Market Overview

The India Space Cryogenics market current size stands at around USD ~ million and reflects steady expansion driven by indigenous launch programs and sustained infrastructure investments. Recent operational activity indicates increasing deployment of cryogenic engines across orbital missions, supported by higher testing throughput and localized manufacturing. The market shows stable demand momentum supported by mission frequency growth, propulsion system upgrades, and evolving launch vehicle architectures. Technology maturation and domestic capability building continue to shape production planning and capacity utilization patterns.

Southern and western regions dominate the market due to concentration of launch facilities, propulsion testing centers, and aerospace manufacturing clusters. Strong institutional presence, established vendor ecosystems, and proximity to space research organizations support sustained activity. Policy alignment, long-term national space programs, and increasing private sector participation further strengthen these regions. Supporting infrastructure, skilled workforce availability, and integration facilities continue to reinforce regional leadership within the cryogenics ecosystem.

Market Segmentation

By Application

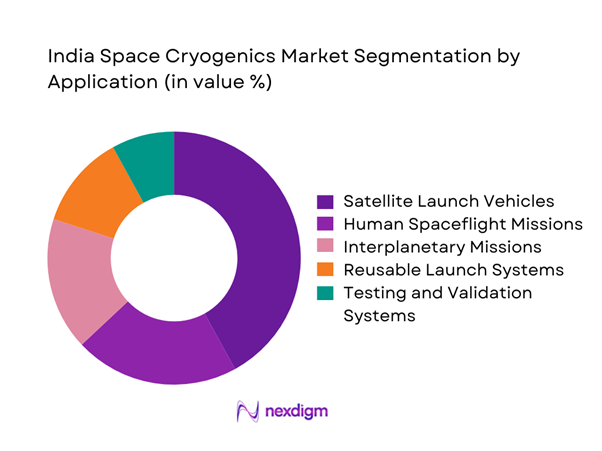

The satellite launch vehicle segment dominates demand due to consistent mission scheduling and increasing payload requirements. Human spaceflight and interplanetary missions contribute steadily, supported by long-term national programs and technology development cycles. Cryogenic systems used in reusable launch platforms are gaining importance as efficiency and recovery capabilities become strategic priorities. Testing and validation applications also hold significance, driven by expanded qualification requirements and higher reliability standards. Overall segmentation reflects program continuity and technology-driven adoption patterns.

By Technology Architecture

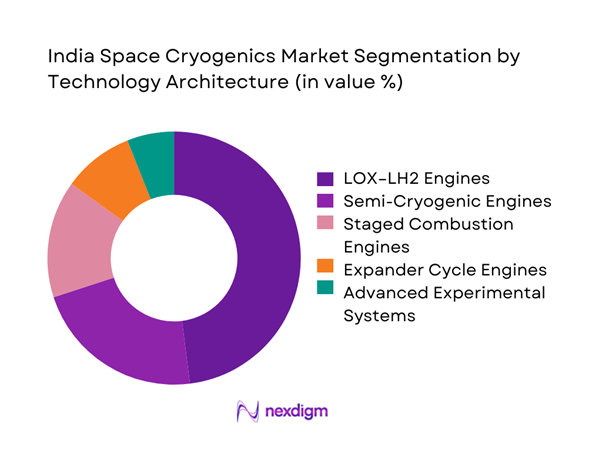

LOX–LH2 propulsion systems account for the largest share due to their established reliability and extensive deployment history. Semi-cryogenic and staged combustion systems are gaining attention as performance optimization becomes critical. Emerging architectures focused on reusability and efficiency are gradually entering development pipelines. Technology selection is influenced by mission type, thrust requirements, and operational flexibility. Continuous innovation remains central to long-term competitiveness within this segmentation.

Competitive Landscape

The competitive environment is characterized by a mix of government-backed organizations and emerging private players. Capability depth, compliance readiness, and long-term program participation define competitive positioning. Collaboration models and technology partnerships are increasingly shaping market participation strategies.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| ISRO | 1969 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Larsen & Toubro | 1938 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

| Godrej Aerospace | 1897 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

| Agnikul Cosmos | 2017 | Chennai | ~ | ~ | ~ | ~ | ~ | ~ |

| Skyroot Aerospace | 2018 | Hyderabad | ~ | ~ | ~ | ~ | ~ | ~ |

India Space Cryogenics Market Analysis

Growth Drivers

Increasing indigenous launch vehicle development

Rising indigenous launch vehicle development has increased domestic demand for advanced cryogenic propulsion systems across multiple mission classes. National programs expanded test campaigns and engine qualification activities during 2024 and 2025 to reduce reliance on imports. Growing payload mass requirements have driven adoption of higher thrust cryogenic stages for reliability and performance improvements. Program continuity ensures stable demand visibility for suppliers supporting engine manufacturing testing and integration activities across multiple national missions. Government prioritization of launch autonomy accelerates investment decisions related to cryogenic subsystem localization initiatives nationwide. Improved testing infrastructure availability reduces development risk and shortens iteration cycles for propulsion validation across multiple qualification stages. Domestic sourcing policies have encouraged component suppliers to scale capabilities aligned with cryogenic performance requirements for national launch programs. Collaborative programs between agencies and industry accelerate knowledge transfer and workforce specialization within propulsion engineering domains nationwide efforts. Increasing mission cadence requires dependable cryogenic engine availability to meet scheduled launch commitments for government and commercial operators. These combined factors collectively reinforce sustained demand momentum across the national space propulsion ecosystem over medium term planning horizons.

Expansion of human spaceflight and heavy-lift missions

Human spaceflight program expansion has intensified focus on reliable cryogenic propulsion systems with enhanced safety and redundancy requirements. Heavy-lift mission planning has increased demand for higher thrust engines supporting crewed and cargo missions. Mission assurance standards have become stricter, driving extensive testing and qualification activities during 2024 and 2025. Long-duration missions necessitate improved thermal efficiency and propellant management system performance. Human rating protocols increase engineering rigor, raising demand for precision manufacturing and validation capabilities. Infrastructure upgrades supporting crewed missions expand cryogenic ground support requirements significantly. Technology development cycles have accelerated to meet ambitious program timelines and operational milestones. Workforce specialization has deepened across propulsion design, testing, and integration functions. Strategic mission planning emphasizes domestic capability to ensure long-term program continuity. These developments collectively strengthen sustained demand for advanced cryogenic propulsion solutions nationwide.

Challenges

High development and testing costs

High development and testing costs remain a critical barrier affecting cryogenic propulsion program scalability across multiple missions. Extensive ground testing requirements significantly increase program timelines and associated engineering expenditures. Specialized infrastructure investment places financial pressure on both public and private program stakeholders. Repeated qualification cycles are necessary to ensure reliability under extreme operational conditions. Cost escalation risks intensify when design iterations extend beyond initial validation phases. Budgetary constraints can delay component procurement and subsystem integration schedules. Smaller suppliers face difficulties absorbing long development cycles without assured order volumes. Limited cost recovery mechanisms constrain rapid technology experimentation and innovation. Testing facility availability bottlenecks further elevate project execution complexity. These cost-related challenges directly influence program pacing and supplier participation levels.

Technology complexity and long qualification cycles

Cryogenic propulsion technology involves highly complex thermodynamic and material engineering requirements. Extended qualification cycles are necessary to validate performance under cryogenic temperature and pressure extremes. Component-level failures can result in prolonged redesign and retesting phases. Integration complexity increases when combining multiple subsystems with stringent tolerance limits. Knowledge concentration within limited expert pools restricts rapid scaling capabilities. Qualification protocols require repeated hot-fire and endurance testing sequences. Documentation and certification processes add further time and resource burdens. Technology maturity timelines often extend beyond initial development projections. Dependency on precision manufacturing heightens schedule sensitivity across programs. These factors collectively slow deployment speed and increase execution risk.

Opportunities

Reusable launch vehicle programs

Reusable launch vehicle programs present significant opportunity for cryogenic system optimization and cost efficiency improvements. Reusability initiatives encourage innovation in thermal management and engine durability design. Increased flight frequency enhances learning curves and operational efficiency across development cycles. Propulsion systems designed for reuse require advanced materials and performance consistency. Testing methodologies are evolving to support rapid turnaround requirements. Program scalability benefits from reduced per-mission development overheads. Collaboration between agencies and private developers accelerates technology validation. Reusability aligns with long-term national goals of sustainable space access. Demand for reliable cryogenic engines increases as reuse cycles expand. These programs create long-term growth avenues for propulsion system providers.

Cryogenic engine export potential

Growing international interest in cost-effective launch solutions creates export potential for cryogenic propulsion technologies. Proven domestic platforms enhance credibility in global collaboration programs. Export-oriented development encourages compliance with international quality and safety standards. Technology transfer frameworks support cross-border cooperation initiatives. Competitive performance metrics attract emerging spacefaring nations seeking launch capabilities. Export opportunities diversify revenue streams beyond domestic programs. Long-term partnerships strengthen industrial learning and manufacturing scale advantages. Standardization efforts improve compatibility with international launch requirements. Global demand growth supports sustained production volumes. This opportunity strengthens strategic positioning within the global space ecosystem.

Future Outlook

The India Space Cryogenics market is expected to maintain steady expansion driven by long-term mission planning and technology self-reliance goals. Continued investments in propulsion innovation, testing infrastructure, and private sector participation will shape future growth. Emphasis on reusability and human spaceflight programs will further strengthen demand. Policy continuity and ecosystem maturity are likely to support sustained market development through the forecast period.

Major Players

- ISRO

- Larsen & Toubro

- Godrej Aerospace

- Agnikul Cosmos

- Skyroot Aerospace

- Bellatrix Aerospace

- MTAR Technologies

- Walchandnagar Industries

- Hindustan Aeronautics Limited

- NewSpace India Limited

- Linde India

- Air Liquide India

- Chart Industries

- ArianeGroup

- Mitsubishi Heavy Industries

Key Target Audience

- Space launch service providers

- Satellite manufacturing companies

- Government and regulatory bodies including ISRO and IN-SPACe

- Defense and strategic agencies

- Private aerospace startups

- Cryogenic equipment manufacturers

- Propulsion system integrators

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Core variables were identified based on propulsion technology types, mission categories, and infrastructure requirements influencing cryogenic system deployment across programs.

Step 2: Market Analysis and Construction

Market structure was developed through assessment of operational programs, technology maturity levels, and deployment frequency across domestic space initiatives.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through expert discussions with propulsion engineers, program managers, and industry specialists involved in cryogenic development activities.

Step 4: Research Synthesis and Final Output

All findings were consolidated through triangulation of qualitative insights and program-level data to ensure analytical consistency and relevance.

- Executive Summary

- Research Methodology (Market Definitions and scope alignment for space cryogenic systems, segmentation framework based on propulsion stage and cryogenic subsystem classification, bottom-up market sizing using launch frequency and engine production data, triangulation using satellite launch manifests and government budget allocations, assumptions and limitations linked to program confidentiality and defense restrictions)

- Definition and Scope

- Market evolution

- Usage and mission deployment pathways

- Ecosystem structure

- Supply chain and manufacturing flow

- Regulatory and policy environment

- Growth Drivers

Increasing indigenous launch vehicle development

Expansion of human spaceflight and heavy-lift missions

Government funding for cryogenic propulsion R&D

Growth of private space launch startups

Rising satellite deployment and launch frequency - Challenges

High development and testing costs

Technology complexity and long qualification cycles

Limited domestic supply chain depth

Dependence on precision manufacturing

Stringent safety and regulatory requirements - Opportunities

Reusable launch vehicle programs

Cryogenic engine export potential

Public–private collaboration models

Advancements in green propellants

Expansion of commercial launch services - Trends

Shift toward semi-cryogenic and methane engines

Indigenization of cryogenic turbopumps

Increased private sector participation

Digital simulation and testing adoption

Focus on reusability and cost optimization - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Launch Vehicle Cryogenic Stages

Upper Stage Cryogenic Modules

In-space Propulsion Cryogenic Systems

Ground Support Cryogenic Infrastructure - By Application (in Value %)

Satellite Launch Vehicles

Human Spaceflight Programs

Interplanetary Missions

Reusable Launch Vehicle Programs

Cryogenic Test and Validation Systems - By Technology Architecture (in Value %)

LOX–LH2 Engines

LOX–Methane Engines

Closed Cycle Cryogenic Engines

Expander Cycle Engines

Staged Combustion Engines - By End-Use Industry (in Value %)

Government Space Agencies

Defense and Strategic Programs

Commercial Launch Service Providers

Space Startups and Private Launch Firms

Research and Academic Institutions - By Connectivity Type (in Value %)

Ground-Based Cryogenic Systems

Vehicle-Integrated Cryogenic Systems

Launch Pad Cryogenic Interfaces

Telemetry-Integrated Cryogenic Controls - By Region (in Value %)

South India

West India

North India

East India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology maturity, propulsion efficiency, manufacturing capability, program participation, cost competitiveness, reliability record, R&D intensity, delivery timelines)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

- Indian Space Research Organisation (ISRO)

Larsen & Toubro Limited

Godrej Aerospace

NewSpace India Limited

Agnikul Cosmos

Skyroot Aerospace

Bellatrix Aerospace

MTAR Technologies

Walchandnagar Industries

Hindustan Aeronautics Limited

Air Liquide India

Linde India

Chart Industries

ArianeGroup

Mitsubishi Heavy Industries

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035