Market Overview

Based on a recent historical assessment, the India Sky Based Communication Market was valued at approximately USD ~ billion, supported by data published by the Indian Space Research Organization, Department of Telecommunications, and India Brand Equity Foundation. The market size is driven by rising deployment of satellite communication systems for broadband connectivity, defense communication, disaster management, remote sensing data relay, and aviation connectivity. Increased public investment in space infrastructure, higher private participation under national space policy reforms, and expanding demand for low latency communication across remote regions continue to sustain overall market expansion.

Based on a recent historical assessment, major dominance within the India Sky Based Communication Market is observed across regions such as Bengaluru, Hyderabad, Chennai, and national-level integration with global satellite hubs in the United States and Europe. Bengaluru and Hyderabad lead due to concentration of space research centers, satellite manufacturing facilities, and private launch service providers, while Chennai supports ground station infrastructure and integration services. International partnerships with satellite operators in the United States and European Union strengthen technology access, capacity leasing, and interoperability, enabling faster adoption across civil, defense, and commercial communication applications.

Market Segmentation

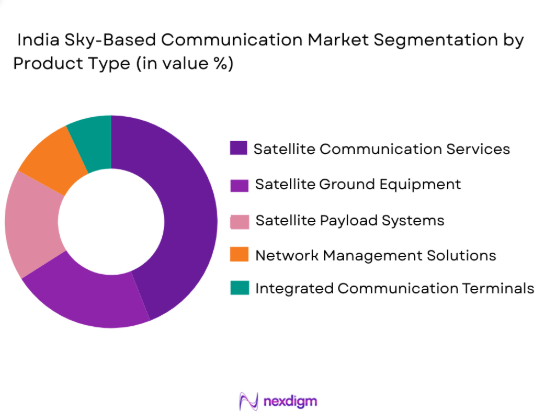

By Product Type

India Sky Based Communication Market is segmented by product type into satellite communication services, satellite ground equipment, satellite payload systems, and network management solutions. Recently, satellite communication services have a dominant market share due to expanding broadband connectivity requirements in remote regions, rising defense and government demand for secure communication links, strong service-level agreements from established operators, and increasing integration with aviation and maritime platforms. The service segment benefits from existing orbital assets, scalable capacity leasing models, and faster deployment timelines compared to hardware-intensive segments. Government-backed connectivity programs, disaster response frameworks, and enterprise digital transformation initiatives further support sustained demand for managed satellite communication services across multiple end-use verticals.

By Platform Type

India Sky Based Communication Market is segmented by platform type into geostationary orbit platforms, low Earth orbit platforms, medium Earth orbit platforms, high altitude platform systems, and hybrid integrated platforms. Recently, geostationary orbit platforms have had a dominant market share due to their long-established infrastructure, wide coverage capability, and reliability for continuous communication services across large geographic areas. These platforms are extensively used for defense networks, national broadcasting, disaster response communication, and backbone connectivity for remote regions. Existing investments in GEO satellites, mature ground station ecosystems, and long-term service contracts reinforce their dominance. Additionally, GEO platforms support stable bandwidth provisioning and compatibility with legacy systems, making them the preferred choice for government and enterprise communication requirements.

Competitive Landscape

The India Sky Based Communication Market exhibits a moderately consolidated competitive landscape, with a mix of government-backed organizations and private enterprises shaping service availability, infrastructure deployment, and technology development. Major players influence market direction through long-term capacity agreements, proprietary satellite platforms, and partnerships with global satellite operators, creating high entry barriers while encouraging selective private participation.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Satellite Assets |

| ISRO | 1969 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

| Antrix Corporation | 1992 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

| NSIL | 2019 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2007 | Hyderabad, India | ~ | ~ | ~ | ~ | ~ |

| Bharti Airtel | 1995 | New Delhi, India | ~ | ~ | ~ | ~ | ~ |

India Sky Based Communication Market Analysis

Growth Drivers

National Satellite Connectivity Expansion Programs

This growth driver is rooted in large-scale government initiatives aimed at extending reliable communication access to remote, border, island, and underserved regions through satellite-based networks that complement terrestrial infrastructure. The driver is reinforced by sustained public funding allocated to digital inclusion, emergency communication preparedness, and secure government networks. Satellite systems enable rapid deployment without geographic constraints, making them critical for connectivity in mountainous, forested, and maritime zones. Increasing integration of satellite links into national broadband frameworks strengthens resilience against terrestrial outages. Defense and internal security agencies increasingly depend on satellite communication for secure operations. Policy-level encouragement for private sector participation accelerates service availability. Advances in satellite payload efficiency reduce operational costs over time. Interoperability with global satellite networks further enhances service reliability and scalability.

Commercial Aviation and Maritime Connectivity Demand

This driver reflects the rising requirement for uninterrupted voice and data connectivity across aircraft and maritime vessels operating beyond terrestrial network coverage. Airlines increasingly integrate satellite-based communication systems to support cockpit communication, passenger connectivity, and real-time operational monitoring. Maritime operators rely on satellite links for navigation, safety compliance, logistics coordination, and crew welfare. Growth in air traffic and commercial shipping intensifies demand for high-throughput satellite solutions. Regulatory mandates for safety communication strengthen adoption. Service providers benefit from long-term contracts and recurring revenue models. Technological advancements in phased-array antennas improve performance. Integration with global mobility platforms enhances network coverage consistency.

Market Challenges

High Capital Intensity and Long Asset Lifecycles

This challenge arises from the substantial upfront investment required for satellite manufacturing, launch services, ground infrastructure, and spectrum coordination. Long development cycles delay revenue realization and increase exposure to technological obsolescence risks. Financing constraints limit participation by smaller firms. Asset lifecycles extending over decades restrict rapid technology refresh. Insurance and launch risks add cost uncertainty. Dependence on foreign launch or component suppliers can create vulnerabilities. Regulatory approvals further extend timelines. These factors collectively constrain market agility and scalability.

Spectrum Allocation and Regulatory Complexity

This challenge is driven by the limited availability of orbital slots and radio frequency spectrum essential for satellite communication operations. Coordination with international regulatory bodies increases compliance complexity. Delays in licensing can postpone service rollout. Overlapping civilian, defense, and commercial spectrum demands create allocation conflicts. Policy uncertainty affects private investment confidence. Cross-border coordination is essential for interference management. Compliance costs burden operators. Regulatory harmonization remains gradual, affecting deployment speed.

Opportunities

Private Sector Participation under Space Policy Reforms

This opportunity is enabled by national reforms encouraging private investment across satellite manufacturing, launch services, and communication service provisioning. Liberalized policies reduce entry barriers and foster innovation. Public-private partnerships enhance capacity utilization. Domestic manufacturing initiatives support supply chain localization. Commercial operators gain access to national satellite assets. Increased competition improves service affordability. International collaboration expands market reach. Venture capital interest accelerates technology development.

Integration of LEO Satellite Constellations: Integration of LEO Satellite Constellations

This opportunity stems from the deployment of low Earth orbit satellite constellations offering low latency and high throughput communication services. LEO systems complement existing GEO infrastructure. Demand from enterprise connectivity, mobility platforms, and IoT applications increases adoption. Technological advancements reduce terminal costs. Regulatory frameworks increasingly accommodate LEO operations. Interoperability improves network resilience. Global partnerships enhance coverage. This creates new service models and revenue streams.

Future Outlook

The India Sky Based Communication Market is expected to experience sustained expansion over the next five years, supported by policy reforms, increased private participation, and advancing satellite technologies. Growth trends indicate stronger integration of LEO and GEO systems, rising demand from mobility and defense applications, and enhanced regulatory clarity. Technological developments in payload efficiency and ground terminals are expected to improve service economics. Demand-side drivers remain anchored in connectivity resilience and national security priorities.

Major Players

- ISRO

- Antrix Corporation

- NewSpace India Limited

- Tata Advanced Systems

- Bharti Airtel

- OneWeb India

- Hughes Communications India

- Nelco

- L&TDefence

- Astra Microwave

- Data Patterns

- Bharat Electronics Limited

- Godrej Aerospace

- Alpha Design Technologies

- MTAR Technologies

Key Target Audience

- Defense ministries

- Government and regulatory bodies

- Satellite operators

- Telecom service providers

- Aviation operators

- Maritime companies

- Infrastructure developers

- Investment and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

Key variables related to satellite assets, service models, regulatory frameworks, and demand sectors were identified through secondary research and industry databases to define the analytical scope and data boundaries.

Step 2: Market Analysis and Construction

Qualitative and quantitative insights were synthesized to construct the market structure, segment dynamics, and competitive landscape using validated secondary data and policy documents.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, policy analysts, and technology specialists were consulted to validate assumptions, demand drivers, and regulatory impacts affecting the market.

Step 4: Research Synthesis and Final Output

All validated inputs were integrated into a structured analytical framework to produce consistent, data-aligned market insights.

- Executive Summary

India Sky Based Communication Market Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government space and communication modernization initiatives

Rising demand for nationwide broadband and connectivity coverage

Defense and strategic communication requirements

Growth in satellite enabled aviation and mobility services

Advancements in satellite manufacturing and launch capabilities - Market Challenges

High capital expenditure for satellite and airborne platforms

Spectrum allocation and regulatory complexities

Long development and deployment timelines

Dependence on launch availability and orbital coordination

Cybersecurity and signal resilience concerns - Market Opportunities

Expansion of low earth orbit communication constellations

Integration of sky-based communication with 5G and future networks

Development of indigenous satellite and platform manufacturing ecosystems

- Trends

Shift toward software defined and flexible payload architectures

Increasing use of low latency communication platforms

Integration of artificial intelligence for network optimization

Focus on dual use civilian and defense communication systems

Rising interest in optical and laser-based communication links - Government Regulations & Space Policy

National space communication and satellite policy frameworks

Spectrum management and licensing regulations

Private sector participation and foreign investment norms - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

By Market Value, 2020-2025

By Installed Units, 2020-2025

By Average System Price, 2020-2025

By System Architecture Tier, 2020-2025

- By System Type (In Value%)

Satellite communication payload systems

High altitude platform station communication systems

Airborne relay and aerial communication nodes

Hybrid satellite airborne integrated networks

Emergency and disaster response sky communication systems - By Platform Type (In Value%)

Geostationary satellite platforms

Low earth orbit satellite constellations

High altitude pseudo satellite platforms

Manned airborne communication platforms

Unmanned aerial communication platforms - By Fitment Type (In Value%)

New communication satellite deployment programs

Upgrade and modernization of existing sky networks

Defense and strategic communication integration

Commercial aviation and mobility communication fitments

Research, testing, and demonstration deployments

By End User Segment (In Value%)

Defense and homeland security agencies

Commercial telecommunications operators

Civil aviation authorities and airlines

Disaster management and emergency services

Scientific research and space agencies - By Procurement Channel (In Value%)

Direct government and space agency procurement

Public sector undertaking contracts

Private satellite operator procurement

Public private partnership programs

International collaboration and leasing arrangements - By Technology (in Value%)

Ka band and Ku band communication technologies

Laser and optical communication systems

Software defined and reconfigurable payloads

Inter satellite link technologies

Ground segment integration and network management systems

- Market share snapshot of major players

- Cross Comparison Parameters (orbital capability, payload technology maturity, network latency performance, regulatory compliance strength, production scalability, launch access, partnership ecosystem, cost competitiveness, innovation pipeline, lifecycle support capability)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Indian Space Research Organization

New Space India Limited

Bharti Airtel Satellite Services

Tata Advanced Systems Limited

Larsen and Toubro Space Systems

OneWeb India

Hughes Communications India

Ananth Technologies

Bharat Electronics Limited

Lockheed Martin Space

Airbus Defence and Space

Thales Alenia Space

Northrop Grumman Space Systems

Boeing Satellite Systems

Viasat Inc.

- Defense and security demand for secure resilient communication links

- Telecom operators focus on rural and remote connectivity

- Aviation sector requirements for continuous high bandwidth communication

- Disaster management agencies reliance on rapid deployable sky networks

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035