Market Overview

The India Space Mining Market current size stands at around USD ~ million driven by experimental missions and early technology investments. Activity levels during 2024 and 2025 reflected growing institutional participation, prototype testing, and increasing budgetary alignment toward extraterrestrial resource utilization. Government-backed programs and private ventures collectively supported exploration payloads, robotic systems, and feasibility assessments. Technology readiness improved through orbital demonstrations, while policy clarity encouraged exploratory capital allocation. The ecosystem remained developmental, with limited commercialization but strong forward momentum. Research collaborations and space infrastructure upgrades further strengthened foundational capabilities.

India’s space mining ecosystem is concentrated around established aerospace hubs with advanced launch and satellite integration infrastructure. Southern and western regions benefit from proximity to space research centers, manufacturing clusters, and mission control facilities. Demand is driven by government agencies, private launch service providers, and research institutions. Policy support and indigenous technology initiatives enhance ecosystem maturity. Strong academic linkages and skilled workforce availability further support innovation. Regional collaboration with global space programs also reinforces long-term market development.

Market Segmentation

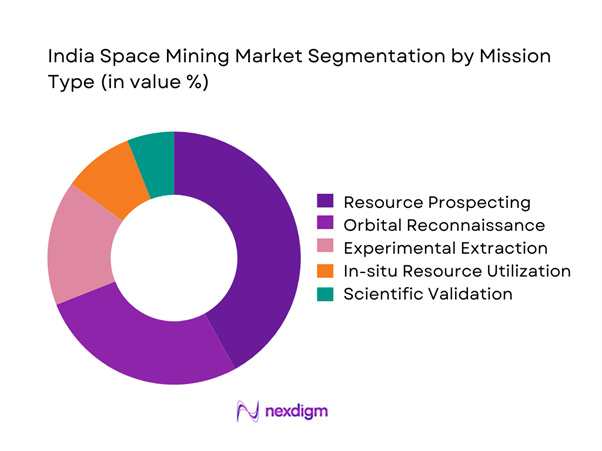

By Mission Type

The market is primarily segmented by mission type, with resource prospecting and orbital reconnaissance dominating early deployments. These missions account for significant activity due to lower technical risk and strong alignment with national exploration priorities. Experimental extraction and in-situ utilization missions are emerging as secondary segments, supported by advancements in robotics and autonomous systems. Scientific validation missions also contribute meaningfully, especially in lunar and near-earth object exploration. Commercial extraction remains limited but is gaining attention as technology maturity improves. Overall segmentation reflects a gradual transition from exploration-focused initiatives to resource-oriented missions.

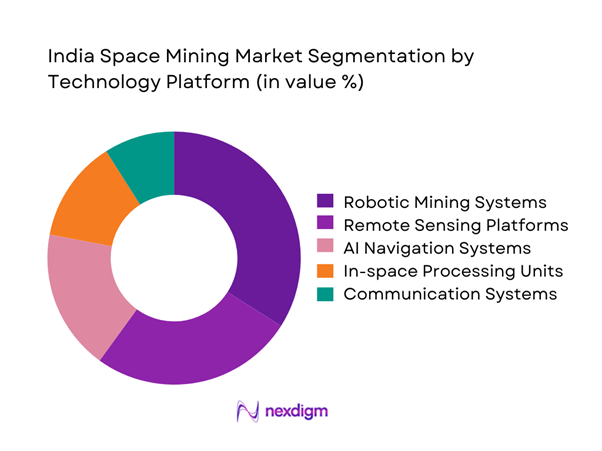

By Technology Platform

Technology-based segmentation shows dominance of robotic and autonomous systems due to operational feasibility and lower human risk. Remote sensing and AI-enabled navigation platforms are widely adopted for terrain analysis and mission planning. In-space processing technologies are still nascent but show strong development potential. Additive manufacturing and material handling systems are gradually entering testing phases. Communication and telemetry platforms remain critical enablers across all mission categories. The segment reflects a strong orientation toward automation and data-driven operations.

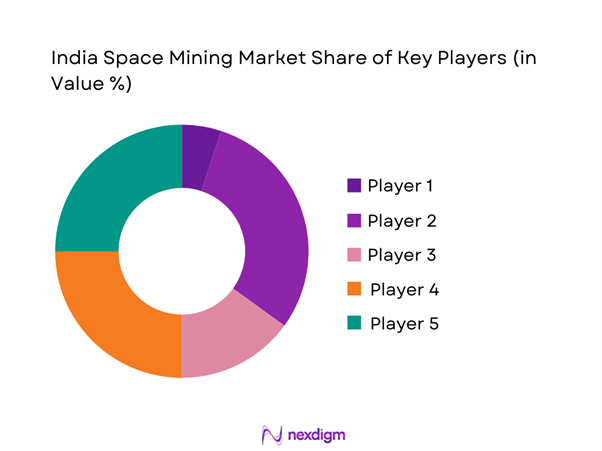

Competitive Landscape

The competitive landscape is characterized by a mix of government-backed entities and emerging private technology developers. Market participation remains concentrated, with high entry barriers related to capital intensity and technical complexity. Collaboration between public institutions and startups defines competitive dynamics. Innovation depth and regulatory alignment significantly influence positioning. Long-term success depends on mission execution capability and technology reliability.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Indian Space Research Organisation | 1969 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Skyroot Aerospace | 2018 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Agnikul Cosmos | 2017 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Bellatrix Aerospace | 2015 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Dhruva Space | 2012 | India | ~ | ~ | ~ | ~ | ~ | ~ |

India Space Mining Market Analysis

Growth Drivers

Rising national investment in space exploration

National investment expansion has strengthened research capabilities and enabled advanced experimentation across orbital and lunar exploration programs. Public funding allocations during 2024 and 2025 supported infrastructure upgrades, mission planning, and technology validation initiatives. Increased governmental commitment enhanced confidence among private participants and academic collaborators. Strategic alignment with long-term space objectives accelerated development of mining-relevant technologies. Budgetary support facilitated testing of autonomous systems and remote sensing platforms. Policy continuity ensured stability for long-term research investments. Inter-agency coordination improved efficiency across exploration programs. Enhanced funding also improved talent retention and technical skill development. National priorities emphasized resource security through extraterrestrial exploration. These combined factors significantly strengthened the operational foundation for space mining initiatives.

ISRO-led deep space mission expansion

ISRO-led missions played a central role in advancing space mining feasibility through deep space exploration activities. Mission planning during 2024 and 2025 incorporated resource mapping and surface analysis objectives. Successful technology demonstrations enhanced confidence in autonomous operations. Mission data improved understanding of extraterrestrial material composition and accessibility. Collaboration with private entities expanded technological experimentation scope. Deep space missions enabled testing of communication and navigation reliability. Operational learnings reduced technical uncertainties associated with extraction environments. Mission success improved investor sentiment toward space mining projects. Long-duration missions supported validation of robotic endurance capabilities. Overall mission expansion directly strengthened the market’s technical readiness.

Challenges

High capital and technology development costs

Space mining requires substantial upfront investment in specialized equipment and mission development. High costs associated with launch systems limit participation from smaller entities. Technology development cycles remain long and capital intensive. Advanced robotics and sensing systems require sustained funding commitments. Financial risks increase due to uncertain mission outcomes. Infrastructure development adds further cost burdens. Limited commercial returns during early phases constrain funding availability. Cost optimization remains difficult due to lack of economies of scale. Technological failures can significantly impact project timelines. These cost challenges slow overall market expansion.

Limited commercial viability in early stages

Commercial viability remains constrained due to unproven revenue models and long development timelines. Market participants face uncertainty regarding resource monetization mechanisms. Limited operational data restricts accurate return forecasting. Regulatory ambiguity further complicates commercial planning. Early-stage missions prioritize research over revenue generation. Infrastructure limitations reduce scalability of extraction operations. Risk perception remains high among potential investors. Supply chain immaturity affects operational efficiency. Market demand for extracted resources is still emerging. These factors collectively hinder near-term commercialization prospects.

Opportunities

Public-private partnership expansion

Public-private partnerships present strong opportunities for accelerating space mining development. Collaborative models reduce financial risks through shared investment structures. Government support enhances credibility for private ventures. Joint missions allow technology transfer and knowledge sharing. Partnerships improve access to testing infrastructure and launch capabilities. Regulatory facilitation encourages private sector participation. Cooperative frameworks enable faster innovation cycles. Shared resources reduce duplication of development efforts. Partnerships also attract international collaboration opportunities. This model significantly strengthens long-term market sustainability.

Development of lunar and asteroid mining missions

Lunar and asteroid missions offer substantial opportunities for resource exploration and extraction. Advancements in propulsion and navigation enhance mission feasibility. Scientific interest supports continuous mission planning. Resource mapping initiatives improve targeting accuracy. Technology readiness improvements enable extended surface operations. Mission scalability allows phased investment approaches. Data from these missions enhances commercial confidence. Strategic importance of extraterrestrial resources drives policy backing. Long-term mission pipelines encourage ecosystem growth. These missions represent the most promising expansion pathway.

Future Outlook

The India Space Mining Market is expected to progress steadily through 2035, supported by technological maturation and sustained government involvement. Increasing private participation will enhance innovation depth and operational efficiency. Policy clarity and international collaboration are likely to accelerate mission deployment. Advancements in automation and in-space processing will define future competitiveness. The market is positioned for gradual transition from exploration to early-stage commercialization.

Major Players

- Indian Space Research Organisation

- Skyroot Aerospace

- Agnikul Cosmos

- Bellatrix Aerospace

- Dhruva Space

- Pixxel

- Astrome Technologies

- Team Indus

- Ananth Technologies

- Tata Advanced Systems

- Larsen and Toubro Defence

- Godrej Aerospace

- Bharat Electronics Limited

- Alpha Design Technologies

- SatSure

Key Target Audience

- Space exploration agencies

- Private aerospace manufacturers

- Satellite and launch service providers

- Robotics and automation companies

- Defense and strategic research bodies

- Investments and venture capital firms

- Ministry of Space and ISRO regulatory divisions

- Advanced materials and propulsion developers

Research Methodology

Step 1: Identification of Key Variables

Core variables related to mission type, technology platform, and regulatory environment were identified. Market boundaries were defined based on operational scope and application relevance. Data points were filtered to align with space mining activities.

Step 2: Market Analysis and Construction

Qualitative and quantitative inputs were analyzed to construct market structure. Technology maturity and deployment trends were mapped across segments. Assumptions were validated using industry-level indicators.

Step 3: Hypothesis Validation and Expert Consultation

Findings were cross-verified through expert discussions and industry consultations. Technical feasibility and adoption drivers were assessed through multiple validation layers.

Step 4: Research Synthesis and Final Output

Insights were consolidated to ensure consistency across sections. Data triangulation ensured logical coherence. Final outputs were refined to reflect realistic market dynamics.

- Executive Summary

- Research Methodology (Market Definitions and Scope Alignment for Space Resource Extraction, Space Mining Value Chain and Segmentation Framework Development, Bottom-Up Market Sizing Using Mission and Payload Economics, Revenue Attribution Across Exploration and Extraction Phases, Primary Interviews with ISRO Scientists and Private Space Startups, Data Triangulation Using Launch Databases and Policy Sources, Assumptions on Regulatory Readiness and Technology Maturity)

- Definition and Scope

- Market evolution

- Usage and mission application pathways

- Ecosystem structure

- Supply chain and value chain structure

- Regulatory and policy environment

- Growth Drivers

Rising national investment in space exploration

ISRO-led deep space mission expansion

Growing demand for in-space resource utilization

Strategic importance of space-based minerals

Increasing private sector participation

Advancements in robotics and AI - Challenges

High capital and technology development costs

Limited commercial viability in early stages

Regulatory uncertainty around space mining rights

Technological risks and mission failure rates

Limited deep-space infrastructure

Long return on investment cycles - Opportunities

Public-private partnership expansion

Development of lunar and asteroid mining missions

Export potential for space resource technologies

Advancement of in-space manufacturing

Strategic alignment with global space economies

Technology spillover into terrestrial mining - Trends

Shift toward autonomous mining systems

Integration of AI and machine learning

Growing focus on lunar resource utilization

Increased funding for private space startups

Collaboration with international space agencies

Development of reusable space mining platforms - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Revenue per Mission, 2020–2025

- By Fleet Type (in Value %)

Orbital prospecting satellites

Robotic landers

Autonomous mining rovers

In-orbit processing platforms

Earth return vehicles - By Application (in Value %)

Resource prospecting and mapping

In-situ resource utilization

Rare earth element extraction

Water and fuel production

Scientific and experimental mining - By Technology Architecture (in Value %)

Robotic excavation systems

AI-based autonomous navigation

In-space material processing systems

Additive manufacturing systems

Remote sensing and telemetry systems - By End-Use Industry (in Value %)

Space exploration agencies

Defense and strategic research bodies

Commercial space companies

Energy and propulsion developers

Advanced materials manufacturers - By Connectivity Type (in Value %)

Deep space communication networks

Satellite relay systems

Ground station integrated links

Inter-satellite communication systems - By Region (in Value %)

Southern India

Western India

Northern India

Eastern India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Technology readiness, Mission success rate, Cost efficiency, R&D intensity, Strategic partnerships, Regulatory compliance, Launch capability, Service portfolio)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Indian Space Research Organisation

Skyroot Aerospace

Agnikul Cosmos

Pixxel

Dhruva Space

Bellatrix Aerospace

Astrome Technologies

Team Indus

SatSure

Ananth Technologies

Larsen & Toubro Defence

Tata Advanced Systems

Godrej Aerospace

Bharat Electronics Limited

Alpha Design Technologies

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Revenue per Mission, 2026–2035