Market Overview

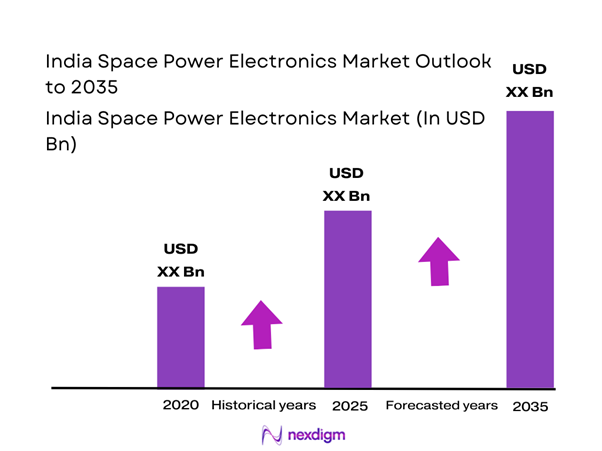

The India Space Power Electronics market current size stands at around USD ~ million, supported by rising satellite missions and indigenous space hardware development momentum. The ecosystem recorded steady unit deployments across power conditioning modules, converters, and control electronics during recent program cycles. Demand expansion is driven by higher satellite counts, diversified payload classes, and mission-specific power architectures. Production volumes remained aligned with launch cadence, while component qualification cycles continued to shape procurement rhythms. Supply alignment has improved through localized sourcing and validated component pipelines.

Southern and western regions dominate activity due to the concentration of space research centers, satellite integrators, and electronics manufacturing clusters. Bengaluru and Hyderabad remain primary hubs supported by testing infrastructure, skilled engineering pools, and vendor ecosystems. Regional advantages stem from proximity to launch agencies, established public sector units, and private aerospace manufacturers. Policy-backed space reforms and startup enablement have further strengthened regional ecosystems. Infrastructure maturity and testing facilities continue to influence geographic demand concentration.

Market Segmentation

By Application

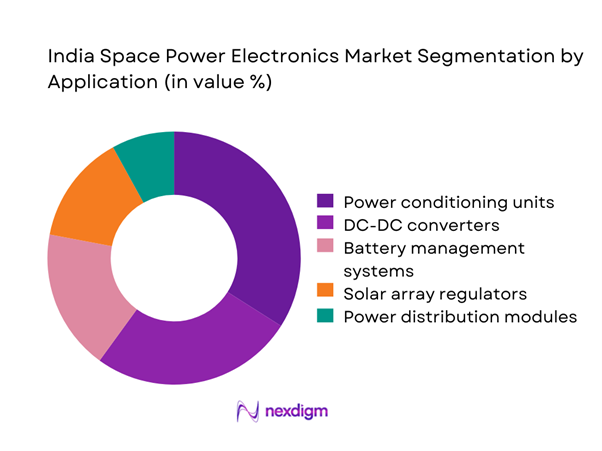

Power conditioning and distribution units dominate the market due to mandatory integration across satellite and launch platforms. Battery management systems show rising adoption driven by extended mission durations and higher onboard power requirements. Solar array regulators maintain stable demand due to consistent satellite architecture requirements. DC-DC converters continue to gain importance as payload miniaturization increases. The dominance of mission-critical subsystems ensures sustained demand across programs, with qualification reliability being the key purchasing determinant.

By Technology Architecture

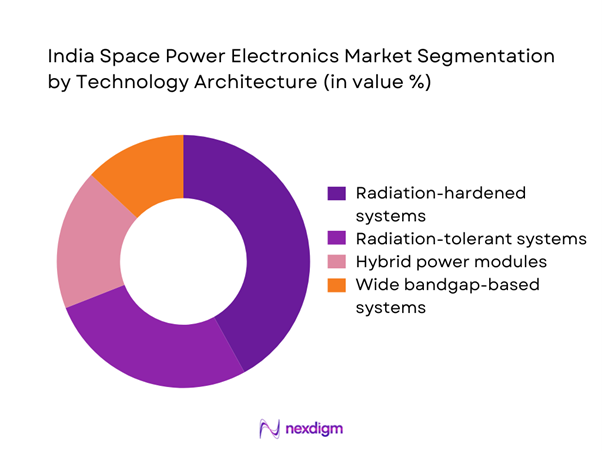

Radiation-hardened electronics hold the largest share due to stringent mission reliability requirements. Radiation-tolerant architectures are gaining adoption for cost-optimized missions and experimental platforms. Hybrid power modules are increasingly selected for modular satellite buses. Wide bandgap semiconductor adoption is rising due to efficiency advantages and thermal resilience. Technology selection remains strongly influenced by mission orbit, lifetime expectations, and regulatory certification requirements.

Competitive Landscape

The competitive landscape is characterized by a mix of public sector enterprises and specialized private manufacturers. Companies compete on reliability certification, indigenous sourcing capability, and long-term program alignment. Entry barriers remain high due to qualification complexity and extended validation timelines. Strategic partnerships with space agencies and system integrators strongly influence competitive positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Larsen & Toubro | 1938 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

| Bharat Electronics | 1954 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Ananth Technologies | 1992 | Hyderabad | ~ | ~ | ~ | ~ | ~ | ~ |

| Data Patterns | 1985 | Chennai | ~ | ~ | ~ | ~ | ~ | ~ |

| Centum Electronics | 1993 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

India Space Power Electronics Market Analysis

Growth Drivers

Rising satellite launch frequency under national space missions

The rising satellite launch frequency has significantly increased demand for reliable space-grade power electronics systems. National missions expanded payload diversity, increasing subsystem complexity and electrical performance requirements across platforms. Launch cadence improvements accelerated procurement cycles for power management components across multiple programs. Higher satellite counts have driven consistent demand for validated power conditioning and distribution architectures. Integration timelines shortened, increasing reliance on standardized electronic modules for mission readiness. The expansion of small satellite programs further amplified demand for compact power electronics solutions. Mission diversification created additional design variants requiring tailored power management approaches. Testing volumes increased as multiple satellites underwent parallel qualification cycles. Increased orbital deployment schedules strengthened vendor order pipelines significantly. Government-backed missions ensured steady consumption of qualified power electronics assemblies.

Growing adoption of indigenously developed power subsystems

Indigenous development initiatives accelerated adoption of domestically designed power electronics subsystems across space missions. Policy support encouraged replacement of imported components with locally developed alternatives. Indigenous platforms improved supply chain resilience and reduced dependency risks significantly. Local manufacturers enhanced design capabilities to meet radiation tolerance requirements. Validation cycles shortened as domestic testing infrastructure matured. Collaborative development programs improved technology transfer between research institutions and manufacturers. Localized sourcing improved delivery timelines and cost predictability for integrators. Increased trust in domestic designs expanded their application across mission types. Qualification success rates improved due to iterative design feedback loops. Indigenous adoption strengthened long-term sustainability of the national space ecosystem.

Challenges

High development and qualification costs

High development and qualification costs remain a critical barrier for power electronics manufacturers. Space-grade component testing requires extensive environmental and radiation validation procedures. Long qualification cycles increase capital requirements and extend break-even timelines. Specialized fabrication processes add further cost pressure for manufacturers. Limited production volumes restrict economies of scale realization. Certification requirements impose repeated testing across mission variants. Cost recovery becomes challenging for smaller vendors entering the ecosystem. High upfront investment discourages rapid innovation cycles. Financial exposure increases due to extended development horizons. These cost dynamics constrain broader participation in the supply chain.

Stringent reliability and radiation tolerance requirements

Stringent reliability standards significantly constrain design flexibility and component selection. Radiation tolerance requirements necessitate specialized materials and design architectures. Qualification failures lead to extended redesign cycles and resource utilization. Reliability assurance demands extensive simulation and testing infrastructure. Thermal management complexity increases due to mission-specific operating conditions. Component traceability requirements add compliance overheads for suppliers. Design redundancy increases weight and system complexity. Testing failures can delay mission schedules significantly. Continuous monitoring of performance metrics is mandatory throughout development. These constraints collectively slow innovation cycles across the market.

Opportunities

Growth of private space manufacturing ecosystem

The expansion of private space manufacturing presents substantial opportunities for power electronics suppliers. New entrants require standardized and scalable power solutions for diverse missions. Private launch vehicles increase demand for modular power subsystems. Commercial satellite constellations expand application diversity significantly. Startups prioritize rapid development cycles, encouraging innovative power architectures. Collaboration opportunities between integrators and electronics firms are increasing steadily. Local manufacturing incentives support ecosystem expansion. Contract volumes diversify across multiple mission profiles. Faster decision cycles improve supplier engagement dynamics. This ecosystem evolution supports long-term market expansion.

ISRO-led technology transfer and vendor development programs

Technology transfer initiatives enhance industry access to proven space-grade designs. Vendor development programs reduce entry barriers for qualified manufacturers. Knowledge sharing accelerates domestic capability building across electronics segments. Standardization guidelines streamline qualification and certification processes. Collaborative testing infrastructure reduces development risk for suppliers. Program-driven demand visibility supports capacity planning decisions. Technology licensing enables faster commercialization of advanced designs. Vendor qualification frameworks improve procurement transparency. Partnerships strengthen ecosystem resilience and innovation capacity. These initiatives collectively expand long-term market participation.

Future Outlook

The India space power electronics market is expected to maintain steady expansion through the next decade driven by sustained mission activity. Increased private sector participation will diversify application demand across satellite and launch platforms. Technology localization and component standardization will continue strengthening domestic capabilities. Policy continuity and infrastructure investment will further stabilize long-term growth prospects.

Major Players

- Larsen & Toubro

- Bharat Electronics

- Ananth Technologies

- Data Patterns

- Centum Electronics

- Alpha Design Technologies

- Astra Microwave Products

- Kaynes Technology

- SFO Technologies

- Mistral Solutions

- VVDN Technologies

- Incore Semiconductors

- MosChip Technologies

- Tata Advanced Systems

- Saankhya Labs

Key Target Audience

- Satellite manufacturers

- Launch vehicle developers

- Space subsystem integrators

- Government and regulatory bodies including ISRO and IN-SPACe

- Defense and aerospace procurement agencies

- Private space startups

- Electronics manufacturing service providers

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Key performance parameters, subsystem classifications, and application areas were identified through industry mapping. Focus was placed on mission profiles, technology usage, and procurement structures. Data points were aligned with space electronics lifecycle stages.

Step 2: Market Analysis and Construction

Market structure was developed using bottom-up assessment of subsystem deployment patterns. Application-level analysis supported segmentation logic. Demand trends were correlated with mission frequency and technology adoption.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert discussions with engineers, procurement specialists, and program managers. Assumptions were tested against deployment trends and qualification norms. Iterative validation ensured consistency.

Step 4: Research Synthesis and Final Output

All insights were consolidated into a structured framework. Data normalization ensured comparability across segments. Final outputs reflect validated trends, challenges, and growth pathways.

- Executive Summary

- Research Methodology (Market Definitions and scope for space-grade power electronics, Satellite and launch vehicle power subsystem segmentation framework, Bottom-up market sizing based on platform-level power electronics integration, Revenue attribution by subsystem and mission class, Primary validation through ISRO vendors and space electronics OEMs, Data triangulation using procurement data and mission manifests, Assumptions related to indigenization and space program cadence)

- Definition and Scope

- Market evolution

- Usage and mission-critical application pathways

- Space electronics ecosystem structure

- Supply chain and indigenization landscape

- Regulatory and policy environment

- Growth Drivers

Rising satellite launch frequency under national space missions

Growing adoption of indigenously developed power subsystems

Increasing small satellite and constellation deployments

Expansion of private space startups and launch service providers

Demand for radiation-hardened and high-reliability electronics - Challenges

High development and qualification costs

Stringent reliability and radiation tolerance requirements

Limited domestic semiconductor fabrication capabilities

Long product development and certification cycles

Dependency on imported critical components - Opportunities

Growth of private space manufacturing ecosystem

ISRO-led technology transfer and vendor development programs

Adoption of wide bandgap semiconductors

Increasing demand for electric propulsion power systems

Export opportunities for space-qualified electronics - Trends

Miniaturization of power electronics modules

Shift toward modular and scalable architectures

Increasing use of GaN and SiC devices

Standardization of satellite bus power systems

Integration of AI-based power management - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Satellite platforms

Launch vehicles

Deep space and interplanetary missions

Ground support and test systems - By Application (in Value %)

Power conditioning units

DC-DC converters

Power management and distribution units

Battery management systems

Solar array regulators - By Technology Architecture (in Value %)

Radiation-hardened power electronics

Radiation-tolerant power electronics

Hybrid power modules

Wide bandgap semiconductor-based systems - By End-Use Industry (in Value %)

Government and defense space programs

Commercial satellite operators

Space research organizations

Private launch service providers - By Connectivity Type (in Value %)

Wired power distribution

Hybrid power and data interfaces

Redundant power bus architectures - By Region (in Value %)

South India

West India

North India

East India

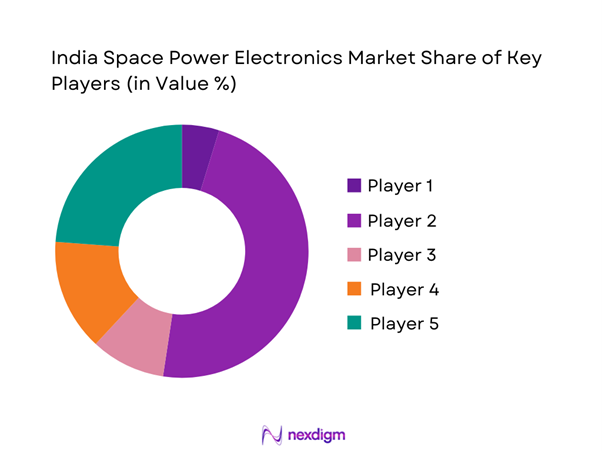

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product portfolio depth, Radiation qualification level, Manufacturing capability, ISRO qualification status, Pricing competitiveness, Technology readiness level, Customization capability, After-sales support strength)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Larsen & Toubro Limited

Bharat Electronics Limited

Ananth Technologies

Tata Advanced Systems

Data Patterns (India)

Centum Electronics

Alpha Design Technologies

Astra Microwave Products

VVDN Technologies

Incore Semiconductors

Saankhya Labs

Mistral Solutions

Kaynes Technology

MosChip Technologies

SFO Technologies

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035