Market Overview

Based on a recent historical assessment, the India simulator market was valued at USD ~ billion, driven by defense training modernization, civil aviation pilot shortages, healthcare skill simulation, and industrial safety mandates. Government procurement, indigenous manufacturing incentives, and private training academies accelerated adoption of flight, driving, medical, and industrial simulators. Demand was reinforced by lifecycle cost advantages over live training, regulatory emphasis on standardized competencies, and increasing use of immersive technologies across military, aviation, automotive, and healthcare training ecosystems nationwide.

Major demand concentration emerged across Bengaluru, Hyderabad, Pune, Chennai, and New Delhi due to aerospace clusters, defense establishments, automotive hubs, and medical education density. International collaborations and domestic suppliers strengthened presence in these cities through testing facilities, integration centers, and training campuses. Regional dominance was supported by skilled engineering talent, proximity to defense commands, airport training infrastructure, hospital networks, and favorable state policies enabling faster certification, deployment, and sustained simulator utilization across sectors supporting long term institutional adoption nationwide programs.

Market Segmentation

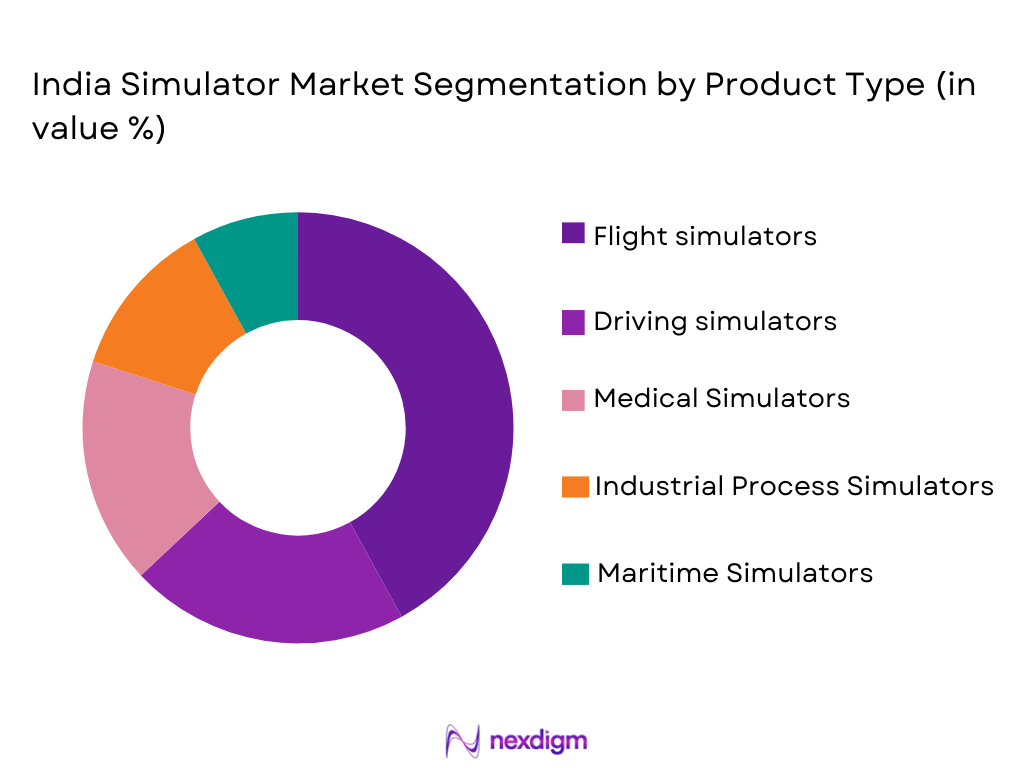

By Product Type:

India Simulator Market is segmented by product type into flight simulators, driving simulators, medical simulators, maritime simulators, and industrial process simulators. Recently, flight simulators have a dominant market share due to sustained demand from military aviation training, expanding civil aviation pilot certification needs, and regulatory requirements mandating simulator hours for licensing. The growth of domestic airline fleets, rising pilot shortages, and increased use of advanced full flight simulators for recurrent training reinforced adoption. Defense modernization programs emphasized mission readiness through simulated environments, while private aviation academies invested heavily to reduce operational costs. Strong OEM presence, long replacement cycles, and continuous software upgrades further supported dominance. Additionally, flight simulators benefit from higher unit values and long-term service contracts, enabling sustained revenue concentration within this sub-segment across institutional and commercial buyers nationwide.

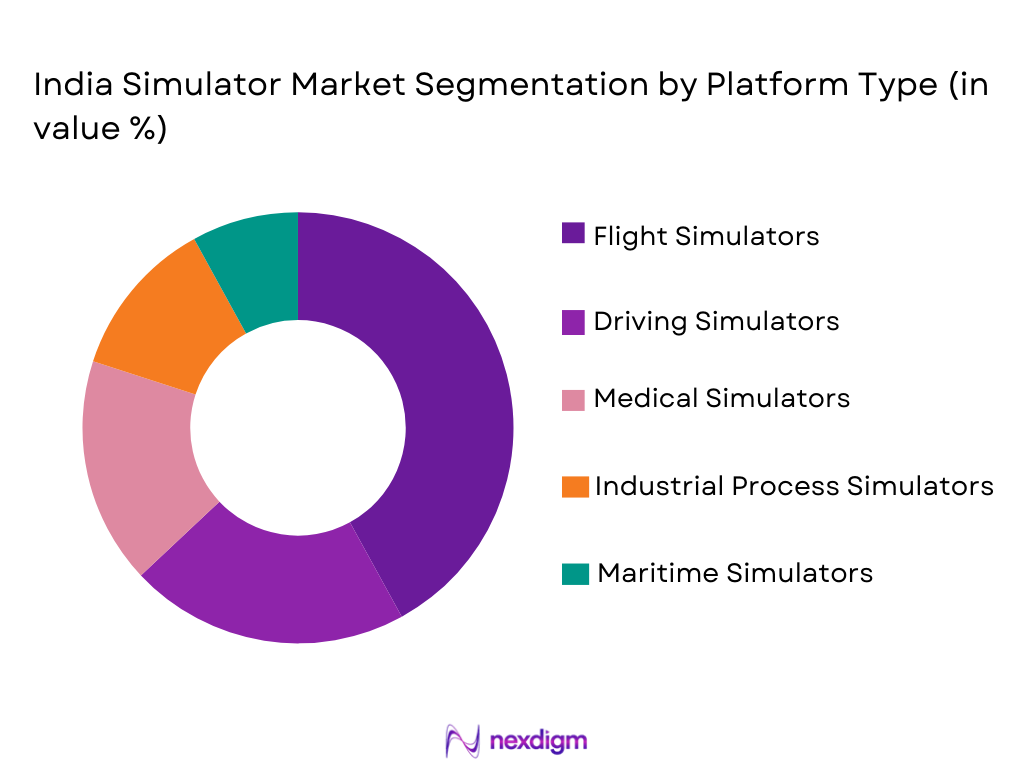

By Platform Type:

India Simulator Market is segmented by platform type into full-motion simulators, fixed-base simulators, virtual reality simulators, augmented reality simulators, and desktop-based simulators. Recently, full-motion simulators have a dominant market share due to their high fidelity, regulatory acceptance, and critical role in advanced training programs. Defense and aviation authorities prioritize motion-based systems for complex maneuver replication and emergency response training. Airlines and military forces continue investing in these platforms to meet compliance standards and reduce real-flight risks. Their integration with high-resolution visuals, motion actuation, and data analytics enhances training outcomes. Although virtual and augmented platforms are expanding, full-motion systems retain dominance due to institutional trust, long deployment cycles, and higher capital allocation from government and large private operators.

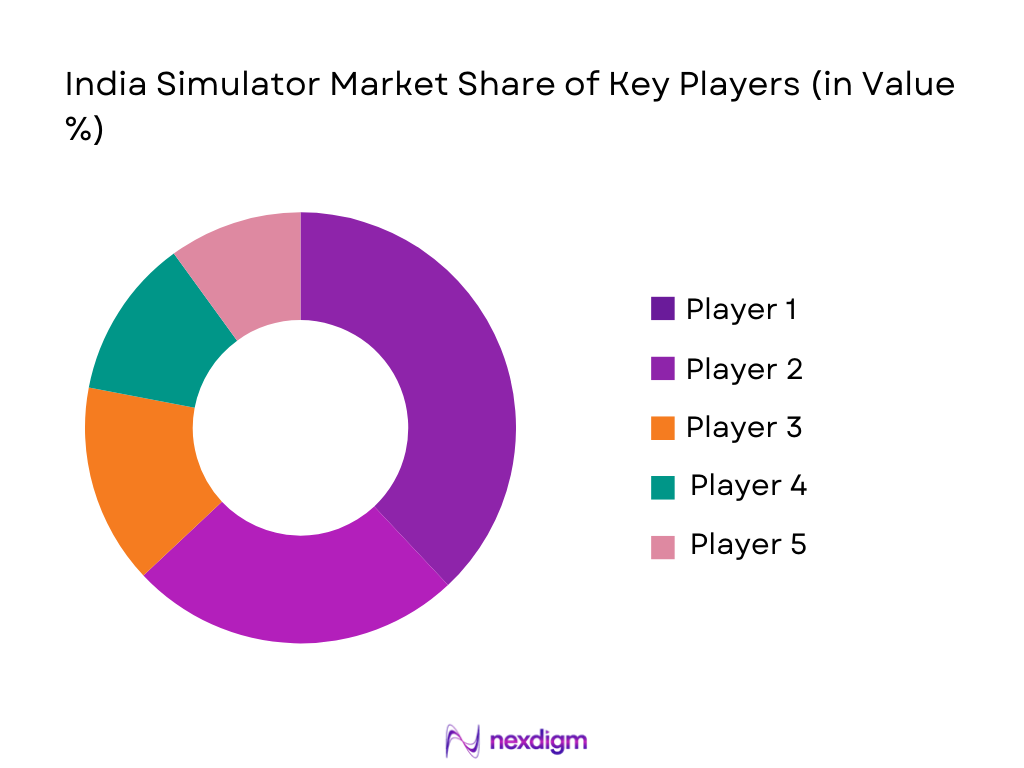

Competitive Landscape

The India Simulator Market exhibits a moderately consolidated competitive structure, with a mix of global technology providers and domestic defense-focused manufacturers shaping market dynamics. Large players benefit from long-term government contracts, strong integration capabilities, and certified training solutions, while domestic firms leverage localization policies and cost advantages. Strategic partnerships, technology transfers, and lifecycle support services influence competitive positioning. Barriers to entry remain high due to certification complexity, capital intensity, and technological expertise requirements, reinforcing the dominance of established suppliers.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Primary End-User Sector |

| CAE India | 1947 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

| HAL Simulation Division | 1964 | Bengaluru, India | ~

|

~

|

~

|

~

|

~

|

| Bharat Electronics Limited | 1954 | Bengaluru, India | ~

|

~

|

~

|

~

|

~

|

| Zen Technologies | 1993 | Hyderabad, India | ~

|

~

|

~

|

~

|

~

|

| L&T Defence Simulation | 2012 | Mumbai, India | ~

|

~

|

~

|

~

|

~

|

India Simulator Market Analysis

Growth Drivers

Defense and Civil Aviation Training Modernization:

Defense and civil aviation training modernization is accelerating adoption across the India Simulator Market as armed forces and airlines prioritize readiness, safety, and standardized competency development through simulated environments that reduce risk, fuel consumption, and equipment wear while enabling repeatable mission rehearsal and regulatory-compliant certification at scale nationwide. Large-scale defense modernization programs emphasize networked simulators, joint-force interoperability, and scenario complexity to prepare personnel for asymmetric threats, multi-domain operations, and rapid deployment requirements without operational disruption. Civil aviation authorities and airlines expand simulator hours to address pilot shortages, fleet induction, and recurrent checks, aligning curricula with international safety mandates and manufacturer type-rating pathways. Public procurement frameworks support long-term contracts, spares, and lifecycle services, ensuring predictable demand and vendor continuity across bases and academies. Indigenous manufacturing incentives, offsets, and technology transfers further strengthen local capability, shortening lead times and lowering ownership costs. Investments in training campuses near operational hubs enable continuous throughput, instructor development, and data-driven assessment for improved outcomes. Integration of analytics, motion systems, and high-fidelity visuals elevates training realism, reinforcing institutional trust. These factors collectively sustain procurement momentum, upgrade cycles, and service revenues across defense and aviation ecosystems.

Immersive Technologies and Cost-Efficient Skill Development:

Immersive technologies and cost-efficient skill development drive growth in the India Simulator Market as organizations seek scalable training solutions that deliver measurable performance gains while controlling expenses associated with live operations, consumables, insurance, and downtime across sectors including healthcare, automotive, and industry. Virtual, augmented, and mixed reality platforms expand access to complex scenarios, enabling safe repetition, remote instruction, and rapid content updates aligned with evolving protocols and equipment configurations. Healthcare institutions adopt simulation to standardize clinical competencies, reduce adverse events, and support accreditation through objective assessment and debriefing workflows. Industrial operators leverage process and safety simulators to mitigate hazards, comply with regulations, and shorten onboarding cycles for technicians and operators. Modular architectures and software-centric upgrades allow incremental investment, extending asset life and improving return profiles for buyers. Cloud-enabled content management and analytics support multi-site deployment, benchmarking, and instructor efficiency. Private training providers capitalize on subscription models and shared facilities to broaden reach. Collectively, these efficiencies accelerate adoption, diversify end-use demand, and underpin sustained expansion across non-aviation segments.

Market Challenges

High Capital Intensity and Certification Complexity:

High capital intensity and certification complexity constrain expansion in the India Simulator Market as buyers face substantial upfront costs for hardware, motion systems, visualization infrastructure, and certified software, alongside prolonged approval cycles that delay deployment and revenue realization. Defense and aviation simulators require compliance with stringent national and international standards, mandating exhaustive validation, audits, and documentation that increase time to operational readiness. Smaller training providers and regional institutions struggle to secure financing, limiting penetration beyond major hubs. Imported subsystems, proprietary components, and specialized tooling elevate acquisition and maintenance expenses, while currency volatility affects procurement planning. Certification updates tied to platform upgrades can necessitate recertification, adding downtime and incremental costs. Long procurement cycles and tendering requirements complicate vendor forecasting and working capital management. Shortage of accredited instructors and maintenance specialists further raises operating costs and constrains utilization rates. Collectively, these factors slow adoption, favor established incumbents, and restrict market breadth despite strong underlying demand.

Technology Obsolescence and Integration Constraints:

Technology obsolescence and integration constraints challenge the India Simulator Market as rapid advances in graphics, motion control, AI, and networking shorten technology lifecycles and pressure buyers to upgrade frequently to maintain relevance and compliance. Legacy systems often lack modularity, making integration of new software, sensors, or analytics complex and costly. Interoperability across platforms, forces, and training centers remains uneven, limiting joint training effectiveness and data portability. Vendor lock-in through proprietary architectures can restrict flexibility and inflate long-term costs. Cybersecurity requirements increase complexity as simulators connect to networks and cloud services, necessitating robust safeguards and compliance audits. Supply chain disruptions for specialized components create maintenance delays and spares shortages. Inconsistent standards across sectors hinder reuse of common platforms, reducing economies of scale. These challenges elevate total cost of ownership and complicate long-term planning for operators and suppliers alike.

Opportunities

Indigenization and Export-Oriented Manufacturing Expansion:

Indigenization and export-oriented manufacturing expansion present a significant opportunity for the India Simulator Market as policy incentives encourage local development of hardware, software, and subsystems to reduce import dependence and improve cost competitiveness. Domestic manufacturing enables faster customization for local requirements, shorter lead times, and improved lifecycle support. Technology partnerships and offsets facilitate knowledge transfer, strengthening engineering depth and quality assurance. Export certification pathways open access to regional markets seeking cost-effective training solutions aligned with global standards. Localization of content libraries and multilingual interfaces enhances appeal across geographies. Cluster development around aerospace and defense corridors supports supplier ecosystems and talent pipelines. Government-backed financing and procurement preferences de-risk investment for manufacturers. Together, these factors position India as a regional hub for simulator production and services.

Cross-Sector Adoption and Service-Based Business Models:

Cross-sector adoption and service-based business models create growth opportunities in the India Simulator Market as providers expand beyond traditional defense and aviation into healthcare, automotive, rail, energy, and emergency response training. Simulation-as-a-service, subscriptions, and shared facilities lower entry barriers for institutions with constrained budgets. Remote training, cloud content management, and analytics enable multi-site scalability and consistent outcomes. Data-driven assessment supports credentialing, compliance, and continuous improvement, enhancing buyer value propositions. Partnerships with educational hospitals, OEMs, and insurers broaden demand drivers. Modular platforms allow reuse across applications, improving utilization and margins. Outcome-based contracts align incentives around performance gains and safety improvements. These shifts diversify revenue streams and stabilize demand across economic cycles.

Future Outlook

The India Simulator Market is expected to demonstrate sustained expansion over the next five years, supported by defense modernization priorities, aviation safety mandates, and wider institutional acceptance of simulation-based training. Technological advancements in immersive platforms, analytics, and modular system design are anticipated to improve training effectiveness and cost efficiency. Regulatory alignment and continued government support for indigenous manufacturing will further strengthen adoption. Demand-side momentum from healthcare, industrial safety, and transportation training is likely to diversify application areas and stabilize long-term growth.

Major Players

- CAE India

- Hindustan Aeronautics Limited Simulation Division

- Bharat Electronics Limited

- Zen Technologies

- Larsen & ToubroDefenceSimulation

- Tata Advanced Systems Training

- Alpha Design Technologies

- Thales India Training Systems

- Saab Training India

- Indra Sistemas India

- Rheinmetall India Simulation

- AdaniDefenceSimulation

- Lockheed Martin India Training

- Boeing India Simulation Services

- Ansys India Simulation Solutions

Key Target Audience

- Defense ministries and armed forces

- Civil aviation authorities and airlines

- Healthcare networks and hospital groups

- Automotive and transportation companies

- Industrial manufacturing and energy operators

- Training academies and skill development centers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The research begins with identifying demand drivers, technology variables, regulatory factors, and end-user requirements relevant to the India Simulator Market. Secondary sources are reviewed to define market boundaries and application scope. Key assumptions are established regarding procurement behavior and training standards. Variables are validated to ensure relevance and measurability.

Step 2: Market Analysis and Construction

Qualitative and quantitative data are analyzed to construct the market structure and segmentation framework. Historical procurement patterns, institutional investments, and technology adoption trends are assessed. Supply-side capabilities and competitive positioning are mapped. Data triangulation is applied to improve robustness.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings are tested through consultations with industry experts, system integrators, and end users. Feedback is incorporated to validate assumptions and refine insights. Discrepancies are resolved through additional source checks. This step enhances accuracy and practical relevance.

Step 4: Research Synthesis and Final Output

All validated insights are synthesized into a coherent narrative aligned with the study objectives. Analytical outputs are structured to meet reporting standards and decision-making needs. Internal reviews ensure consistency and clarity. The final report is prepared for stakeholder consumption.

- Executive Summary

- India Simulator Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense training modernization programs

Expansion of civil aviation pilot training infrastructure

Increased adoption of simulation-based medical education

Cost efficiency compared to live training environments

Integration of AI and immersive technologies in training systems - Market Challenges

High upfront capital investment requirements

Complex certification and regulatory approval processes

Limited domestic manufacturing of high-end components

Rapid technology obsolescence risks

Dependence on skilled operators and instructors - Market Opportunities

Localization of simulator manufacturing and software development

Growth of private training academies across sectors

Adoption of simulation for safety and compliance training - Trends

Shift toward virtual and augmented reality platforms

Increasing use of data analytics for performance assessment

Modular and scalable simulator architectures

Cloud-enabled simulation software deployment

Cross-sector use of common simulation platforms - Government Regulations & Defense Policy

Emphasis on indigenization under national defense procurement policies

Standardization of training and certification norms

Increased public investment in skill development infrastructure - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Flight simulators

Driving simulators

Maritime simulators

Medical training simulators

Industrial process simulators - By Platform Type (In Value%)

Fixed-base simulators

Full-motion simulators

Virtual reality simulators

Augmented reality simulators

Desktop-based simulators - By Fitment Type (In Value%)

New installation

Retrofit and upgrade

Modular expansion

Software-only deployment

Hybrid hardware-software integration - By EndUser Segment (In Value%)

Defense and armed forces

Commercial aviation training centers

Healthcare education institutions

Automotive and transportation training

Industrial and energy operators - By Procurement Channel (In Value%)

Direct government procurement

Defense public sector undertakings

Private training academies

System integrators and EPC contractors

OEM direct sales - By Material / Technology (in Value %)

High-fidelity visual systems

Motion control and actuation systems

Simulation software platforms

Haptic and sensory feedback systems

AI-enabled training analytics

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (technology maturity, system fidelity, customization capability, after-sales support, integration flexibility, pricing competitiveness, regulatory compliance, domestic manufacturing presence) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

HAL Simulation Division

Larsen & Toubro Simulation Systems

Bharat Electronics Simulation Solutions

CAE India

Thales India Training Systems

Saab Training India

Indra Sistemas India

Zen Technologies

Alpha Design Technologies

Tata Advanced Systems Training

Adani Defence Simulation

Rheinmetall India Simulation

Lockheed Martin India Training

Boeing India Simulation Services

Ansys India Simulation Solutions

- Defense users focus on mission realism and interoperability

- Aviation training centers prioritize regulatory compliance and uptime

- Healthcare institutions demand precision and repeatability in scenarios

- Industrial users emphasize safety training and process optimization

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035