Market Overview

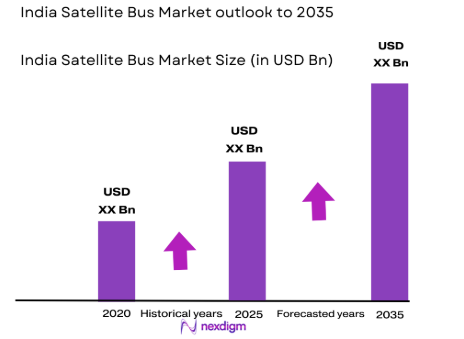

The India Satellite Bus market is projected to reach an estimated value of USD ~ billion in 2025, driven by significant advancements in satellite technology, the increasing demand for satellite communication, and government support for space initiatives. Key factors such as reduced launch costs, growing demand for data transmission, and evolving space exploration missions fuel this growth. This market expansion is also supported by international collaborations and the adoption of high-performance satellite bus systems in various satellite programs.

India, along with leading nations in space technology, remains a major player in the satellite bus market. India’s Space Research Organization (ISRO) continues to push for greater satellite launches and missions. With substantial investments in space infrastructure, India is expected to retain its position in the global satellite bus market. Major cities such as Bengaluru and New Delhi, which host the primary space research and manufacturing hubs, are central to the market’s growth. Their prominence is also backed by the governmental focus on advancing satellite capabilities and bolstering national security.

Market Segmentation

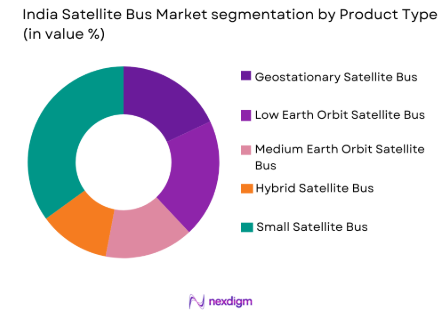

By Product Type

The India Satellite Bus market is segmented by product type into geostationary, low Earth orbit (LEO), medium Earth orbit (MEO), hybrid, and small satellite buses. Small satellite buses dominate due to increasing demand for cost-effective, compact satellites used in Earth observation, communications, and research. These buses offer efficient payload integration, propulsion, and power systems, making them ideal for government and private sector missions. Their lower cost and faster deployment compared to larger satellites add to their appeal. Additionally, small satellite buses support satellite constellations for broadband internet and remote sensing. As demand for affordable, rapid-deployment systems rises, small satellite buses will continue to lead the market, driving innovation in satellite manufacturing.

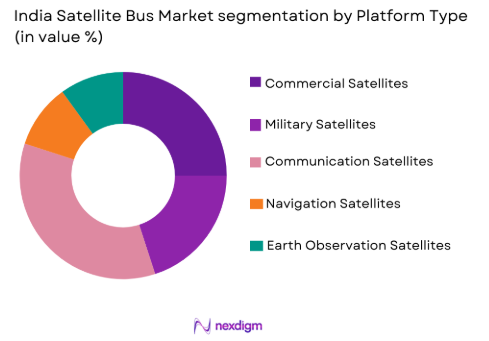

By Platform Type

The India Satellite Bus market is segmented by platform type into commercial, military, communication, navigation, and Earth observation satellites. The communication satellite sub-segment leads due to growing demand for satellite-based services like broadband, television, and data transmission, especially in remote areas. The rise of IoT, 5G, and global connectivity needs further boosts demand. Government initiatives such as Digital India and satellite broadband projects, especially for rural connectivity, accelerate this trend. Additionally, low Earth orbit (LEO) constellations for global broadband coverage are driving the need for specialized satellite buses that support high-speed data transmission and low-latency communication. These factors make communication satellite buses crucial in the India Satellite Bus market.

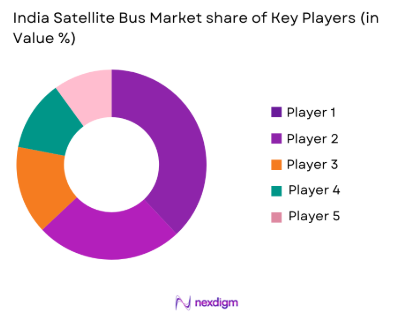

Competitive Landscape

The competitive landscape of the India Satellite Bus market is characterized by the presence of both established players and emerging companies. Consolidation trends are evident, with major global and local companies vying for market share through strategic partnerships, technological advancements, and expanding product offerings. Key players such as ISRO, Thales Alenia Space, and Lockheed Martin play a significant role in driving innovations in satellite bus design and manufacture. These players also influence the market by offering highly customizable and advanced satellite bus solutions catering to both governmental and commercial customers.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| ISRO | 1969 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

| Thales Alenia Space | 2005 | Cannes, France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Airbus | 2000 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

India Satellite Bus market Analysis

Growth Drivers

Government Support for Space Exploration and Infrastructure Development

Government initiatives have been pivotal in accelerating the growth of the India Satellite Bus market. The Indian government, primarily through its space agency ISRO (Indian Space Research Organisation), has demonstrated its commitment to advancing space technologies, which directly influences the demand for satellite buses. India’s space exploration initiatives, including the successful Mars Orbiter Mission (Mangalyaan) and Chandrayaan missions, along with plans for the Gaganyaan mission, have all spurred an increased need for robust and efficient satellite bus systems to carry payloads for such ambitious projects. The government’s substantial funding of the space sector, alongside plans to augment national security through satellite systems, further propels the demand for satellite buses. Moreover, India’s National Space Policy and various regulatory reforms designed to boost private sector participation are leading to an influx of new entrants in the space sector, which in turn is increasing the demand for satellite buses. India’s space policy also emphasizes international collaboration, opening opportunities for cross-border satellite programs that further necessitate the production of satellite buses capable of catering to varied mission requirements. A key element of this growth is India’s expanding satellite launch capabilities, such as the Polar Satellite Launch Vehicle (PSLV) and the Geosynchronous Satellite Launch Vehicle (GSLV), which are enhancing the affordability and reliability of satellite missions. Additionally, the government has prioritized developing space infrastructure, including the establishment of ground stations, tracking facilities, and communication networks, to support satellite operations. This infrastructure growth feeds directly into the satellite bus market, as these buses are required to support a broad spectrum of missions, from communication to Earth observation and security. Moreover, India’s vision of becoming a space superpower hinge on bolstering its satellite capabilities, reinforcing the critical role satellite buses play in this strategy.

Technological Advancements in Satellite Systems

Technological innovation is a primary growth driver in the India Satellite Bus market. The increasing miniaturization of satellite components, the rise of electric propulsion systems, and the use of advanced materials are transforming satellite buses into more efficient, cost-effective solutions. As satellite missions evolve, the need for more advanced satellite buses that support these innovations grows exponentially. The trend toward small and medium-sized satellites, often referred to as small sats, is leading to a shift in the satellite bus market toward smaller, modular buses that are less expensive to manufacture and launch, while still maintaining high levels of functionality. The growing demand for satellite constellations, such as those used in communications and Earth observation, has also accelerated the development of smaller, more versatile satellite buses that can be mass-produced at lower costs. The adoption of electric propulsion in satellite buses is a key technological development, offering numerous benefits, including longer lifespans, lower operational costs, and enhanced mission flexibility. These propulsion systems use less fuel, providing longer operational capabilities for satellites, which is essential for deep-space and long-duration missions. Furthermore, advances in modular satellite buses, which allow for quick customization based on specific mission requirements, have made satellite bus systems more adaptable and versatile. These innovations are essential to meet the diverse demands of both governmental and commercial customers. In addition, the integration of artificial intelligence (AI) and machine learning (ML) into satellite bus systems has led to the development of “smart” satellite buses that can autonomously monitor satellite performance, manage power systems, and perform diagnostic functions. These AI-powered systems enhance satellite efficiency, reduce the likelihood of failure, and extend the life of satellites, thereby adding immense value to the satellite bus market. As these technologies continue to mature, they will not only drive the growth of the market but also lower the costs and enhance the performance of satellite bus systems.

Market Challenges

High Cost of Satellite Bus Systems and Launch Operations

A primary challenge for the India Satellite Bus market is the high cost of manufacturing satellite buses and launching them into space. While technological advancements have led to some cost reductions, satellite buses remain expensive due to the complexity of their design and the high-quality materials required for their construction. Satellite buses are intricate systems that must support a range of satellite components such as propulsion, power systems, thermal control, communication systems, and payload integration. These advanced components require extensive research and development, leading to significant production costs. In addition, the cost of launching satellites, which includes vehicle costs, payload integration, and ground infrastructure, is often a significant barrier for smaller companies and new entrants. Despite the success of low-cost launch vehicles developed by ISRO, such as the PSLV, the overall cost of satellite launches remains high. As the demand for small satellite constellations increases, satellite bus manufacturers must focus on reducing the cost of producing these systems while maintaining performance standards. The price of satellite buses can also vary depending on the type of satellite bus being produced, with complex systems designed for high-resolution imaging, advanced communication, or military purposes requiring higher investments. These costs are compounded by the fact that many satellite programs are large-scale endeavors that require significant investments in infrastructure, such as launch facilities, ground stations, and tracking systems. For emerging players or companies with limited budgets, these high costs can make entering the market a difficult prospect, limiting competition and slowing the pace of innovation. Furthermore, the significant costs associated with satellite bus systems may also deter potential customers, especially those operating on tighter budgets or within emerging markets. To overcome this challenge, there is a need for continued innovation in manufacturing processes and the development of lower-cost satellite buses that can still meet mission-critical performance requirements.

Regulatory and Compliance Barriers in International Satellite Deployments

Regulatory and compliance challenges are a major hurdle for the India Satellite Bus market, particularly when it comes to international satellite deployments. The growing number of satellite launches worldwide has led to increased attention from regulatory bodies, which impose stringent requirements related to satellite frequency allocation, orbital slot assignment, and space debris management. In India, while ISRO regulates the satellite development and launch process, navigating the complex global regulatory environment remains challenging for satellite bus manufacturers and satellite operators. International satellite deployments often require approval from multiple countries and agencies, including the International Telecommunication Union (ITU), the United Nations Office for Outer Space Affairs (UNOOSA), and national space agencies, which oversee satellite licensing, frequency coordination, and orbital slot allocation. This web of regulations can create delays in satellite deployment and increase costs, as satellite bus manufacturers must ensure that their systems comply with a wide range of legal and technical standards. Moreover, the rules governing satellite launches vary from country to country, and international collaboration is often necessary for shared satellite missions. This collaborative process can be time-consuming, subject to political influence, and expensive. The rapid increase in the number of small satellite missions has only exacerbated these regulatory challenges, as the growing number of satellites in orbit raises concerns about space traffic management and space debris mitigation. The increasing demand for satellite constellations, such as those aimed at providing global broadband services, further complicates the regulatory landscape, as these systems require large numbers of satellites to be launched and operated in close proximity to one another. Satellite bus manufacturers and operators must therefore work closely with regulatory bodies to ensure that their systems meet all required standards and operate within the confines of international space law. The complexity and cost of complying with these regulations remain one of the largest barriers to the expansion of the satellite bus market.

Opportunities

Demand for Small Satellite Systems and Miniaturization of Satellite Buses

One of the most significant opportunities for the India Satellite Bus market lies in the growing demand for small satellite systems and the miniaturization of satellite buses. Small satellite systems, which include micro, nano, and picosatellites, offer substantial cost advantages over traditional large satellites, and as a result, they are increasingly being adopted by both commercial and governmental entities. The miniaturization of satellite buses plays a central role in making these small satellites viable, as smaller satellite buses allow for more affordable manufacturing, faster deployment, and lower launch costs. The adoption of small satellite constellations, which are deployed in low Earth orbit (LEO) and are designed to provide global broadband coverage, Earth observation, and remote sensing services, is particularly driving the demand for miniaturized satellite buses. These constellations consist of hundreds or even thousands of small satellites, each requiring a dedicated satellite bus to carry out specific mission functions. As satellite manufacturers continue to refine their designs, the cost of small satellite buses is expected to decrease further, making them more accessible to a broader range of customers, including start-ups, research institutions, and private enterprises. Additionally, smaller satellite buses offer increased flexibility and scalability, allowing for the easy deployment of satellites in groups or constellations to provide continuous, global coverage. The demand for small satellite systems is particularly strong in the communications, Earth observation, and scientific research sectors, where satellites can provide critical data and connectivity in underserved or remote areas. As space programs increasingly prioritize small satellite missions, satellite bus manufacturers are well-positioned to capitalize on this trend by developing affordable and efficient solutions for a rapidly expanding customer base.

Increased Investments in Satellite-Based Communication and Connectivity

The rapid expansion of satellite-based communication and connectivity services represents another significant opportunity for the India Satellite Bus market. Satellite communication systems have become essential for delivering high-speed internet and data services to remote and underserved regions where terrestrial infrastructure is inadequate or unavailable. The rise of the Internet of Things (IoT), 5G technology, and mobile broadband services has created a growing demand for satellite systems that can handle vast amounts of data transmission. Satellite buses play a key role in enabling these services, as they provide the platform for deploying communication satellites that are capable of supporting high-throughput data systems. This need for global connectivity has led to an explosion in satellite constellations designed to provide continuous coverage, with companies such as SpaceX’s Starlink, OneWeb, and Amazon’s Project Kuiper leading the charge in providing global broadband coverage via LEO satellites. The Indian government’s focus on bridging the digital divide through initiatives like the Digital India program aligns with this trend, creating a favorable environment for satellite-based communication systems. Satellite buses that can support these constellations are essential for the continued success of such large-scale communication systems. As India seeks to provide better connectivity across rural and remote areas, satellite buses capable of supporting high-speed data transfer, real-time communication, and emergency services are expected to see a surge in demand. The commercial satellite communication sector, particularly for sectors such as aviation, maritime, and defense, is another key area driving growth. As new players enter the satellite-based communication market, the demand for advanced satellite bus systems that can support high-performance communication systems is set to increase, providing manufacturers with ample opportunities for expansion and growth.

Future Outlook

Over the next five years, the India Satellite Bus market is expected to experience significant growth, driven by advancements in satellite technology, growing demand for satellite-based communication services, and expanding government initiatives. Increasing investments in space infrastructure, particularly with the rise of small satellite systems and miniaturization, will boost the demand for more cost-effective satellite buses. The growing focus on sustainable satellite design, coupled with regulatory support, will further contribute to market development. As technological innovation continues to progress, the market will see new opportunities in satellite miniaturization and advanced propulsion systems, shaping the future of space exploration and satellite communication in India.

Major Players

- ISRO

- Thales Alenia Space

- Lockheed Martin

- Airbus

- Northrop Grumman

- Boeing

- Arianespace

- SES

- SpaceX

- OneWeb

- Orbital ATK

- Maxar Technologies

- China Aerospace Corporation

- Rocket Lab

- Surrey Satellite Technology

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite service providers

- Aerospace and defense contractors

- Space research organizations

- Telecommunications companies

- Satellite technology developers

- Satellite bus manufacturers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the critical factors that influence the India Satellite Bus market, such as technological advancements, market trends, regulatory frameworks, and economic conditions. These variables include government policies, technological innovations, and industry demand, which are essential in shaping the market landscape. By defining these variables, the research aims to ensure a comprehensive understanding of the market’s drivers and constraints. The identification of these key variables helps establish a strong foundation for subsequent analysis and forecasting.

Step 2: Market Analysis and Construction

In this step, extensive data is collected through primary and secondary research sources, including industry reports, government publications, and expert interviews. This data is then analyzed to build a comprehensive market model, covering market size, growth trends, competitive landscape, and key drivers. By analyzing the market from different angles, this step ensures a complete understanding of current dynamics and future market potential. Data is also segmented by product type, platform, procurement channels, and other key factors to provide detailed insights.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, initial hypotheses and market forecasts are validated through consultations with industry experts, including manufacturers, satellite operators, and policymakers. These consultations help ensure the accuracy and relevance of the research findings by incorporating insights from experienced professionals in the field. Expert validation also provides clarity on market assumptions and helps refine the methodology to reflect real-world industry conditions. The process ensures that the conclusions drawn are credible and aligned with actual industry trends.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the collected data, insights, and expert feedback to produce a detailed and actionable market report. This synthesis includes compiling growth forecasts, market segmentation, competitive analysis, and trends that will guide stakeholders in making informed decisions. The output is rigorously reviewed for accuracy, and all assumptions are clearly documented. This step ensures that the final research output is comprehensive, reliable, and ready for presentation to key stakeholders in the industry.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for satellite-based communication networks

Government investments in space exploration and satellite programs

Technological advancements in miniaturization and materials

Growth in Earth observation and data collection requirements

Expansion of private sector involvement in space programs - Market Challenges

High initial development and launch costs

Technical challenges in satellite bus integration

Stringent regulatory and certification requirements

Dependence on global supply chains for components

Limited access to spaceports and launch facilities - Market Opportunities

Growth in space tourism and private satellite launches

Advancements in satellite propulsion systems

Partnerships between governments and private enterprises - Trends

Miniaturization of satellite bus systems

Increased focus on low-cost satellite buses

Rising demand for autonomous satellite operations

Development of hybrid propulsion systems

Integration of satellite buses with 5G infrastructure - Government Regulations & Defense Policy

National Space Policy Framework

Launch vehicle and satellite licensing regulations

Export control laws affecting satellite bus technologies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Geostationary Satellite Bus

Low Earth Orbit (LEO) Satellite Bus

Medium Earth Orbit (MEO) Satellite Bus

Hybrid Satellite Bus

Small Satellite Bus - By Platform Type (In Value%)

Commercial Satellites

Military Satellites

Communication Satellites

Navigation Satellites

Earth Observation Satellites - By Fitment Type (In Value%)

Modular Satellite Buses

Customized Satellite Buses

Small Satellite Buses

High-Performance Satellite Buses

Integrated Satellite Bus Systems - By EndUser Segment (In Value%)

Government and Space Agencies

Private Aerospace Companies

Telecommunications Service Providers

Defense and Military Contractors

Space Research Institutions - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Distributors & Resellers

Third-Party Integration Services

Government Tenders and Contracts

Global Supply Chain Networks - By Material / Technology (In Value%)

Carbon Fiber Composites

Thermal Insulation Materials

Aluminum Alloys

Power Generation Technologies

Communication and Control Systems

- Market share snapshot of major players

- Cross Comparison Parameters (Product Innovation, Market Reach, Cost Efficiency, Technological Capabilities, Regulatory Compliance)

- SWOT Analysis of Key Players

- Pricing & Analysis

- Porter’s Five Forces

- Key Players

SpaceX

ISRO

Lockheed Martin

Airbus Defence and Space

Northrop Grumman

Thales Alenia Space

Boeing Space and Launch

OneWeb

Blue Origin

Arianespace

Rocket Lab

Sierra Nevada Corporation

Maxar Technologies

Relativity Space

SSL (Space Systems Loral)

- Government agencies focused on national security

- Telecommunication companies expanding satellite coverage

- Private space companies with commercial satellite needs

- International space agencies conducting global research

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035