Market Overview

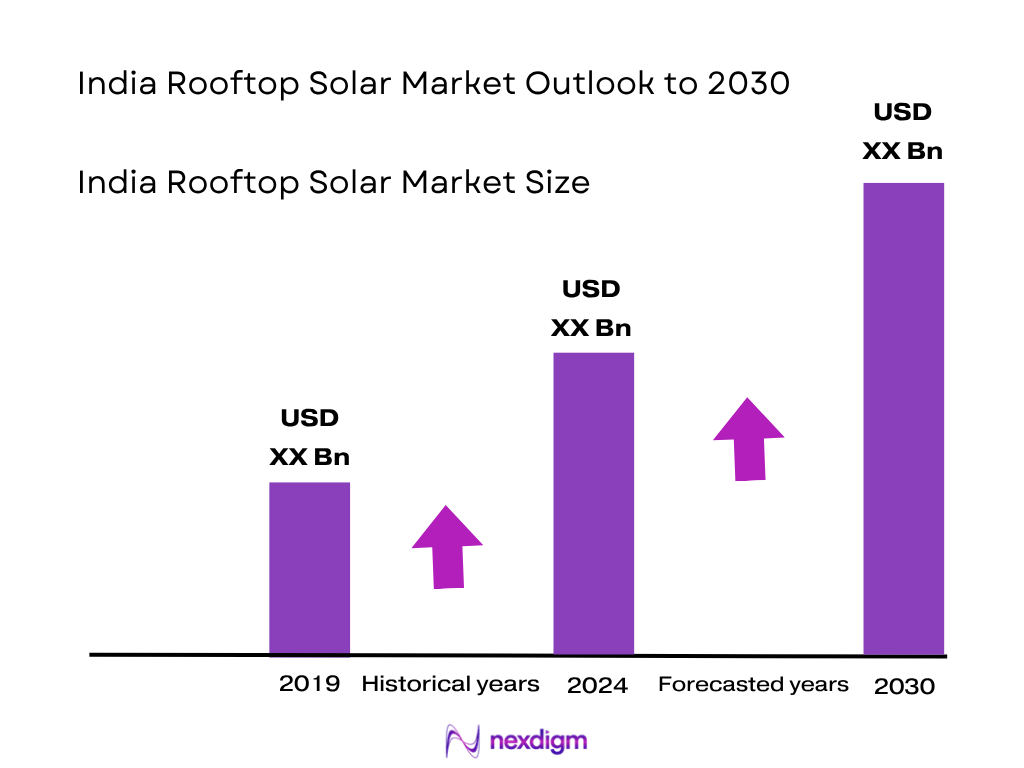

The India rooftop solar market is valued at USD 5.36 billion in a recent year, growing from a value of USD 5.36 billion previously, based on a detailed historical revenue series and industry forecasts. Installed capacity reached approximately 10.8 GW by March and expanded to about 11.87 GW grid‑connected rooftop by end‑of‑year. Growth is fuelled by streamlined net‑metering, major government subsidy schemes under PM Surya Ghar, and sharply declining module and inverter costs.

The rooftop solar landscape is led by South Indian states (Andhra Pradesh, Telangana, Karnataka, Tamil Nadu), due to strong state net‑metering policies, high urban industrial base, and active DISCOM support. Additionally, Gujarat and Maharashtra rank among the top in installations, owing to robust MSME uptake and scalable industrial and residential adoption in states like Gujarat, Haryana, and Delhi. Chandigarh also features prominently in government rooftop deployment, motivated by aggressive municipal solar saturation campaigns.

Market Segmentation

By Application Type

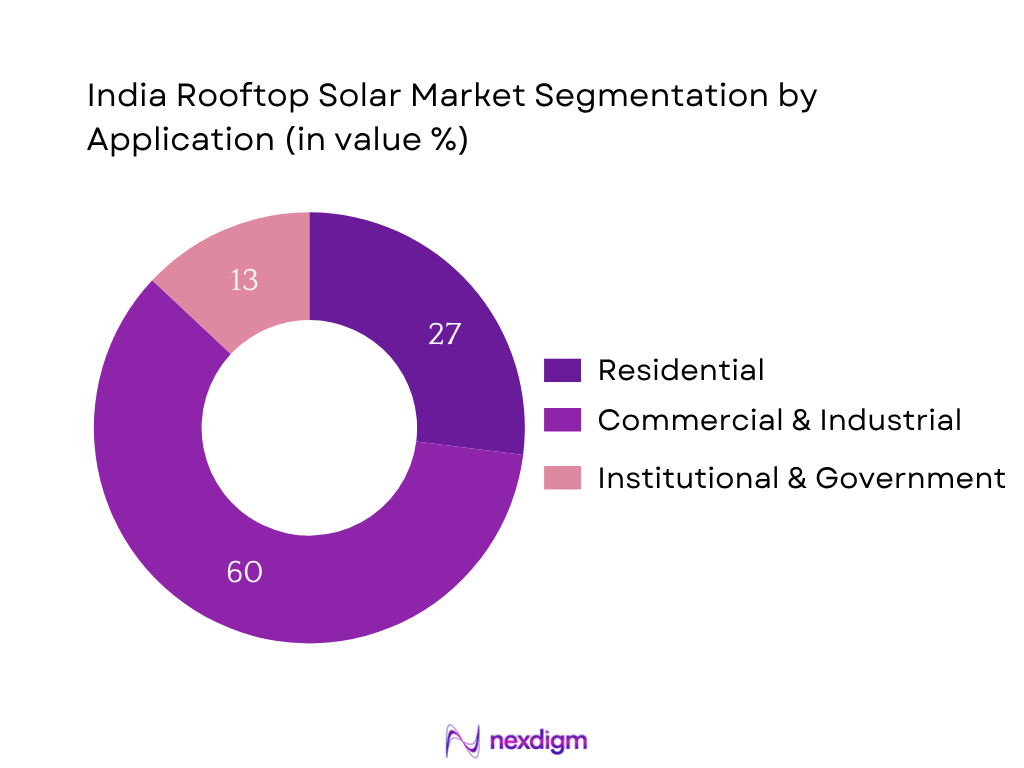

India rooftop solar market is segmented into Residential, Commercial & Industrial (C&I), and Institutional & Government systems. In 2024 C&I dominates with approximately 60% market share. This is because large-angle policies and subsidy channels lead industrial and commercial entities to adopt rooftop solar at scale, leveraging CAPEX investments and net‑metering returns. Residential uptake lags at around 27% share due to slower consumer awareness and financing access. Government/institutional segment remains a smaller share though visible in certain states like Chandigarh. C&I systems dominate due to high rooftop availability, predictable loads, and attractive returns in industrial clusters and commercial complexes. Residential adoption, while growing, remains limited by consumer awareness, financing constraints, and rooftop suitability.

By Ownership Model

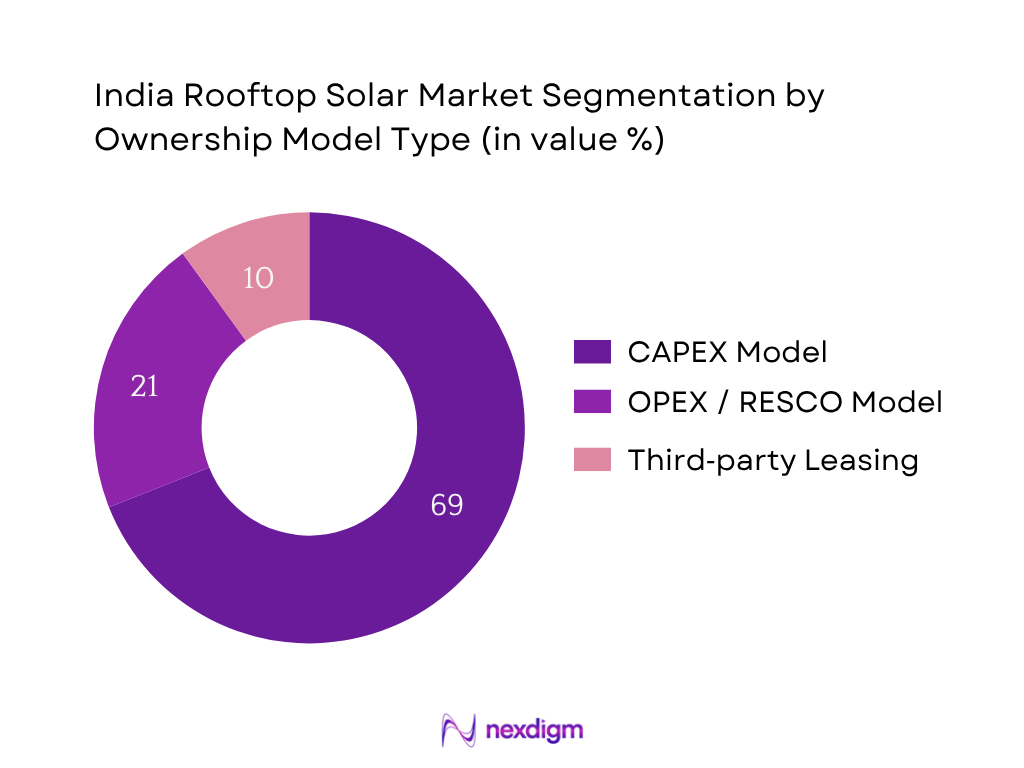

India rooftop solar is segmented into CAPEX model, OPEX/RESCO model, and Leasing structures. CAPEX installations account for about 69% share of new installations (Q1 2024), capturing majority of cumulative capacity. RESCO/OPEX model and leasing share smaller portions. CAPEX leads because direct ownership offers higher long‑term savings, government subsidy alignment, and simplified net‑metering credits. Commercial and industrial users prefer owning systems to optimize ROI over 5–7 years. RESCO models continue in residential or smaller institutional cases where capex remains a barrier. CAPEX dominates due to alignment with subsidy mechanisms, predictable returns for larger consumers, and strong bank financing for business users. OPEX and leasing fill gaps where upfront capex is less feasible.

Competitive Landscape

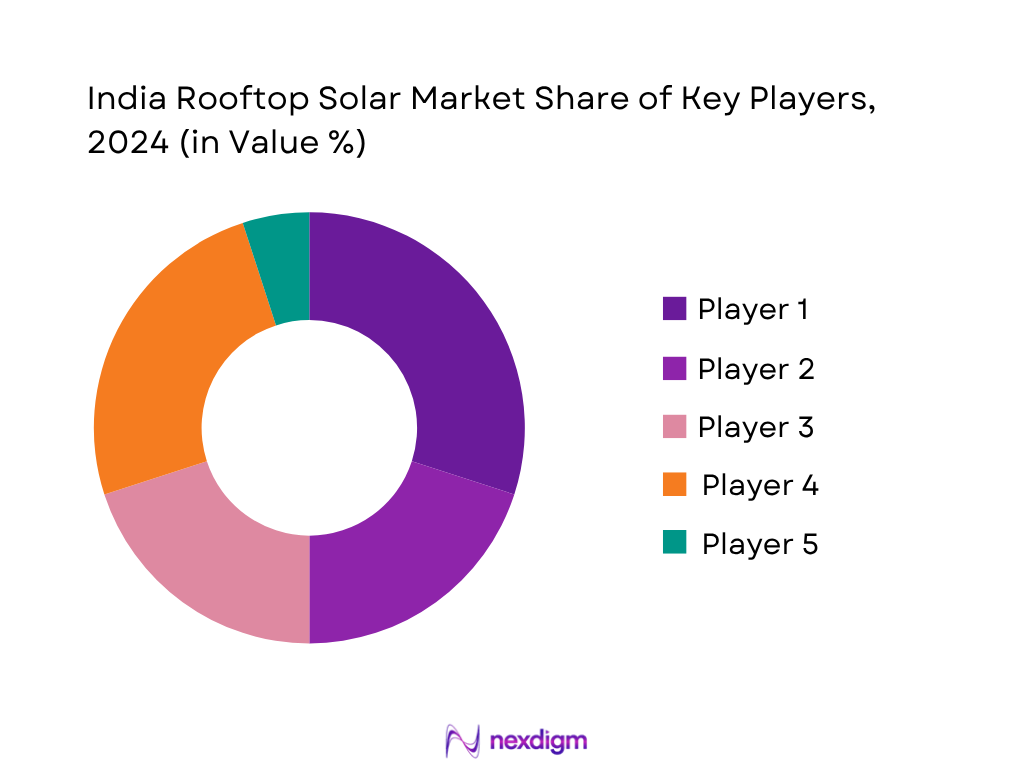

India rooftop solar market is dominated by a handful of major players including Tata Power Solar, Amplus Solar, CleanMax Enviro, Fourth Partner Energy, and ReNew Power. These firms lead due to integrated EPC plus RESCO services, deep state relationships, and multi-sector footprints.

| Company | Establishment Year | Headquarters | EPC vs RESCO Mix | States Operated | Installed Capacity (GW) | Average System Size (kW) | Net‑Metering Approvals p.a. |

| Tata Power Solar | 1989 | Mumbai, Maharashtra | – | – | – | – | – |

| Amplus Solar | 2010 | Mumbai | – | – | – | – | – |

| CleanMax Enviro Energy | 2011 | Ahmedabad, Gujarat | – | – | – | – | – |

| Fourth Partner Energy | 2010 | Bengaluru, Karnataka | – | – | – | – | – |

| ReNew Power (Rays Power) | 2011 | Gurugram, Haryana | – | – | – | – | – |

India Rooftop Solar Market Analysis

Growth Drivers

Net Metering Policies and DISCOM Incentives

Urban electricity access in India stands at 99.5 percent of the population in 2023, up from rural access at 99.2 percent, as per World Bank data. These high electrification levels in urban centers have enabled DISCOMs to operate net‐metering schemes at scale. In states such as Tamil Nadu and Karnataka, DISCOMs have credited rooftop solar consumers through net‐metering within billing cycles covering over 1,300 hours of excess energy fallback in FY 2023 – 2024 (CEA dashboard reports), creating viable paybacks and utility support. These policy frameworks and DISCOM incentives have underpinned widespread rooftop solar uptake in C&I sectors in major cities.

Urban Residential Electrification Goals

India achieved near-universal urban electrification with 99.5 percent access by 2023, driven by programs like Saubhagya (Pradhan Mantri Sahaj Bijli Har Ghar Yojana) and DDUGJY. Despite widespread connectivity, household sanctioned load capacity remains low, typically between 1 to 2 kW per customer (CEA reporting FY 2022–24), prompting many urban households in Delhi, Mumbai, and Bengaluru to seek rooftop solar to meet rising appliance demand. This load-based stress is pushing homeowners toward rooftop adoption to supplement grid capacity, motivated by reliability concerns and elevated power consumption patterns in urban households emitting peak loads around 1,400 MW daily.

Market Challenges

Delays in Net‑Metering Approvals

In Puducherry, a rooftop solar consumer received a ₹98,139 electricity bill instead of a ₹6,722 credit, after installation in August 2024 due to billing misprocessing and net‑metering delays, and required more than one month of interaction with government offices to correct it. Similar processing issues have surfaced in Tamil Nadu under PM Surya Ghar Yojana, where incorrect application data entries delayed subsidy disbursal worth ₹236 crore as of mid‑2025, causing multiple reapplications and stalled consumer installations. These cases highlight systemic friction in approvals and subsidy linkage for rooftop solar.

Financial Risks in RESCO Model

As of early 2024, nearly 1.8 million rooftop solar subsidy applications were received under the PMSGY scheme, resulting in around 385,000 installations totaling 1.8 GW capacity. While accelerated, such volumes also exposed resilience risks: RESCO developers must carry upfront capital against uncertain subsidy flow timelines. State programme implementation and subsidy disbursement delays have strained liquidity for third-party operators, with limited bank refinancing options under industry-sourced credit facilities, affecting project onboarding across residential clusters.

Opportunities

Integration with Battery Storage

India’s initiatives in utility-scale battery energy storage systems (BESS) include pilot projects like the BRPL-GEAPP public-private partnership in Delhi, servicing 12,000 low-income customers approved mid‑2024. As of late 2023, India had commissioned BESS capacity of over 600 MWh at industrial and grid level (CEA and GEAPP summary). Rooftop solar plus home battery setups of typical 5–10 kWh are increasingly adopted in urban households in metro cities like Delhi and Bengaluru. Rising electricity peak demands (daily peak load ~56,631 MW FY 2024) and DISCOM grid stress provide a compelling rationale for hybrid rooftop–storage systems in both commercial and residential settings.

Peer‑to‑Peer Solar Trading via Blockchain

India has piloted solar peer-to-peer (P2P) energy trading using blockchain in states like Maharashtra and Karnataka via DISCOM-led platforms in 2023. P2P exchanges connected over 500 small-scale prosumers with collective rooftop capacity exceeding 20 MW in pilot districts. Market regulators, including MERC and KERC, approved trial trading programs in 2023, allowing rooftop solar generators to transfer surplus energy within local grids. With urban electrification reaching saturation (99.5 percent access), these P2P initiatives enable monetization of excess rooftop generation, especially in Delhi and Hyderabad municipal areas, unlocking new revenue channels for residential and C&I rooftop owners.

Future Outlook

Over the next six years, India rooftop solar market is expected to grow significantly, driven by expanded government subsidy schemes (PM Surya Ghar), increased DISCOM collaboration on net‑metering, falling module prices, and rising corporate sustainability goals. Industrial and residential demand are expected to grow driven by MSME electrification, energy cost savings, and increasing residential electrification. Battery‑solar hybrid and IoT‑based rooftop management innovations will add momentum.

Major Players

- Tata Power Solar

- Amplus Solar

- CleanMax Enviro Energy

- Fourth Partner Energy

- ReNew Power (Rays Power Infra)

- Hero Future Energies

- Mahindra Susten

- Loom Solar

- Havells Solar

- Waaree Energies

Key Target Audience

- Leading corporate energy procurement heads (large C&I consumers)

- Investment and venture capitalist firms focussing on renewables

- National Renewable Energy Ministry (MNRE) and State Electric Regulatory Commissions

- DISCOM leadership teams and power utilities

- MSME industrial associations exploring rooftop solar

- Government and regulatory bodies (MNRE, SECI, State Nodal Agencies)

- Housing developers and group‑housing cooperative societies

- Green real estate investment funds and ESG‑focused investors

Research Methodology

Step 1: Identification of Key Variables

Mapping stakeholder ecosystem including DISCOMs, rooftop providers, financial institutions, developers, and policy bodies. Desk research leveraged government databases, MNRE, SECI, Bridge to India and Mercom for capacity and policy data to define critical market inputs.

Step 2: Market Analysis and Construction

Historical capacity reviews and financial modeling of user segments across residential, C&I, and institutional, analyzing penetration, net‑metering credits, project size mix, and resultant revenue streams to estimate market size reliably.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on drivers and barriers validated via structured interviews (CATI) with industry experts from solar EPC firms, RESCO operators, and state nodal agencies, collecting granular operational and financial insights.

Step 4: Research Synthesis and Final Output

Direct engagement with major rooftop solar players (e.g., Tata Power Solar, CleanMax, Fourth Partner Energy) to collect segment‑wise installed capacities, business model splits, payback metrics, and finalize validated bottom‑up revenue modelling.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Hybrid Research Framework, Policy and Regulatory Source Review, Stakeholder Expert Interviews, Primary and Secondary Research Approach, Limitations and Future Outlook)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Major Policy Milestones

- Rooftop Solar Ecosystem and Stakeholder Mapping

- Value Chain and Flow of Funds in Rooftop Installations

- Technical Overview – PV Modules, Inverters, Mounting Structures, and Storage

- Business Model Analysis – CAPEX, RESCO, OPEX, and Leasing

- Growth Drivers

Net Metering Policies and DISCOM Incentives

Urban Residential Electrification Goals

Declining Module and Inverter Prices

Green Building and Sustainability Mandates

Corporate Sustainability and ESG Pressure

Increasing Demand from MSMEs and Industrial Clusters - Market Challenges

Delays in Net Metering Approvals

Financial Risks in RESCO Model

Rooftop Space Limitations and Load Constraints

Quality Assurance and Installer Credibility

Limited Access to Low-cost Financing - Opportunities

Integration with Battery Storage

Peer-to-Peer Solar Trading via Blockchain

Smart Rooftop and IoT-enabled Monitoring

Aggregator Model for Residential Rooftops

Onsite Green Hydrogen Production from Solar - Trends

Rise in Group Housing and Community Solar Projects

BIPV (Building Integrated Photovoltaics) Adoption

Rooftop Solar Integration in EV Charging Infrastructure - Government Regulations and Policy Framework

MNRE Initiatives and Subsidy Disbursement Structure

DISCOM-led Rooftop Programs and Targets

Electricity (Rights of Consumers) Rules Impact

State-level Rooftop Solar Policies Overview - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Installed Capacity (MW), 2019-2024

- By Average System Cost (INR/kW), 2019-2024

- By End-User (In Value and MW)

Residential

Commercial

Industrial

Institutional

Government & Public Sector - By Ownership Model (In Value and MW)

CAPEX Model

OPEX/RESCO Model

Third-party Leasing - By Rooftop Type (In Value and MW)

Flat Roof

Sloped Roof

Metal Sheet Roof - By Technology Type (In Value and MW)

Monocrystalline

Polycrystalline

Thin Film

Bifacial Panels - By Region (In Value and MW)

North India

South India

East India

West India

Central India

- Market Share of Major Players by Value and Installed Capacity

- Cross Comparison Parameters (Company Overview, Business Strategy, Rooftop Solar Portfolio and Project Size, Financing and CAPEX/OPEX Mix, Number of States Operated, EPC vs RESCO Ratio, Number of Residential vs Commercial Installations, Net Metering Approvals per Year, Technology Type Deployed, Project Turnaround Time)

- SWOT Analysis of Leading Players

- Price Benchmarking by Segment and kW Size

- Profiles of Major Companies

Tata Power Solar

Amplus Solar

CleanMax Enviro Energy Solutions

Fourth Partner Energy

Hero Future Energies

ReNew Power

Mahindra Susten

Havells India

Jakson Group

Loom Solar

Vikram Solar

Waaree Energies

Azure Power

Rays Power Infra

SunSource Energy

- Installed Capacity by Sector and Segment

- Financing and Procurement Behavior

- Payback Expectations and Incentive Utilization

- Purchase Decision-Making Cycle

- Pain Points, Expectations, and ROI Benchmarks

- By Value, 2025-2030

- By Installed Capacity (MW), 2025-2030

- By Average System Cost (INR/kW), 2025-2030