Market Overview

The India Satellite Component market is valued at USD ~ billion, driven by significant investments in satellite infrastructure and the growing need for advanced communication systems. The market is fueled by increasing satellite launches, government initiatives to expand satellite communication networks, and the demand for space-based data services. This growth is further supported by technological advancements in miniaturized satellite components and the expansion of global satellite constellations.

Dominant cities like Bengaluru, New Delhi, and Hyderabad play key roles in the market’s development. Bengaluru, known as the “Silicon Valley of India,” is home to major space technology companies and research centers. New Delhi, as the political and economic hub of India, facilitates government-backed space initiatives. Hyderabad’s growing tech ecosystem, particularly in defense and space technologies, has made it an emerging hotspot for satellite component manufacturing and innovation.

Market Segmentation

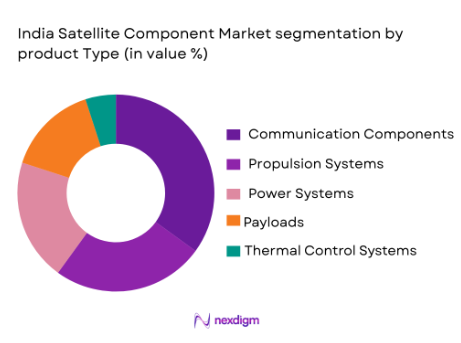

By Product Type

The India Satellite Component market is segmented by product type into communication components, propulsion systems, power systems, payloads, and thermal control systems. Communication components dominate the market due to their essential role in satellite communication systems. These components, which include transponders, antennas, and signal processors, are vital for ensuring reliable communication between satellites and ground stations. The growing demand for satellite internet services, especially in remote and rural areas, drives the dominance of communication components, as they form the backbone of satellite-based communication systems.

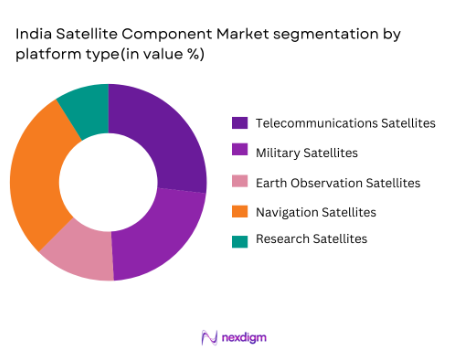

By Platform Type

The market is segmented by platform type into telecommunications satellites, military satellites, Earth observation satellites, navigation satellites, and research satellites. Telecommunications satellites dominate the market, driven by the increasing demand for satellite-based communication services. As global connectivity becomes more crucial, the need for satellites that provide internet, television, and telecommunication services continues to rise. Additionally, the Indian government’s initiatives, such as the Indian Space Program and projects by ISRO, are driving the demand for reliable communication platforms, boosting the demand for telecommunications satellites.

Competitive Landscape

The India Satellite Component market is marked by consolidation, with major players such as ISRO, Boeing, Thales Alenia Space, Lockheed Martin, and Airbus dominating the market. These companies play a significant role in developing satellite systems, components, and related technologies, ensuring the market remains highly competitive. The presence of both international and domestic players, backed by government initiatives, fosters innovation and enhances competition, providing consumers with a range of advanced products.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| ISRO | 1969 | Bengaluru, India | – | – | – | – | – |

| Boeing | 1916 | Chicago, USA | – | – | – | – | – |

| Thales Alenia Space | 2005 | Cannes, France | – | – | – | – | – |

| Lockheed Martin | 1912 | Bethesda, USA | – | – | – | – | – |

| Airbus Defence and Space | 2000 | Toulouse, France | – | – | – | – | – |

India Satellite Component Market Analysis

Growth Drivers

Rising demand for satellite communication services

The demand for satellite communication services in India is rapidly growing due to the need for reliable internet and telecommunication services, especially in remote and rural areas. With an estimated 800 million internet users in India, the government’s efforts to provide universal broadband access, such as the BharatNet initiative, is pushing the need for more satellite-based communication systems. The expansion of mobile data services and the rise of video content consumption also contribute to the increasing demand for satellite bandwidth. Furthermore, India’s increasing participation in global satellite constellations, such as SpaceX’s Starlink, further boosts demand for satellite communication systems. As the government continues to invest in satellite technologies to meet national communication needs, this demand will drive the satellite component market.

Government investments in space infrastructure

The Indian government’s investment in space technology and infrastructure is a critical driver of the satellite component market. With the Indian Space Research Organisation (ISRO) at the forefront, the government has allocated significant funds to the development and expansion of satellite systems, such as the GSAT series and Gaganyaan mission. These investments provide a solid foundation for the growth of the satellite component market, including the production of propulsion systems, communication components, and payloads. The government’s efforts to boost the space industry, including partnerships with private players, fuel innovation and improve infrastructure, creating opportunities for manufacturers of satellite components. As India seeks to enhance its global presence in space exploration and satellite communication, these investments will ensure the market’s continuous growth.

Market Challenges

High cost of satellite component manufacturing

The high cost of manufacturing advanced satellite components poses a significant challenge to market growth. Raw materials such as specialized metals, semiconductors, and composites required for satellite components are expensive, which drives up production costs. Additionally, the complexity of designing and manufacturing components that can withstand the harsh conditions of space further contributes to the high cost. The reliance on advanced technologies and precision manufacturing processes also adds to the overall expenses. Small and medium-sized enterprises may struggle to compete with larger manufacturers who have economies of scale, potentially limiting the market’s growth potential.

Regulatory compliance and certification hurdles

The complexity of regulatory compliance and the certification process for satellite components in India presents a significant market challenge. The Indian Space Research Organisation (ISRO) and other regulatory bodies have stringent requirements for satellite components to ensure safety, quality, and reliability. Compliance with these regulations requires substantial investments in testing, quality control, and certification processes, which can delay product development and increase costs. The evolving nature of satellite technology also means that companies must constantly update their systems to meet new regulatory standards. These challenges can slow down innovation and product deployment, negatively impacting the overall market.

Opportunities

Expansion of satellite constellations for global connectivity

The expansion of satellite constellations, such as those planned by SpaceX and OneWeb, presents significant opportunities for India’s satellite component market. The drive to provide global broadband coverage through low Earth orbit (LEO) satellites is creating new demand for satellite components. As India aims to expand its broadband coverage, both domestically and as part of global connectivity initiatives, the need for reliable, high-performance satellite components will continue to grow. The Indian government’s collaboration with private companies on satellite launches and communication systems further fuels the demand for advanced satellite components, providing a substantial market opportunity for local manufacturers.

Adoption of sustainable and eco-friendly manufacturing practices

As the global space industry shifts towards sustainability, there is a growing opportunity for India’s satellite component manufacturers to invest in environmentally friendly production processes. The adoption of green manufacturing practices, such as using recyclable materials for satellite components and minimizing energy consumption during production, aligns with global sustainability trends. As satellite technology advances, manufacturers that prioritize eco-friendly practices can attract new customers, including government agencies and private operators with sustainability mandates. By adopting these practices, Indian manufacturers can position themselves as leaders in the eco-conscious segment of the satellite component market, meeting the demands of both regulatory frameworks and environmentally conscious consumers.

Future Outlook

The India Satellite Component market is expected to see significant growth over the next five years, driven by increased investments in space infrastructure, the expansion of satellite constellations, and the rising demand for satellite-based communication services. Technological advancements in satellite miniaturization and communication systems will continue to evolve, opening up new opportunities for manufacturers. The Indian government’s focus on enhancing the space sector and supporting private-sector participation will provide further momentum for the market. In addition, regulatory frameworks supporting innovation in satellite technologies are expected to create a favorable environment for growth.

Major Players

- ISRO

- Boeing

- Lockheed Martin

- Thales Alenia Space

- Airbus Defence and Space

- Maxar Technologies

- SpaceX

- SES

- Viasat Inc.

- Telesat

- Hughes Network Systems

- Intelsat

- Arianespace

- OneWeb

- Tata Advanced Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (Department of Space, ISRO)

- Telecommunications providers

- Satellite manufacturers

- Defense contractors

- Research organizations

- Private satellite operators

- Aerospace and defense agencies

Research Methodology

Step 1: Identification of Key Variables

In this step, key variables affecting the India Satellite Component market are identified, including technological trends, regulatory factors, and demand drivers. Extensive desk research is conducted to gather market insights and identify influential market drivers.

Step 2: Market Analysis and Construction

This phase involves analyzing historical market data, including demand for satellite components, market penetration rates, and key technologies used in satellite systems. The focus is on assessing the market dynamics and understanding growth patterns.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including satellite component manufacturers, defense contractors, and government officials. This step ensures the reliability and accuracy of the research findings.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the findings from previous stages, engaging with manufacturers and stakeholders, and ensuring that all data points align with industry trends and market projections. This comprehensive analysis forms the basis for the final market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for satellite-based communication services

Rising government investments in space and defense sectors

Advancements in satellite miniaturization technologies - Market Challenges

High cost of raw materials for satellite components

Complex regulatory and certification requirements for satellite components

Supply chain disruptions affecting satellite production - Market Opportunities

Expansion of satellite constellations for global broadband

Growing focus on satellite communication infrastructure in rural India

Integration of AI and IoT technologies in satellite systems - Trends

Miniaturization and integration of satellite components

Increased private sector participation in satellite manufacturing

Adoption of reusable satellite components - Government Regulations

Telecommunications and Broadcasting Regulatory Framework

Space Launch and Satellite Deployment Regulations

Environmental Impact Guidelines for Satellite Production

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Power Systems

Thermal Control Systems

Payloads

Propulsion Systems

Structural Components - By Platform Type (In Value%)

Telecommunications Satellites

Military Satellites

Navigation Satellites

Earth Observation Satellites

Research Satellites - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Custom Fitment

Upgrade Fitment - By End User Segment (In Value%)

Telecommunications Providers

Government Agencies

Defense Contractors

Private Satellite Operators

Research Organizations - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Procurement

OEM Suppliers

Private Sector Procurement

Government Contracts

- Market Share Analysis

- Cross Comparison Parameters (Technology Innovation, Supply Chain Efficiency, Government Contracts, Manufacturing Capacity, Market Reach)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Detailed Company Profiles

ISRO

Arianespace

SpaceX

SES S.A.

Boeing

Lockheed Martin

Maxar Technologies

Telesat

Thales Alenia Space

Intelsat

Viasat Inc.

Airbus Defence and Space

OneWeb

Tata Advanced Systems

Hughes Network Systems

- Government Defense and Space Agencies

- Private Satellite Operators

- Telecommunications Service Providers

- Research and Development Institutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035