Market Overview

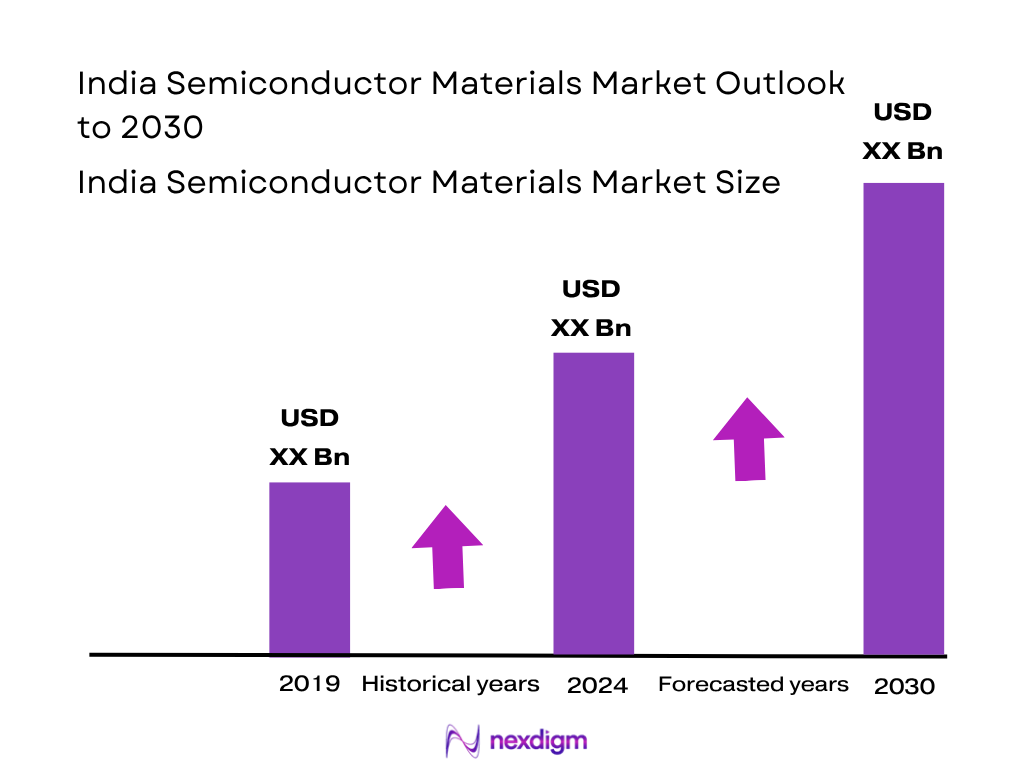

The India Semiconductor Materials Market is valued at USD 2.44 billion and grew from USD 2.34 billion the prior year. Its expansion is driven by the sharp rise in electronics manufacturing and the government’s incentive schemes—such as SPECS and PLI—boosting domestic fabrication and assembly, thereby increasing demand for wafer‑grade chemicals, gases, and packaging consumables.

Semiconductor materials procurement and usage are dominated by major industrial hubs such as Bengaluru, Hosur, Pune, Chennai, and states like Maharashtra and Gujarat. Bengaluru leads due to its design‑to‑fab ecosystem, Pune and Chennai have strong manufacturing bases, while Maharashtra and Gujarat attract investments in fabs and OSAT facilities courtesy of robust infrastructure, state incentives, and established electronics clusters.

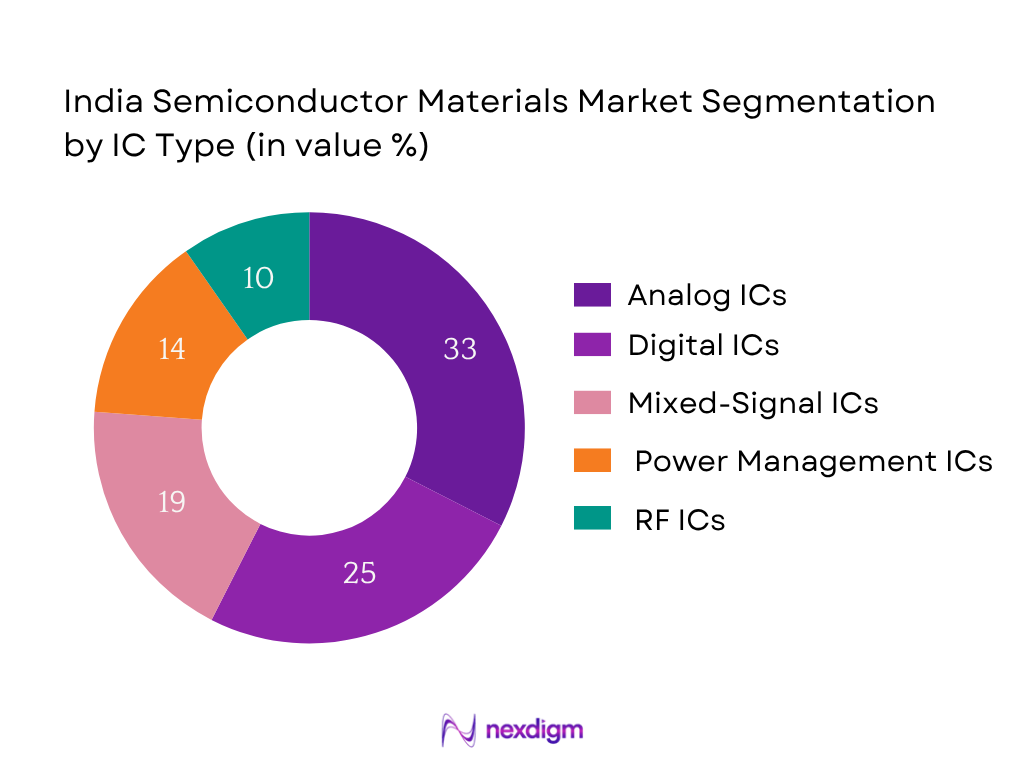

Market Segmentation

By Product Type

Currently, Fab Materials dominate with ~55% share of the materials market in 2024. Fab Materials lead due to continuous wafer production ramp‑up in foundries and local assembly plants, necessitating large volumes of gases, photoresists, and CMP materials, while packaging materials follow in usage as assembly scales slowly.

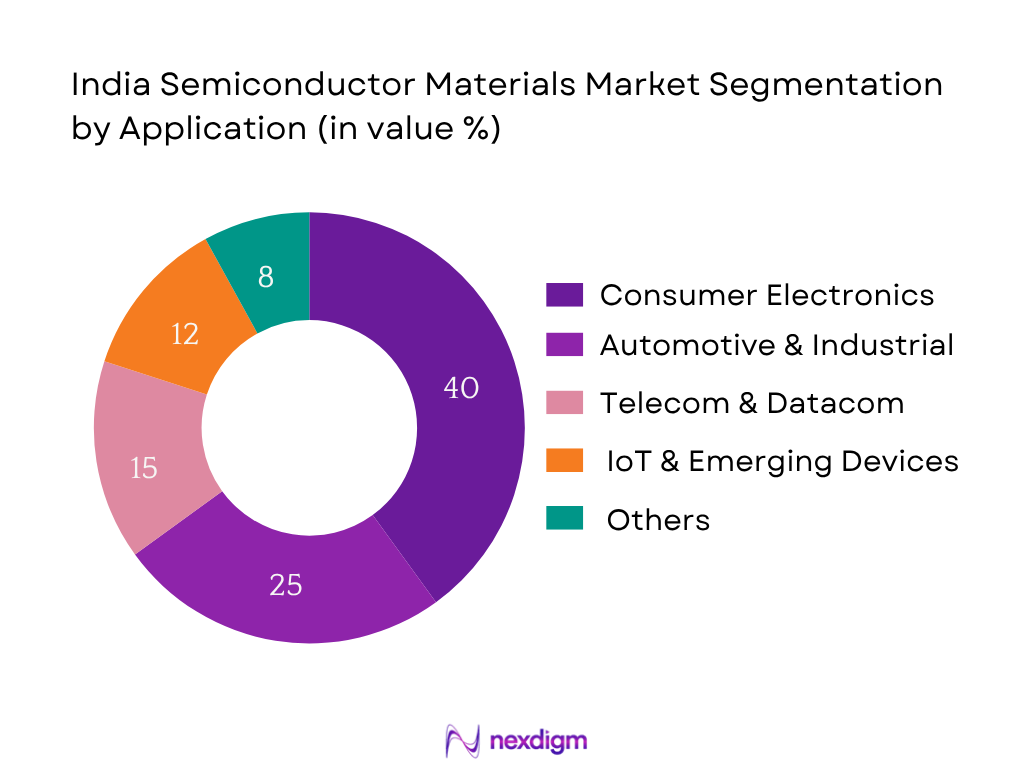

By Application

Consumer Electronics holds ~40% of total material consumption in 2024, dominating because mass production of smartphones, laptops, and smart devices uses high volumes of silicon wafers, photoresists, gases, and encapsulation materials. Brands ramping output and EV/5G adoption reinforce this dominance.

Competitive Landscape

The India semiconductor materials space is consolidating around both global majors and local entrants. Key players include DuPont, Merck, Shin‑Etsu, TOK, Air Liquide, Linde, Applied Materials, Lam Research, NXP (materials division), Tata Chemicals, Micron, Intel, GlobalFoundries, AMD, and Entegris. Their strategies include supplying gas/chemical portfolios, local partnerships, and R&D investments in India.These players influence material sourcing, standardization, supply‑chain reliability, and local content mandates.

| Company | Establishment Year | HQ Location | India Manufacturing Footprint | Local R&D Investment | Supply Chain Partners | Key Material Categories | Fab Node Compatibility |

| DuPont | 1802 | USA | – | – | – | – | – |

| Merck Group | 1668 | Germany | – | – | – | – | – |

| Shin‑Etsu | 1926 | Japan | – | – | – | – | – |

| TOK (Tokyo Ohka) | 1950 | Japan | – | – | – | – | – |

| Air Liquide | 1902 | France | – | – | – | – | – |

India Semiconductor Materials Market Analysis

Growth Drivers

Domestic Wafer Demand

India’s electronics manufacturing value reached USD 115 billion in fiscal 2023‑24, constituting 3% of GDP—up from USD 37 billion in 2015‑16. This surge reflects increasing domestic wafer fabrication and packaging activity, especially as several semiconductor fabs and OSAT units move toward commissioning. In 2024, India approved four new semiconductor fabrication units and nine component manufacturing projects under the SPECS initiative, estimated to generate 15,710 jobs. The rising electronics output and investment activity translate into substantial domestic wafer and related materials demand, directly boosting consumption of high‑purity chemicals, sputtering targets, photoresists, and specialty gases. These developments underscore wafer demand as a core growth lever for semiconductor materials.

ESDM Push

The central government’s Electronics System Design & Manufacturing (ESDM) sector has seen 100% FDI allowed via automatic route since 2022, promoting fabs, ATP facilities, and materials supply chains. Budget allocation to chip manufacturing and electronics via the Union budget jumped to ₹13,104.5 crore in 2024, up 71% from earlier levels. India’s electronic production doubled to USD 115 billion in 2023‑24 from USD 102 billion in 2023. Strong government backing via PLI and SPECS under ESDM, coupled with fiscal allocations, has catalysed domestic electronics and semiconductor initiatives, compelling material providers to scale up supply of cleaning chemicals, wet etchants, packaging resins, and CMP formulations.

Market Challenges

Import Dependency

As of 2015, 65–70% of semiconductor demand was met via imports, and that dependency remains significant in 2024 for chemicals, gases, and wafers. India does not produce high‑purity silicon wafers or specialty CMP slurries domestically. For instance, silicon wafer market was valued at USD 1.1 billion in 2024—imported nearly entirely. This heavy reliance on imports exposes material suppliers to global supply chain disruptions, foreign exchange fluctuations, and lead‑time risk, limiting domestic substitution and adding cost burden to local fabs.

Technology Licensing

Material suppliers in India depend on technology transfers and licensing from global chemical giants to produce advanced photoresists and CMP slurries. Indian enterprises have limited local patent holdings. Government reports show that Indian players rely on licensing agreements for sub‑65 nm resist chemistry and precursors. This dependence constrains scale‑up unless licensing fees and compliance costs are absorbed. Restrictions in IP access slow domestic innovation in material formulations essential for node‑shrinking.

Market Opportunities

Localization Push

The central government has approved nine projects under SPECS, with four semiconductor fabs greenlit in 2024 and resulting investments exceeding ₹13,104.5 crore in chip manufacturing grants. As incentives encourage domestic sourcing, local players can supply materials like CMP slurries, photoresists, specialty gases, and substrates to fabs that aim to produce 20,000‑50,000 wafers per month. This localization drive creates a sustained opportunity for domestic material companies to reduce import dependence and capture upstream supply‑chain share.

Strategic FDI Partnerships

Foreign direct investment in semiconductor fabs from Micron, Tata‑Powerchip, Foxconn‑HCL, and Tower‑Adani consortiums represents billions of dollars in infrastructure and assembly capacity (e.g. Micron’s USD 2.75 billion, HCL-Foxconn’s ₹3,706 crore OSAT project). These partnerships open the door for Indian material suppliers to become preferred vendors for global firms, supplying high‑purity chemicals, packaging materials, specialty gases, and substrate components. Strategic collaborations bring technology transfer opportunities and joint ventures, enabling localization of advanced material manufacturing.

Future Outlook

Over the next six years, the India Semiconductor Materials Market is projected to grow at a CAGR of approximately 6.6% from USD 2.44 billion in 2024 to about USD 4.92 billion by 2030. Growth will be fueled by domestic fab commissioning, scaling foundry capacity, rising EV semiconductor use, and a shift toward localization of materials. Government incentives, ecosystem development, and strategic FDI will support a steady ramp‑up in material consumption, though global supply chain trends and technology adoption will moderate volatility.

Major Players in the Market

- DuPont

- Merck Group

- Shin‑Etsu Chemical

- Tokyo Ohka Kogyo (TOK)

- Air Liquide

- Linde

- Applied Materials

- Lam Research

- NXP Semiconductors

- Tata Chemicals

- Micron Technology

- Intel Corporation

- GlobalFoundries

- AMD

- Entegris

Key Target Audience

- Heads of Fab Materials Procurement at semiconductor fabs

- Budget decision‑makers in Packaging Materials Procurement

- Materials R&D and Innovation Heads at fabless and IDM companies

- Investment and Venture Capitalist Firms assessing materials ecosystem

- Central and State Government & Regulatory Bodies (e.g. Ministry of Electronics & IT, India Semiconductor Mission)

- Supply‑chain Risk Managers in electronics manufacturing

- Procurement Heads in automotive Tier‑1 suppliers using semiconductors

- EV OEM Materials Strategy Heads

Research Methodology

Step 1: Identification of Key Variables

We mapped the full ecosystem including wafer fabs, OSAT centers, design houses, and material suppliers. Secondary data from government budgets, SPECS, industry associations and proprietary databases were compiled to define variables like material categories, node size demand, and import dependency.

Step 2: Market Analysis and Construction

Historical data from 2019–2024 on materials import volumes and fab filter consumption were collected. We analyzed penetration of fab capacity, ratio of fabrication to packaging, and derived material consumption volumes and value through bottom‑up revenue models.

Step 3: Hypothesis Validation and Expert Consultation

We conducted CATI interviews with industry experts at material suppliers, foundry operators, and R&D labs to validate pricing assumptions, demand patterns (e.g. CMP vs gas vs resist), and supply constraints.

Step 4: Research Synthesis and Final Output

We engaged directly with major companies, including Tata Chemicals and Merck, to verify material portfolios, client usage across node ranges and align forecast assumptions. Final material segment forecasts and strategic conclusions were corroborated through top‑down and bottom‑up triangulation.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Industry Expert Validation, Primary Research Approach, Limitations)

- Definition and Scope

- Industry Genesis and Evolution

- Timeline of Key Developments and Players

- Semiconductor Industry Value Chain & Material Flow (Wafer to Packaging)

- Semiconductor Material Import-Export Analysis (by Material Type, Source Country, End-Use)

- Growth Drivers

Domestic Wafer Demand

ESDM Push

FDI Inflows

PLI Scheme

Technological Advancements

Electric Vehicle Boom

IoT Penetration

Data Center Growth - Market Challenges

Import Dependency

Technology Licensing

Cleanroom Setup Costs

Environmental Regulations - Market Opportunities

Localization Push

Strategic FDI Partnerships

R&D Hubs

Green Materials - Emerging Trends

Use of Compound Semiconductors

3D Packaging

Sub-10nm Demand

Sustainable Materials - Regulatory Environment

MoS Guidelines

Environmental Clearances

Import Tariff Structure - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price (By Material Type – in $/kg, $/wafer, etc.), 2019-2024

- By Material Type (In Value %)

Silicon Wafers

Photoresists & Ancillaries

Dielectric Materials

Sputtering Targets

CMP Slurries & Pads

Wet Chemicals

Gases (Specialty + Bulk)

Others (Silicon Carbide, GaN, Advanced Packaging Materials) - By Application (In Value %)

Wafer Fabrication

Packaging & Assembly

Photolithography

Cleaning & Etching

Doping & Deposition - By Manufacturing Process (In Value %)

Front-End-of-Line (FEOL)

Back-End-of-Line (BEOL)

Advanced Packaging - By Node Size (In Value %)

≤10nm

11–28nm

29–65nm

>65nm - By End-User (In Value %)

Foundries

IDMs

OSATs

R&D Labs

Academic Institutions - By Region (In Value %)

North India

South India

West India

East India

- Market Share Analysis (By Value & Volume – By Material Type)

- Cross Comparison Parameters (Company Overview, Key Products, Manufacturing Footprint in India, Distribution Network, R&D Investment, Sustainability Practices, Fab Compatibility, Revenue by Material Category, Strategic Partnerships, Import Dependency, Localization Ratio)

- SWOT Analysis of Major Players

- Material Price Benchmarking (By Material Type, Source Country, Logistics Cost Impact)

- Detailed Profiles of Key Players

DuPont

BASF

Sumitomo Chemical

Merck Group

Shin-Etsu Chemical

TOK (Tokyo Ohka Kogyo)

Entegris

Avantor

Showa Denko

Air Liquide

Linde

Technic Inc.

Mitsui Chemicals

Silex Microsystems

Tata Chemicals (Indian Entrant)

- Purchasing Patterns & Sourcing Trends

- Material Selection Criteria

- Usage Lifecycle and Frequency

- Material Compatibility with Equipment

- Price Sensitivity and Lead Time Expectations

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030