Market Overview

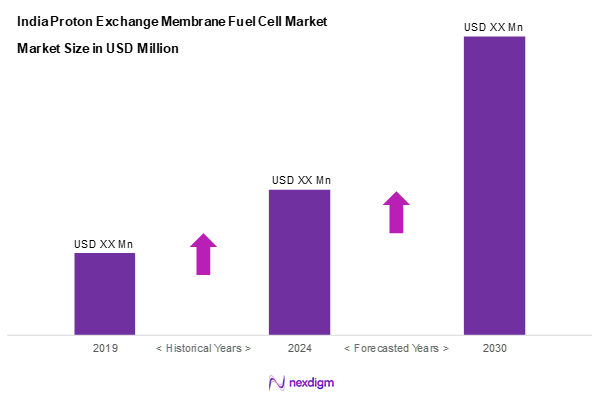

As of 2024, the India proton exchange membrane fuel cell market is valued at USD 218.1 million, with a growing CAGR of 21.1% from 2024 to 2030, driven by increasing environmental concerns and technological advancements in the renewable energy sector. This market growth is supported by government incentives aimed at promoting clean energy solutions, making it an attractive area for investment. As sectors such as transportation and industrial applications grow increasingly reliant on sustainable energy sources, the demand for fuel cells is expected to rise significantly.

Key cities such as Bangalore, Hyderabad, and Pune dominate the market due to their robust industrial infrastructure, investment in research and development, and proximity to manufacturing hubs. Furthermore, government policies specifically targeting clean energy initiatives in these regions contribute to their prominence in the proton exchange membrane fuel cell market, fostering an ecosystem conducive to innovation and growth.

Market Segmentation

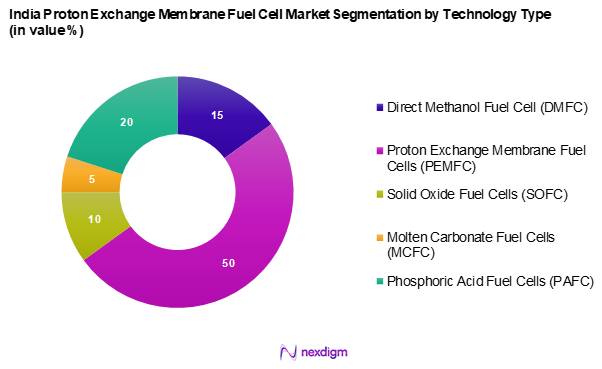

By Technology Type

India proton exchange membrane fuel cell market is segmented by technology type into Direct Methanol Fuel Cell (DMFC), Proton Exchange Membrane Fuel Cells (PEMFC), Solid Oxide Fuel Cells (SOFC), Molten Carbonate Fuel Cells (MCFC), and Phosphoric Acid Fuel Cells (PAFC). Among these, PEMFC is the dominant segment, driven by its high efficiency, quick start-up time, and capability to operate at lower temperatures compared to other technologies. The widespread adoption in automotive applications, especially in electric vehicles, has bolstered its market presence significantly as manufacturers prioritize performance and environmental sustainability.

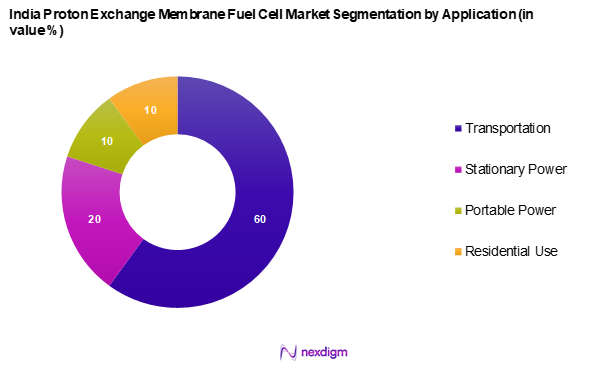

By Application

India proton exchange membrane fuel cell market is segmented into transportation, stationary power, portable power, and residential use. The transportation segment leads the market, primarily due to the increasing demand for clean energy solutions in electric and hybrid vehicles. Governments are actively promoting fuel cell vehicles as part of their commitment to reducing air pollution and carbon emissions, encouraging automotive companies to invest heavily in this technology and contribute to its dominance over other applications.

Competitive Landscape

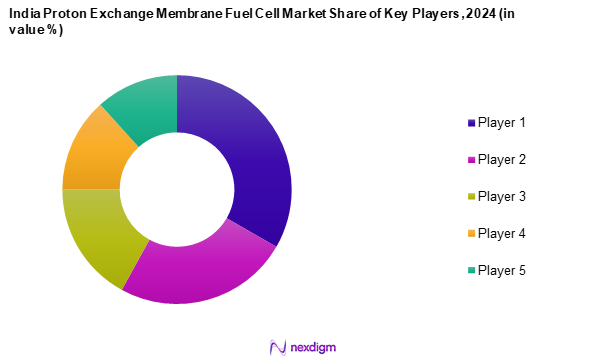

The India proton exchange membrane fuel cell market is dominated by several key players, including Ballard Power Systems, Plug Power, Cummins, Intelligent Energy, and Bloom Energy. The consolidation of these major companies indicates significant influence over market dynamics, fostering innovation and competitive pricing strategies within the sector.

| Company | Establishment Year | Headquarters | Technology Focus | Revenue (USD Mn) | Market

Share |

| Ballard Power Systems Inc. | 1979 | Canada | – | – | – |

| Plug Power Inc. | 1997 | USA | – | – | – |

| Cummins Inc. | 1919 | USA | – | – | – |

| Intelligent Energy Limited | 2001 | UK | – | – | – |

| Bloom Energy | 2001 | USA | – | – | – |

India Proton Exchange Membrane Fuel Cell Market Analysis

Growth Drivers

Increasing Environmental Concerns

Increasing environmental concerns related to air pollution and climate change are propelling the demand for cleaner energy alternatives, including PEMFC technology. India is one of the world’s top five greenhouse gas emitters, with carbon dioxide emissions anticipated to reach approximately 3.2 billion tons. The urgency for cleaner mobility options is underscored by the WHO’s data indicating that 51% of air pollution-related deaths in India are linked to vehicular emissions. As environmental initiatives gain momentum, the emphasis on hydrogen fuel cell technology aligns with global sustainability goals, impacting both urban and rural rollout strategies for cleaner energy vehicles.

Technological Advancements

Rapid advancements in fuel cell technology significantly contribute to the growth of the India PEMFC market. The efficiency of PEMFCs has been improving, with new innovations enhancing power output and longevity. For instance, as of 2023, research indicates several fuel cell systems are achieving efficiency levels nearing 60% in automotive applications. The increasing integration of advanced materials and performance monitoring systems keeps operational costs competitive. This momentum is supported by various R&D projects funded by both public and private institutions, reinforcing the technology’s viability and reliability for mass adoption.

Market Challenges

High Initial Costs

Despite the advantages of PEMFCs, the high initial costs associated with hydrogen fuel cell technology present a significant barrier to market growth. Fuel cell systems can cost approximately USD 1,000 per kW installed capacity. The price of associated components, such as hydrogen storage systems, adds to these expenses, making the initial investment a challenge for consumers and companies alike. Currently, the high manufacturing costs stem from the use of precious metals like platinum as catalysts, which further complicate cost reduction strategies. Overcoming this challenge is essential for widespread adoption and participation in the market.

Limited Infrastructure

The lack of infrastructure for hydrogen production, storage, and distribution remains a critical challenge for the growth of the PEMFC market in India. Currently, the number of hydrogen fueling stations in India is extremely limited, with only a few operational facilities located primarily in metropolitan areas like Delhi and Mumbai. The existing reliance on fossil fuels and inadequate infrastructure hinders the potential of fuel cell vehicles, which rely on efficient and widespread hydrogen access. Thus, expanding infrastructure is vital to support the growth of PEMFC technology in India.

Opportunities

Expansion in Emerging Markets

Expansion into emerging markets presents compelling opportunities for the PEMFC sector in India. The global demand for hydrogen as a clean energy source is projected to grow significantly, with the Asian market for hydrogen anticipated to exceed USD 2.5 billion by 2025 due to increased industrial demand and sustainable energy initiatives. India, as part of this momentum, aims to integrate hydrogen fuel cells for various applications, including public transport and logistics. By aligning with initiatives like the National Hydrogen Mission, which aims to establish India as a global hub for hydrogen production by promoting R&D, the country is well-poised to capitalize on this opportunity. Expansion into these markets not only enhances energy security but also positions India as a key player in global hydrogen technology, attracting international investments.

Increasing Investment in R&D

The growing emphasis on research and development (R&D) within the hydrogen sector presents notable growth opportunities for India’s PEMFC market. In recent years, total R&D investment in clean energy technology has surpassed INR 3,500 crore (approximately USD 475 million). Government-led initiatives and collaborations with private entities are focusing on developing more efficient fuel cell technologies. This financial backing allows researchers to advance hydrogen production and storage technologies further, effectively making hydrogen a more attractive option for energy generation and automotive applications in the future. By optimizing energy conversion and reducing costs, enhanced R&D efforts are likely to trigger accelerated market growth.

Future Outlook

Over the next five years, the India proton exchange membrane fuel cell market is poised for substantial growth, driven by advancements in fuel cell technology, increasing investments in clean energy infrastructure, and widespread acceptance of hydrogen-based solutions. As consumers become more environmentally conscious and governments push for stricter emissions regulations, the market is expected to expand, presenting opportunities for innovation and collaboration among industry players.

Major Players

- Ballard Power Systems Inc.

- Plug Power Inc.

- Cummins Inc.

- Intelligent Energy Limited

- AVL List GmbH

- Bloom Energy

- Ceres Power Holdings PLC

- Doosan Fuel Cell America, Inc.

- FuelCell Energy, Inc.

- Hydrogenics Corporation

- ITM Power PLC

- PowerCell Sweden AB

- Oxford Instruments PLC

Key Target Audience

- Industry Manufacturers

- Automotive Companies

- Energy and Utility Providers

- Research Institutions

- Investments and Venture Capitalist

- Government and Regulatory Bodies (Ministry of New and Renewable Energy, Bureau of Energy Efficiency)

- Infrastructure Developers

- Environmental Consultancies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves outlining an ecosystem map that includes all major stakeholders within the India proton exchange membrane fuel cell market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to accumulate comprehensive industry information. The primary goal is to discern and define critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertinent to the India proton exchange membrane fuel cell market will be compiled and analysed. This includes assessing market penetration rates, ratios of service providers to marketplaces, and their resultant revenue generation. Additionally, an evaluation of service quality metrics will be performed to ensure the reliability and accuracy of revenue estimates, forming the foundation for market predictions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be devised and validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts from diverse companies active in the proton exchange membrane fuel cell sector. These consultations aim to provide invaluable operational and financial insights directly from practitioners, which are essential for refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with numerous fuel cell manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to validate and complement statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India proton exchange membrane fuel cell market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Environmental Concerns

Technological Advancements - Market Challenges

High Initial Costs

Limited Infrastructure - Opportunities

Expansion in Emerging Markets

Increasing Investment in R&D - Trends

Shift Towards Renewable Energy

Rise in Vehicle Electrification - Government Regulation

Policy Framework

Subsidies and Incentives - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Technology Type (In Value %)

Direct Methanol Fuel Cell (DMFC)

Proton Exchange Membrane Fuel Cells (PEMFC)

– Low-Temperature

– High-Temperature

Solid Oxide Fuel Cells (SOFC)

Molten Carbonate Fuel Cells (MCFC)

Direct Methanol Fuel Cells (DMFC)

Phosphoric Acid Fuel Cells (PAFC)

Others - By Fuel Type (In Value %)

Pure Hydrogen

Reformed Methanol

Hydrogen-Compressed Gas - By Application (In Value %)

Transportation

Stationary Power

Portable Power

Residential - By End-User (In Value %)

Automotive

Industrial

Commercial

Utility Providers - By Region (In Value %)

North India

South India

East India

West India

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Technology Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Production Capacity, Revenue by Technology)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Product Types

- Detailed Profiles of Major Companies

Ballard Power Systems Inc.

Plug Power Inc.

Cummins Inc.

Intelligent Energy Limited

AVL List GmbH

Bloom Energy

Ceres Power Holdings PLC

Doosan Fuel Cell America, Inc.

FuelCell Energy, Inc.

Hydrogenics Corporation

ITM Power PLC

PowerCell Sweden AB

Oxford Instruments PLC

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs and Expectations Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030