Market Overview

As of 2024, the KSA soft gelatin capsules market is valued at USD 70.2 million, with a growing CAGR of 10.4% from 2024 to 2030. The growth is driven by the increasing prevalence of respiratory disorders, heightened awareness around health monitoring, and the surge in demand for home healthcare solutions. The market dynamics are being shaped by innovations in technology, which are enhancing the functionality and accuracy of pulse oximeters, thereby widening their use across various healthcare settings.

Cities such as Delhi, Mumbai, and Bengaluru dominate the India pulse oximeters market due to their advanced healthcare infrastructures, higher concentrations of healthcare facilities, and sizeable patient population with respiratory problems. The urban populations in these regions are equally more aware of health technologies, propelling the adoption of advanced medical devices in both hospitals and homecare settings.

Market Segmentation

By Product Type

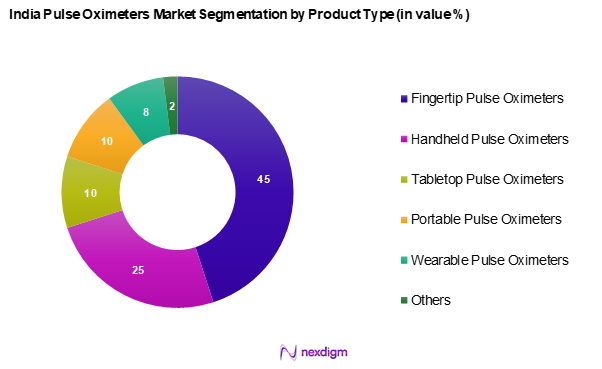

India’s pulse oximeters market is segmented into fingertip pulse oximeters, handheld pulse oximeters, tabletop pulse oximeters, portable pulse oximeters, wearable pulse oximeters, and others. Fingertip pulse oximeters dominate the market share due to their compact design, affordability, and ease of use, making them the preferred choice for home monitoring among consumers and healthcare providers. The increasing emphasis on health tracking apps and consumer health awareness also contributes to their popularity.

By End User

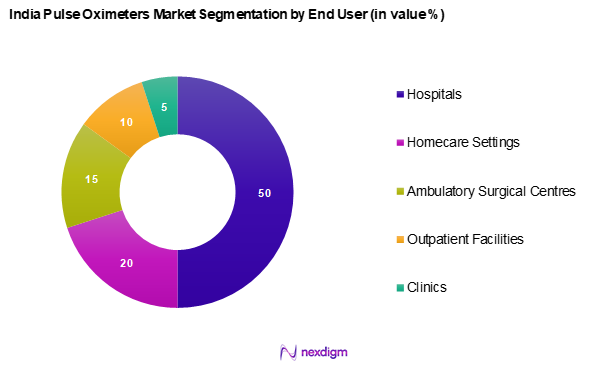

India’s pulse oximeters market is segmented into hospitals, homecare settings, ambulatory surgical centres, outpatient facilities, and others. Hospitals are the leading segment, driven by their integrated health management systems and the high volume of patients requiring constant monitoring. Additionally, advancements in hospital-based technology and enhanced patient care protocols have fortified the demand for pulse oximeters in clinical environments.

Competitive Landscape

The India pulse oximeters market is characterized by a competitive landscape with several key players leading the market. Major companies include Philips Healthcare, Masimo Corporation, Nonin Medical, Smiths Medical, and Mindray Medical. These companies have established a strong presence due to their innovative product offerings and strategic positioning in both hospitals and homecare markets.

| Company | Establishment Year | Headquarters | Revenue

(USD Mn) |

Market

Share |

Product Range | Distribution Channels |

| Koninklijke Philips N.V. | 1891 | Amsterdam, Netherlands | – | – | – | – |

| Masimo | 1989 | California, USA | – | – | – | – |

| Nonin | 1986 | Minnesota, USA | – | – | – | – |

| Smiths Group plc | 1851 | London, UK | – | – | – | – |

| Shenzhen Mindray Bio-Medical Electronics Co., Ltd. | 1991 | Shenzhen, China | – | – | – | – |

India Pulse Oximeters Market Analysis

Growth Drivers

Rising Prevalence of Respiratory Disorders

The growing prevalence of respiratory disorders in India is a significant driver for the pulse oximeters market. Approximately 55 million individuals in India suffer from chronic obstructive pulmonary disease (COPD), and around 34.3 million are affected by asthma, according to the World Health Organization (WHO). Moreover, India ranks as one of the top countries globally facing air pollution, with over 1.5 million premature deaths attributed to it in 2022. The urgent need for respiratory monitoring tools like pulse oximeters is escalating, facilitating timely medical interventions for affected patients.

Increasing Awareness of Health Monitoring

Awareness around health monitoring has surged in India, driven by government initiatives and the rise of digital health technologies. The Indian government’s National Health Mission aims to promote preventive healthcare and early diagnosis, which is crucial given the increasing rates of lifestyle diseases. By 2025, the government plans to roll out measures that enhance health literacy across his large population. Additionally, the use of health apps and wearables has grown, enhancing public awareness about the importance of devices like pulse oximeters for better health management.

Market Challenges

Regulatory and Compliance Hurdles

Regulatory hurdles pose a significant challenge for the pulse oximeters market in India. The Central Drugs Standard Control Organization (CDSCO) governs the approval process for medical devices, which can often be lengthy and complicated. In recent reports, more than approx. 30% of new medical device approvals were delayed in 2023, which hampers market entry for innovation. The stringent compliance requirements increase the time and costs for companies wishing to introduce new pulse oximeter models, limiting competition and technological advancements in the market.

Competition from Alternative Smart Devices

The growing availability of multifunctional smart devices, such as smartwatches and fitness bands with built-in SpO2 monitoring, poses a challenge to the Indian pulse oximeter market. These wearable alternatives offer convenience by integrating multiple health tracking features, making them an attractive option for consumers seeking all-in-one solutions. As technology advances and the accuracy of these smart devices improves, standalone pulse oximeters face increasing competition, potentially impacting their adoption among general consumers.

Opportunities

Technological Advancements

Technological advancements are setting the stage for future growth within the India pulse oximeters market. The integration of IoT and AI is revolutionizing patient monitoring by enabling real-time data analytics. Currently, the healthcare technology sector reflects significant growth, with India’s telemedicine market expected to reach USD 5.5 billion in coming years. These innovations allow for greater accuracy in monitoring oxygen levels, fostering demand for advanced pulse oximeters. The ongoing focus on health tech investment provides fertile ground for companies to capitalize on these advancements and enhance service delivery.

Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure presents promising opportunities for pulse oximeter adoption. In 2023, the Indian government allocated around INR 99,858.56 crore (approximately USD 12.0 billion) to the healthcare sector to improve facilities nationwide. This budget will include upgrading emergency healthcare services and rural healthcare facilities, projected to positively influence demand for hospital-grade medical devices, including pulse oximeters. Initiatives such as the Ayushman Bharat scheme aim to provide affordable healthcare access, stimulating market growth for high-quality health monitoring devices.

Future Outlook

Over the next five years, the India pulse oximeters market is expected to witness robust growth driven by technological advancements, increased healthcare spending, and a growing older population with chronic conditions. The emphasis on health and wellness will further catalyse the demand for non-invasive health monitoring devices like pulse oximeters, particularly in homecare settings where patient monitoring is becoming increasingly crucial.

Major Players

- Koninklijke Philips N.V.

- Masimo

- Nonin

- Smiths Group plc

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Medtronic

- Drägerwerk AG & Co. KGaA

- GE HealthCare

- NIHON KOHDEN CORPORATION

- TeraRecon

- Spacelabs Healthcare

- CareFusion

- WA Warehouse

- OMRON Corporation

- BPL Medical Technologies

Key Target Audience

- Hospitals and Healthcare Facilities

- Homecare Providers

- Distributors and Wholesalers

- Rehabilitation Centers

- Government and Regulatory Bodies

- Pharmaceutical Companies

- Investments and Venture Capitalist Firms

- Health Insurance Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India pulse oximeters market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India pulse oximeters market. This includes assessing market penetration, the ratio of suppliers to end-users, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which is instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple pulse oximeters manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India pulse oximeters market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Regulatory Landscape

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Prevalence of Respiratory Disorders

Increasing Awareness of Health Monitoring - Market Challenges

Regulatory and Compliance Hurdles

Competition from Alternative Smart Devices - Opportunities

Technological Advancements

Expansion of Healthcare Infrastructure - Trends

Increase in Home Healthcare Services

Rising Demand for Wearable Health Devices - Government Regulation

Quality Standards and Certifications

Import Duties - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Fingertip Pulse Oximeters

Handheld Pulse Oximeters

Tabletop Pulse Oximeters

Portable Pulse Oximeter

Wearable Pulse Oximeter

Others - By End User (In Value %)

Hospitals

Homecare Settings

Ambulatory Surgical Centers

Outpatient Facilities

Others - By Technology (In Value %)

Bluetooth-Enabled Devices

Non-Bluetooth Devices - By Distribution Channel (In Value %)

Online Channels

Offline Channels - By Patient Type (In Value %)

Adult

Neonatal

Pediatric - By Region (In Value %)

North India

South India

East India

West India

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Distribution Reach, Unique Value Proposition, Manufacturing Capacity, Product Portfolio Analysis)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Koninklijke Philips N.V.

Masimo

Nonin

Smiths Group plc

Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Medtronic

Drägerwerk AG & Co. KGaA

GE HealthCare

NIHON KOHDEN CORPORATION

TeraRecon

Spacelabs Healthcare

CareFusion

WA Warehouse

OMRON Corporation

BPL Medical Technologies

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Consumer Preferences and Pain Points

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030