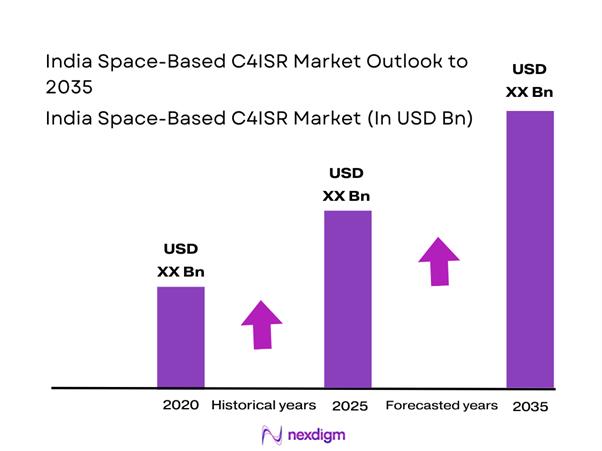

Market Overview

The India Space-Based C4ISR market current size stands at around USD ~ million, reflecting strong institutional demand across defense and strategic intelligence domains. The market recorded steady expansion during 2024 and 2025 due to increased satellite launches and ISR platform integration. Rising allocation toward network-centric warfare and situational awareness programs supported sustained adoption. Indigenous satellite manufacturing and mission-specific payload development strengthened domestic capability depth. Operational emphasis on surveillance continuity and secure communications further accelerated system deployment across strategic agencies.

The market is primarily concentrated across regions hosting defense command centers, launch facilities, and aerospace manufacturing clusters. Southern and western regions benefit from strong space infrastructure, satellite integration facilities, and skilled workforce availability. Northern regions witness higher demand due to border surveillance and tactical intelligence requirements. Policy-backed indigenization initiatives and public–private collaboration continue to shape ecosystem maturity. Urban defense corridors and aerospace parks increasingly anchor technology development and system testing activities.

Market Segmentation

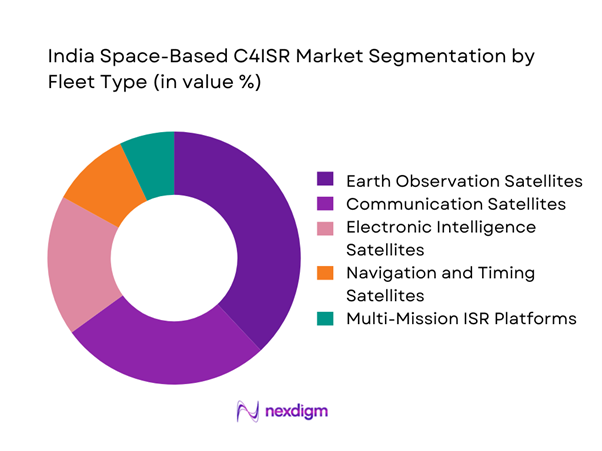

By Fleet Type

The fleet type segmentation reflects growing emphasis on multi-layered intelligence collection and command integration capabilities. Earth observation platforms dominate deployment due to persistent surveillance requirements and high-resolution imaging needs. Communication satellites form the second-largest share, supporting secure data relay and real-time battlefield connectivity. Electronic intelligence platforms are expanding steadily as electronic warfare becomes integral to modern defense strategy. Navigation and timing assets support coordinated operations across domains. The increasing adoption of multi-mission satellite constellations enhances interoperability and mission flexibility across defense agencies.

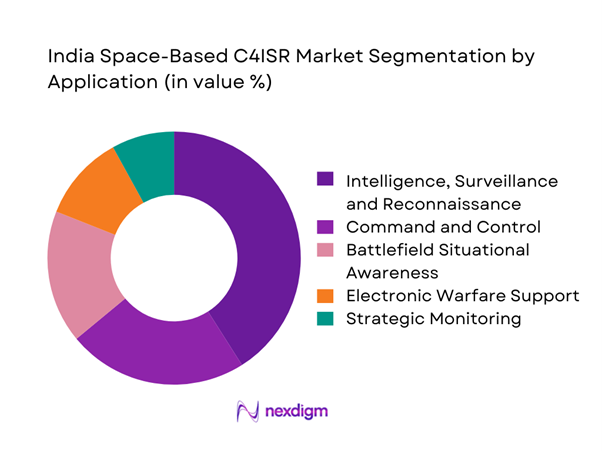

By Application

Application-based segmentation highlights dominance of intelligence, surveillance, and reconnaissance missions driven by border monitoring and maritime security priorities. Command and control applications represent a significant share due to modernization of defense communication architectures. Battlefield situational awareness solutions are increasingly integrated with real-time analytics platforms. Electronic warfare support applications continue to gain traction amid evolving threat environments. Disaster response and strategic monitoring also contribute to sustained demand across civil-military use cases.

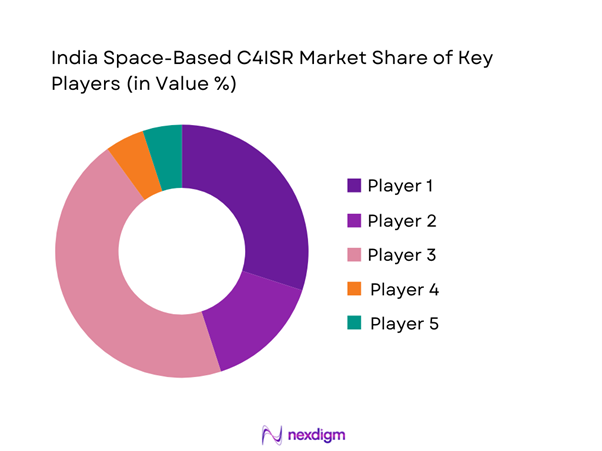

Competitive Landscape

The competitive landscape is characterized by a mix of government-backed entities and private technology providers supporting satellite manufacturing, payload development, and system integration. Market participants focus on enhancing indigenous capabilities while aligning with evolving defense modernization objectives.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| ISRO | 1969 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| NewSpace India Limited | 2019 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Bharat Electronics Limited | 1954 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2001 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Larsen & Toubro Defence | 2010 | India | ~ | ~ | ~ | ~ | ~ | ~ |

India Space-Based C4ISR Market Analysis

Growth Drivers

Rising defense modernization and network-centric warfare adoption

Modernization programs emphasize integrated command systems linking sensors, platforms, and decision networks across operational theaters. Defense modernization initiatives in 2024 expanded satellite-enabled ISR integration across land, sea, and air domains. Network-centric warfare doctrines increased reliance on persistent surveillance and secure communications capabilities. Enhanced situational awareness requirements accelerated investment in space-based reconnaissance assets. Indigenous system development strengthened interoperability across command layers and operational units. Advanced data fusion capabilities supported faster decision-making cycles across defense hierarchies. Cross-domain operational doctrines reinforced reliance on satellite-enabled intelligence networks. Defense planners prioritized resilient communication infrastructure to ensure mission continuity under contested conditions. Satellite-based ISR improved real-time threat detection and response coordination capabilities. Continuous modernization programs sustained consistent demand for advanced C4ISR solutions.

Increasing border surveillance and maritime domain awareness needs

Geopolitical developments heightened focus on border surveillance and maritime domain monitoring across sensitive regions. Expanded coastal security initiatives increased deployment of space-based observation systems. Maritime trade protection requirements strengthened surveillance coverage across strategic sea lanes. Persistent monitoring capabilities enabled early threat detection and response readiness. Integration of space assets enhanced situational awareness for naval and air forces. Cross-border monitoring mandates increased reliance on high-resolution imaging platforms. Maritime domain awareness programs aligned with long-term national security priorities. Satellite-enabled tracking improved coordination between defense and homeland security agencies. Growing surveillance intensity drove demand for advanced ISR platforms. Operational readiness objectives sustained long-term adoption of space-based C4ISR assets.

Challenges

High development and deployment costs

Space-based C4ISR systems require significant capital investment for satellite design and launch. Development cycles involve complex testing, validation, and mission assurance processes. Advanced payload integration increases overall system complexity and financial exposure. Budgetary constraints affect procurement pacing and platform modernization timelines. Maintenance and lifecycle management add to long-term operational expenditure. Specialized ground infrastructure further elevates deployment costs. Cost-intensive redundancy requirements increase total program expenditure. Technology obsolescence risks necessitate continuous upgrade investments. Funding allocation prioritization affects multi-year program execution. Financial constraints influence scalability and deployment speed across operational theaters.

Dependence on sensitive and classified technologies

C4ISR systems rely heavily on restricted technologies requiring stringent security protocols. Limited technology transfer options constrain rapid capability expansion. Classified component dependencies affect supply chain flexibility and sourcing diversity. Security clearance requirements slow development and integration cycles. Export control regulations restrict collaboration with external technology partners. Sensitive data handling mandates robust cybersecurity infrastructure. Technology secrecy limits private sector participation in core system development. Integration complexity increases with classified subsystem dependencies. Security compliance adds procedural layers to procurement processes. These constraints collectively impact deployment timelines and system scalability.

Opportunities

Private sector participation under space sector reforms

Policy reforms encouraged increased private participation in satellite manufacturing and system integration. Commercial entities gained access to launch infrastructure and testing facilities. Public-private collaboration expanded innovation capacity within the C4ISR ecosystem. Startups contributed specialized payloads and analytics capabilities. Market liberalization attracted domestic investment into space technology ventures. Collaborative development models improved cost efficiency and innovation speed. Private participation enhanced supply chain resilience and diversification. Increased competition fostered technological advancement across platforms. Commercial involvement accelerated deployment timelines for ISR assets. Policy support created a conducive environment for long-term industry growth.

Growth of dual-use and commercial ISR applications

Dual-use satellite platforms enabled broader application across defense and civilian sectors. Commercial Earth observation supported disaster management and infrastructure monitoring. Data-sharing frameworks expanded usability of ISR assets beyond military applications. Commercial analytics platforms leveraged satellite data for strategic insights. Dual-use capabilities improved return on investment for satellite deployments. Integration of civilian applications increased utilization efficiency. Market demand diversified across government and enterprise users. Commercial partnerships accelerated technology adoption cycles. Dual-use models enhanced sustainability of space-based ISR investments. Expanded application scope strengthened overall market resilience.

Future Outlook

The India Space-Based C4ISR market is expected to witness sustained expansion driven by defense modernization and space sector liberalization initiatives. Increasing reliance on real-time intelligence and secure communications will shape system architecture evolution. Indigenous manufacturing and private sector participation are expected to strengthen technological self-reliance. Integration of artificial intelligence and data analytics will enhance operational efficiency. Long-term strategic priorities will continue supporting investment momentum through 2035.

Major Players

- Indian Space Research Organisation

- NewSpace India Limited

- Bharat Electronics Limited

- Tata Advanced Systems

- Larsen & Toubro Defence

- Ananth Technologies

- Alpha Design Technologies

- Data Patterns India

- Astra Microwave Products

- Centum Electronics

- Dhruva Space

- Pixxel

- Bellatrix Aerospace

- Paras Defence

- Avantel Limited

Key Target Audience

- Ministry of Defence

- Indian Armed Forces

- Indian Space Research Organisation

- Defence Research and Development Organisation

- Homeland Security Agencies

- Satellite Communication Operators

- Aerospace System Integrators

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Market boundaries, technology scope, application areas, and operational parameters were defined based on defense and space sector structures. Core performance indicators and deployment models were identified for analysis.

Step 2: Market Analysis and Construction

Market segmentation and value chain mapping were conducted using industry data and program-level assessment. Demand drivers and system deployment trends were evaluated across defense segments.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through structured consultations with defense technology experts and industry stakeholders. Assumptions were refined using operational feedback and secondary validation.

Step 4: Research Synthesis and Final Output

Findings were consolidated through triangulation and qualitative assessment. Final insights were structured to ensure consistency, accuracy, and strategic relevance.

- Executive Summary

- Research Methodology (Market Definitions and operational scope for space-based C4ISR in India, Platform and payload taxonomy alignment across ISR layers, Bottom-up and top-down market sizing using satellite and ground segment data, Revenue attribution across defense and dual-use programs, Primary validation through defense procurement experts and satellite operators, Data triangulation using government budgets and contract disclosures, Assumptions and limitations linked to classified program visibility)

- Definition and Scope

- Market evolution

- Usage and mission integration across defense domains

- Ecosystem structure and stakeholder roles

- Supply chain and value chain structure

- Regulatory and policy environment

- Growth Drivers

Rising defense modernization and network-centric warfare adoption

Increasing border surveillance and maritime domain awareness needs

Government push for space-based intelligence autonomy

Growing integration of ISR with tactical command systems

Expansion of small satellite and constellation programs - Challenges

High development and deployment costs

Dependence on sensitive and classified technologies

Spectrum allocation and orbital congestion issues

Long procurement and approval cycles

Data security and cyber vulnerability risks - Opportunities

Private sector participation under space sector reforms

Growth of dual-use and commercial ISR applications

Indigenous satellite manufacturing and launch capabilities

AI-driven analytics integration with ISR platforms

Export potential to friendly nations - Trends

Shift toward LEO-based ISR constellations

Integration of AI and real-time analytics

Increased use of synthetic aperture radar

Public-private collaboration in defense space programs

Focus on secure and resilient space architectures - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Earth observation satellites

Communication satellites

Electronic intelligence satellites

Navigation and timing satellites

Multi-mission ISR constellations - By Application (in Value %)

Intelligence, surveillance and reconnaissance

Command and control

Battlefield situational awareness

Border and maritime monitoring

Electronic warfare support - By Technology Architecture (in Value %)

LEO-based systems

MEO-based systems

GEO-based systems

Hybrid and multi-orbit architectures - By End-Use Industry (in Value %)

Defense and armed forces

Homeland security and border management

Intelligence agencies

Space and research organizations - By Connectivity Type (in Value %)

SATCOM-based links

RF-based data relay

Laser and optical communication

Hybrid connectivity systems - By Region (in Value %)

North India

South India

West India

East India

Central India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Technology capability, Satellite payload portfolio, Indigenous content level, Program execution capability, Defense certifications, Cost competitiveness, Integration capability, After-sales and lifecycle support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

- Indian Space Research Organisation

NewSpace India Limited

Antrix Corporation

Bharat Electronics Limited

Tata Advanced Systems

Larsen & Toubro Defence

Data Patterns India

Alpha Design Technologies

Astra Microwave Products

Ananth Technologies

Pixxel

Dhruva Space

Airbus Defence and Space

Thales Alenia Space

Lockheed Martin Space

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035