Market Overview

The India Space Electronics market current size stands at around USD ~ million, reflecting sustained demand across satellite, launch vehicle, and ground system electronics. The market has witnessed steady expansion driven by increasing mission frequency, higher indigenous component integration, and rising participation of private manufacturers. Growth momentum remains supported by technology upgrades, improved qualification infrastructure, and higher adoption of space-grade subsystems. Demand levels have remained stable across recent periods, supported by consistent government program execution and expanding commercial space initiatives.

Southern and western India dominate the ecosystem due to the concentration of launch centers, research facilities, and electronics manufacturing clusters. Bengaluru, Hyderabad, and Pune act as primary hubs supported by testing infrastructure and skilled engineering talent. Strong policy backing, proximity to space agencies, and supplier ecosystems reinforce regional dominance. Growing participation from emerging industrial corridors is gradually improving geographic diversification across the national space electronics value chain.

Market Segmentation

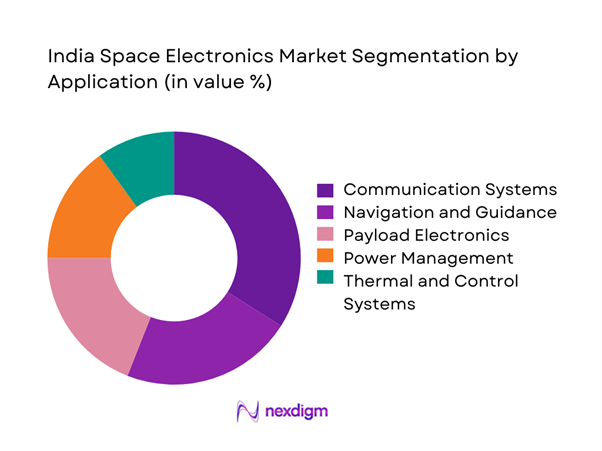

By Application

The application-based segmentation is primarily driven by increasing deployment of satellites for communication, navigation, and earth observation purposes. Communication electronics dominate due to continuous demand for telemetry, tracking, and control systems across launch and in-orbit operations. Navigation and payload electronics follow closely, supported by regional positioning systems and remote sensing programs. Power management and thermal control systems maintain steady demand due to mission-critical reliability requirements. Ground control electronics remain stable contributors owing to expanding mission control and data processing needs. The segment benefits from recurring upgrade cycles and system replacements across operational satellites.

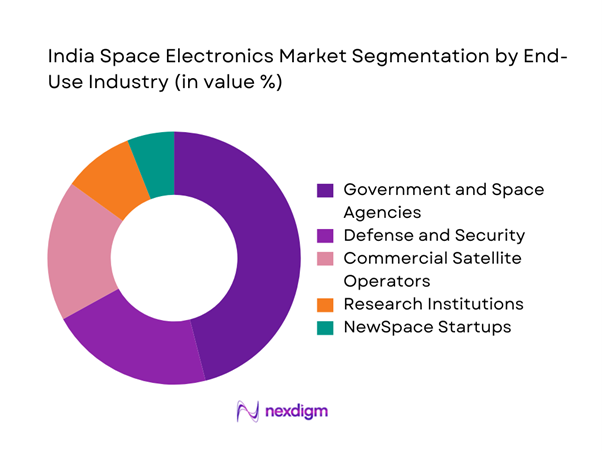

By End-Use Industry

Government and space agencies represent the dominant end-use segment due to sustained mission launches and strategic programs. Defense-related applications continue to grow steadily with increasing focus on surveillance and secure communication satellites. Commercial satellite operators are expanding rapidly, supported by rising demand for broadband and earth observation services. Research institutions contribute through experimental missions and technology demonstrations. NewSpace startups are emerging as a fast-growing segment, leveraging policy reforms and private investment to develop specialized electronics platforms.

Competitive Landscape

The competitive landscape is characterized by a mix of established public-sector entities and emerging private manufacturers. Market participants compete on technological reliability, space qualification capability, and long-term program participation. Strong entry barriers exist due to stringent certification requirements and extended development timelines.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Ananth Technologies | 1992 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Bharat Electronics | 1954 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Centum Electronics | 1993 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Data Patterns | 1985 | Chennai | ~ | ~ | ~ | ~ | ~ | ~ |

| Alpha Design | 2003 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

India Space Electronics Market Analysis

Growth Drivers

Rising ISRO and private launch missions

Rising ISRO and private launch missions continue to expand demand for high-reliability space-grade electronic systems. Increasing annual launch frequencies have created sustained requirements for avionics, telemetry, and onboard computing subsystems. Mission diversification across communication, navigation, and earth observation drives broader electronics adoption. Private launch service providers contribute additional demand beyond traditional government missions. Enhanced payload complexity further increases electronics content per launch. Growing international collaborations have elevated performance expectations across electronic components. Standardization efforts improve repeatability and production planning for suppliers. Supplier ecosystems benefit from predictable order pipelines and long-term contracts. Testing infrastructure expansion supports higher mission throughput and component qualification. Overall launch momentum continues strengthening domestic electronics manufacturing depth.

Expansion of small satellite constellations

Expansion of small satellite constellations significantly increases demand for compact and power-efficient electronics platforms. Satellite miniaturization trends require advanced processing and communication modules with lower mass constraints. Commercial earth observation and communication constellations accelerate production volumes for standardized electronics. Faster satellite replacement cycles create recurring procurement opportunities for component suppliers. Modular spacecraft architectures further amplify electronics unit demand. Private operators prioritize rapid deployment timelines, boosting electronics sourcing frequency. Design reuse strategies improve manufacturing scalability across missions. Integration of onboard data processing raises electronics value per satellite. Growth of constellation-based services ensures sustained market traction. Overall constellation expansion reshapes demand patterns across the electronics value chain.

Challenges

High cost of radiation-hardened components

High cost of radiation-hardened components remains a critical challenge for domestic manufacturers and integrators. Specialized materials and fabrication processes significantly elevate production expenses. Limited local foundry capabilities increase reliance on imported components. Procurement constraints affect scalability for commercial space programs. Cost pressures restrict adoption among emerging private satellite developers. Extended qualification requirements further add to development expenses. Budget limitations impact experimentation with advanced architectures. Price sensitivity influences component selection decisions across missions. Cost optimization remains difficult without volume manufacturing. Overall pricing challenges slow broader commercialization of space electronics.

Long qualification and testing cycles

Long qualification and testing cycles delay time-to-market for newly developed electronic subsystems. Space-grade certification requires extensive thermal, vibration, and radiation testing. Testing infrastructure availability often limits parallel validation activities. Extended timelines increase development costs and resource utilization. Iterative design modifications prolong qualification schedules. Delays affect mission readiness and launch planning coordination. Smaller manufacturers face greater challenges managing prolonged validation phases. Qualification bottlenecks restrict rapid innovation adoption. Program timelines become less flexible under stringent validation requirements. Lengthy certification remains a structural challenge across the ecosystem.

Opportunities

Private sector participation through IN-SPACe reforms

Private sector participation through IN-SPACe reforms is expanding commercial access to space programs. Policy clarity enables private firms to engage in satellite and launch vehicle electronics development. Streamlined authorization processes encourage faster project execution. Public-private collaboration improves technology transfer and infrastructure utilization. Increased transparency supports investor confidence in space manufacturing ventures. Startups gain access to testing facilities and launch opportunities. Collaborative programs reduce entry barriers for new electronics suppliers. Market competition stimulates innovation and cost efficiency. Industry partnerships accelerate indigenous capability development. Reforms collectively enhance long-term market sustainability.

Development of indigenous space-grade semiconductors

Development of indigenous space-grade semiconductors presents a significant growth opportunity for domestic manufacturers. Reduced dependency on imports strengthens supply chain resilience. Local fabrication enables customization for mission-specific requirements. Government support accelerates semiconductor ecosystem development. Indigenous chips improve cost control and availability. Design localization enhances intellectual property ownership. Collaboration between research institutions and industry fosters innovation. Domestic fabrication supports faster qualification cycles. Strategic autonomy strengthens national space objectives. Semiconductor development underpins long-term electronics sector growth.

Future Outlook

The India Space Electronics market is expected to witness sustained expansion through increasing launch activity and private sector participation. Policy support and indigenous manufacturing initiatives will strengthen domestic capabilities. Growing adoption of small satellites and advanced onboard systems will further drive electronics demand. Continued investment in testing infrastructure and semiconductor development will enhance long-term competitiveness.

Major Players

- Ananth Technologies

- Bharat Electronics

- Centum Electronics

- Data Patterns

- Alpha Design Technologies

- Tata Advanced Systems

- Larsen and Toubro Defence

- Godrej Aerospace

- Astra Microwave Products

- Paras Defence and Space Technologies

- Dhruva Space

- Solar Industries India

- Sahasra Electronics

- Vikram Sarabhai Space Centre

- Indian Space Research Organisation

Key Target Audience

- Satellite manufacturers

- Launch vehicle developers

- Defense and aerospace contractors

- Government and regulatory bodies including ISRO and IN-SPACe

- Space technology startups

- Electronics component manufacturers

- System integrators and OEMs

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Key variables were identified through mapping of space electronics components, applications, and end-use sectors. Industry-specific parameters influencing demand, qualification, and deployment were defined. Regulatory frameworks and technology adoption factors were also incorporated.

Step 2: Market Analysis and Construction

Market structure was developed using segmentation based on application and end-use. Historical deployment trends and production activity were analyzed to establish demand patterns. Cross-validation ensured consistency across segments.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through consultations with industry participants, engineers, and procurement specialists. Feedback was used to refine market dynamics and competitive positioning assessments.

Step 4: Research Synthesis and Final Output

Findings were consolidated through triangulation of qualitative insights and quantitative indicators. Final outputs were structured to reflect realistic market behavior and industry evolution.

- Executive Summary

- Research Methodology (Market Definitions and Scope Framing for Space-Grade Electronics, Satellite and Launch Vehicle Electronics Segmentation Logic, Bottom-Up and Top-Down Market Sizing for Space Electronics Value Chains, Revenue Attribution Across Payload and Platform Electronics, Primary Interviews with ISRO Vendors and Private Space OEMs, Data Triangulation Using Launch Manifests and Procurement Disclosures, Assumptions and Limitations Related to Defense and Strategic Programs)

- Definition and Scope

- Market evolution

- Usage and mission-critical application landscape

- Space electronics ecosystem structure

- Supply chain and qualification pathways

- Regulatory and policy environment

- Growth Drivers

Rising ISRO and private launch missions

Expansion of small satellite constellations

Government support for private space manufacturing

Increasing defense and surveillance satellite demand

Indigenization of space-grade components

Growth of commercial space startups - Challenges

High cost of radiation-hardened components

Long qualification and testing cycles

Dependence on imported semiconductor materials

Limited domestic fabrication capabilities

Stringent reliability and certification standards

Low production volumes affecting economies of scale - Opportunities

Private sector participation through IN-SPACe reforms

Development of indigenous space-grade semiconductors

Export opportunities in small satellite electronics

Growing demand for reusable launch vehicle electronics

Integration of AI and edge computing in space systems - Trends

Shift toward miniaturized and modular electronics

Adoption of COTS-based space electronics

Increased use of AI-enabled onboard processing

Electronics standardization for small satellites

Rising investment in radiation-tolerant chip design - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Launch vehicles

Satellites

Deep space and exploration missions

Ground control and tracking systems - By Application (in Value %)

Power management and distribution

Communication and telemetry

Navigation and guidance

Payload data handling

Thermal control and monitoring - By Technology Architecture (in Value %)

Radiation-hardened electronics

Radiation-tolerant electronics

Commercial off-the-shelf adapted electronics

Custom ASICs and FPGAs - By End-Use Industry (in Value %)

Government and space agencies

Defense and security

Commercial satellite operators

NewSpace startups

Research and academic institutions - By Connectivity Type (in Value %)

RF-based systems

Optical and laser communication

Hybrid connectivity architectures - By Region (in Value %)

South India

West India

North India

East India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product portfolio depth, Space qualification level, Manufacturing capability, R&D intensity, Client base strength, Pricing competitiveness, Strategic partnerships, Export presence)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Ananth Technologies

Bharat Electronics Limited

Centum Electronics

Alpha Design Technologies

Data Patterns India

Astra Microwave Products

Sahasra Electronics

Tata Advanced Systems

Larsen & Toubro Defence

Godrej Aerospace

Solar Industries India

Paras Defence and Space Technologies

Vikram Sarabhai Space Centre

Indian Space Research Organisation

Dhruva Space

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035