced communication systems into urban infrastructure. The implementation of these advanced networks is essential for managing public safety in rapidly growing urban centers. Additionally, government policies promoting cybersecurity and data protection have created an environment where secure communication systems are a priority. Public-private partnerships have been instrumental in facilitating the transition to more robust, high-performance networks, further accelerating the adoption of private virtual communications. As the need for seamless and secure communication between law enforcement agencies intensifies, government efforts to support the digital transformation of public safety systems continue to drive market demand.

Market Challenges

Integration with Legacy Systems

One of the major challenges faced by the India private virtual communications for police network market is the integration with legacy systems. Many police forces in India still rely on outdated communication infrastructure that is not compatible with modern, digital communication systems. This makes it difficult to introduce new technologies such as 5G or LTE networks into the existing network infrastructure. Upgrading these legacy systems requires substantial investment in both time and resources, which many departments may not have available. Furthermore, there are concerns about interoperability between old and new systems, which can lead to communication failures and delays in critical situations. For law enforcement agencies to fully benefit from private virtual communication networks, these legacy systems need to be modernized, which is a complex and costly process. The inability to seamlessly integrate with legacy systems could lead to a slower adoption of advanced communication technologies in police networks, impacting operational efficiency. Another challenge is the training required for police personnel to effectively use these new technologies. Officers must be familiar with both the new systems and the old infrastructure, creating a potential barrier to effective communication during critical operations.

Regulatory and Security Concerns

The regulatory environment and security concerns present additional challenges for the adoption of private virtual communications in police networks. Strict regulations governing spectrum allocation, data privacy, and encryption requirements make it challenging for private companies to deploy communication systems that comply with government standards. The need for high-level encryption and secure communication platforms adds another layer of complexity, particularly when dealing with sensitive law enforcement data. Given the nature of police operations, any breach in communication security could have severe consequences, including the exposure of confidential information related to ongoing investigations, informants, or operational tactics. Moreover, the regulatory landscape surrounding data protection laws is continually evolving, and companies need to ensure that their communication solutions are adaptable to these changing standards. The government’s policy regarding the allocation of spectrum for private communications also impacts on the market, with competition for bandwidth affecting the availability of optimal network resources. As the demand for high-quality communication systems grows, managing these regulatory and security challenges will be crucial to ensure the successful implementation of private virtual networks in law enforcement. Compliance with these standards is not only essential for maintaining the integrity of police operations but also for ensuring that the systems meet the government’s requirements for national security and public safety.

Opportunities

Integration of AI and Big Data Analytics for Real-time Decision Making

One significant opportunity in the India private virtual communications for police network market lies in the integration of AI and big data analytics to enhance real-time decision-making in police operations. As police forces adopt more sophisticated communication technologies, they can also leverage AI and analytics to process large volumes of data in real-time, providing critical insights during emergencies. By integrating AI algorithms with communication systems, law enforcement agencies can predict and analyze crime patterns, detect potential threats, and enhance situational awareness. Real-time video analytics, facial recognition, and predictive policing are areas where AI can significantly improve decision-making, helping law enforcement agencies act proactively. These technologies can also optimize communication systems by reducing network congestion, prioritizing critical communications, and streamlining data flows across multiple channels. With India’s increasing focus on smart cities and digital policing, there is ample opportunity for police agencies to adopt these technologies to improve safety, prevent crimes, and streamline investigations. The integration of AI into private virtual communication networks presents an opportunity to create smarter, more responsive police systems that can adapt to rapidly changing situations and deliver better outcomes for public safety.

Development of Next-Generation 5G Networks for Enhanced Connectivity

The development of next-generation 5G networks presents a major opportunity for the India private virtual communications for police network market. With 5G, law enforcement agencies will be able to deploy ultra-low latency, high-bandwidth communication solutions that support more advanced applications such as real-time video streaming, augmented reality (AR) for tactical operations, and enhanced connectivity for IoT-enabled devices. The high speeds and low latency of 5G networks will enable faster, more reliable communication between officers, command centers, and emergency responders, improving response times during critical situations. The deployment of 5G networks can also support more robust surveillance systems, drone operations, and connected vehicle fleets, which will be integral to modernizing law enforcement agencies. The adoption of 5G will also create new opportunities for law enforcement to engage in collaborative initiatives with other public and private sector organizations, enhancing public safety on a larger scale. As the Indian government pushes for the roll-out of 5G services, police networks will be a key beneficiary of this technology, enabling them to meet the growing demand for high-performance communications systems. The anticipated availability of 5G networks in urban and rural areas will drive the expansion of private virtual communications solutions, creating a significant opportunity for vendors in this market.

Future Outlook

Over the next five years, the India private virtual communications for police network market are expected to experience strong growth, driven by advancements in 5G, AI, and cloud technologies. Regulatory support for digital policing and smart city initiatives will further accelerate the demand for robust communication infrastructure in law enforcement. These advancements will enhance connectivity, improve operational efficiency, and provide real-time data analytics for better decision-making. Growing investments and a focus on national security will continue to shape the market’s trajectory.

Major Players

- Ericsson India

- Huawei India

- Nokia Solutions and Networks India

- Cisco Systems India

- Samsung Networks India

- CommScope India

- HFCL Limited

- Tata Communications

- Reliance Jio Platforms

- Bharti Airtel Enterprise

- Tejas Networks

- Sterlite Technologies

- ESRI India (for GIS integrations)

- Hexacom Networks

- ZTE India

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Law enforcement agencies

- Private telecom providers

- Network infrastructure providers

- System integrators

- Technology solution providers

- Emergency response service providers

Research Methodology

Step 1: Identification of Key Variables

We define the key variables impacting the market, such as government initiatives, technological advancements, and regulatory frameworks.

Step 2: Market Analysis and Construction

The market analysis involves examining the adoption of communication technologies within law enforcement, including the role of private networks.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses through expert consultations with law enforcement agencies and technology providers.

Step 4: Research Synthesis and Final Output

The final report synthesizes insights from secondary research, primary interviews, and expert opinions to produce actionable market insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rapid digitization of police operations and data needs

Demand for secure and interoperable communications systems

Government emphasis on public safety modernization

Technological advances in private wireless and 5G

Need for real-time situational awareness and analytics - Market Challenges

Spectrum allocation and regulation issues

Security and privacy concerns in virtual networks

Skill gaps for deployment and maintenance - Market Opportunities

Adoption of 5G private networks with edge computing for AI analytics

Public-private collaborations for technology deployment

Integration with national emergency response frameworks - Trends

Shift from narrowband to broadband mission-critical services

Increased use of IoT sensors and video analytics

Cloud-native and virtualized network functions

multi-agency interoperability platforms

Adoption of AI-driven communication optimization - Government Regulations & Defense Policy

National Telecom policies affecting private networks

Law enforcement data protection and encryption standards

Spectrum licensing frameworks for private 5G - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Mission-critical broadband

Mission-critical narrowband

Virtual private LTE

Virtual private 5G

Hybrid virtual deployments - By Platform Type (In Value%)

Handheld devices

Vehicular systems

Body-worn cameras with comms

Fixed infrastructure nodes

Command center solutions - By Fitment Type (In Value%)

New deployments

Upgrades and modernization

Temporary deployment for events

Redundant/resilience networks

Interoperability add-ons - By EndUser Segment (In Value%)

State police forces

Central armed police forces

Specialized enforcement units

Traffic and transport police

Intelligence units - By Procurement Channel (In Value%)

Government tenders

Public-private partnerships

Direct vendor sales

System integrator contracts

Leasing and managed services - By Material / Technology (in Value%)

Software defined radios

Edge computing nodes

Network virtualization platforms

Security and encryption tech

Cloud integration platforms

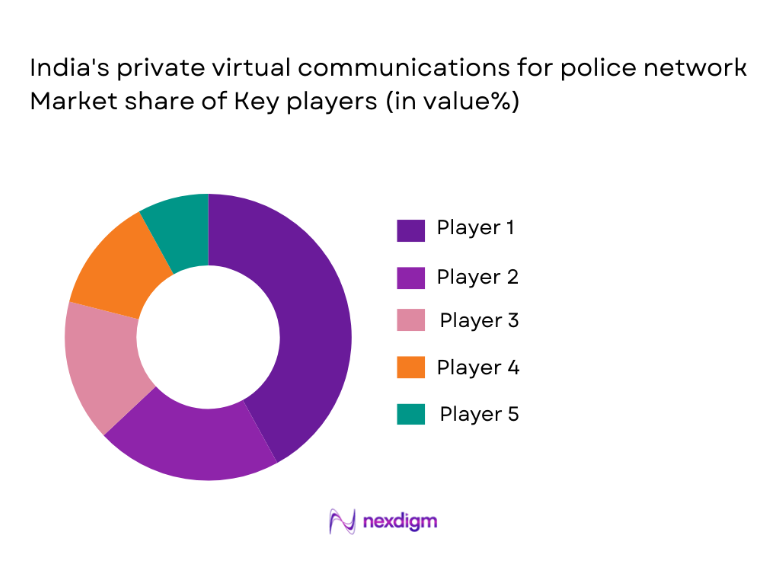

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Technology breadth, Deployment footprint, Security features, Integration capability, Cost efficiency, Support services, Compliance, Innovation index, Scalability, Customer base)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Ericsson India

Huawei India

Nokia Solutions and Networks India

Cisco Systems India

Samsung Networks India

CommScope India

HFCL Limited

Tata Communications

Reliance Jio Platforms

Bharti Airtel Enterprise

Tejas Networks

Sterlite Technologies

ESRI India (for GIS integrations)

Hexacom Networks

ZTE India

- State policing requirements for digital communications

- Central forces need for coordinated multi-jurisdictional networks

- Specialized units’ demand for high-bandwidth video and analytics

- Traffic enforcement reliance on connected vehicle data exchange

- Forecast Market Value, 2026–2035

- Forecast Installed Units, 2026–2035

- Price Forecast by System Tier, 2026–2035

- Future Demand by Platform, 2026–2035