Market Overview

The India Rare Earth Elements (REE) market is valued at USD 9.03 billion in 2024, based on recent global data from P&S Intelligence estimating the broader rare-earth metals market at that level. This value reflects a marked increase from USD 8.32 billion in 2023, driven by sharpening demand for REEs in electronics, automotive (especially EV motors), renewable energy, and defense applications. The shift toward clean technology and government initiatives like incentives for domestic magnet production and production-linked schemes are strong catalysts.

Key regional hubs dominating the India REE landscape include Kerala (Aluva processing), Odisha (mineral extraction), and Visakhapatnam (magnet production plant). Kerala’s integrated refining infrastructure, Odisha’s rich beach sand monazite reserves, and Visakhapatnam’s recent domestic magnet plant—all under government-supported entities like IREL—establish India as a strategic node in the global supply chain. These locations combine resource availability, processing capability, and policy backing, positioning them as national centers of REE dominance.

Market Segmentation

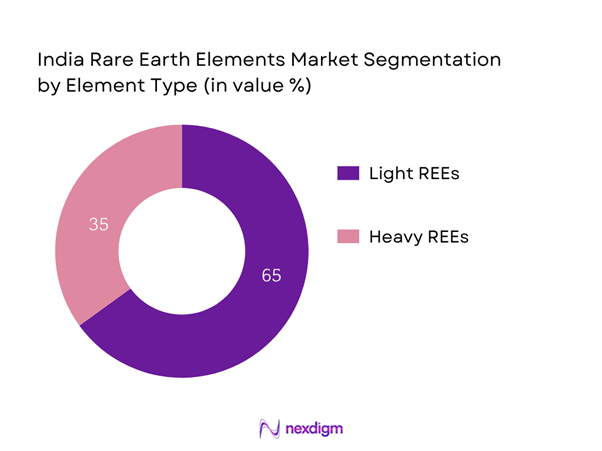

By Element Type

The India REE market is segmented into Light REEs and Heavy REEs. Light REEs dominate with an estimated 65 % market share in 2024, due to India’s abundant monazite sand resources rich in cerium and lanthanum, and strong demand for neodymium‑praseodymium grades used in domestic magnet production. Indian refining facilities such as Kerala and Odisha are optimized for light REO extraction and conversion, supporting heavy domestic processing of LREE oxides. Heavy REEs hold the remaining share, constrained by limited domestic reserves and reliance on imports for dysprosium and terbium grades, needed for specialized magnet alloy formulations.

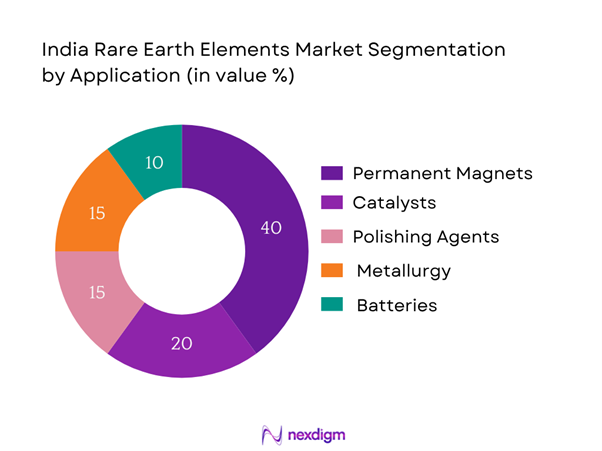

By Application

The India REE market is segmented into Permanent Magnets, Catalysts, Polishing Agents, Metallurgy, and Batteries. Permanent Magnets lead with roughly 40 % share in 2024, propelled by rising EV production, wind turbine installations, and industrial motors. India’s nascent but growing domestic magnet facility in Visakhapatnam underscores this trend, focusing on high‑performance samarium‑cobalt magnets for defense and automotive sectors. Catalysts follow, particularly in petroleum refining and petrochemical processes, with about 20 % market share, leveraging cerium‑based oxide catalysts. The remaining share is distributed among polishing agents, metallurgy, and battery alloys, each supporting niche industries such as electronics, glass polishing and NiMH battery applications.

Competitive Landscape

The India REE market is currently concentrated among a handful of major state-linked and private organizations, highlighting emerging consolidation and strategic partnerships in processing and extraction. India’s REE ecosystem is increasingly concentrated around a few major players: the government-owned IREL (India) Limited, regional mineral extractors like V.V. Mineral and Trimex Sands, and private-sector joint ventures in magnet production. This consolidation underscores strategic national efforts to build self‑reliant supply chains, reduce dependence on Chinese imports, and align with Make in India and EV ecosystem goals.

| Company | Establishment Year | Headquarters | Mining Licences Held | Processing Capacity (tpa REO) | Domestic Magnet Output | Export Orientation | Strategic Tie‑ups |

| IREL (India) Limited | 1950 | Mumbai | – | – | – | – | – |

| Trimex Sands | – | Odisha/Kerala | – | – | – | – | – |

| V.V. Mineral | – | Tamil Nadu | – | – | – | – | – |

| Toyotsu Rare Earths India | 2012 | Odisha/Kerala | – | – | – | – | – |

| Kerala Minerals & Metals Ltd | – | Kerala | – | – | – | – | – |

India Rare Earth Elements Market Analysis

Growth Drivers

Make in India

India’s nominal GDP reached USD 3.91 trillion in 2024, supported by annual GDP growth of 6.5 % and GDP per capita of USD 2,696.7. The Make in India initiative targets mineral and strategic autonomy by promoting domestic manufacturing, including rare earth processing and magnets. Government valuations show exports reached USD 820.93 billion in FY2024‑25, reinforcing policy synergies between manufacturing and trade. This strong macroeconomic foundation motivates investment in REE facilities, reducing import dependence and stimulating value-added extraction and downstream production.

Clean Energy Push

India produced 9.2 % of electricity from renewable sources (excluding hydro) as of 2021 and aims to expand renewable capacity further. With over 99.5 % population electrification in 2023, the shift toward wind and solar assets increases demand for permanent magnets based on REEs. India also targets expanding electric power infrastructure, increasing grid-scale renewable installations, creating consistent magnet demand and pushing REE exploration and processing investment in key states.

Market Challenges

China Dependency

Currently, 90 % of global rare earth magnet processing occurs in China. India’s reliance on imported dysprosium and terbium for high-power magnets underscores strategic and supply-chain risk. Although India possesses 6.9 million tonnes of REE reserves, its domestic refining and magnet production capacity remain nascent, making it vulnerable to export restrictions—such as recent Chinese policy changes that disrupted supply to Indian manufacturers

Environmental Regulations

Rare earth extraction often involves radiological byproducts such as thorium and uranium, demanding rigorous environmental controls. India’s forestry and mining regulations impose strict environmental clearances, especially near sensitive coastal zones. The Ministry of Mines flagged significant revenue loss and resource depletion due to unregulated and illegal mining in states like Karnataka and Goa. Compliance burden increases development cost for new mining and processing facilities.

Market Opportunities

Strategic Partnerships

With India targeting enhanced REE processing and magnet production, joint ventures are emerging. For instance, Toyotsu Rare Earths India—a JV aligned with Japanese partner Toyota Tsusho—is active in Odisha/Kerala sourcing REOs and exporting to Japan. Such partnerships facilitate technology access, capital infusion, and integrated supply chains. Macroeconomic health—GDP growing at 6.5 %, exports at USD 820.93 billion—provides a solid backdrop for foreign investors and strategic collaborations to build capacity and downstream capabilities.

Technology Transfer

India’s planned PLI scheme of ₹3,500–5,000 crore, including ₹1,000 crore for magnet capacity, inherently involves technology transfer to bridge local skill gaps. Under National Critical Mineral Mission, ₹500 crore and ₹1,500 crore are budgeted for processing parks and recycling initiatives. These structured investments are designed to catalyze adoption of advanced separation, refining, and alloy techniques, enabling upskilling of local industry and reducing dependence on foreign tech providers.

Future Outlook

Over the next few years, the India REE market is expected to undergo significant transformation. India’s strategic shift toward domestic REE value‑chains—including refining, magnet manufacturing, and battery alloy production—driven by government policy and clean‑energy momentum, will fuel sustained growth. Industrial demand from EV, renewable energy, electronics, and defense sectors will scale sharply, supported by state incentives and public‑private partnerships. Increased downstream integration will also reduce import dependency over time and stimulate export-led growth, positioning India as a rising REE hub in Asia.

Major Players

- IREL (India) Limited

- Trimex Sands

- V. Mineral

- Toyotsu Rare Earths India (Toyota Tsusho JV)

- Kerala Minerals & Metals Ltd (KMML)

- Monazite Processing Plant (IREL/DAE)

- Beach Minerals Company

- Metastable Materials

- Earthstahl & Alloys

- JSW Rare Earths

- Hindustan Dorr‑Oliver Ltd

- Tata Advanced Materials (REE initiatives)

- Larsen & Toubro – REE infrastructure projects

- Mantra Resources (private explorer)

- Toyotsu

Key Target Audience

- EV & electric motor OEMs

- Renewable energy equipment manufacturers

- Electronics component makers using REEs for catalysts, polishing, phosphors

- Aerospace & defense procurement agencies

- Investment and venture capitalist firms

- Government and regulatory bodies

- Mineral resource exploration firms looking to enter REE mining

- Downstream alloy manufacturers and magnet‑component fabricators

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping India’s REE ecosystem—including mining stakeholders, processing facilities, government licenses, and end‑use industries—through secondary sources and public data. Key variables such as resource reserves, production capacity, application demand (EV, renewables, electronics) and policy drivers were defined.

Step 2: Market Analysis and Construction

Historical data for India’s rare earth production, refining volumes, and export/import flows were compiled. Revenue estimates were derived using unit volumes multiplied by realized REO prices observed in industry reports. Supply chain mapping and processing yield ratios were also applied to validate market sizing.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding growth drivers (e.g. government incentive schemes, demand from EV sector, domestic magnet capacity ramp‑up) were validated through interviews with experts from IREL, Ministry of Mines, BARC and industry bodies. Their operational insights were used to refine projections.

Step 4: Research Synthesis and Final Output

Final synthesis involved consolidation of bottom‑up market estimates with expert insight feedback. Cross‑validation against global market growth trends ensured coherence. The result is a robust, validated analysis tailored for business and policy decision‑making.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Evolution of REE Industry in India

- Strategic Importance of REEs

- Value Chain and Supply Chain Analysis

- India’s Position in Global REE Value Chain

- Mineral Reserves Mapping (REE Resources in India by State and Deposit Type)

- Growth Drivers

Make in India

Clean Energy Push

EV Mission

Strategic Resource Security

Export Incentives

PLI Scheme - Market Challenges

China Dependency

Environmental Regulations

CapEx Barriers

IP Restrictions

Illegal Mining

Processing Constraints - Market Opportunities

Strategic Partnerships

Technology Transfer

Circular Economy

Export Markets

Public-Private Collaboration - Trends

Green REE Extraction

Hybrid Supply Chains

Local Value Addition - Government Regulation

Atomic Minerals Directorate

IREL Policies

FDI Caps

Environmental Clearances - Stake Ecosystem

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2091-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type (In Value %)

Light Rare Earth Elements (LREE)

– Cerium

– Lanthanum

– Neodymium

– Praseodymium

Heavy Rare Earth Elements (HREE)

– Dysprosium

– Terbium

– Yttrium

– Samarium - By Application (In Value %)

Magnets

Catalysts

Polishing Agents

Metallurgy

Batteries - By Processing Route (In Value %)

Monazite Sand

Bastnaesite

Xenotime

Ion-Adsorption Clays - By Source (In Value %)

Primary Ore (Mined)

Recycled REEs

Coal Ash/Industrial Waste - By End-Use Industry (In Value %)

Electronics

Renewable Energy

Defense & Aerospace

Automotive (EV & Hybrid)

Healthcare - By Region (In Value %)

Southern India

Eastern India

Western India

Northern India

North-East India

- Market Share of Major Players on the Basis of Volume/Value

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Organizational Structure, Production Facilities, Revenue by Type and End-Use, Number of Licenses and Mines, Strategic Tie-Ups)

- SWOT Analysis of Major Players

- Pricing Analysis by Element Type and Purity

- Detailed Profiles of 15 Key Players

Indian Rare Earths Ltd (IREL)

Trimex Sands

V.V. Mineral

Toyotsu Rare Earths India

Kerala Minerals and Metals Ltd (KMML)

Mantra Resources

Monazite Processing Plant (BARC Collaboration)

Beach Minerals Company

Metastable Materials

Earthstahl & Alloys

JSW Rare Earths

Hindustan Dorr-Oliver Ltd

Tata Advanced Materials

DAE (Department of Atomic Energy, Govt of India)

Larsen & Toubro – REE Infra Projects

- Sectoral Demand Mapping

- End-User Budget Allocations

- REE Requirement per Product Unit (Magnets, Batteries, etc.)

- Unmet Demand and Supply Gaps

- End-User Procurement Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030