Market Overview

Based on a recent historical assessment, the India situational awareness systems market recorded spending of approximately USD ~ billion, reflecting confirmed investments across defense, internal security, and strategic surveillance programs. The market size is driven by modernization of command-and-control infrastructure, expansion of intelligence, surveillance, and reconnaissance capabilities, and growing demand for real-time data fusion across land, air, maritime, and space domains. Government focus on network-centric warfare, border monitoring, and internal security, combined with increased indigenization under national defense programs, continues to support sustained procurement of advanced situational awareness solutions.

Based on a recent historical assessment, New Delhi, Bengaluru, Hyderabad, and Pune dominate the India situational awareness systems market due to their concentration of defense command structures, system integrators, and R&D institutions. New Delhi leads as the center for defense planning, procurement, and joint command initiatives. Bengaluru and Hyderabad drive dominance through strong ecosystems in aerospace, electronics, and software-defined defense systems. Pune benefits from proximity to army formations, testing establishments, and system integration facilities, enabling rapid development, validation, and deployment of situational awareness technologies.

Market Segmentation

By Product Type

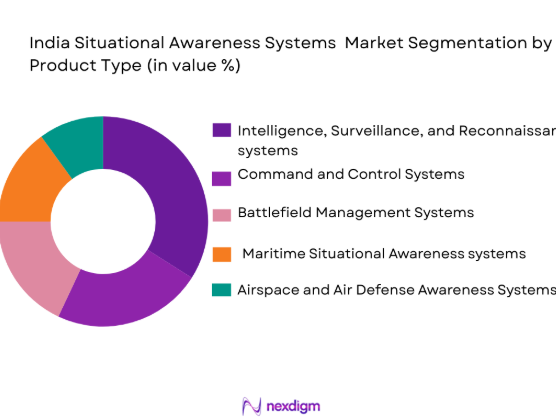

India situational awareness systems market is segmented by system type into command-and-control systems, intelligence surveillance and reconnaissance systems, battlefield management systems, maritime situational awareness systems, and airspace and air defense situational awareness systems. Recently, intelligence, surveillance, and reconnaissance systems dominate the market due to persistent border monitoring requirements, maritime domain awareness needs, and internal security operations. These systems enable continuous collection and analysis of data from multiple sensors, improving threat detection and response times. Integration with satellites, UAVs, radars, and ground sensors enhance coverage and reliability. Ongoing border tensions and maritime security priorities sustain high deployment intensity. Strong government funding and emphasis on real-time intelligence reinforce the dominance of ISR systems.

By Platform Type

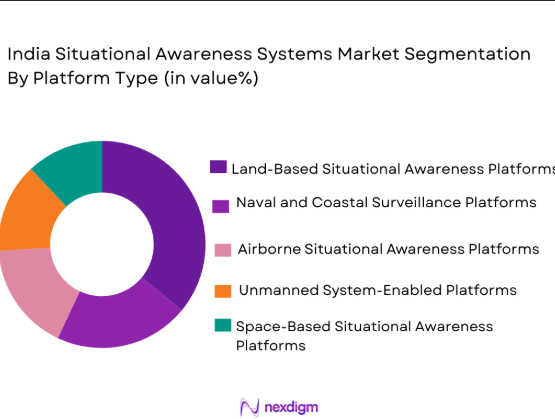

India situational awareness systems market is segmented by platform type into land-based platforms, naval and coastal surveillance platforms, airborne situational awareness platforms, space-based platforms, and unmanned system-enabled platforms. Recently, land-based situational awareness platforms hold a dominant market share due to extensive deployment along land borders and internal security zones. These platforms support army operations, border forces, and paramilitary units through integrated sensors, communication networks, and command centers. Continuous upgrades and expansion of border infrastructure drive demand. Integration with national command networks improves coordination. High deployment scale and sustained operational requirements reinforce dominance of land-based platforms.

Competitive Landscape

The India situational awareness systems market is moderately consolidated, characterized by strong participation of domestic defense public sector units and large private system integrators, alongside select global technology providers. Indigenization mandates, offset requirements, and long procurement cycles shape competition. Domestic players benefit from government preference for local manufacturing and lifecycle support, while foreign firms primarily engage through partnerships and technology transfer arrangements.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Core Capability |

| Bharat Electronics Limited | 1954 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

| Larsen & Toubro Defence | 2011 | Mumbai, India | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2007 | Hyderabad, India | ~ | ~ | ~ | ~ | ~ |

| DRDO | 1958 | New Delhi, India | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ |

India Situational Awareness Systems Market Analysis

Growth Drivers

Network-Centric Warfare and Joint Command Modernization

Network-centric warfare and joint command modernization are major growth drivers for the India situational awareness systems market as the armed forces increasingly transition toward integrated, multi-domain operational doctrines. Situational awareness systems enable seamless real-time sharing of intelligence, surveillance, and operational data across army, navy, air force, and strategic commands, significantly improving decision-making speed and coordination. Modern command-and-control architectures rely heavily on data fusion from radars, satellites, UAVs, electronic intelligence, and ground sensors to support precision operations. Government-backed initiatives focus on establishing unified command structures and interoperable digital networks. Enhanced interoperability reduces information slots and operational delays. Continuous upgrades to legacy systems and induction of new platforms sustain procurement momentum. These developments collectively reinforce long-term market growth.

Border Surveillance and Internal Security Requirements

Border surveillance and internal security requirements strongly drive demand in the India situational awareness systems market due to the country’s extensive land borders, long coastline, and complex internal security environment. Situational awareness systems support persistent monitoring, early threat detection, and rapid response against conventional, asymmetric, and non-traditional threats. Integration of ground sensors, UAVs, aerostats, satellite feeds, and secure communication networks improves situational clarity in difficult terrains such as mountains, deserts, and coastal regions. Internal security and paramilitary forces depend on real-time intelligence for counterinsurgency, counterterrorism, and law-and-order operations. High operational tempo necessitates continuous system availability. Regular upgrades, replacements, and expansion of surveillance coverage sustain steady market expansion.

Market Challenges

System Interoperability and Integration Complexity

System interoperability and integration complexity represent significant challenges for the India situational awareness systems market as solutions are required to function seamlessly across a wide range of platforms, services, and legacy infrastructures operated by different defense and security agencies. Situational awareness systems must integrate data from heterogeneous sensors, communication networks, and command software developed over multiple decades, often using incompatible architectures and standards. Variations in hardware interfaces, data formats, encryption protocols, and communication bandwidths substantially increase engineering effort and system customization requirements. Achieving real-time data fusion across army, navy, air force, and internal security networks demands extensive testing, validation, and iterative refinement. Integration delays can directly impact deployment schedules, joint operational readiness, and mission effectiveness. The complexity of synchronizing upgrades across interconnected systems further elevates technical risk. Collectively, these challenges increase program costs, extend timelines, and slow the pace of large-scale, nationwide situational awareness implementation.

High Lifecycle Costs and Procurement Delays

High lifecycle costs and procurement delays pose major challenges to market scalability due to the capital-intensive and prolonged nature of defense acquisition and sustainment processes. Situational awareness systems require continuous maintenance, frequent software upgrades, cybersecurity hardening, and periodic replacement of sensors, servers, and communication hardware, resulting in substantial recurring expenditure throughout their operational life. Lengthy testing, field trials, user acceptance evaluations, and multi-stage certification processes significantly extend induction timelines. Budgetary constraints and competing defense priorities often lead to phased procurement, slowing full-scale deployment. Multi-layer approval mechanisms involving multiple ministries and agencies further delay contract finalization. Dependence on imported subsystems and specialized components introduces supply chain uncertainty, foreign exchange exposure, and cost volatility. Together, these factors delay implementation, reduce deployment speed, and limit the rapid expansion of integrated situational awareness capabilities across India.

Opportunities

Indigenous AI-Enabled Situational Awareness Platforms

Indigenous AI-enabled situational awareness platforms offer strong opportunities as India intensifies its focus on self-reliance and technological sovereignty in defense and security systems. Artificial intelligence significantly enhances threat detection, pattern recognition, anomaly identification, and predictive analysis by processing vast volumes of multi-sensor data in near real time. AI-driven analytics improve decision-making speed, accuracy, and consistency while reducing operator workload in complex, data-intensive operational environments. Advanced algorithms support automated prioritization of threats and resource allocation across multiple domains. Local development of AI-enabled platforms reduces dependence on imported software, proprietary algorithms, and foreign-controlled data architectures, strengthening data security and operational control. Government programs promoting indigenization, defense startups, and innovation funding actively support domestic R&D and commercialization. Additionally, AI-based situational awareness solutions tailored to Indian operational conditions have strong export potential to friendly nations facing similar security challenges, further increasing long-term market value.

Expansion of Maritime and Space-Based Surveillance

Expansion of maritime and space-based surveillance systems presents substantial opportunities as India places growing emphasis on securing sea lanes, coastal regions, island territories, and space-based assets. Maritime situational awareness systems enhance continuous monitoring of extensive coastlines, exclusive economic zones, offshore energy infrastructure, and critical shipping routes, supporting naval operations and trade security. Space-based surveillance using satellites enables wide-area coverage, persistent observation, early warning, and strategic intelligence collection beyond the reach of terrestrial sensors. Integration of satellite data with naval, air, and ground command systems strengthens real-time situational awareness and response coordination. Government initiatives focused on maritime security, space domain awareness, and expansion of satellite constellations ensure sustained funding and policy support. These developments create long-term growth opportunities across defense, homeland security, disaster response, and strategic monitoring applications.

Future Outlook

Over the next five years, the India situational awareness systems market is expected to grow steadily, supported by defense modernization, indigenization initiatives, and evolving security requirements. Technological development will emphasize AI-driven data fusion, unmanned systems, and secure communication networks. Regulatory support for domestic manufacturing will remain strong. Demand will increasingly favor integrated, multi-domain situational awareness solutions.

Major Players

- Bharat Electronics Limited

- Larsen & Toubro Defence

- Tata Advanced Systems

- Mahindra Defence Systems

- DRDO

- Hindustan Aeronautics Limited

- Thales Group

- Elbit Systems

- Lockheed Martin

- Raytheon Technologies

- Saab Group

- Leonardo

- Northrop Grumman

- BAE Systems

- Rafael Advanced Defense Systems

Key Target Audience

- Defense ministries and armed forces

- Government and regulatory bodies

- Investments and venture capitalist firms

- Internal security and paramilitary forces

- Defense system integrators

- Aerospace and electronics OEMs

- Maritime security agencies

- Strategic intelligence organizations

Research Methodology

Step 1: Identification of Key Variables

Defense spending, surveillance requirements, technology adoption, and platform integration variables were identified. Demand and supply indicators were mapped. Market scope was defined.

Step 2: Market Analysis and Construction

Data from defense programs, procurement disclosures, and industry sources were analyzed. Market segmentation was constructed by system type and platform. Cross-validation ensured consistency.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with defense and security experts. Assumptions were refined based on operational insights and regulatory considerations.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into structured narratives. Quantitative and qualitative findings were aligned. Outputs were reviewed for accuracy and coherence.

- Executive Summary

- India Situational Awareness Systems Market Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Network-centric warfare and joint command modernization

Border surveillance and internal security requirements

Expansion of maritime domain awareness initiatives

Integration of AI and real-time data fusion technologies

Government focus on indigenization and make in India programs - Market Challenges

System interoperability across diverse platforms

High integration and lifecycle management costs

Dependence on imported sensors and subsystems

Cybersecurity and data integrity risks

Lengthy defense procurement and approval cycles - Market Opportunities

Indigenous development of AI-enabled situational awareness platforms

Expansion of coastal and space-based surveillance systems

Exports to friendly and allied nations - Trends

Adoption of multi-domain integrated command systems

Increased use of unmanned platforms for persistent surveillance

AI-driven threat detection and predictive analytics

Real-time data fusion across sensors and services

Emphasis on secure and resilient communication networks - Government Regulations & Defense Policy

Defense procurement procedure and indigenization mandates

Border and coastal surveillance policy frameworks

Space and cyber domain security initiatives

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command and control systems

Intelligence, surveillance, and reconnaissance (ISR) systems

Battlefield management systems

Maritime situational awareness systems

Airspace and air defense situational awareness systems - By Platform Type (In Value%)

Land-based situational awareness platforms

Naval and coastal surveillance platforms

Airborne situational awareness platforms

Space-based situational awareness platforms

Unmanned system-enabled situational awareness platforms - By Fitment Type (In Value%)

New defense procurement programs

System upgrades and modernization projects

Retrofit installations on existing platforms

Network-centric integration projects

Training and simulation system deployments - By End User Segment (In Value%)

Army and land forces

Air force and air defense units

Navy and coastal security forces

Internal security and paramilitary forces

Defense intelligence and command organizations - By Procurement Channel (In Value%)

Direct government defense procurement

Defense public sector undertaking contracts

Private sector system integrator procurement

Public-private partnership programs

Foreign collaboration and licensed production - By Technology / Sensor Type (in Value%)

Radar and RF-based sensing systems

Electro-optical and infrared sensors

Acoustic and sonar-based sensing technologies

Satellite and space-based sensors

AI-enabled data fusion and analytics platforms

- Market share snapshot of major players

- Cross Comparison Parameters (sensor integration capability, data fusion sophistication, system scalability, cybersecurity resilience, indigenization level, lifecycle support strength, interoperability, cost competitiveness, deployment experience)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Bharat Electronics Limited

Hindustan Aeronautics Limited

Tata Advanced Systems

Larsen & Toubro Defence

Mahindra Defence Systems

DRDO

Elbit Systems

Thales Group

Raytheon Technologies

Lockheed Martin

Saab Group

Leonardo

Northrop Grumman

BAE Systems

Rafael Advanced Defense Systems

- Army focus on battlefield and border situational awareness

- Navy emphasis on maritime and coastal surveillance

- Air force requirements for integrated airspace awareness

- Internal security agencies’ demand for real-time intelligence

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035