Market Overview

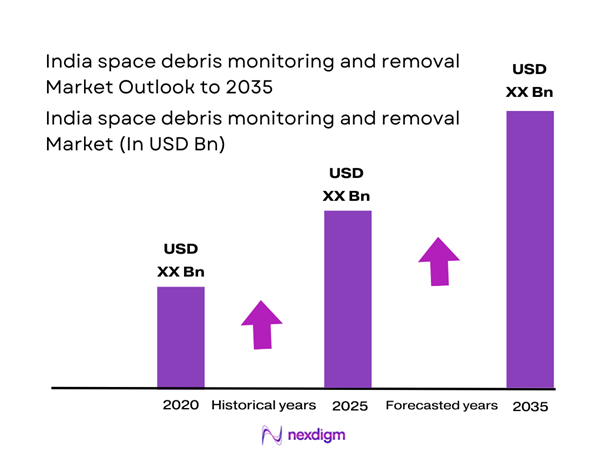

The India space debris monitoring and removal market current size stands at around USD ~ million, supported by expanding satellite deployments and rising orbital congestion. Increasing launches in recent years have accelerated debris tracking requirements, while 2024 and 2025 recorded higher mission planning activity. Government-backed programs and private participation strengthened infrastructure readiness, while investments in surveillance systems increased. Growing awareness of orbital safety has elevated demand for predictive monitoring, avoidance analytics, and debris mitigation services across multiple orbital layers.

India’s market activity is concentrated around Bengaluru, Hyderabad, and Chennai due to strong aerospace clusters and research infrastructure. These regions benefit from proximity to launch facilities, space research centers, and manufacturing ecosystems. Policy support, growing startup density, and access to testing facilities further strengthen regional dominance. Coastal launch advantages, skilled workforce availability, and government-backed innovation programs continue to shape regional demand concentration.

Market Segmentation

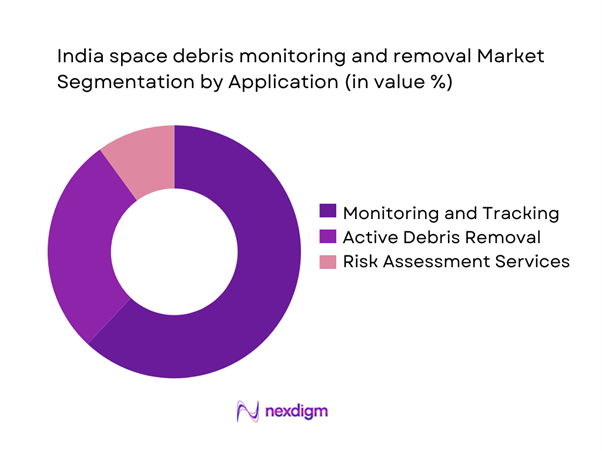

By Application

The monitoring segment dominates due to increasing satellite congestion and rising demand for conjunction analysis services. Government agencies and private operators prioritize real-time tracking to prevent collisions, especially in low Earth orbit. Removal services are gradually expanding as proof-of-concept missions demonstrate feasibility. Demand is further driven by regulatory expectations for end-of-life disposal and sustainability compliance. Monitoring remains the primary revenue contributor due to recurring service models, while removal activities are project-based and technology intensive.

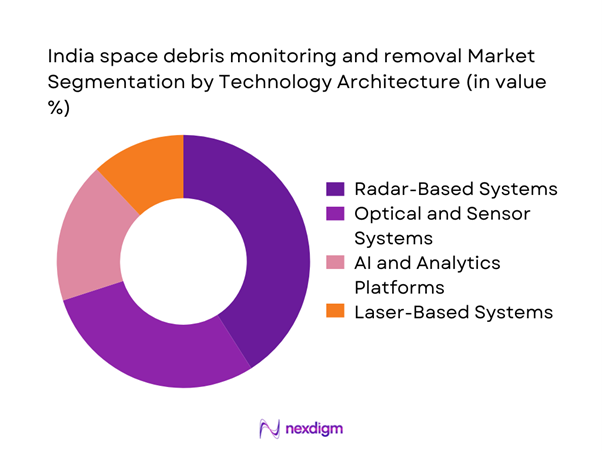

By Technology Architecture

Radar-based systems dominate due to reliability and continuous coverage capabilities across orbital regimes. Optical and AI-enabled systems are gaining adoption for predictive modeling and collision avoidance. Laser-based mitigation remains in early deployment stages, mainly in experimental and research applications. Integration of data analytics platforms is improving accuracy and reducing response time. Hybrid architectures combining ground and space-based assets are increasingly preferred for operational resilience.

Competitive Landscape

The competitive landscape is moderately concentrated with a mix of public agencies and emerging private firms. Players compete on technological depth, orbital coverage, and system integration capabilities. Partnerships with government agencies and international collaborators play a critical role in capability development and deployment readiness.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| ISRO | 1969 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Ananth Technologies | 1992 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Bellatrix Aerospace | 2015 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Digantara | 2018 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2001 | India | ~ | ~ | ~ | ~ | ~ | ~ |

India space debris monitoring and removal Market Analysis

Growth Drivers

Rising satellite launches and mega-constellations

The increasing number of satellite launches has intensified orbital congestion across low Earth orbit regions. Commercial operators expanded constellation deployments during 2024 and 2025 to support communication and observation services. This expansion elevated the need for continuous tracking and collision avoidance systems. Higher satellite density directly increases conjunction probability, driving monitoring demand. Government programs encourage sustainable space practices, further supporting adoption. Operators increasingly allocate resources toward debris assessment to protect high-value assets. Enhanced launch frequency has also increased data requirements for situational awareness platforms. Monitoring accuracy requirements have consequently become more stringent across mission operators. Advanced analytics tools are therefore gaining importance in operational planning. These trends collectively reinforce sustained market growth.

Increasing collision risk in low Earth orbit

Orbital congestion has significantly increased collision probability within densely populated altitude bands. Fragmentation events recorded during 2024 heightened awareness regarding cascading debris risks. Operators now prioritize real-time tracking to prevent mission disruption and asset loss. Insurance providers increasingly mandate debris risk assessments for satellite coverage eligibility. Collision avoidance maneuvering has become a standard operational requirement. Rising spacecraft density further complicates trajectory prediction accuracy. Improved modeling capabilities are therefore being actively deployed. Space agencies continue to issue safety advisories reinforcing debris monitoring importance. Growing awareness supports sustained investment in mitigation technologies. This dynamic directly contributes to long-term market expansion.

Challenges

High cost of debris removal missions

Active debris removal requires complex spacecraft design and precision control systems. Development and deployment costs remain significantly high for most operators. Limited economies of scale further restrict cost optimization opportunities. Missions require extensive testing and validation before deployment approval. Financial risk exposure remains elevated due to uncertain mission outcomes. Limited commercial revenue models hinder private sector participation. High insurance requirements further increase project expenditure. Government funding support remains selective and competitive. These cost pressures restrict widespread adoption of removal solutions. Cost efficiency remains a primary market challenge.

Technological complexity of capture mechanisms

Debris capture requires advanced robotics, navigation, and control technologies. Variability in debris size and motion complicates system design. Autonomous operation in harsh orbital environments presents engineering challenges. Precision targeting accuracy remains difficult under dynamic conditions. Failure risks during capture can generate additional debris. Integration of sensing and actuation systems increases system complexity. Testing in real orbital conditions is limited and expensive. Technology readiness levels remain uneven across solution types. Development cycles are therefore extended significantly. These factors collectively constrain rapid commercialization.

Opportunities

Development of indigenous SSA platforms

Domestic development of space situational awareness platforms is gaining strategic priority. Indigenous systems reduce dependency on foreign tracking infrastructure. Government programs increasingly encourage local technology development initiatives. Domestic firms benefit from access to national space assets and datasets. Integration with defense and civilian applications expands use cases. Enhanced data sovereignty strengthens national space security objectives. Innovation funding supports algorithm and sensor development. Collaborative research environments accelerate capability maturity. Growing domestic demand ensures sustained platform utilization. This creates long-term growth opportunities.

Public–private partnerships with ISRO

Collaborative frameworks with ISRO enable technology validation and mission access. Private firms gain credibility through joint development programs. Shared infrastructure reduces development costs and timelines. Government backing improves investor confidence and funding access. Partnerships facilitate knowledge transfer and operational exposure. Commercial entities benefit from policy alignment and regulatory support. Joint missions enable testing of emerging debris mitigation technologies. These partnerships accelerate commercialization pathways. Enhanced collaboration strengthens ecosystem maturity. This model remains central to market expansion.

Future Outlook

The market is expected to evolve steadily as satellite deployments continue increasing and sustainability norms strengthen. Policy-driven monitoring requirements will expand adoption across government and commercial operators. Technological advancements in automation and analytics will improve operational efficiency. Collaboration between public agencies and private enterprises will remain critical to long-term growth and capability development.

Major Players

- ISRO

- Ananth Technologies

- Bellatrix Aerospace

- Digantara

- Tata Advanced Systems

- Larsen & Toubro

- Alpha Design Technologies

- Dhruva Space

- Skyroot Aerospace

- Agnikul Cosmos

- Centum Electronics

- Bharat Electronics Limited

- Pixxel

- Ansys India

- Godrej Aerospace

Key Target Audience

- Satellite operators

- Space launch service providers

- Government and regulatory bodies including ISRO and IN-SPACe

- Defense and security agencies

- Space infrastructure developers

- Insurance and risk assessment firms

- Investments and venture capital firms

- Space technology integrators

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined using orbital activity, satellite deployment trends, and debris monitoring requirements. Key operational parameters and service categories were mapped based on industry relevance.

Step 2: Market Analysis and Construction

Data was analyzed using mission frequency, technology adoption, and infrastructure development indicators. Market behavior was assessed across monitoring and removal segments.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts and domain specialists validated assumptions related to adoption drivers and technical feasibility. Feedback was incorporated to refine analytical accuracy.

Step 4: Research Synthesis and Final Output

Findings were consolidated through triangulation and consistency checks. Insights were structured to reflect market dynamics, challenges, and growth opportunities.

- Executive Summary

- Research Methodology (Market Definitions and orbital debris classification framework, India-centric space situational awareness segmentation logic, bottom-up estimation using satellite launches and debris catalog growth, revenue attribution across monitoring and remediation services, primary interviews with ISRO, private space startups and SSA experts, triangulation using mission databases and space policy disclosures, assumptions linked to orbital regimes and regulatory enforcement)

- Definition and Scope

- Market evolution

- Usage and mission criticality across orbital regimes

- Ecosystem structure and stakeholder roles

- Value chain and service delivery framework

- Regulatory and policy environment in India

- Growth Drivers

Rising satellite launches and mega-constellations

Increasing collision risk in low Earth orbit

Government focus on space sustainability

Growth of private space startups in India

Need for real-time space situational awareness

International collaboration on debris mitigation - Challenges

High cost of debris removal missions

Technological complexity of capture mechanisms

Limited indigenous debris tracking infrastructure

Regulatory ambiguity on debris ownership

Long development and validation cycles

Limited commercial monetization models - Opportunities

Development of indigenous SSA platforms

Public–private partnerships with ISRO

Export potential for debris monitoring services

Integration of AI and predictive analytics

On-orbit servicing and life-extension missions

Participation in global debris remediation programs - Trends

Shift from passive monitoring to active removal

Adoption of AI-based conjunction analysis

Miniaturization of tracking payloads

Increased collaboration with global space agencies

Growth of space traffic management frameworks

Emergence of debris-as-a-service models - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Mission Cost, 2020–2025

- By Fleet Type (in Value %)

Ground-based surveillance systems

Space-based debris tracking satellites

Active debris removal spacecraft

Hybrid monitoring and mitigation fleets - By Application (in Value %)

Low Earth orbit monitoring

Medium Earth orbit tracking

Geostationary orbit surveillance

Collision avoidance and conjunction analysis

End-of-life satellite disposal - By Technology Architecture (in Value %)

Radar-based tracking systems

Optical and infrared sensors

AI-enabled tracking and prediction platforms

Robotic capture and deorbit systems

Laser-based debris mitigation - By End-Use Industry (in Value %)

Government and defense agencies

Commercial satellite operators

Space launch service providers

Research and academic institutions

Insurance and risk analytics providers - By Connectivity Type (in Value %)

Ground-to-space communication

Inter-satellite data links

Cloud-based data integration platforms - By Region (in Value %)

South India

West India

North India

East India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology capability, orbital coverage, mission success rate, cost efficiency, regulatory compliance, partnerships, scalability, innovation pipeline)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Indian Space Research Organisation (ISRO)

Ananth Technologies

Larsen & Toubro

Bellatrix Aerospace

Skyroot Aerospace

Agnikul Cosmos

Dhruva Space

Pixxel

Digantara

Astroscale

ClearSpace

Tata Advanced Systems

Alpha Design Technologies

Centum Electronics

Bharat Electronics Limited

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Mission Cost, 2026–2035