Market Overview

The India Space Militarization Market current size stands at around USD ~ million, reflecting accelerating defense space investments and mission expansions. The market has shown consistent activity across 2024 and 2025, supported by satellite launches, space surveillance programs, and secure communication upgrades. Demand is driven by increased defense preparedness, strategic deterrence requirements, and enhanced situational awareness capabilities. Government-led initiatives continue to dominate spending patterns, while private sector participation is gradually increasing through collaborative programs and technology partnerships.

The market is primarily concentrated across regions hosting major defense establishments, space research centers, and launch infrastructure. Southern and western regions lead due to established space facilities, skilled workforce availability, and stronger industrial ecosystems. Northern regions benefit from defense command presence and policy alignment. The ecosystem maturity is shaped by centralized procurement systems, indigenous manufacturing mandates, and evolving regulatory frameworks supporting military space operations and dual-use technology integration.

Market Segmentation

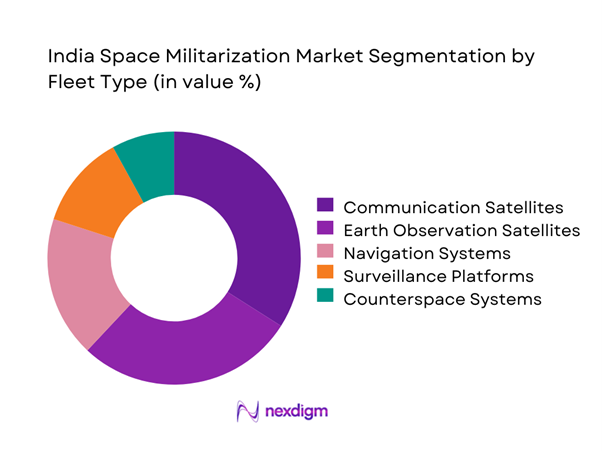

By Fleet Type

The fleet type segmentation is dominated by surveillance and communication satellite systems due to their critical role in defense operations. Earth observation and reconnaissance platforms command strong adoption driven by border monitoring and intelligence requirements. Navigation and positioning systems support operational coordination and targeting accuracy. Counterspace capabilities are emerging steadily as strategic deterrence tools. Investment focus remains on enhancing satellite resilience, redundancy, and orbital coverage to ensure uninterrupted military communication and surveillance capabilities.

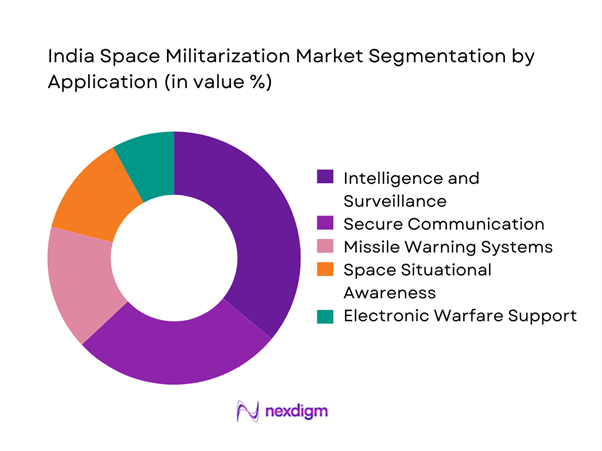

By Application

Application-based segmentation is led by intelligence, surveillance, and reconnaissance operations due to heightened border monitoring requirements. Secure communication systems follow closely, supporting real-time military coordination. Missile early warning and tracking applications are gaining relevance as strategic defense priorities expand. Space situational awareness is increasingly critical for monitoring orbital assets. Electronic warfare applications remain niche but are growing as space-based threats evolve.

Competitive Landscape

The competitive landscape is characterized by strong government dominance supported by a growing ecosystem of domestic defense manufacturers and space technology firms. Public sector entities maintain leadership in core space programs, while private players contribute through component manufacturing, system integration, and launch services.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Indian Space Research Organisation | 1969 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Defence Research and Development Organisation | 1958 | New Delhi | ~ | ~ | ~ | ~ | ~ | ~ |

| Bharat Electronics Limited | 1954 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics Limited | 1940 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Larsen and Toubro Defence | 2015 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

India Space Militarization Market Analysis

Growth Drivers

Rising geopolitical tensions and border security needs

Rising geopolitical tensions continue to intensify focus on space-based surveillance and defense readiness across strategic regions. Increased border monitoring requirements have accelerated deployment of reconnaissance satellites supporting real-time intelligence and situational awareness capabilities. Defense planners emphasize space assets for enhanced early warning and threat detection reliability. Military doctrines increasingly integrate space as a critical operational domain alongside land, sea, and air. This shift drives continuous investments in satellite communication and imaging technologies. Strategic deterrence priorities reinforce the necessity of resilient space-based systems. Growing cross-border uncertainties sustain long-term demand for militarized space infrastructure. Operational preparedness remains closely tied to satellite-enabled decision-making frameworks. These dynamics collectively support consistent market expansion momentum. National security imperatives ensure sustained budgetary allocation toward space militarization initiatives.

Expansion of India’s space defense doctrine

India’s evolving space defense doctrine emphasizes protection of orbital assets and strategic autonomy in space operations. Policy frameworks increasingly recognize space as an operational warfighting domain. Dedicated defense space agencies strengthen institutional capacity and program execution efficiency. Doctrinal clarity enables structured investments across surveillance, communication, and counterspace capabilities. Integration of space assets into military planning enhances mission effectiveness and coordination. Strategic emphasis on indigenous capabilities reduces dependence on external technologies. Formalized doctrines also guide procurement prioritization and capability development pathways. Military exercises increasingly incorporate space-based operational simulations. Long-term doctrine alignment supports continuity of space militarization initiatives. This institutional evolution strengthens overall market confidence and stability.

Challenges

High capital intensity and long development cycles

Space militarization programs require significant capital commitments and extended development timelines before operational deployment. Complex system engineering increases project execution risks and cost overruns. Technology validation and testing cycles are lengthy due to mission-critical reliability requirements. Budget allocation constraints often delay project timelines and scaling efforts. Specialized infrastructure demands elevate entry barriers for new participants. Program delays impact synchronization with defense modernization schedules. Limited flexibility in reallocating budgets restricts rapid capability enhancement. High upfront investments reduce private sector participation appetite. Procurement complexity further slows implementation momentum. These factors collectively constrain short-term market scalability.

Technological dependence on foreign components

Reliance on imported components exposes defense space programs to supply chain vulnerabilities. Export controls and geopolitical restrictions affect timely access to critical technologies. Limited domestic manufacturing capabilities constrain system-level self-reliance. Indigenous alternatives often require extended development and validation cycles. Dependency risks increase operational uncertainty during geopolitical disruptions. Technology transfer limitations slow capability upgrades. Localization challenges affect cost efficiency and program timelines. Strategic autonomy objectives intensify pressure to reduce import reliance. Policy measures aim to address gaps, but progress remains gradual. These constraints pose persistent challenges for sustained market growth.

Opportunities

Indigenization of military satellite platforms

Indigenization initiatives present significant opportunities for domestic manufacturing and technology development. Government policies encourage local production of satellite components and subsystems. Indigenous platforms enhance supply chain resilience and strategic autonomy. Collaboration between public institutions and private firms accelerates innovation cycles. Development of homegrown technologies reduces long-term operational dependence. Indigenous programs create opportunities for cost optimization and customization. Skill development initiatives support workforce readiness for advanced space programs. Domestic production aligns with national security priorities. Growing confidence in local capabilities attracts increased project allocations. These trends collectively expand market growth potential.

Development of counterspace and anti-satellite technologies

Emerging counterspace capabilities represent a strategic growth avenue within space militarization. Increasing focus on space asset protection drives demand for defensive and deterrent technologies. Anti-satellite research enhances national security preparedness. Development programs emphasize non-kinetic and electronic countermeasures. These technologies strengthen resilience against hostile space actions. Investment in space situational awareness complements counterspace initiatives. Strategic emphasis encourages technological innovation and experimentation. Capability development aligns with evolving threat landscapes. Policy support enables sustained funding for research programs. This segment offers long-term expansion opportunities for specialized defense firms.

Future Outlook

The India Space Militarization Market is expected to witness sustained strategic expansion through 2035, driven by defense modernization and space security priorities. Increasing institutional focus on space dominance will encourage technology advancement and indigenous development. Policy support and private sector participation are likely to strengthen operational capabilities. Long-term investments in surveillance, communication, and counterspace systems will continue shaping market evolution.

Major Players

- Indian Space Research Organisation

- Defence Research and Development Organisation

- Bharat Electronics Limited

- Hindustan Aeronautics Limited

- Larsen and Toubro Defence

- Antrix Corporation

- NewSpace India Limited

- Bharat Dynamics Limited

- Alpha Design Technologies

- Data Patterns India

- Astra Microwave Products

- Paras Defence and Space Technologies

- Skyroot Aerospace

- Agnikul Cosmos

- Tata Advanced Systems

Key Target Audience

- Ministry of Defence

- Defence Space Agency

- Indian Armed Forces

- Government procurement bodies

- Space technology manufacturers

- Satellite system integrators

- Investments and venture capital firms

- Department of Space and regulatory authorities

Research Methodology

Step 1: Identification of Key Variables

The study identifies critical operational, technological, and policy variables influencing space militarization. Data points include platform types, mission objectives, and institutional roles. Scope definition ensures alignment with defense space applications.

Step 2: Market Analysis and Construction

Market structure is developed using program-level assessment and deployment mapping. Segmentation reflects functional and operational usage. Analytical frameworks align demand with defense modernization priorities.

Step 3: Hypothesis Validation and Expert Consultation

Insights are validated through expert interactions across defense, space research, and policy domains. Assumptions are refined using operational feedback and strategic alignment reviews. Consistency checks ensure analytical robustness.

Step 4: Research Synthesis and Final Output

Findings are consolidated through triangulation of qualitative and quantitative inputs. Market dynamics are structured into actionable insights. Final outputs ensure clarity, relevance, and strategic applicability.

- Executive Summary

- Research Methodology (Market Definitions and Scope for Military Space Assets, Satellite and Counterspace Capability Classification Framework, Bottom-up Defense Budget and Program-Based Market Estimation, Revenue Attribution by Platform and Mission Type, Primary Interviews with Defense Officials and Space Industry Experts, Triangulation Using Defense Procurement Data and Launch Manifests, Assumptions on Classified Program Expenditure and Dual-Use Systems)

- Definition and Scope

- Market evolution

- Strategic and operational role of space assets

- Ecosystem structure

- Defense-space industrial value chain

- Regulatory and policy environment

- Growth Drivers

Rising geopolitical tensions and border security needs

Expansion of India’s space defense doctrine

Increasing reliance on ISR and satellite-enabled warfare

Government investments in indigenous space capabilities

Formation of dedicated defense space agencies

Growing vulnerability of terrestrial defense systems - Challenges

High capital intensity and long development cycles

Technological dependence on foreign components

Regulatory restrictions on military space activities

Limited private sector participation in defense space

Cybersecurity and space debris risks

Budget allocation constraints - Opportunities

Indigenization of military satellite platforms

Development of counterspace and anti-satellite technologies

Private sector participation through defense reforms

Dual-use satellite commercialization

International defense and space collaborations

Expansion of space-based surveillance networks - Trends

Shift toward small satellite constellations

Integration of AI in space-based ISR

Growth of space situational awareness programs

Increased emphasis on space warfare readiness

Public-private partnerships in defense space

Development of responsive launch capabilities - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Program Cost, 2020–2025

- By Fleet Type (in Value %)

Military communication satellites

Earth observation and reconnaissance satellites

Navigation and positioning satellites

Early warning and surveillance systems

Counterspace and anti-satellite systems - By Application (in Value %)

Intelligence, surveillance, and reconnaissance

Secure military communications

Missile early warning and tracking

Navigation and targeting support

Space situational awareness

Electronic and cyber warfare - By Technology Architecture (in Value %)

LEO-based defense satellites

MEO-based navigation systems

GEO-based communication platforms

Small satellite and constellation architectures

Ground-based counterspace systems - By End-Use Industry (in Value %)

Indian Armed Forces

Strategic Forces Command

Defense space agencies and commands

Intelligence and security agencies

Government research establishments - By Connectivity Type (in Value %)

Satellite-to-ground communication

Inter-satellite links

Secure military broadband links

Command and control networks - By Region (in Value %)

North India

South India

West India

East India

Central India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product portfolio depth, Indigenous manufacturing capability, Defense contract portfolio, Technology maturity, R&D investment intensity, Strategic partnerships, Pricing and contract flexibility, Program execution capability)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Indian Space Research Organisation

Defence Research and Development Organisation

Antrix Corporation

NewSpace India Limited

Bharat Electronics Limited

Hindustan Aeronautics Limited

Larsen & Toubro Defence

Tata Advanced Systems

Bharat Dynamics Limited

Alpha Design Technologies

Data Patterns India

Astra Microwave Products

Paras Defence and Space Technologies

Skyroot Aerospace

Agnikul Cosmos

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Program Cost, 2026–2035