Market Overview

Based on a recent historical assessment, the India Search and Rescue Robots market was valued at approximately USD ~ million, driven by increasing deployment of robotic systems across disaster response, industrial safety, defense support, and urban emergency operations. Market expansion is supported by public sector investments in disaster resilience, modernization of national and state disaster response forces, and growing acceptance of robotics to reduce human risk in hazardous environments. Demand is further reinforced by advancements in artificial intelligence, sensor fusion, autonomous navigation, and ruggedized robotics architectures suited for complex terrain and confined rescue scenarios.

Based on a recent historical assessment, major adoption and operational dominance are concentrated in regions such as New Delhi, Maharashtra, Gujarat, Tamil Nadu, and Telangana due to the presence of central disaster management authorities, defense research establishments, industrial corridors, and technology development hubs. These regions benefit from stronger infrastructure, higher exposure to industrial and urban risk environments, proximity to robotics manufacturers and integrators, and better access to pilot programs supported by government agencies, resulting in faster deployment and higher operational utilization of search and rescue robotic systems.

Market Segmentation

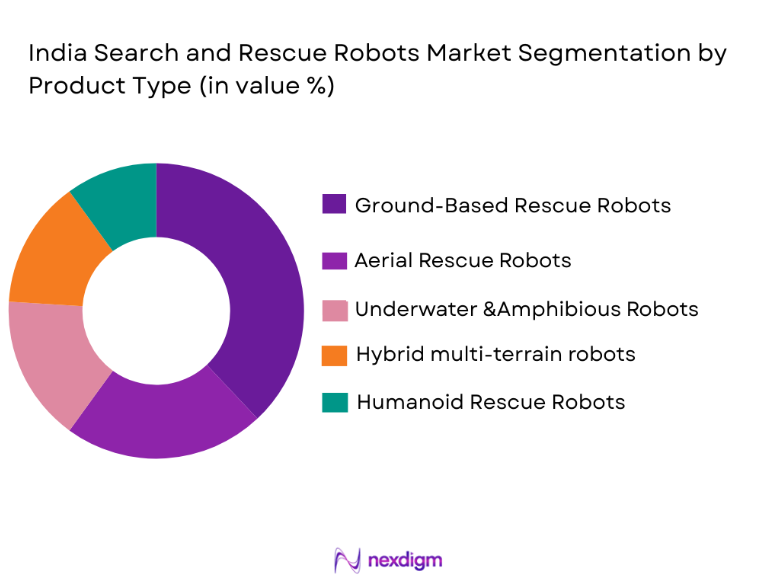

By Product Type

India Search and Rescue Robots market is segmented by product type into ground-based rescue robots, aerial rescue robots, underwater and amphibious robots, hybrid multi-terrain robots, and support logistics robots. Recently, ground-based rescue robots have held a dominant market share due to their extensive use in urban disaster response, industrial accident mitigation, and confined space operations. These robots offer higher payload capacity, superior stability, and adaptability across rubble, debris, tunnels, and collapsed infrastructure, making them indispensable for first responders. Their compatibility with thermal imaging, gas detection, and manipulator arms further enhances operational value. Strong domestic manufacturing capabilities, lower acquisition costs compared to aerial systems, and easier regulatory acceptance also contribute to sustained dominance across public safety and defense applications.

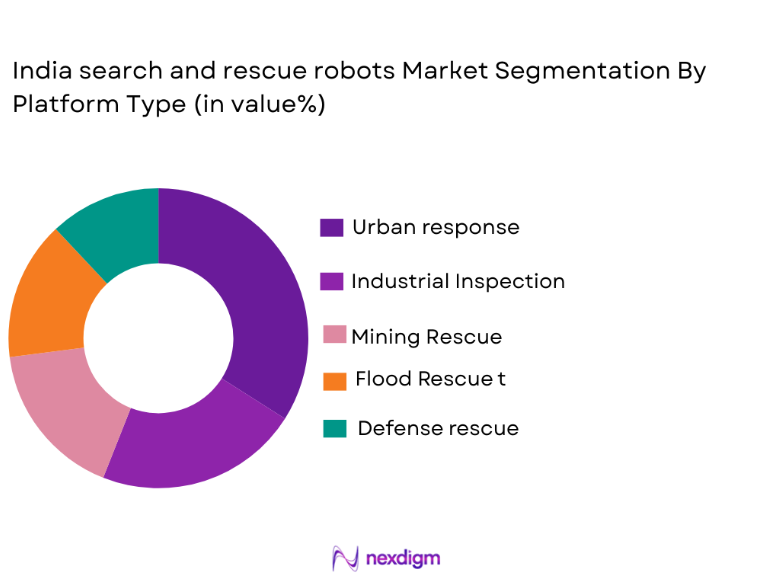

By Platform Type

India Search and Rescue Robots market is segmented by platform type into urban disaster response robotic platforms, industrial and infrastructure inspection robotic platforms, mining and confined-space rescue robotic platforms, flood and water rescue robotic platforms, and defense and paramilitary rescue robotic platforms. Recently, urban disaster response robotic platforms have dominated market adoption due to higher deployment frequency in metropolitan emergency scenarios, stronger integration with city-level command systems, availability of trained response units, and prioritization under national and state disaster preparedness programs, resulting in sustained procurement and higher operational utilization compared to other platform categories.

Competitive Landscape

The India Search and Rescue Robots market exhibits moderate consolidation, with a mix of public sector enterprises, defense-linked manufacturers, and private robotics startups shaping competition. Major players influence technology standards, pricing benchmarks, and procurement access through government partnerships and pilot deployments, while emerging firms focus on niche innovation and cost-optimized solutions, intensifying competitive differentiation.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Deployment Environment |

| Bharat Electronics Limited | 1954 | India | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2001 | India | ~ | ~ | ~ | ~ | ~ |

| Larsen & Toubro Defence | 2011 | India | ~ | ~ | ~ | ~ | ~ |

| DRDO Robotics Systems | 1958 | India | ~ | ~ | ~ | ~ | ~ |

| Mahindra Defence Systems | 1945 | India | ~ | ~ | ~ | ~ | ~ |

India Search and Rescue Robots Market Analysis

Growth Drivers

Urban Disaster Vulnerability and Emergency Response Modernization

The accelerating expansion of densely populated urban centers, aging infrastructure, and increasing exposure to industrial hazards has significantly amplified the need for advanced search and rescue robots across India, creating sustained growth momentum for the market. Metropolitan regions face complex rescue scenarios involving collapsed structures, toxic gas leaks, fires, and confined spaces where human responders face elevated risk, directly driving adoption of robotic alternatives. Government authorities increasingly recognize robotic platforms as essential tools for minimizing casualties among emergency personnel while improving response efficiency. Integration of robots into standardized emergency response protocols enhances situational awareness through real-time imaging, thermal detection, and environmental sensing. Public investment in smart cities further reinforces robotic deployment as part of integrated emergency management systems. Urban disaster response modernization programs also prioritize interoperability between robots and command-and-control infrastructure. Growing public scrutiny of emergency preparedness effectiveness strengthens political and administrative commitment to robotics adoption. Continuous training programs centered on robotic-assisted rescue further institutionalize long-term demand.

Advancements in Autonomous Robotics and Artificial Intelligence Integration

Rapid technological progress in artificial intelligence, machine vision, and autonomous navigation is fundamentally transforming the operational effectiveness of search and rescue robots, accelerating market growth across India. Enhanced autonomy enables robots to operate in GPS-denied environments, navigate debris-filled terrain, and make adaptive decisions with minimal human intervention. AI-driven perception systems improve victim detection accuracy using thermal signatures, sound localization, and motion analysis, increasing mission success rates. Continuous reduction in sensor costs and computational hardware prices supports wider adoption across budget-constrained agencies. Domestic startups and defense research institutions actively collaborate to localize advanced algorithms suited for Indian operating conditions. Improved battery efficiency extends operational endurance, addressing earlier deployment limitations. Modular architecture allows rapid customization for specific disaster scenarios, increasing procurement attractiveness. Technology maturity strengthens confidence among end users, converting pilot projects into scaled deployments.

Market Challenges

High System Costs and Procurement Complexity

The elevated acquisition cost of advanced search and rescue robots remains a significant barrier to widespread adoption across India, particularly for state-level agencies and volunteer organizations operating under constrained budgets. Sophisticated sensors, autonomous navigation systems, ruggedized materials, and specialized actuators substantially increase unit prices. Procurement processes within public institutions often involve lengthy approval cycles, tendering complexities, and rigid compliance requirements, delaying deployment. Limited economies of scale further restrict cost optimization for domestically produced platforms. Budget allocations for disaster preparedness must compete with other critical public spending priorities. Fragmented procurement across agencies reduces standardization benefits. Post-acquisition costs related to training, maintenance, and software updates further strain budgets. These factors collectively slow penetration despite strong operational demand.

Regulatory Uncertainty and Operational Readiness Gaps

The absence of a unified regulatory framework governing the deployment, safety certification, and operational use of search and rescue robots poses a persistent challenge for the Indian market. Different agencies follow varying compliance standards, complicating cross-agency deployment during large-scale disasters. Certification pathways for autonomous systems remain unclear, increasing approval timelines. Limited real-world operational testing environments restrict validation of performance claims. Skill shortages in robotic operation and maintenance reduce effective utilization post-procurement. Inconsistent training standards create variability in mission outcomes. Interoperability challenges with legacy communication systems further constrain effectiveness. Addressing these readiness gaps requires coordinated policy action, which remains gradual.

Opportunities

Indigenous Robotics Manufacturing and Technology Localization

The strong national focus on domestic manufacturing and technology self-reliance presents a substantial opportunity for the India Search and Rescue Robots market to expand sustainably. Government-backed initiatives encouraging indigenous defense and robotics production reduce reliance on imported components and lower long-term system costs. Localization enables customization for Indian terrain, climate, and disaster profiles, improving operational effectiveness. Domestic manufacturing ecosystems foster collaboration between startups, academic innovators, and public sector enterprises. Increased local content enhances procurement eligibility under government policies. Scaled production supports cost efficiencies and export potential to other emerging markets. Technology localization also strengthens intellectual property ownership within the country. This opportunity positions India as a regional hub for rescue robotics innovation.

Integration with National Disaster Management Infrastructure

Expanding integration of search and rescue robots into national disaster management frameworks creates significant long-term market opportunity. Centralized command systems increasingly require real-time data inputs from robotic assets for coordinated response planning. Robotics integration enhances early damage assessment, victims’ localization, and operational safety. Alignment with national response drills institutionalizes robotic usage. Inter-agency interoperability frameworks enable scalable deployment across states. Continuous investment in disaster preparedness infrastructure sustains recurring demand. Data-driven response strategies further elevate the value proposition of robotic systems. This integration strengthens the strategic relevance of rescue robotics in public safety planning.

Future Outlook

The India Search and Rescue Robots market is expected to experience sustained growth over the next five years, supported by increasing disaster preparedness investments and continued technological advancement. Adoption of autonomous systems, improved sensor capabilities, and modular platforms will enhance deployment efficiency. Regulatory clarity and domestic manufacturing incentives are likely to strengthen market stability. Rising urbanization and industrial risk exposure will further reinforce long-term demand across public and defense sectors.

Major Players

- Bharat Electronics Limited

- Tata Advanced Systems

- Larsen & ToubroDefence

- MahindraDefenceSystems

- DRDO Robotics Systems

- IdeaForge Technology

- Genrobotics

- Gridbots Technologies

- ASIMOV Robotics

- GreyOrangeRobotics

- AddverbTechnologies

- Tonbo Imaging

- Asteria Aerospace

- SystemanticsRobotics

- Detect Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense andParamilitary Agencies

- Disaster management authorities

- Industrial safety operators

- Infrastructure developers

- Smart city planners

- Public sector enterprises

Research Methodology

Step 1: Identification of Key Variables

Key demand drivers, technology adoption factors, regulatory influences, and procurement patterns were identified through structured secondary research and industry data review.

Step 2: Market Analysis and Construction

Market structure was developed using segmentation analysis, competitive benchmarking, and demand-side assessment across major end-user categories.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert discussions with industry professionals, robotics developers, and disaster response stakeholders.

Step 4: Research Synthesis and Final Output

All insights were synthesized into a coherent analytical framework ensuring consistency, accuracy, and strategic relevance.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing frequency of urban disasters and industrial accidents

Government emphasis on disaster preparedness and response modernization

Rising adoption of robotics and automation in public safety operations

Limitations of human responders in hazardous environments

Advancements in artificial intelligence and autonomous mobility - Market Challenges

High development and acquisition costs of advanced robotic systems

Limited field-tested deployments in complex disaster scenarios

Regulatory and safety certification uncertainties

Dependence on imported critical components and subsystems

Skill gaps in operation and maintenance of robotic platforms - Market Opportunities

Indigenous development of cost-effective rescue robotic platforms

Integration of robotics with national disaster management infrastructure

Export potential to other disaster-prone emerging economies - Trends

Growing use of AI-enabled perception and decision-support systems

Shift toward multi-role and modular robotic architectures

Increased collaboration between defense laboratories and startups

Focus on rapid-deployment and portable robotic solutions

Expansion of training and simulation-supported robotic systems - Government Regulations & Defense Policy

Strengthening of national disaster response frameworks

Support for domestic robotics manufacturing and innovation

Defense assistance to civil authorities during large-scale emergencies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ground-based search and rescue robots

Aerial search and rescue robotic platforms

Amphibious and underwater rescue robots

Hybrid multi-terrain robotic systems

Support and logistics assistive robots - By Platform Type (In Value%)

Urban disaster response robotic platforms

Industrial and infrastructure inspection robots

Mining and confined-space rescue robots

Flood and water rescue robotic platforms

Defense and paramilitary rescue robots - By Fitment Type (In Value%)

Tracked and wheeled robotic systems

Legged and articulated robots

Portable and deployable robotic units

Vehicle-launched robotic systems

Fixed-base robotic monitoring systems - By End User Segment (In Value%)

National and state disaster response forces

Urban fire and emergency services

Defense and paramilitary forces

Industrial safety and infrastructure operators

Research institutions and specialized rescue units - By Procurement Channel (In Value%)

Direct government procurement

Defense and homeland security tenders

Public sector research and development programs

Pilot projects and demonstration deployments

Public-private collaboration initiatives - By Material / Technology (in Value %)

Artificial intelligence and machine vision systems

Autonomous navigation and control software

Advanced sensors and perception technologies

Ruggedized materials and thermal protection

High-density battery and power management systems

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Mobility capability, Autonomy level, Sensor integration, Deployment time, Payload capacity, Operational endurance, Terrain adaptability, Lifecycle support, Cost efficiency)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

DRDO Robotics and Autonomous Systems

Bharat Electronics Limited

Tata Advanced Systems

Larsen & Toubro Defence

Mahindra Defence Systems

IdeaForge Technology

ASIMOV Robotics

GreyOrange Robotics

Genrobotics

Tonbo Imaging

Asteria Aerospace

Detect Technologies

Systemantics Robotics

Addverb Technologies

Gridbots Technologies

- Disaster response agencies prioritize reliability and rapid deployment

- Urban emergency services focus on compact and maneuverable robots

- Defense users emphasize robustness and autonomous capability

- Industrial users demand precision and safety compliance

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035