Market Overview

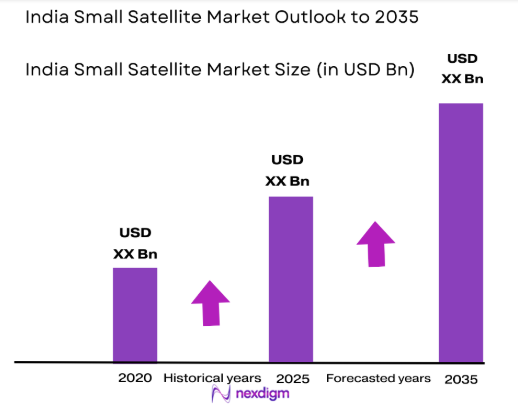

Based on a recent historical assessment, the India small satellite market generated USD ~ billion, supported by increasing deployment of nanosatellites and microsatellites for earth observation, communication, and scientific missions. This market size is driven by sustained government-backed launch programs, expanding private startup participation, and rising commercial demand for satellite-based data services. Institutional procurement by national space agencies and defense organizations continues to anchor demand, while cost-efficient manufacturing and launch capabilities improve deployment frequency. The market is further reinforced by regulatory reforms enabling private sector launches, downstream application development, and international collaboration agreements.

Based on a recent historical assessment, India dominates the regional small satellite landscape through concentrated activity in Bengaluru, Hyderabad, and Chennai, supported by established aerospace clusters, skilled engineering talent, and proximity to national research institutions. India’s leadership is strengthened by operational launch facilities, indigenous launch vehicle programs, and strong policy backing for space commercialization. International partnerships with the United States, Europe, and Japan further enhance technology exchange and mission collaboration. The presence of vertically integrated manufacturers and launch service providers sustains national competitiveness across commercial, civil, and defense-oriented small satellite programs.

Market Segmentation

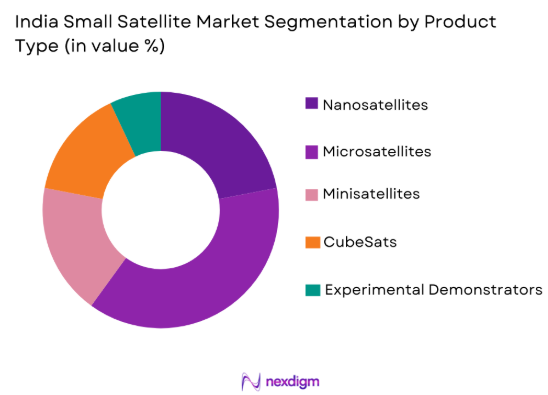

By Product Type

India Small Satellite market is segmented by product type into nanosatellites, microsatellites, minisatellites, CubeSats, and experimental technology demonstrators. Recently, microsatellites have a dominant market share due to balanced payload capacity, operational lifespan, and mission flexibility across earth observation and defense applications. Microsatellites enable higher-resolution imaging and more sophisticated sensors than nanosatellites while remaining cost-efficient compared to larger platforms. Government agencies favor microsatellites for surveillance and meteorological missions due to reliable power and communication subsystems. Commercial operators adopt microsatellites for data continuity and revisit rates. Their compatibility with existing launch vehicles and rideshare missions accelerates deployment timelines. Increased domestic manufacturing capability further reinforces this dominance.

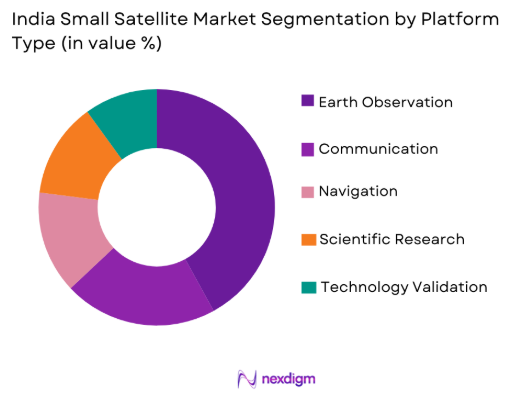

By Platform Type

India Small Satellite market is segmented by platform type into earth observation platforms, communication platforms, navigation platforms, scientific research platforms, and technology validation platforms. Recently, earth observation platforms have a dominant market share due to consistent demand from agriculture monitoring, disaster management, urban planning, and defense surveillance users. These platforms generate recurring data demand and enable commercial analytics services. Government-backed missions prioritize imaging and remote sensing for national programs. Private firms increasingly commercialize high-resolution imagery and analytics. Strong downstream data monetization supports platform dominance. Frequent mission replenishment further sustains demand across public and private sectors.

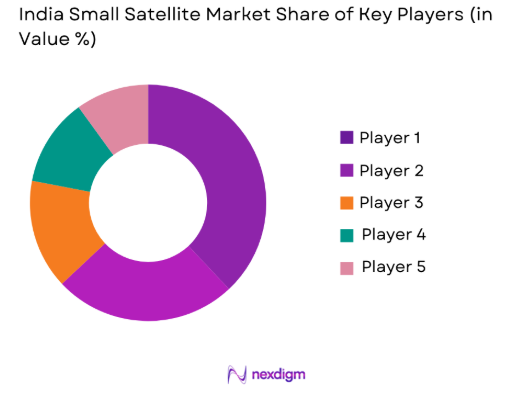

Competitive Landscape

The India small satellite market exhibits moderate consolidation, with a limited number of vertically integrated firms controlling manufacturing, integration, and launch interfaces. Established defense and aerospace companies coexist with agile startups focused on payloads, platforms, and data services.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Ananth Technologies | 1992 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

| Dhruva Space | 2012 | Hyderabad | ~ | ~ | ~ | ~ | ~ |

| Pixxel | 2019 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2007 | Hyderabad | ~ | ~ | ~ | ~ | ~ |

| Larsen & Toubro Defence | 2011 | Mumbai | ~ | ~ | ~ | ~ | ~ |

India Small Satellite Market Analysis

Growth Drivers

Expansion of Commercial Earth Observation and Downstream Data Analytics Demand

Expansion of commercial earth observation and downstream data analytics demand is a major growth driver for the India Small Satellite market because satellite-derived data has become essential for decision-making across multiple economic and security sectors. Agriculture stakeholders increasingly rely on high-resolution imagery for crop health assessment, irrigation planning, and yield forecasting across large and diverse geographies. Urban development authorities use satellite data to monitor infrastructure expansion, land-use changes, and compliance with planning regulations. Disaster management agencies depend on frequent imaging to assess floods, cyclones, landslides, and forest fires, improving preparedness and response effectiveness. The defense sector requires persistent surveillance and reconnaissance capabilities to support border monitoring, maritime domain awareness, and strategic intelligence needs. Commercial enterprises monetize satellite data through analytics platforms that transform raw imagery into actionable insights for insurance, logistics, mining, and energy companies. Subscription-based data models generate recurring revenue and favor continuous satellite deployment. Improvements in sensor resolution, revisit frequency, and onboard processing enhance data value and usability. As data consumption grows, demand for small satellites capable of rapid deployment and flexible mission profiles continues to rise. This sustained expansion of downstream applications directly drives manufacturing, launch, and service demand within the small satellite ecosystem.

Government-Led Space Sector Liberalization and Institutional Procurement Support

Government-led space sector liberalization and institutional procurement support strongly drive growth in the India Small Satellite market by creating a stable and enabling environment for private participation. Regulatory reforms have opened satellite manufacturing, launch services, and space-based data activities to private companies under clearer authorization frameworks. Dedicated institutions and policy mechanisms facilitate licensing, spectrum coordination, and mission approvals, reducing procedural uncertainty for new entrants. Public funding programs and innovation grants support research, prototyping, and commercialization of small satellite technologies. Large institutional buyers, including civil space agencies and defense organizations, provide anchor demand through long-term procurement programs. Preference for domestically developed platforms encourages local manufacturing and supply chain development. Investments in launch infrastructure, testing facilities, and space parks reduce operational bottlenecks and improve time-to-market. International cooperation agreements enable technology exchange and joint missions, expanding commercial opportunities. Government-backed demand signals improve investor confidence and attract venture capital into the sector. Together, policy liberalization and institutional support create predictable demand conditions that sustain long-term market growth.

Market Challenges

Launch Capacity Constraints and Mission Scheduling Uncertainty

Launch capacity constraints and mission scheduling uncertainty represent a major challenge for the India Small Satellite market because the pace of satellite manufacturing has begun to exceed the availability of reliable and timely launch opportunities. Small satellite operators often depend on limited domestic launch vehicles or international rideshare missions, which restrict flexibility in orbital selection and deployment timelines. Delays in launch schedules disrupt constellation planning, affect service continuity, and create revenue uncertainty for commercial earth observation and communication providers. Government missions frequently receive launch priority, which can extend waiting periods for private operators and startups. As satellite constellations expand, the need for rapid replenishment becomes critical, yet constrained launch slots slow replacement cycles. This uncertainty increases insurance costs and complicates contractual commitments with downstream data customers. Infrastructure expansion, including new launchpads and vehicles, requires long gestation periods and substantial capital investment. Until launch cadence improves consistently, market scalability remains structurally constrained. These factors collectively limit short-term growth despite strong underlying demand.

Dependence on Imported Critical Components and Supply Chain Vulnerability

Dependence on imported critical components poses a significant challenge for the India Small Satellite market by exposing manufacturers to supply chain disruptions, regulatory barriers, and cost volatility. High-performance payload sensors, radiation-hardened electronics, propulsion systems, and specialized materials are often sourced from foreign suppliers with strict export controls. Geopolitical tensions and trade restrictions can delay component availability, directly affecting production timelines. Currency fluctuations further increase procurement costs and compress margins for domestic manufacturers. Limited domestic alternatives slow efforts toward full indigenization and increase technological dependence. Certification and qualification of new indigenous components require extended testing cycles, delaying commercialization. Startups face heightened risk due to limited bargaining power with global suppliers. Supply uncertainty also complicates long-term mission planning for defense and institutional customers. These vulnerabilities reduce operational resilience and slow the pace of ecosystem self-sufficiency.

Opportunities

Development of Large-Scale Small Satellite Constellations for Continuous Data Services

Development of large-scale small satellite constellations presents a substantial opportunity for the India Small Satellite market as demand grows for persistent, high-frequency data across commercial, civil, and defense applications. Constellations enable continuous earth observation coverage, significantly improving revisit rates and data reliability for agriculture monitoring, climate analysis, maritime surveillance, and urban infrastructure planning. Commercial customers increasingly prefer subscription-based data services that rely on uninterrupted satellite coverage, making constellation architectures economically attractive. Defense and security agencies benefit from redundancy and resilience, as constellation-based systems reduce single-satellite mission risk. Advances in satellite miniaturization and standardized platforms lower per-unit manufacturing costs, improving constellation affordability. Domestic launch vehicle development further supports phased constellation deployment and replenishment strategies. Integrated analytics platforms allow operators to monetize not only raw imagery but also processed insights, increasing value capture across the data chain. Policy support for private participation and streamlined licensing accelerates approval timelines for multi-satellite missions. As global demand for real-time geospatial intelligence expands, India-based operators can position constellation services competitively in international markets.

Export of Small Satellite Platforms, Subsystems, and Turnkey Mission Solutions

Export of small satellite platforms, subsystems, and turnkey mission solutions represents a strong growth opportunity for the India Small Satellite market due to rising global demand for cost-effective and reliable space systems. Emerging space nations and commercial operators seek affordable alternatives to traditional large satellite missions, creating demand for modular small satellite platforms. India’s competitive manufacturing costs and growing flight heritage enhance credibility among international customers. Export-ready subsystems such as structures, avionics, power systems, and propulsion units offer diversified revenue streams beyond complete satellite sales. Turnkey mission offerings, including design, integration, launch coordination, and ground support, further strengthen value propositions. Government-led export promotion initiatives and bilateral space cooperation agreements facilitate market access. Technology transfer and joint development programs enable long-term partnerships with foreign agencies and firms. As domestic suppliers achieve higher levels of indigenization, export margins improve while dependence on imported components declines. This opportunity supports ecosystem scale-up, foreign exchange generation, and India’s positioning as a global small satellite solutions provider.

Future Outlook

Over the next five years, the India small satellite market is expected to advance steadily as commercial data demand, defense modernization, and institutional missions converge. Continued policy clarity and private sector participation will accelerate manufacturing scale and mission cadence. Progress in miniaturized sensors, electric propulsion, onboard processing, and secure communications will improve performance and cost efficiency. Expanded launch infrastructure and diversified access options should ease deployment constraints. Growth in downstream analytics, climate monitoring, agriculture intelligence, and maritime surveillance will sustain demand. International partnerships, exports, and constellation programs are likely to broaden revenue streams while strengthening ecosystem resilience and global competitiveness.

Major Players

- Ananth Technologies

- Dhruva Space

- Pixxel

- Tata Advanced Systems

- Larsen & Toubro Defence

- Alpha Design Technologies

- Bellatrix Aerospace

- Skyroot Aerospace

- Agnikul Cosmos

- Azista BST Aerospace

- Centum Electronics

- Data Patterns India

- Paras Defence

- Solar Industries India

- Walchandnagar Industries

Key Target Audience

- Satellite manufacturers

- Launch service providers

- Defense organizations

- Commercial earth observation firms

- Telecommunications operators

- Investments and venture capitalist firms

- Government and regulatory bodies

- Space infrastructure developers

Research Methodology

Step 1: Identification of Key Variables

Key variables including satellite mass classes, platform types, end-user demand, and procurement channels were identified. Secondary sources were reviewed to define scope. Variables were validated through expert references. Data relevance was assessed for consistency.

Step 2: Market Analysis and Construction

Market structure was constructed using demand-side and supply-side indicators. Segment relationships were mapped. Revenue attribution logic was applied. Cross-validation ensured coherence.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were tested through industry expert inputs. Feedback refined segmentation logic. Contradictory data points were reconciled. Final assumptions were validated.

Step 4: Research Synthesis and Final Output

Findings were synthesized into structured insights. Data was normalized for consistency.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for earth observation and remote sensing data

Government-led space reforms supporting private participation

Growing defense surveillance and reconnaissance requirements

Cost-effective launch and manufacturing capabilities

Expansion of downstream satellite data applications - Market Challenges

Limited access to dedicated small satellite launch windows

Dependence on imported critical electronic components

Regulatory approval timelines for commercial missions

Space debris management and orbital congestion concerns

Funding constraints for early-stage satellite startups - Market Opportunities

Development of large-scale satellite constellations

Export of small satellite platforms and subsystems

Growth in commercial earth observation analytics services - Trends

Increased use of standardized small satellite platforms

Adoption of AI and edge computing onboard satellites

Shift toward constellation-based mission architectures

Rising collaboration between ISRO and private firms

Integration of dual-use civil and defense satellite missions - Government Regulations & Defense Policy

Liberalization of space sector under national space policy

Strengthening defense space surveillance initiatives

Promotion of indigenous satellite manufacturing ecosystem

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Earth observation small satellites

Communication small satellites

Navigation and positioning small satellites

Technology demonstration satellites

Scientific and research satellites - By Platform Type (In Value%)

CubeSat platforms

Nano-satellite platforms

Micro-satellite platforms

Mini-satellite platforms

Custom modular small satellite platforms - By Fitment Type (In Value%)

Dedicated satellite missions

Hosted payload satellites

Constellation-based deployment

Technology rideshare missions

Experimental and validation missions - By End User Segment (In Value%)

Government space agencies

Defense and security organizations

Commercial satellite operators

Academic and research institutions

Startups and private space enterprises - By Procurement Channel (In Value%)

Direct government procurement

Public-private partnership contracts

Commercial off-the-shelf procurement

International collaboration programs

Research and academic grants - By Material / Technology (in Value %)

Advanced composite satellite structures

Radiation-hardened electronics

Electric propulsion systems

Miniaturized payload sensors

AI-enabled onboard data processing

- Market share snapshot of major players

- Cross Comparison Parameters (Satellite mass class, Payload capability, Orbit type support, Launch integration capability, Manufacturing lead time, Technology maturity level, Cost efficiency, End-user focus, Export readiness, After-launch support)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Ananth Technologies

Dhruva Space

Pixxel

Agnikul Cosmos

Skyroot Aerospace

Bellatrix Aerospace

Alpha Design Technologies

Tata Advanced Systems

Larsen & Toubro Defence

Walchandnagar Industries

Paras Defence and Space Technologies

Centum Electronics

Solar Industries India

Data Patterns India

Azista BST Aerospace

- Government agencies focus on strategic and sovereign missions

- Defense users prioritize secure and resilient satellite networks

- Commercial operators seek scalable and cost-efficient platforms

- Academic institutions emphasize technology validation missions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035