Market Overview

The India Satellite Cable and Assemblies market is valued at USD ~ million based on recent assessments, primarily driven by the growing demand for satellite-based communication and broadcasting services. The sector is influenced by the increasing number of satellite launches and advancements in cable technology. Government initiatives to expand communication infrastructure and investments in space technology further fuel the demand for satellite cable assemblies, creating a favorable environment for market growth. Key cities such as Bengaluru, Hyderabad, and New Delhi are dominant in the market due to the presence of major satellite and space technology companies, alongside robust government support for satellite communications. Bengaluru, known as the “Silicon Valley of India,” hosts leading companies in space technology, contributing significantly to the growth of satellite cable demand. New Delhi’s strategic position as the capital facilitates government investments and policy frameworks, which enhance market development.

Market Segmentation

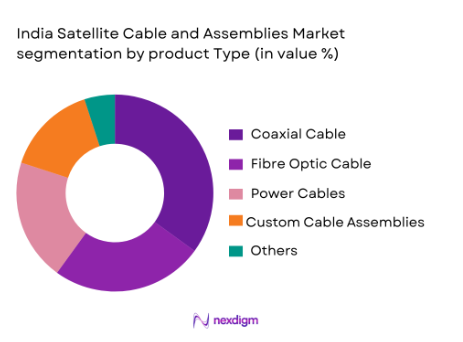

By Product Type

The India Satellite Cable and Assemblies market is segmented by product type into coaxial cables, fiber optic cables, power cables, and custom cable assemblies. Coaxial cables have a dominant share due to their long-established use in satellite communications, known for their robustness and ability to carry high-frequency signals over long distances. The demand for coaxial cables remains strong, owing to the growing installation of satellite dishes and demand for high-quality television broadcasts.

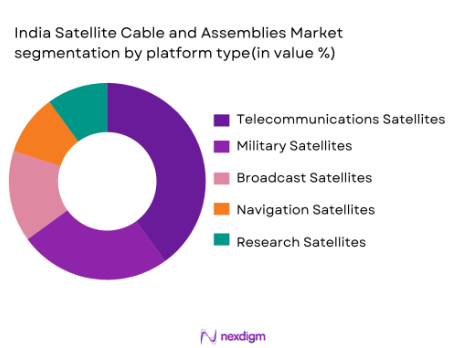

By Platform Type

The market is segmented by platform type into telecommunications satellites, military satellites, broadcast satellites, navigation satellites, and research satellites. Telecommunications satellites take the lead, supported by the rapid expansion of communication infrastructure in India, which fuels demand for high-capacity satellite connections. The need for broadband services, both in rural and urban regions, drives the adoption of these satellites, as they are essential for providing internet and mobile services across the country.

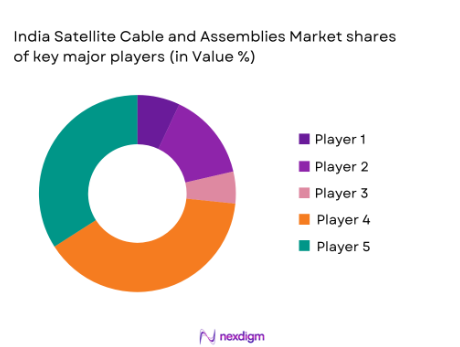

Competitive Landscape

The India Satellite Cable and Assemblies market is dominated by a few key players who shape the competitive landscape. Companies such as ISRO (Indian Space Research Organisation), SES S.A., Intelsat, Viasat Inc., and Boeing Space and Launch play a significant role in the development and deployment of satellite technologies. These companies have established themselves as leaders by providing reliable satellite systems and services that cater to telecommunications, defense, and broadcast sectors.

| Company Name | Establishment Year | Headquarters | Market Focus | Satellite Technology | Cable Assembly Expertise | Customer Base |

| ISRO | 1969 | Bengaluru, India | – | – | – | – |

| SES S.A. | 1985 | Luxembourg | – | – | – | – |

| Intelsat | 1964 | Luxembourg | – | – | – | – |

| Viasat Inc. | 1986 | California, USA | – | – | – | – |

| Boeing Space and Launch | 1916 | Illinois, USA | – | – | – | – |

India Satellite Cable and Assemblies Market Analysis

Growth Drivers

Growing demand for satellite-based communication services

India’s demand for satellite-based communication services is propelled by increasing urbanization and the expanding digital landscape. In 2023, the number of internet users in India reached over 800 million, which translates into a rising demand for broadband and mobile connectivity. The government’s push for broadband penetration through initiatives like the BharatNet Project aims to connect rural India with high-speed internet using satellite technology. The demand for direct-to-home (DTH) services, essential for reaching remote areas, further supports the growth of satellite cable services. Government investments in communication infrastructure are anticipated to continue growing, fostering the expansion of satellite communication systems across urban and rural sectors.

Rising government investments in space and defense sectors

India’s government has significantly increased its investments in both the space and defense sectors, directly benefiting the satellite cable and assemblies market. The Indian Space Research Organisation (ISRO) has been allocated INR 13,479 crore for space technology development in the 2024-25 budget, showing strong governmental commitment to expanding space exploration, satellite communication, and defense capabilities. With a growing focus on self-reliance, the government’s support for satellite systems, including cables and communication infrastructure, has led to a surge in demand for advanced satellite communication systems, benefiting domestic satellite cable manufacturers.

Market Challenges

High cost of raw materials for cable production

The high cost of raw materials, particularly copper and specialized alloys used in cable production, poses a significant challenge to the satellite cable market. As of 2023, the price of copper has been volatile, influenced by global supply chain disruptions and geopolitical factors, making the production of satellite cables more expensive. According to data from the International Copper Study Group (ICSG), global copper prices peaked at USD ~ per metric ton, contributing to the rise in manufacturing costs for satellite cables. These increasing costs are being transferred to end-users, potentially slowing market growth.

Source: International Copper Study Group

Complex regulatory compliance for satellite components

Regulatory compliance for satellite components, especially cables, has become more complex in India. The country’s regulatory framework governing satellite communication, particularly the Indian Telegraph Act and the guidelines from the Department of Space, has been tightened to ensure quality and security standards are met. With the rapid evolution of space technologies and the proliferation of satellite systems, manufacturers face the challenge of meeting increasingly stringent certification requirements for satellite cables and components. Non-compliance risks could lead to costly delays, affecting the overall market dynamics.

Market Opportunities

Expansion of satellite constellations for global communication

The global satellite constellation market is growing, creating new opportunities for India’s satellite cable and assemblies sector. The growing demand for global communication services and the need for low-latency internet has led to the launch of large-scale satellite constellations, such as SpaceX’s Starlink. India, with its vast geographical expanse, is positioned to benefit significantly from these global initiatives, as the country increasingly adopts satellite-based communication for internet connectivity in rural and remote areas. The integration of these satellite constellations will require advanced satellite cables to manage the communication networks effectively, representing a significant market opportunity for local manufacturers.

Adoption of sustainable manufacturing practices in cable production

The growing global emphasis on sustainability is leading satellite cable manufacturers in India to adopt eco-friendly practices in their production processes. This includes the use of recyclable materials, reducing carbon emissions, and utilizing energy-efficient manufacturing technologies. The Indian government’s push for a green economy through initiatives like the National Clean Energy Fund is encouraging businesses to incorporate sustainability into their operations. Companies that adopt these practices not only benefit from cost savings but also tap into a growing consumer preference for environmentally conscious products, positioning themselves for long-term success in the satellite cable industry.

Future Outlook

Over the next decade, the India Satellite Cable and Assemblies market is expected to experience significant growth. This growth will be driven by an increase in satellite launches, advancements in cable technology, and the growing demand for global satellite communication systems. The Indian government’s continued investment in space technology, coupled with the expansion of satellite-based internet and mobile services, will further propel market development. With the rise of broadband connectivity in underserved regions, the need for satellite infrastructure, and, consequently, satellite cables will grow substantially.

Major Players

- ISRO

- SES S.A.

- Intelsat

- Viasat Inc.

- Boeing Space and Launch

- SpaceX

- Thales Alenia Space

- Telesat

- Maxar Technologies

- Hughes Network Systems

- Arianespace

- Eutelsat Communications

- OneWeb

- Lockheed Martin

- L3Harris Technologies

Key Target Audience

- Satellite Communication Providers

- Defense and Aerospace Organizations

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Telecommunications Providers

- Private Satellite Operators

- Broadcasting and Cable Service Providers

- Research and Development Agencies

Research Methodology

Step 1: Identification of Key Variables

The first phase of the research process involves identifying and mapping the key variables that influence the India Satellite Cable and Assemblies market. Extensive desk research is conducted, utilizing secondary sources such as government reports, industry databases, and company filings to gather information on the key market drivers, challenges, and opportunities.

Step 2: Market Analysis and Construction

In this phase, historical data related to market penetration, platform types, and the adoption of satellite cable technologies will be analyzed. The focus is on understanding the usage patterns and financial impacts of satellite cables in various sectors such as telecommunications and defense.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding the demand and supply dynamics of satellite cable products will be validated by consulting with industry experts, including satellite manufacturers, telecom operators, and government agencies. This step ensures the authenticity of the data gathered.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data and integrating it with insights from satellite cable manufacturers. This engagement helps refine the data, ensuring a comprehensive and accurate understanding of the market trends and future projections.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing demand for satellite-based communication services

Rising government investments in space and defense sectors

Technological advancements in satellite cable manufacturing - Market Challenges

High cost of raw materials for cable production

Complex regulatory compliance for satellite components

Limited infrastructure in remote regions - Market Opportunities

Expansion of satellite constellations for global communication

Adoption of sustainable manufacturing practices in cable production

Increasing demand for high-speed data transmission in space applications - Trends

Shift towards miniaturization of satellite components

Increase in commercial satellite launches

Adoption of hybrid and integrated satellite systems

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Custom Cable Assemblies

High-Frequency Cables

Fiber Optic Cable Assemblies

Power and Signal Cables

Coaxial Cables - By Platform Type (In Value%)

Telecommunications Satellites

Broadcast Satellites

Military Satellites

Navigation Satellites

Research and Space Exploration - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Upgrade Fitment - By End User Segment (In Value%)

Telecommunications Providers

Satellite Service Providers

Defense Contractors

Space Agencies

Research Organizations - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Procurement

Government Contracts

Private Sector Procurement

OEM Suppliers

- Market Share Analysis

- Cross Comparison Parameters (Product Quality, Innovation, Customer Service, Production Capacity, Supply Chain Efficiency)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Detailed Company Profiles

SpaceX

ISRO

Thales Alenia Space

Arianespace

Boeing

Lockheed Martin

Airbus Defence and Space

Intelsat

SES S.A.

Viasat Inc.

Telesat

Hughes Network Systems

Globalstar

OneWeb

Maxar Technologies

- Demand from government defense and space agencies

- Growth in demand from private satellite operators

- Technological requirements for 5G satellite communication

- Increasing investment in satellite manufacturing facilities

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035