Market Overview

The India satellite payload market has been expanding rapidly due to increasing demand for advanced communication, earth observation, and scientific applications. In recent years, the market has been driven by government initiatives, such as the Indian Space Research Organisation’s (ISRO) advancements in satellite technology. According to estimates, the market size for satellite payloads in India is projected to reach severa USD ~ Billion based on recent historical assessments. This growth is also fueled by expanding infrastructure for satellite launches and payload development.

India continues to dominate the satellite payload market, primarily due to the robust support from ISRO and increasing private sector participation. The nation’s strategic position in the Asia-Pacific region and its strong focus on enhancing satellite capabilities contribute to its leadership. The increasing use of satellites for communications, defense, and scientific purposes has further reinforced India’s position. Key cities such as Bengaluru, which hosts the ISRO headquarters, play a vital role in developing and launching these payloads.

Market Segmentation

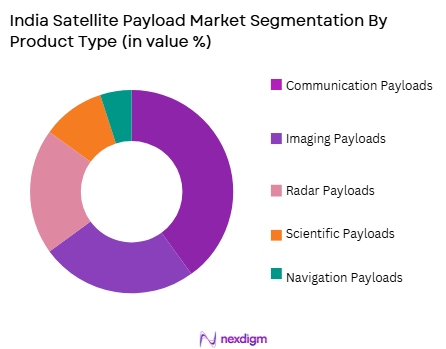

Product Type:

The India satellite payload market is segmented by product type into communication payloads, imaging payloads, radar payloads, scientific payloads, and navigation payloads. Recently, communication payloads have captured a dominant market share due to the ever-increasing demand for global connectivity and broadband services. With a focus on advancing satellite networks, communication payloads cater to government and private sector requirements for telecommunication, broadcasting, and internet connectivity. The growing demand for high-speed internet, especially in remote areas, has significantly boosted the growth of communication payloads.

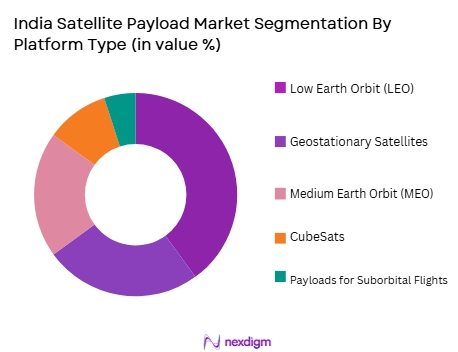

By Platform Type:

The India satellite payload market is segmented by platform type into geostationary satellites, low Earth orbit (LEO) satellites, medium Earth orbit (MEO) satellites, CubeSats, and payloads for suborbital flights. Low Earth orbit satellites dominate the market share due to their cost-effectiveness and ability to provide rapid data collection. LEO satellites are used extensively for earth observation, weather monitoring, and scientific research. Their ability to offer real-time data transmission with low latency has made them highly preferred for both government and commercial applications.

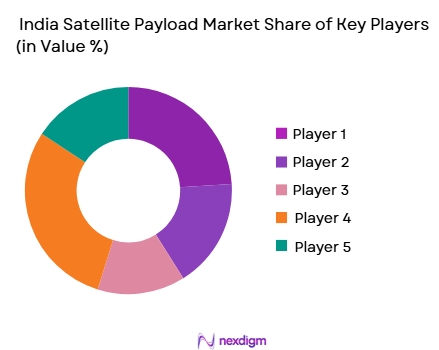

Competitive Landscape

The competitive landscape of the India satellite payload market is shaped by a few key players, including government agencies like ISRO and private firms that are increasingly joining the space race. ISRO continues to lead in satellite development, with significant contributions from private players such as Antrix Corporation, Bharti Airtel, and Hughes Communications. This segment is marked by consolidation, as key players collaborate with international companies and expand their satellite constellations for enhanced services.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Market-Specific Parameter |

| Indian Space Research Organisation (ISRO) | 1969 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

| Antrix Corporation | 1992 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

| Hughes Communications India | 1992 | Gurgaon | ~ | ~ | ~ | ~ | ~ |

| Tata Communications | 1986 | Mumbai | ~ | ~ | ~ | ~ | ~ |

| Bharti Airtel | 1995 | New Delhi | ~ | ~ | ~ | ~ | ~ |

India Satellite Payload Market Analysis

Growth Drivers

Government Investment in Space Programs:

One of the primary growth drivers in the India satellite payload market is the significant government investment in space programs, particularly those driven by ISRO. The Indian government has made substantial investments in the space sector, focusing on enhancing satellite communication infrastructure, launching new payloads, and expanding satellite coverage to remote areas. This investment has led to the rapid development of payload technologies that are essential for various applications such as communication, remote sensing, and navigation.

Technological Advancements in Satellite Payloads:

Another key growth driver for the India satellite payload market is the continuous technological advancements in satellite payload systems. The development of more efficient, reliable, and compact payloads has significantly enhanced the performance and capabilities of Indian satellites. These advancements are driven by the increasing demand for higher data transfer rates, more precise navigation, and improved Earth observation capabilities. Innovations in payload miniaturization, multi-functional payloads, and cost-effective solutions have opened up new opportunities for satellite operators and service providers in India.

Market Challenges

High Costs of Development and Launch:

Despite technological advancements, the high costs associated with satellite payload development and launch remain a significant barrier. While the prices of satellite payloads have reduced over time due to economies of scale, the initial cost of payload development, including research, manufacturing, and regulatory compliance, continues to hinder market growth. Additionally, the expenses related to satellite launches, such as transportation and insurance, remain high, limiting opportunities for smaller players and new entrants in the market.

Regulatory Hurdles and International Competition:

The satellite payload market faces complex regulatory frameworks that vary from country to country. These regulations create challenges for companies seeking to deploy satellites internationally. Furthermore, with the increasing global competition in space exploration, international players like SpaceX and Boeing also contribute to market fragmentation. As a result, Indian companies must navigate these regulatory challenges and compete with well-established international firms to maintain a foothold in the market.

Opportunities

Small Satellite Payloads for Emerging Markets:

The growing demand for low-cost satellite payloads, particularly in emerging markets, represents a significant opportunity. The development of small satellites, or CubeSats, which offer a more affordable alternative to traditional large satellites, has opened up opportunities for commercial enterprises, government agencies, and research institutions. Small satellite payloads cater to applications such as telecommunications, earth observation, and scientific research, driving growth in the segment.

Partnerships with Global Space Agencies:

As India continues to strengthen its position in the global space market, the opportunity for partnerships with international space agencies is growing. India’s strong track record in satellite development and launching makes it an attractive partner for nations seeking to develop their own space programs. These partnerships offer opportunities for joint missions, satellite payload development, and knowledge exchange, boosting the Indian satellite payload market’s growth prospects.

Future Outlook

The satellite payload market in India is expected to continue its growth trajectory, driven by technological advancements, government support, and increasing private sector participation. Over the next five years, satellite payloads will continue to evolve, with an increasing focus on small satellite payloads, AI integration, and more efficient communication systems. Additionally, the regulatory environment is expected to become more favorable, allowing for easier access to global markets. As these trends take hold, India is poised to remain a leader in the satellite payload industry, attracting more investments and collaborations with international space agencies.

Major Players

- Indian Space ResearchOrganisation(ISRO)

- Antrix Corporation

- Hughes Communications India

- Tata Communications

- Bharti Airtel

- AirbusDefenceand Space

- Lockheed Martin

- Northrop Grumman

- Thales Alenia Space

- SpaceX

- Blue Origin

- OneWeb

- Planet Labs

- Sierra Nevada Corporation

- Arianespace

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite payload manufacturers

- Telecommunication service providers

- Space agencies and defense contractors

- Aerospace engineering firms

- Satellite data analytics companies

- Commercial spaceflight operators

Research Methodology

Step 1: Identification of Key Variables

The first step in the research process involves identifying the key market variables influencing the satellite payload industry, including technological advancements, demand drivers, and market constraints.

Step 2: Market Analysis and Construction

Detailed market analysis is conducted through the use of secondary data sources, expert opinions, and industry reports, allowing for the construction of a robust market model.

Step 3: Hypothesis Validation and Expert Consultation

This stage involves validating hypotheses using primary research through expert consultations with stakeholders and thought leaders within the satellite payload market.

Step 4: Research Synthesis and Final Output

The final stage synthesizes all findings and insights, leading to the generation of a comprehensive report, including future forecasts and actionable market recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for advanced communication infrastructure

Government investment in space exploration

Advancements in satellite technology - Market Challenges

High cost of satellite payload development

Regulatory hurdles and certification processes

Limited domestic manufacturing capabilities for complex payloads - Market Opportunities

Growing demand for small satellite payloads

Expansion of satellite constellations for broadband services

Potential for partnerships with global space agencies - Trends

Miniaturization of payload systems

Rise in private sector participation in satellite development

Integration of AI and machine learning in payload functionality - Government regulations

Department of Space (DoS) policies

ISRO certification requirements for satellite payloads

Foreign collaboration agreements in satellite technology - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Communication Payloads

Imaging Payloads

Radar Payloads

Scientific Payloads

Navigation Payloads - By Platform Type (In Value%)

Geostationary Satellites

Low Earth Orbit Satellites

Medium Earth Orbit Satellites

CubeSats

Payloads for Suborbital Flights - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Upgrade Fitment - By EndUser Segment (In Value%)

Telecommunications

Government & Defense

Commercial Enterprises

Research Institutions

Space Exploration Agencies - By Procurement Channel (In Value%)

Direct Procurement

Third-party Procurement

Government Contracts

Private Sector Collaboration

International Partnerships

- Cross Comparison Parameters (Market Value, Installed Units, System Complexity, Regional Presence, Research & Development Investment, Market Value, Installed Units, System Complexity, Regional Presence, Research & Development Investment)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Indian Space Research Organisation (ISRO)

Antrix Corporation

Hughes Communications India

Tata Communications

ArianeGroup

Lockheed Martin

Airbus Defence and Space

Northrop Grumman

Thales Alenia Space

SpaceX

Blue Origin

OneWeb

Amazon Kuiper Systems

Planet Labs

Sierra Nevada Corporation

- Telecommunications companies increasing reliance on satellite payloads

- Government and defense sectors pushing for advanced surveillance payloads

- Commercial enterprises seeking cost-effective small satellite payloads

- Research institutions utilizing payloads for scientific data collection

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035