Market Overview

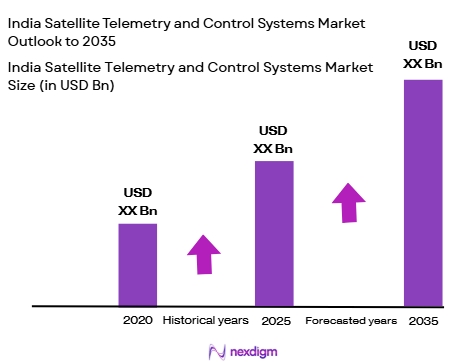

The India satellite telemetry and control systems market is driven by increasing demand for satellite-based communication, surveillance, and data monitoring systems. The market size for satellite telemetry and control systems is projected to grow significantly, reaching billions of USD based on recent historical assessments. Technological advancements and government investments in satellite infrastructure continue to drive the development and expansion of these systems.

India stands as a key player in the satellite telemetry and control systems market, primarily due to the strong support from the Indian Space Research Organisation (ISRO). With its robust space capabilities and growing space infrastructure, the country has become a leader in satellite technology, making significant strides in satellite payload development, tracking, and control systems. The presence of major cities like Bengaluru, where ISRO is headquartered, plays a crucial role in maintaining India’s dominance in this sector.

Market Segmentation

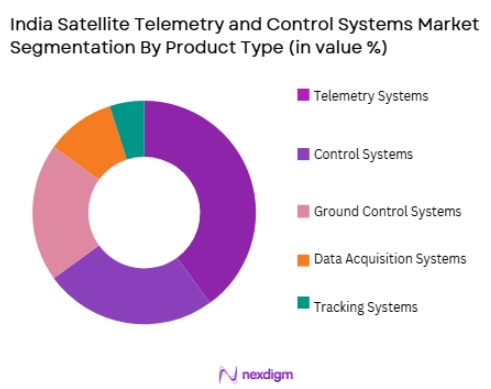

By Product Type:

The India satellite telemetry and control systems market is segmented by product type into telemetry systems, control systems, ground control systems, data acquisition systems, and tracking systems. Recently, telemetry systems have emerged as the dominant sub-segment, largely due to their essential role in transmitting satellite data and monitoring performance. The growth in demand for satellite-based communication, particularly for government and defense applications, has driven the increased deployment of advanced telemetry systems, which are critical for real-time satellite data collection and management.

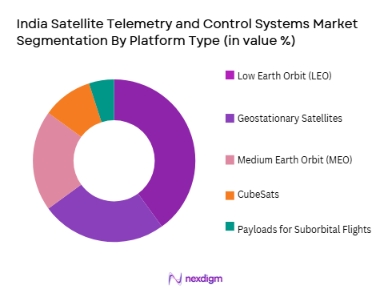

By Platform Type:

The market is segmented by platform type into geostationary satellites, low Earth orbit (LEO) satellites, medium Earth orbit (MEO) satellites, CubeSats, and payloads for suborbital flights. Low Earth orbit (LEO) satellites dominate the market share due to their widespread application in communication, Earth observation, and scientific research. LEO satellites are particularly important for military and defense purposes, where low-latency data transmission is crucial. The cost-effectiveness and growing demand for miniaturized LEO satellites have significantly contributed to their market leadership.

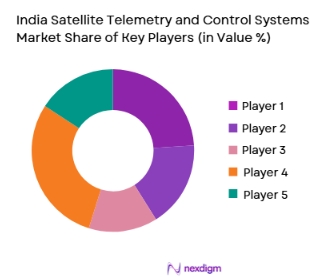

Competitive Landscape

The India satellite telemetry and control systems market is highly competitive, with significant contributions from both government agencies and private players. ISRO remains the market leader, supported by its extensive space infrastructure and established track record in satellite technology. Other private and public players are also investing in R&D to meet the growing demand for advanced satellite control and telemetry solutions.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Market-Specific Parameter |

| Indian Space Research Organisation (ISRO) | 1969 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

| Antrix Corporation | 1992 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

| Hughes Communications India | 1992 | Gurgaon | ~ | ~ | ~ | ~ | ~ |

| Thales Alenia Space | 2003 | Paris | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda | ~ | ~ | ~ | ~ | ~ |

India Satellite Telemetry and Control Systems Market Analysis

Growth Drivers

Government Support for Space Development:

India’s government plays a pivotal role in supporting the satellite telemetry and control systems market through funding, policy initiatives, and regulatory frameworks. The Indian Space Research Organisation (ISRO) continues to receive government backing, which accelerates advancements in satellite communication, tracking, and telemetry systems. In addition, India’s push for space exploration and defense capabilities has led to a surge in demand for satellite-based telemetry and control systems, creating significant market growth opportunities.

Technological Advancements in Satellite Telemetry Systems:

The rapid evolution of satellite telemetry and control systems is another key growth driver. Recent innovations such as miniaturized satellite systems, enhanced real-time data processing capabilities, and improvements in AI-driven control systems are making satellite operations more efficient and cost-effective. India’s satellite telemetry sector has benefitted from these technological advancements, with companies focused on developing cutting-edge telemetry systems to meet the rising demand for high-performance satellite applications in communication, defense, and commercial sectors.

Market Challenges

High Development and Operational Costs:

The high cost of developing and maintaining satellite telemetry and control systems presents a major challenge for market players. These systems require advanced technology, highly skilled labor, and substantial infrastructure investments. While government and defense agencies can manage these costs, private companies often face significant financial barriers when trying to develop or upgrade satellite telemetry solutions. The complexity and resource-intensive nature of satellite payloads add to the overall costs of deployment, which can deter potential new entrants.

Regulatory Barriers and Compliance:

The regulatory environment for satellite telemetry and control systems is stringent, and companies must comply with numerous national and international regulations. While the Indian Space Research Organisation (ISRO) plays a central role in satellite development, satellite operators must also adhere to strict guidelines set by the Indian government, including data protection and security protocols. Compliance with these regulations, along with international space laws, can delay satellite missions and increase the time and cost associated with bringing new telemetry systems to market.

Opportunities

Rising Demand for Low-Cost Small Satellites:

The growing demand for small satellites, particularly in the commercial and research sectors, presents significant opportunities for satellite telemetry and control systems. These small satellites, or CubeSats, require less expensive telemetry systems, creating an opportunity for cost-effective, scalable solutions. India’s space sector is rapidly adopting this trend, as small satellites are particularly useful for Earth observation, communication, and scientific missions, which are all key growth areas for satellite telemetry services.

Expansion of Satellite Constellations and Global Collaborations:

Another opportunity in the India satellite telemetry and control systems market is the expansion of satellite constellations, particularly in LEO. With growing interest in providing global internet connectivity, satellite constellations are being deployed, requiring robust telemetry and control systems. As global space collaborations increase, India’s satellite systems are likely to become an integral part of international missions, leading to more opportunities for market growth in both the private and governmental sectors.

Future Outlook

The future of India’s satellite telemetry and control systems market is set to expand rapidly, with an increasing focus on innovation and cost-effective solutions for small satellite constellations. As demand grows for satellite data, real-time communications, and enhanced defense systems, India’s market for satellite telemetry systems will continue to thrive. With ongoing government initiatives and increasing private-sector investments, India is poised to become a global leader in satellite telemetry and control technologies in the coming years.

Major Players

- Indian Space Research Organisation (ISRO)

- Antrix Corporation

- Hughes Communications India

- Tata Communications

- ArianeGroup

- Lockheed Martin

- Airbus Defence and Space

- Northrop Grumman

- Thales Alenia Space

- SpaceX

- Blue Origin

- OneWeb

- Planet Labs

- Sierra Nevada Corporation

- Arianespace

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite telemetry and control systems manufacturers

- Telecommunication service providers

- Space agencies and defense contractors

- Aerospace engineering firms

- Satellite data analytics companies

- Commercial spaceflight operators

Research Methodology

Step 1: Identification of Key Variables

Identification of key factors affecting the satellite telemetry and control systems market, including technological advancements, market demand, and regulatory considerations.

Step 2: Market Analysis and Construction

Comprehensive analysis of the market, based on primary and secondary research, including industry trends, competitive landscape, and customer needs.

Step 3: Hypothesis Validation and Expert Consultation

Validating hypotheses through expert consultations, interviews, and feedback from stakeholders in the satellite industry.

Step 4: Research Synthesis and Final Output

Synthesizing the collected data and insights into a comprehensive market report, including forecasts and strategic recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for satellite-based communication services

Government initiatives to support space exploration

Technological advancements in satellite control systems - Market Challenges

High development and operational costs of telemetry and control systems

Complex regulatory frameworks governing satellite systems

Limited domestic manufacturing of advanced telemetry systems - Market Opportunities

Growing demand for low-cost small satellite systems

International collaborations and partnerships for satellite missions

Advancements in AI-driven satellite control systems - Trends

Miniaturization of telemetry and control systems

Rise in private sector involvement in space exploration

Integration of real-time data processing and monitoring in satellite systems - Government Regulations

Indian Space Research Organisation (ISRO) regulatory policies

Government guidelines on satellite payload certifications

Space-based data protection and cybersecurity regulations

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Telemetry Systems

Control Systems

Ground Control Systems

Data Acquisition Systems

Tracking Systems - By Platform Type (In Value%)

Geostationary Satellites

Low Earth Orbit Satellites

Medium Earth Orbit Satellites

CubeSats

Payloads for Suborbital Flights - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Upgrade Fitment - By EndUser Segment (In Value%)

Telecommunications

Government & Defense

Commercial Enterprises

Research Institutions

Space Exploration Agencies - By Procurement Channel (In Value%)

Direct Procurement

Third-party Procurement

Government Contracts

Private Sector Collaboration

International Partnerships

- Cross Comparison Parameters (Market Value, Installed Units, System Complexity, Regional Presence, Research & Development Investment, Market Value, Installed Units, System Complexity, Regional Presence, Research & Development Investment, Regulatory Compliance, Technology Integration, Supply Chain Efficiency)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Indian Space Research Organisation (ISRO)

Antrix Corporation

Hughes Communications India

Tata Communications

ArianeGroup

Lockheed Martin

Airbus Defence and Space

Northrop Grumman

Thales Alenia Space

SpaceX

Blue Origin

OneWeb

Amazon Kuiper Systems

Planet Labs

Sierra Nevada Corporation

- Telecommunications companies adopting advanced telemetry systems

- Government and defense sectors increasing reliance on satellite-based tracking

- Commercial enterprises deploying satellite systems for data services

- Research institutions utilizing telemetry systems for scientific applications

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035