Market Overview

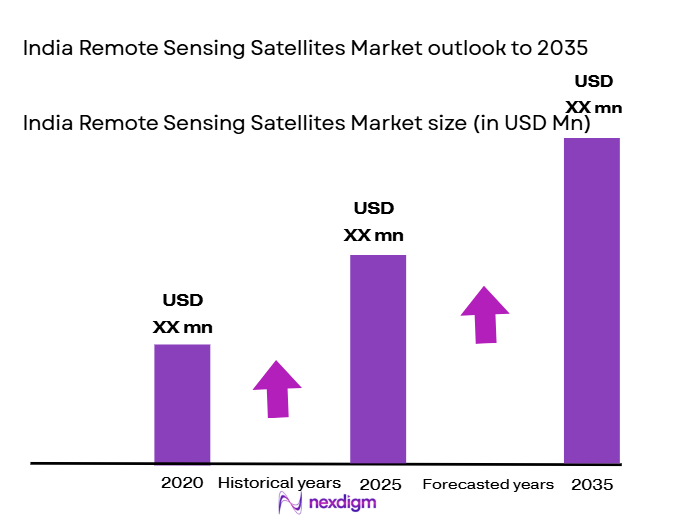

The India Remote Sensing Satellites market is primarily driven by a surge in governmental space initiatives, increasing investments in satellite technologies, and rising demand for Earth observation capabilities. Based on a recent historical assessment, the market is valued at USD ~ billion, a figure reflecting government-backed projects, commercial satellite launches, and partnerships with international space agencies. The country’s space agency, ISRO, has been instrumental in spearheading satellite development and launch initiatives, contributing significantly to the market’s growth. Additionally, the advancements in satellite data collection and processing technologies have played a pivotal role in enhancing the application of remote sensing data across various sectors.

India is emerging as a key player in the global remote sensing satellite market, with leading cities such as Bengaluru and Hyderabad hosting major space research centers. The dominance of these locations can be attributed to their strategic importance in the Indian space program, with significant investments in infrastructure and satellite-related technology. Moreover, the country benefits from its partnerships with international entities such as the European Space Agency and NASA, allowing for collaborative advancements in satellite technology. This collaborative approach, coupled with the growing number of government and private initiatives, positions India as a formidable force in the global remote sensing satellite sector.

Market Segmentation

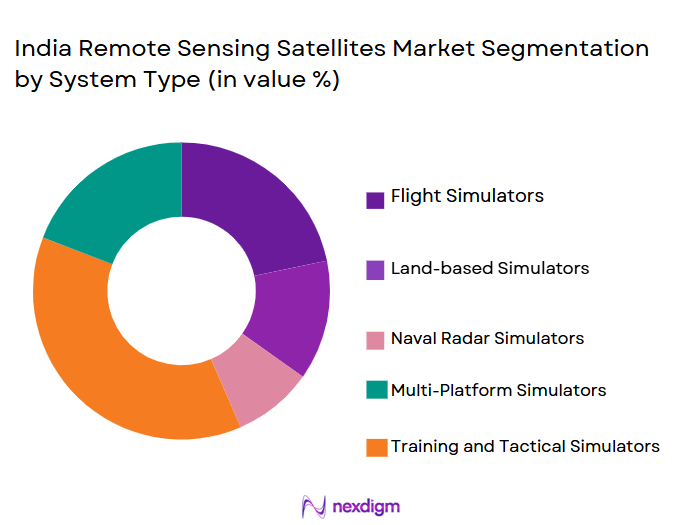

By System Type

The India Remote Sensing Satellites market is segmented by system type into Earth Observation Satellites, Communication Satellites, Weather Satellites, Navigation Satellites, and Data Relay Satellites. Recently, Earth Observation Satellites have gained a dominant market share due to increasing applications across agriculture, urban planning, and environmental monitoring. The demand for precise, real-time data has surged, particularly in sectors that rely heavily on geospatial intelligence. The infrastructure supporting Earth Observation Satellites, combined with a robust regulatory framework, has driven the adoption and deployment of these systems, thus solidifying their position as the dominant sub-segment.

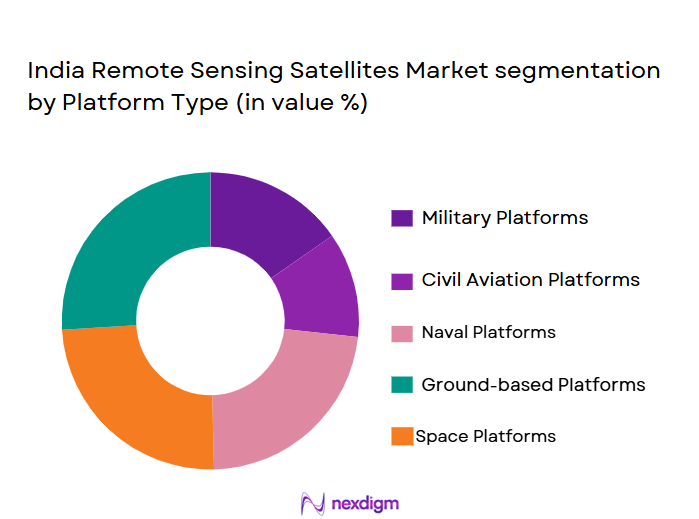

By Platform Type

The India Remote Sensing Satellites market is segmented by platform type into Space-Based Platforms, Airborne Platforms, Ground-Based Platforms, Hybrid Platforms, and Mobile Platforms. Space-Based Platforms hold the largest share, driven by their ability to deliver continuous and high-resolution data for various applications. This market dominance is largely attributed to advancements in satellite launch capabilities and the scalability of space-based solutions. Furthermore, the launch of numerous government and commercial satellites in low Earth orbit (LEO) has significantly strengthened the prevalence of space-based platforms.

Competitive Landscape

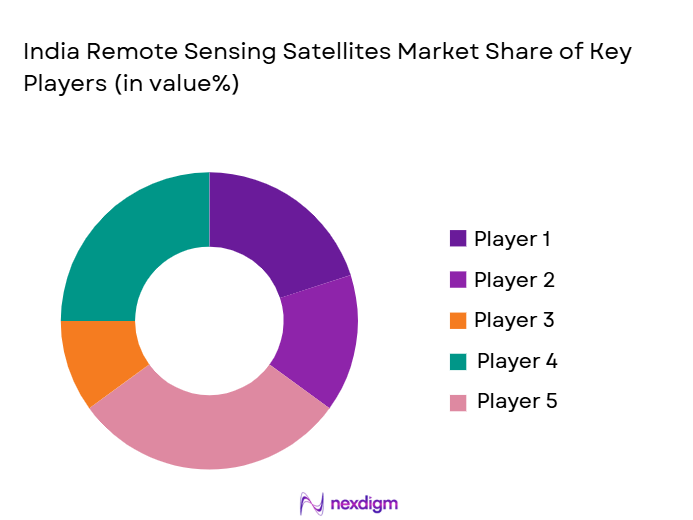

The India Remote Sensing Satellites market features a competitive landscape with both governmental entities and private players vying for market share. Government agencies, such as the Indian Space Research Organisation (ISRO), play a pivotal role in shaping market trends through large-scale satellite deployments. Consolidation is evident in the form of strategic partnerships between private firms and governmental bodies, particularly in satellite manufacturing and launch services. Major players’ influence is significant, as they not only drive technological innovations but also collaborate to reduce costs and enhance satellite data accessibility.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Space-based Applications |

| Indian Space Research Organisation (ISRO) | 1969 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

| Antrix Corporation | 1992 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

| Maxar Technologies | 1969 | Westminster, US | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, US | ~ | ~ | ~ | ~ | ~ |

| Airbus Defence and Space | 2000 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

India remote sensing satellites Market Analysis

Growth Drivers

Government Investment in Space Programs

The Indian government’s significant investment in space programs is a major driver of the remote sensing satellites market. This includes the launch of satellites under various national schemes like the Indian National Satellite System (INSAT) and the Indian Remote Sensing (IRS) satellites. Government-backed initiatives have led to the development of cost-effective solutions for Earth observation, providing an impetus for both public and private sector adoption. With increasing funding allocated for satellite-based technologies and innovations, the market has seen growth across various applications, such as environmental monitoring, urban development, and defense surveillance. The financial backing has also allowed the Indian space sector to form strategic collaborations with international space agencies, which in turn enhances the technological capabilities of India’s remote sensing satellites.

Technological Advancements in Satellite Systems

Another critical growth driver for the market is the rapid pace of technological advancements in satellite systems. Innovations in satellite miniaturization, improved communication capabilities, and the integration of artificial intelligence (AI) for data processing have made remote sensing satellites more efficient and accessible. Satellite systems that were once costly and complex have become more affordable and scalable due to these advancements. Moreover, the increase in the accuracy of satellite data and the ability to deploy larger constellations of smaller satellites has created new opportunities across industries, from agriculture to urban planning. These technological improvements support a more dynamic and competitive environment, facilitating enhanced market growth and positioning India as a key player in satellite technology.

Market Challenges

High Development and Launch Costs

One of the most significant challenges facing the India Remote Sensing Satellites market is the high cost of satellite development and launch. The intricate nature of building high-performance remote sensing satellites requires significant financial investments in research and development, manufacturing, and testing. Additionally, the cost of launching satellites into orbit is another considerable barrier, especially for small private companies and startups. Despite the cost advantages brought by technological advancements, these expenses remain a primary deterrent for many potential market entrants, leading to slower adoption rates. Government and private sector collaborations can help mitigate these costs, but the high initial investment continues to pose a challenge for market expansion.

Regulatory Barriers and Licensing Issues

Another challenge facing the India Remote Sensing Satellites market is the complex regulatory environment surrounding satellite launches and operations. The Indian government enforces strict licensing and compliance protocols for satellite operators, especially for those using high-resolution imaging or data for commercial purposes. These regulations are intended to ensure national security, but they often lead to delays and added costs for satellite operators. Moreover, there are concerns regarding the potential for satellite data being used for illegal activities or geopolitical tensions. These regulatory hurdles can create barriers to entry for international players and may slow down the adoption of satellite technologies in certain sectors.

Opportunities

Commercialization of Satellite Data

One of the key opportunities for growth in the India Remote Sensing Satellites market is the commercialization of satellite data. As the demand for accurate and real-time data from satellite imagery grows across industries, from agriculture to urban planning, companies can capitalize on offering satellite-based data services. By offering advanced geospatial data analytics and insights, businesses can serve a diverse range of industries, including agriculture, forestry, environmental monitoring, and disaster management. This commercialization not only opens up new revenue streams for satellite operators but also contributes to the growth of the overall market by increasing the demand for high-quality remote sensing data.

Partnerships with International Space Agencies

Another promising opportunity lies in India’s continued collaborations with international space agencies. Partnerships with organizations such as NASA, the European Space Agency (ESA), and Japan’s JAXA provide Indian companies access to advanced technologies, funding, and expertise in satellite development. These collaborations can lead to the joint development of next-generation satellite systems and foster innovation in the remote sensing satellite sector. Additionally, by aligning with global standards and participating in international satellite programs, India can strengthen its position in the global space market, attract foreign investments, and accelerate the growth of the remote sensing satellite industry.

Future Outlook

The future of the India Remote Sensing Satellites market appears promising, with expected growth driven by technological innovations and increasing demand for satellite-based services across multiple sectors. Over the next five years, advancements in AI and machine learning will enhance satellite data processing, making remote sensing more efficient. Regulatory support from the Indian government, along with growing private sector investments, will further accelerate the adoption of satellite technologies. Additionally, collaborations with global space agencies will ensure that India remains at the forefront of satellite innovations, positioning it to meet the increasing demand for Earth observation, communication, and navigation satellite services.

Major Players

• Antrix Corporation

• Maxar Technologies

• Lockheed Martin

• Airbus Defence and Space

• Thales Alenia Space

• Boeing Space and Launch

• Northrop Grumman

• Tata Communications

• Bharti Airtel

• Reliance Jio

• Planet Labs

• ExPace Technologies

• SpaceX

• Blue Origin

Key Target Audience

• Government and regulatory bodies

• Satellite manufacturing companies

• Aerospace and defense companies

• Geospatial analytics providers

• Environmental monitoring organizations

• Agricultural technology firms

• Disaster management agencies

Research Methodology

Step 1: Identification of Key Variables

Key variables influencing the India Remote Sensing Satellites market are identified, including technological advancements, regulatory frameworks, and market demand. This helps outline the parameters that affect market dynamics.

Step 2: Market Analysis and Construction

In-depth analysis is performed on market drivers, challenges, and segmentation. This stage builds the foundation for understanding the existing market structure and future trends.

Step 3: Hypothesis Validation and Expert Consultation

Expert insights are sought to validate hypotheses and provide real-world perspectives, ensuring accuracy in the market’s anticipated trajectory.

Step 4: Research Synthesis and Final Output

The final output synthesizes all gathered data, forming a comprehensive and actionable market report that serves both strategic and operational decision-making.

- Executive Summary

- India Remote Sensing Satellites Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased government investments in space exploration

Technological advancements in satellite miniaturization

Growing demand for environmental monitoring and disaster management - Market Challenges

High costs of satellite development and launch

Regulatory and licensing constraints in satellite operations

Limited availability of skilled workforce in space technologies - Market Opportunities

Expansion of commercial satellite services

Rising demand for satellite-based communication infrastructure

Partnerships with international space agencies for technological collaboration - Trends

Growing use of AI and machine learning in satellite data processing

Adoption of small satellite constellations

Increased focus on sustainability and environmental monitoring via satellites - Government Regulations & Defense Policy

Compliance with national security standards

Promotion of satellite technology for disaster management

Support for space sector startups and innovation hubs - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Earth Observation Satellites

Communication Satellites

Weather Satellites

Navigation Satellites

Data Relay Satellites - By Platform Type (In Value%)

Space-Based Platforms

Airborne Platforms

Ground-Based Platforms

Hybrid Platforms

Mobile Platforms - By Fitment Type (In Value%)

Launch Vehicle Fitment

Onboard Payload Integration

Ground System Integration

Cloud-Based Integration

Sensor Integration - By EndUser Segment (In Value%)

Government & Military

Agriculture & Forestry

Environmental Monitoring

Urban Planning & Infrastructure

Disaster Management & Relief Operations - By Procurement Channel (In Value%)

Direct Government Contracts

Public-Private Partnerships

Private Sector Procurement

International Collaborations

Defense Sector Procurement

- Market Share Analysis

- Cross Comparison Parameters

(Market Value, Installed Units, Platform Type, System Type, End-User Segmentation, Procurement Channel, Regional Demand, Technological Innovations) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Indian Space Research Organisation (ISRO)

Antrix Corporation

Tata Communications

Bharti Airtel

Reliance Jio

Airbus Defence and Space

Northrop Grumman

Boeing Space and Launch

Thales Alenia Space

Lockheed Martin

Larsen & Toubro

Maxar Technologies

Sukhoi

Planet Labs

ExPace Technologies

- Government agencies increasing satellite usage for national security

- Agriculture sector using remote sensing for crop health monitoring

- Environmental organizations leveraging satellite data for climate change research

- Urban planning bodies using satellite data for infrastructure development

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035