Market Overview

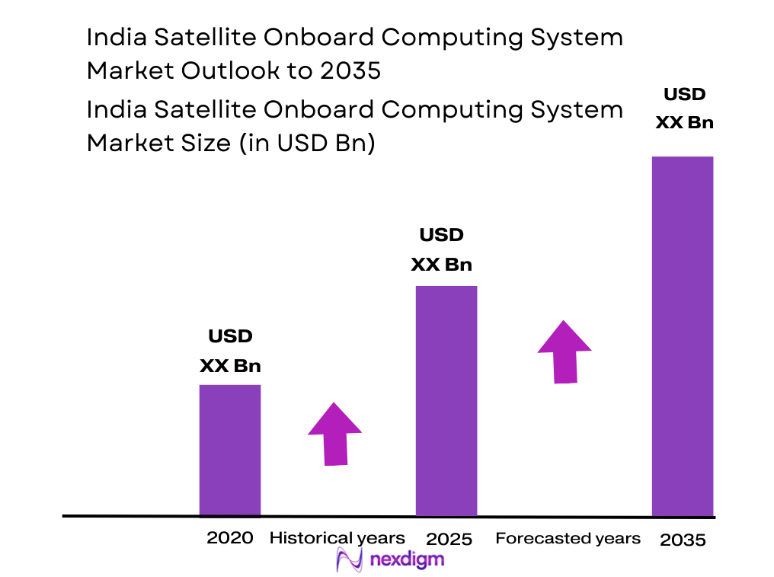

The India Satellite Onboard Computing System Market is projected to reach a market size of USD ~ billion, driven by advancements in satellite technologies and government investments. The market growth is supported by increasing demand for high-performance computing systems for satellite operations, including satellite communications, earth observation, and defense applications. Additionally, the shift towards miniaturization, as well as the adoption of AI and machine learning in satellite systems, further fuels market growth. The rising importance of space exploration and commercial satellite launches is expected to continue boosting the demand for advanced onboard computing systems.

In India, cities such as Bengaluru, New Delhi, and Hyderabad dominate the satellite sector due to their robust aerospace and defense infrastructure. Bengaluru, often dubbed the “Silicon Valley” of India, houses several aerospace and defense companies, along with the Indian Space Research Organisation (ISRO). New Delhi, the national capital, acts as a hub for government initiatives, policy making, and collaboration with global satellite manufacturers. Hyderabad is growing as a key player with its satellite and defense manufacturing units, further strengthening India’s leadership in satellite technology development.

Market Segmentation

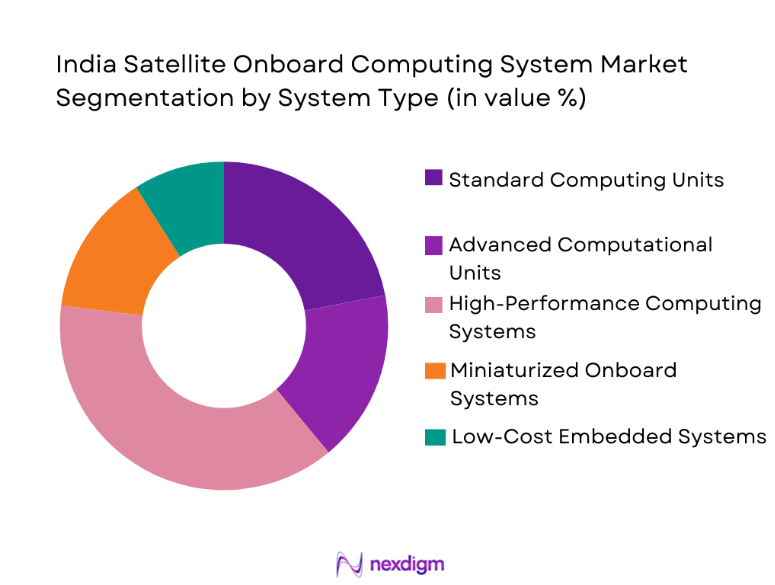

By System Type

India Satellite Onboard Computing System Market is segmented by system type into standard computing units, advanced computational units, high-performance computing systems, miniaturized onboard systems, and low-cost embedded systems. Recently, high-performance computing systems have a dominant market share due to the increasing need for powerful systems that can handle complex satellite operations. These systems are preferred for large-scale applications such as earth observation and defense satellites, where performance, speed, and reliability are critical. The growing demand for AI-integrated satellites and the need for real-time data processing further boost the adoption of high-performance systems, making them the dominant sub-segment in the market.

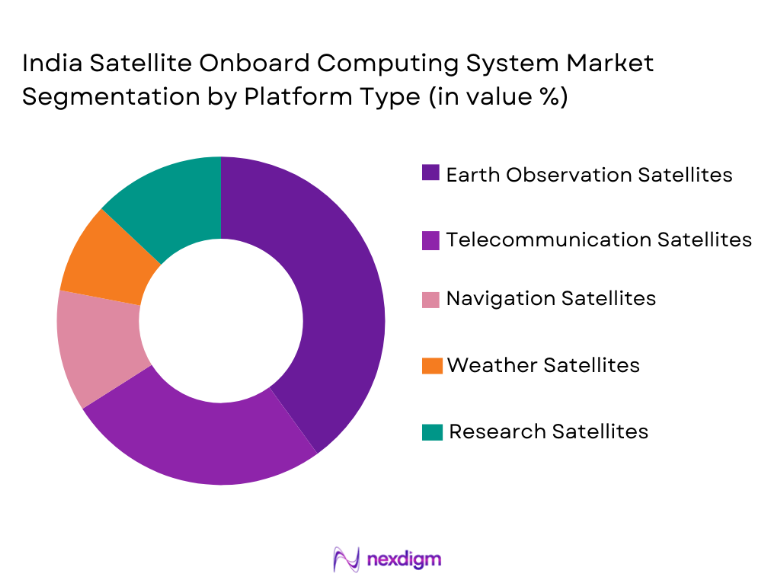

By Platform Type

India Satellite Onboard Computing System Market is segmented by platform type into earth observation satellites, telecommunication satellites, navigation satellites, weather satellites, and research satellites. Earth observation satellites dominate the market share as they play a pivotal role in monitoring environmental changes, agricultural developments, and urban planning. The rise in government and private sector initiatives aimed at using satellite data for agriculture, urbanization, and disaster management has led to an increase in the demand for earth observation satellites. Furthermore, the growing need for high-resolution imagery and data processing capabilities strengthens the dominance of this segment.

Competitive Landscape

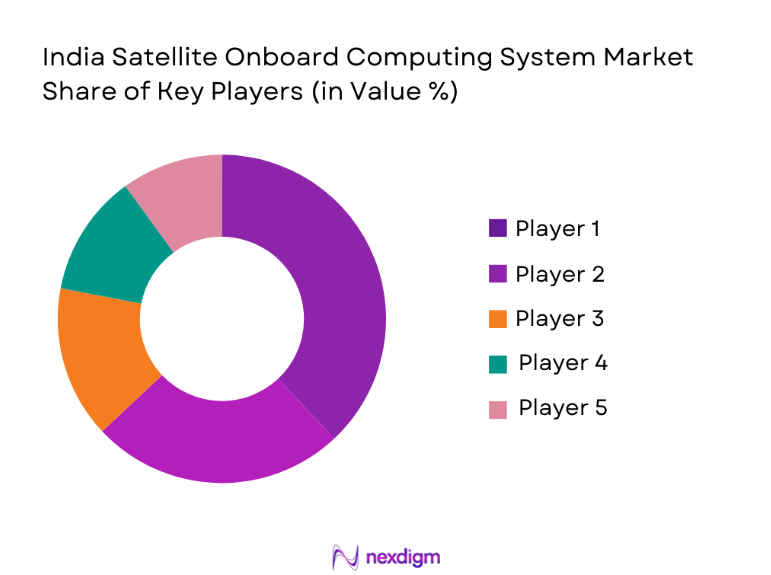

The competitive landscape of the India Satellite Onboard Computing System Market is characterized by a growing number of global and local players. Major players in the market are consolidating their presence through technological advancements and strategic partnerships with governments and private entities. The competition in the market is intensifying, with companies focusing on offering high-performance systems tailored for specific satellite missions. Companies are also expanding their research and development (R&D) activities to enhance the computational power and energy efficiency of onboard systems, thus leading to increased market consolidation.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Space Mission Focus |

| ISRO | 1969 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

| Thales Alenia Space | 2005 | Paris | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church | ~ | ~ | ~ | ~ | ~ |

India Satellite Onboard Computing System Market Analysis

Growth Drivers

Government Investment in Space Exploration

The Indian government has significantly increased its investment in space exploration, which has directly impacted the demand for advanced onboard computing systems. The Indian Space Research Organisation (ISRO), in particular, has played a critical role in driving the market by developing various satellite missions, such as the Mars Orbiter Mission and Chandrayaan. These missions require highly reliable onboard systems to process real-time data, increasing the market demand for high-performance computing units. Government initiatives, including funding space startups and facilitating international partnerships, have made India an attractive location for satellite manufacturing and launch services. This ongoing support from the Indian government is expected to continue driving market growth, as it encourages technological advancements, infrastructure development, and greater participation in the global space economy.

Rise in Commercial Satellite Launches

The increasing number of private companies entering the satellite launch market is another key growth driver. The commercial space sector in India has seen significant growth, particularly with the establishment of startups and private players like OneWeb India and Skyroot Aerospace. These companies are working to develop their own satellite constellations and launch vehicles, which require onboard computing systems. With the growing demand for satellite-based services such as global communications, broadband internet, and earth observation, there is a need for advanced computing solutions that ensure efficient data transmission and real-time processing. As more private players contribute to the satellite ecosystem, the need for reliable onboard systems will continue to rise, contributing to market expansion.

Market Challenges

High Development and Manufacturing Costs

One of the major challenges in the India Satellite Onboard Computing System Market is the high cost associated with the development and manufacturing of advanced computing systems. Onboard computing systems require specialized components, which are costly to design, test, and integrate into satellites. Furthermore, the research and development efforts required to improve processing power, energy efficiency, and system reliability contribute to the escalating costs of these systems. For emerging market players or smaller satellite manufacturers with limited budgets, these high costs can be a significant barrier to entry, hindering their ability to compete with established players in the market. This challenge is compounded by the need for extensive testing and compliance with stringent space mission standards.

Limited Availability of Skilled Workforce

Another major challenge facing the India Satellite Onboard Computing System Market is the shortage of skilled professionals specializing in satellite technology and onboard computing systems. As the demand for advanced satellite technologies increases, there is a growing need for engineers and technicians who are equipped with the knowledge to design, integrate, and maintain sophisticated onboard systems. The limited availability of such talent, coupled with the rapidly evolving technological landscape, poses a challenge to market growth. Companies in the market must invest heavily in training and development programs to bridge this skills gap, which adds to operational costs. Moreover, the shortage of skilled labor can delay project timelines, leading to higher production costs and missed business opportunities.

Opportunities

Expansion of Satellite Applications in IoT

One of the significant opportunities for growth in the India Satellite Onboard Computing System Market is the increasing use of satellites for Internet of Things (IoT) applications. As industries such as agriculture, logistics, and environmental monitoring seek to leverage satellite-based IoT solutions, there is a growing demand for advanced onboard computing systems that can handle vast amounts of real-time data. These systems need to support numerous sensors, communication modules, and data-processing tasks, making high-performance computing a critical requirement. India’s growing space sector, along with its push for technological innovation in the satellite industry, is positioning the country to capitalize on the expanding IoT satellite market.

Development of Sustainable Satellite Technologies

Another key opportunity in the market is the focus on developing sustainable satellite technologies. As environmental concerns rise globally, there is an increasing demand for eco-friendly satellite systems that minimize space debris and reduce the environmental impact of satellite launches and operations. India has the opportunity to lead in the development of green satellite technologies, such as energy-efficient computing systems and low-emission propulsion systems. By prioritizing sustainability in satellite designs, India’s space sector can attract global customers and government contracts, further accelerating the growth of the satellite onboard computing system market.

Future Outlook

The India Satellite Onboard Computing System Market is expected to witness substantial growth over the next five years, driven by government support, technological innovations, and the increasing commercialization of space. With the launch of new space missions and advancements in satellite technologies, the demand for high-performance, energy-efficient, and reliable onboard computing systems will rise. Additionally, the emergence of new applications such as satellite-based IoT, advanced communication services, and earth observation will drive further growth. Regulatory frameworks that support private sector participation and foreign investments will also contribute to a favorable market environment.

Major Players

- ISRO

- Thales Alenia Space

- Boeing

- Lockheed Martin

- Northrop Grumman

- SpaceX

- General Electric

- OneWeb

- Airbus

- Honeywell Aerospace

- L3Harris Technologies

- Inmarsat

- Telesat

- SES

- SSTL

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace & satellite manufacturers

- Telecommunications companies

- Space research organizations

- Satellite communications providers

- Military & defense contractors

- Satellite service operators

Research Methodology

Step 1: Identification of Key Variables

Key variables influencing the market, including government policies, technological advancements, and industry trends, are identified through secondary research and expert consultations.

Step 2: Market Analysis and Construction

A comprehensive market analysis is conducted using both qualitative and quantitative data sources to construct a detailed market model.

Step 3: Hypothesis Validation and Expert Consultation

Expert opinions and insights from industry leaders are gathered to validate hypotheses and refine the research framework.

Step 4: Research Synthesis and Final Output

The data gathered is synthesized into actionable insights and compiled into the final research output, ensuring accuracy and relevance for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of the space sector

Increasing demand for miniaturization in satellite systems

Growing investments in satellite communications

Rising government focus on space exploration

Emergence of advanced computational capabilities - Market Challenges

High cost of advanced computing systems

Challenges in satellite system integration

Limited availability of skilled workforce

Reliability and endurance concerns in harsh environments

Regulatory barriers to satellite launches - Market Opportunities

Increase in satellite launches by private players

Development of low-cost satellite systems

Growth in satellite-based IoT applications - Trends

Shift towards high-performance onboard computing systems

Integration of AI and machine learning in satellite systems

Miniaturization of satellite components

Use of open-source software in onboard systems

Development of sustainable satellite technologies - Government Regulations & Defense Policy

Regulations for satellite communications

Policy framework for space exploration

Government funding for satellite R&D - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Standard Computing Units

Advanced Computational Units

High-Performance Computing Systems

Miniaturized Onboard Systems

Low-Cost Embedded Systems - By Platform Type (In Value%)

Earth Observation Satellites

Telecommunication Satellites

Navigation Satellites

Weather Satellites

Research Satellites - By Fitment Type (In Value%)

Small Satellites

Medium Satellites

Large Satellites

CubeSats

Micro Satellites - By EndUser Segment (In Value%)

Government & Defense

Telecommunications

Commercial Enterprises

Space Research Organizations

Agriculture & Environmental Monitoring - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

OEMs and Integrators

System Integrators

Distributors

Online Marketplaces - By Material / Technology (In Value%)

Silicon-Based Systems

Carbon Nanotube Technology

Quantum Computing Systems

Integrated Circuits & Microprocessors

Hybrid Computing Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Technology Trends, Procurement Channels, Regulatory Landscape, Fitment Type, Geographical Focus, Integration Capabilities, End-User Segmentation, Competitive Intensity)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Tata Consultancy Services

ISRO

Larsen & Toubro

Hindustan Aeronautics Limited

Bharti Airtel

Aerospace Systems India

General Electric

OneWeb

Satellogic

Intelsat

Northrop Grumman

SpaceX

Thales Alenia Space

SES S.A.

Lockheed Martin

- Increased demand from the defense sector for advanced satellite systems

- Commercial enterprises driving innovation in satellite-based applications

- Government investment in space technology R&D

- Growing partnerships between research organizations and space agencies

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035