Market Overview

Based on a recent historical assessment, the India Search and Rescue Equipment Market was valued at USD ~ million, supported by government disaster preparedness spending, defense modernization programs, aviation safety compliance, and coastal security investments. Demand is driven by frequent natural disasters, expanding civil aviation operations, offshore energy activity, and increased focus on rapid emergency response capabilities. Central government budget allocations, multiyear procurement programs, and replacement of aging rescue systems continue to sustain steady purchasing across air, land, and maritime rescue platforms nationwide.

India’s market dominance is concentrated in New Delhi, Mumbai, Chennai, Bengaluru, Hyderabad, Kochi, and Visakhapatnam due to the presence of defense commands, aviation hubs, shipyards, and disaster response headquarters. These locations benefit from dense infrastructure, higher operational risk exposure, and direct access to central procurement authorities. India remains the sole country represented in this market scope, with domestic manufacturing clusters and public sector undertakings reinforcing national self-reliance objectives and localized supply chains.

Market Segmentation

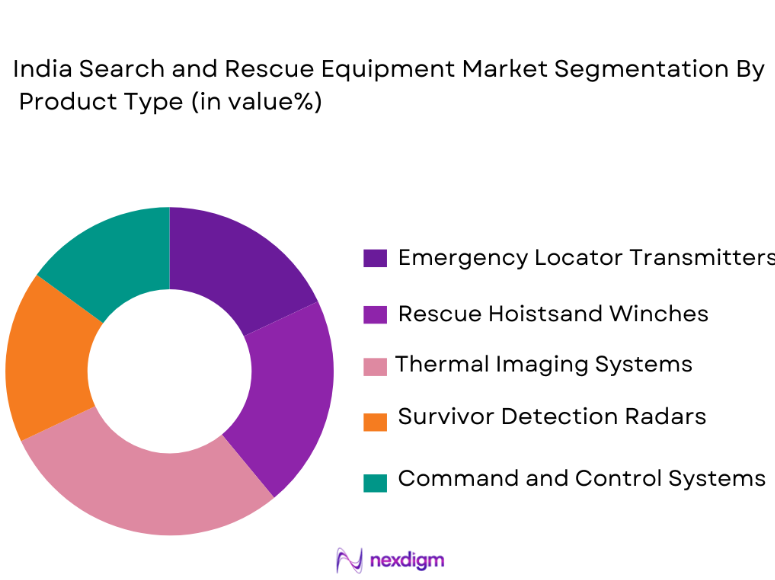

By Product Type

The India Search and Rescue Equipment Market is segmented by product type into emergency locator transmitters, rescue hoists and winches, thermal imaging systems, survivor detection radars, and integrated command and control systems. Recently, thermal imaging systems have held a dominant market share due to their effectiveness in low-visibility conditions, wide applicability across land, air, and maritime operations, and strong demand from defense and disaster management agencies. Increased deployment during floods, earthquakes, night-time aviation incidents, and maritime rescues has reinforced adoption. Indigenous manufacturing capability, proven operational reliability, and compatibility with multiple platforms further strengthen dominance. Government preference for sensor-based situational awareness, combined with declining unit costs through local production, continues to favor this sub-segment across procurement cycles.

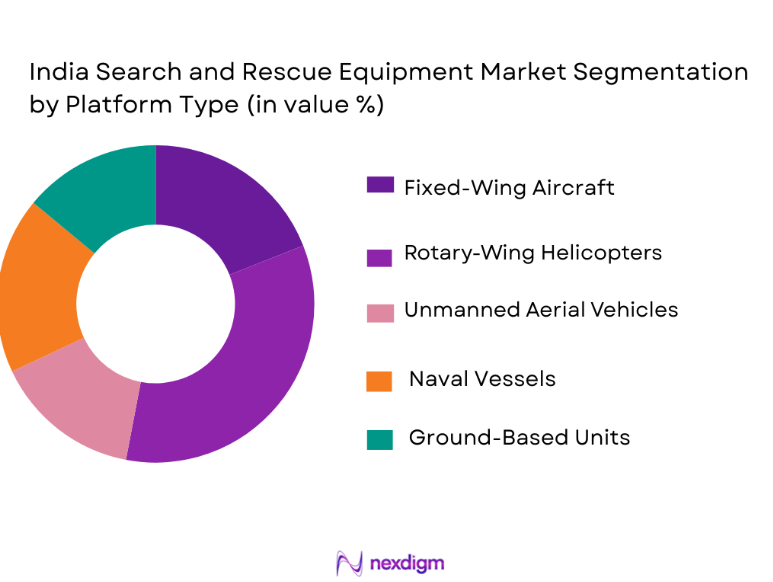

By Platform Type

The India Search and Rescue Equipment Market is segmented by platform type into fixed-wing aircraft, rotary-wing helicopters, unmanned aerial vehicles, naval vessels, and ground-based mobile units. Recently, rotary-wing helicopters have dominated the market due to their vertical lift capability, rapid deployment, precision hovering, and suitability for diverse terrains. Helicopters remain indispensable for mountain rescues, offshore evacuations, urban disaster response, and maritime search operations. Strong fleet presence across defense forces, coast guard units, and state agencies ensure continuous equipment integration and upgrades. Infrastructure readiness, trained crews, and mission flexibility further reinforce helicopter-based system dominance across India.

Competitive Landscape

The India Search and Rescue Equipment Market exhibit moderate consolidation, dominated by domestic defense manufacturers and select technology specialists supported by government procurement frameworks. Public sector undertakings and large private defense firms exert strong influence through long-term contracts, indigenous development mandates, and system integration capabilities, limiting fragmentation and reinforcing high entry barriers.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Indigenous Content Level |

| Bharat Electronics Limited | 1954 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics Limited | 1940 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

| Larsen and Toubro Defence | 2011 | Mumbai | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2007 | Hyderabad | ~ | ~ | ~ | ~ | ~ |

| Data Patterns India | 1985 | Chennai | ~ | ~ | ~ | ~ | ~ |

India Search and Rescue Equipment Market Analysis

Growth Drivers

Expansion of National Disaster Response and Civil Safety Infrastructure

Expansion of National Disaster Response and Civil Safety Infrastructure is driving the India Search and Rescue Equipment Market by increasing sustained government investment in preparedness, response capability, and rapid deployment assets across states and union territories. Rising frequency of floods, cyclones, earthquakes, industrial accidents, and urban emergencies has intensified focus on equipping response agencies with advanced detection, communication, and rescue technologies. Centralized funding mechanisms and disaster mitigation programs have strengthened procurement consistency and reduced budget volatility. Integration of modern equipment into national and state disaster response forces improves operational efficiency and reduces rescue timeframes. Inter-agency coordination requirements further increase demand for interoperable systems. Infrastructure expansion in airports, ports, offshore installations, and remote regions amplifies equipment deployment needs. Policy emphasis on resilience planning ensures long-term demand visibility. Continuous training investments also encourage acquisition of standardized equipment platforms.

Defense and Homeland Security Modernization Programs

Defense and Homeland Security Modernization Programs are accelerating market growth through systematic upgrades of air force, navy, coast guard, and internal security rescue capabilities. Platform modernization initiatives require advanced sensors, hoists, communication modules, and command systems compatible with next-generation aircraft and vessels. Strategic focus on coastal security, border surveillance, and aviation safety elevates the importance of reliable rescue infrastructure. Indigenous manufacturing mandates increase procurement volumes while fostering technology absorption. Long procurement cycles ensure recurring demand for spares, upgrades, and replacements. Enhanced interoperability requirements drive integrated system purchases. National security priorities stabilize funding flows. Continuous fleet expansion sustains multi-year equipment integration programs.

Market Challenges

High Acquisition and Lifecycle Cost of Advanced Systems

High Acquisition and Lifecycle Cost of Advanced Systems constrain adoption across smaller agencies and state-level organizations despite recognized operational benefits. Advanced sensors, avionic-integrated rescue equipment, and ruggedized communication systems require substantial upfront capital investment. Maintenance, calibration, and periodic upgrades further increase total ownership costs. Import dependence on critical components exposes buyers to currency risk and supply disruptions. Budget limitations can delay procurement cycles and reduce fleet-wide standardization. Limited economies of scale restrict cost optimization. Training and certification expenses add to the further financial burden. Cost sensitivity remains a significant barrier for widespread deployment.

Complex Regulatory and Certification Environment

Complex Regulatory and Certification Environment presents a challenge due to multi-layered approval requirements across aviation, maritime, and defense authorities. Compliance with safety, airworthiness, and interoperability standards extends deployment timelines. Certification delays can disrupt procurement schedules and operational readiness. Overlapping jurisdiction among agencies complicates coordination. Evolving standards require continuous system updates. Smaller manufacturers face higher compliance costs. Documentation and testing requirements increase development cycles. Regulatory complexity can deter rapid technological adoption.

Opportunities

Indigenous Development of Advanced Sensors and Analytics

Indigenous Development of Advanced Sensors and Analytics presents significant opportunity by reducing import reliance and improving cost competitiveness. Local development of thermal imaging, radar, and AI-based detection systems aligns with national self-reliance objectives. Government incentives support technology transfer and domestic innovation. Export potential expands with proven indigenous solutions. Customization of local operating conditions enhances performance. Integration with existing platforms becomes more efficient. Skill development strengthens ecosystem maturity. Long-term procurement preference supports sustained growth.

Integration of Unmanned Platforms in Rescue Operations

Integration of Unmanned Platforms in Rescue Operations offers opportunity through expanded use of UAVs for rapid assessment, survivor detection, and logistics support. UAV deployment reduces risk to personnel in hazardous environments. Advances in endurance, payload capacity, and sensor integration increase operational value. Regulatory clarity supports wider adoption. Cost efficiency encourages multi-agency utilization. Data-driven rescue coordination improves outcomes. Scalable deployment suits diverse scenarios. Technology maturation supports long-term adoption.

Future Outlook

The India Search and Rescue Equipment Market is expected to experience steady expansion over the next five years, supported by sustained government funding, platform modernization, and disaster resilience initiatives. Technological advancements in sensors, unmanned systems, and integrated command platforms will enhance operational efficiency. Regulatory support for indigenous manufacturing will strengthen domestic supply chains. Growing demand from aviation, maritime, and disaster response sectors will continue to underpin long-term market stability.

Major Players

- Bharat Electronics Limited

- Hindustan Aeronautics Limited

- Larsen and ToubroDefence

- Tata Advanced Systems

- Data Patterns India

- Bharat Dynamics Limited

- Alpha Design Technologies

- ParasDefenceand Space Technologies

- Astra Microwave Products

- Ananth Technologies

- Tonbo Imaging

- MTAR Technologies

- Zen Technologies

- ideaForgeTechnology

- Solar Industries India

Key Target Audience

- Defense procurement agencies

- Disaster management authorities

- Civil aviation authorities

- Maritime security agencies

- Investments and venture capitalist firms

- Government and regulatory bodies

- Offshore energy operators

- Aerospace and defense manufacturers

Research Methodology

Step 1: Identification of Key Variables

Key demand, supply, regulatory, and technology variables influencing the market were identified through sector analysis and procurement trend review. Market boundaries and assumptions were defined to ensure relevance and accuracy.

Step 2: Market Analysis and Construction

Historical procurement data, budget disclosures, and industry inputs were analyzed to construct market size and segmentation. Cross-validation ensured consistency across sources.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through expert interviews and domain consultations. Feedback refined segmentation logic and competitive assessment.

Step 4: Research Synthesis and Final Output

All insights were synthesized into a structured framework. Final outputs were reviewed for coherence, accuracy, and compliance with research objectives.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing frequency of natural disasters across coastal and inland regions

Expansion of civil aviation and maritime traffic requiring advanced rescue readiness

Modernization initiatives within defense and paramilitary forces

Government investments in disaster preparedness infrastructure

Rising adoption of unmanned and sensor-based rescue technologies - Market Challenges

High capital cost of advanced search and rescue systems

Complex procurement and lengthy approval cycles

Limited interoperability between legacy and modern equipment

Skill gaps in operating advanced digital rescue platforms

Maintenance and lifecycle management constraints in remote regions - Market Opportunities

Localization and domestic manufacturing under national industrial programs

Integration of AI and satellite data for faster search operations

Public private partnerships for nationwide emergency response coverage - Trends

Growing deployment of drones for rapid area assessment

Increased use of satellite-based distress signaling

Shift toward lightweight and portable rescue equipment

Integration of real-time data analytics in command centers

Emphasis on multi-agency coordinated rescue operations - Government Regulations & Defense Policy

Strengthening of national disaster management guidelines

Defense procurement reforms favoring indigenous suppliers

Enhanced safety and compliance standards for aviation and maritime operations - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Personal locator beacons

Thermal imaging cameras

Unmanned aerial search systems

Life rafts and flotation devices

Ground-based rescue communication systems - By Platform Type (In Value%)

Airborne platforms

Naval and coastal platforms

Land-based emergency platforms

Space-based satellite support platforms

Hybrid multi-platform systems - By Fitment Type (In Value%)

Portable handheld equipment

Vehicle-mounted systems

Fixed installation systems

Wearable rescue devices

Rapid deployment kits - By EndUser Segment (In Value%)

Defense forces

Coast guard and maritime agencies

Civil aviation authorities

Disaster response agencies

Industrial emergency response teams - By Procurement Channel (In Value%)

Government direct procurement

Defense public sector undertakings

System integrators and OEM contracts

Emergency services tenders

International aid and cooperation programs - By Material / Technology (in Value %)

Advanced composites

Infrared and thermal sensing technology

Satellite communication modules

AI-enabled analytics software

High-durability polymer materials

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Technology maturity, Product reliability, Indigenous manufacturing capability, After-sales support, Integration capability)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Bharat Electronics Limited

Hindustan Aeronautics Limited

Larsen and Toubro Defence

Tata Advanced Systems

Bharat Dynamics Limited

Alpha Design Technologies

Astra Microwave Products

Data Patterns India

MTAR Technologies

Paras Defence and Space Technologies

ideaForge Technology

Zen Technologies

Solar Industries India

Tonbo Imaging

MKU Limited

- Defense forces focus on high-endurance and mission-critical rescue systems

- Civil agencies prioritize rapid deployment and interoperability

- Maritime operators demand corrosion-resistant and long-range equipment

- Industrial users emphasize compliance with safety and emergency norms

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035