Market Overview

The India Space Propulsion Systems market current size stands at around USD ~ million, reflecting steady expansion driven by launch activity and satellite deployments. Demand has risen with increased missions, higher spacecraft counts, and broader adoption of indigenous propulsion solutions. The market supports ~ launch programs and ~ satellite platforms annually, with propulsion integration occurring across multiple mission classes. Technology depth, reliability benchmarks, and qualification cycles strongly influence procurement. Public and private collaboration continues expanding system deployment volumes across orbital and suborbital missions. Overall growth remains structurally supported by long-term space program commitments.

Southern and western India dominate activity due to concentrated launch infrastructure, testing facilities, and manufacturing clusters. Bengaluru, Sriharikota, and Hyderabad host propulsion development, integration, and testing ecosystems. These regions benefit from established supplier networks, skilled engineering talent, and proximity to national space agencies. Policy support, industrial corridors, and startup incubation frameworks further strengthen regional leadership. Northern and western regions are emerging through component manufacturing and subsystem testing roles. Ecosystem maturity remains highest around launch vehicle development hubs.

Market Segmentation

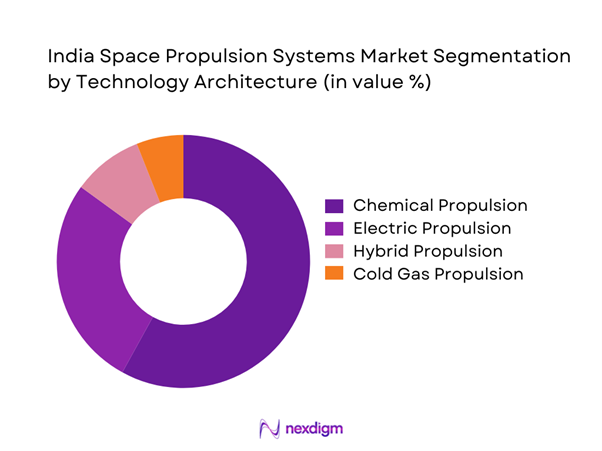

By Technology Architecture

Chemical propulsion systems dominate due to proven reliability, high thrust capability, and extensive heritage across launch vehicles and satellites. These systems remain essential for orbital insertion, attitude control, and mission-critical maneuvers. Electric propulsion is gaining momentum, particularly for small satellites and station-keeping applications, driven by efficiency advantages and reduced propellant mass. Hybrid systems are emerging in experimental and small launch segments, offering balanced performance and cost efficiency. Cold gas propulsion continues serving nanosatellite missions where simplicity and low thrust requirements prevail. Technology selection is strongly influenced by mission duration, payload mass, and orbit type.

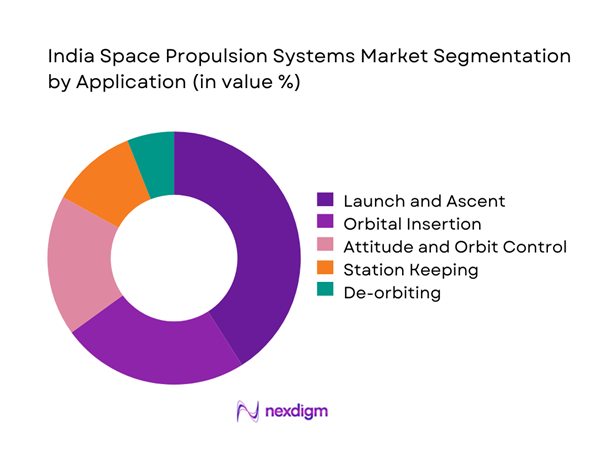

By Application

Launch and ascent applications account for the largest share due to continuous deployment of launch vehicles and test missions. Orbital insertion systems follow closely, driven by increasing satellite constellation deployments. Attitude and orbit control applications remain critical for mission stability and longevity. Station keeping demand is rising with long-duration satellite operations in low Earth and geostationary orbits. De-orbiting propulsion is emerging as a regulated requirement for space sustainability compliance. Application selection depends on mission duration, satellite class, and regulatory mandates.

Competitive Landscape

The competitive environment is characterized by a mix of government-backed entities and rapidly scaling private companies. Players compete on propulsion efficiency, reliability, integration capability, and manufacturing depth. Strong entry barriers exist due to certification requirements and capital-intensive development processes. Partnerships with launch providers and space agencies significantly influence competitive positioning. Innovation cycles are accelerating with increased private participation and mission frequency.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| ISRO | 1969 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| L&T Defence | 2016 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

| Godrej Aerospace | 1985 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

| Skyroot Aerospace | 2018 | Hyderabad | ~ | ~ | ~ | ~ | ~ | ~ |

| Agnikul Cosmos | 2017 | Chennai | ~ | ~ | ~ | ~ | ~ | ~ |

India Space Propulsion Systems Market Analysis

Growth Drivers

Rising number of satellite launches and constellations

Increasing satellite launches have significantly expanded propulsion system demand across orbital and suborbital missions nationwide. Commercial and government missions increased during 2024 and 2025, driving sustained propulsion procurement volumes. Growth in communication and earth observation satellites intensified propulsion integration requirements across platforms. Launch cadence expansion created recurring demand for propulsion refurbishment and replacement cycles. Higher mission frequency increased emphasis on reliable thrust performance and redundancy architectures. Propulsion suppliers experienced consistent order inflows due to mission pipeline visibility. Satellite miniaturization further increased unit volumes while maintaining propulsion performance expectations. Integration timelines shortened as launch schedules became more frequent and competitive. Mission diversity expanded propulsion system configuration requirements across platforms. Overall launch growth continues shaping long-term propulsion system demand trajectories.

Expansion of private space startups under IN-SPACe

Private space startups accelerated propulsion innovation through increased participation in national launch programs. Policy reforms encouraged private investment and testing access during 2024 and 2025. Startups focused on modular propulsion architectures to reduce development timelines. Increased competition improved component standardization and manufacturing scalability. Collaborative missions created new propulsion qualification opportunities across vehicle classes. Startup-led launches expanded propulsion use cases beyond traditional government missions. Private sector agility enabled faster adoption of electric and hybrid propulsion technologies. Innovation cycles shortened due to rapid prototyping and testing capabilities. Funding access supported propulsion research and in-house manufacturing expansion. Overall ecosystem diversification strengthened propulsion demand stability.

Challenges

High development and qualification costs

Propulsion system development requires extensive testing, increasing financial burden on manufacturers significantly. Qualification cycles extend timelines due to rigorous safety and performance validation requirements. Specialized materials and precision manufacturing elevate overall development complexity and expense. Limited test infrastructure availability constrains rapid iteration and validation schedules. Compliance with mission-critical reliability standards adds cost pressure across development phases. Smaller firms face capital constraints in sustaining long development cycles. Certification processes require repeated testing under extreme environmental conditions. Engineering talent scarcity further increases development expenditure. Customization requirements limit economies of scale across propulsion programs. These factors collectively restrict rapid market expansion.

Dependence on limited domestic suppliers

The propulsion ecosystem relies heavily on a narrow base of qualified domestic component suppliers. Supply concentration increases vulnerability to production delays and capacity constraints. Limited vendor diversity restricts competitive pricing and technological alternatives. Import dependencies for specific materials affect project timelines and approvals. Supplier qualification cycles are lengthy, slowing ecosystem expansion. Scaling production remains challenging due to specialized manufacturing requirements. Any disruption impacts multiple programs simultaneously. Technology transfer limitations constrain supplier capability development. Dependence increases operational risk across mission schedules. Diversification efforts remain gradual and resource intensive.

Opportunities

Miniaturized propulsion for small satellites

Rising small satellite deployments create strong demand for compact propulsion solutions. Miniaturized systems enable cost-efficient orbit control and de-orbiting functions. Design optimization supports higher payload efficiency for small launch vehicles. Increased cubesat missions during 2024 and 2025 accelerated adoption trends. Reduced mass propulsion improves mission economics and launch flexibility. Startups focus heavily on scalable micro-propulsion technologies. Standardized interfaces enhance integration across satellite platforms. Demand growth encourages innovation in low-thrust, high-efficiency systems. Regulatory emphasis on debris mitigation supports propulsion inclusion. This segment presents long-term growth potential.

Reusable launch vehicle programs

Reusable launch initiatives drive demand for durable and restart-capable propulsion systems. Propulsion components require extended life cycles and rapid refurbishment capability. Development programs emphasize thermal resilience and repeated ignition reliability. Reusability reduces mission costs while increasing launch frequency. Testing standards for reusable engines are evolving rapidly. Increased private participation accelerates propulsion innovation cycles. Engine reusability improves mission economics and operational scalability. Collaboration between agencies and startups strengthens technical maturity. Successful demonstrations expand future deployment potential. This opportunity supports sustained propulsion demand growth.

Future Outlook

The India Space Propulsion Systems market is expected to witness sustained technological advancement driven by launch frequency growth and private sector participation. Policy support and infrastructure expansion will continue strengthening domestic manufacturing capabilities. Increasing adoption of electric and reusable propulsion technologies will reshape system design priorities. Collaboration between government agencies and private firms is expected to accelerate innovation. Long-term outlook remains positive with expanding mission diversity and commercialization momentum.

Major Players

- Indian Space Research Organisation

- Larsen and Toubro Defence

- Godrej Aerospace

- Skyroot Aerospace

- Agnikul Cosmos

- Ananth Technologies

- MTAR Technologies

- Walchandnagar Industries

- Tata Advanced Systems

- Bellatrix Aerospace

- Alpha Design Technologies

- Data Patterns India

- Hindustan Aeronautics Limited

- Solar Industries India

- Bharat Heavy Electricals Limited

Key Target Audience

- Satellite manufacturing companies

- Launch service providers

- Space technology startups

- Government and regulatory bodies such as ISRO and IN-SPACe

- Defense and aerospace contractors

- Component and subsystem manufacturers

- Investments and venture capital firms

- Space infrastructure developers

Research Methodology

Step 1: Identification of Key Variables

Key propulsion technologies, application areas, and demand drivers were identified through industry mapping and program analysis. Focus was placed on launch frequency, satellite deployment trends, and propulsion architecture evolution.

Step 2: Market Analysis and Construction

Data was structured using application-wise and technology-based assessment to understand demand patterns. Comparative evaluation of propulsion types supported segmentation development.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through discussions with propulsion engineers, program managers, and industry stakeholders. Feedback helped refine assumptions and usage dynamics.

Step 4: Research Synthesis and Final Output

All findings were consolidated through triangulation of technical trends, deployment activity, and industry inputs to ensure analytical consistency.

- Executive Summary

- Research Methodology (Market Definitions and Scope Delineation, Propulsion System Taxonomy and Platform Classification, Bottom-up Market Sizing Using Program-wise Procurement Data, Revenue Attribution Across Launch and Satellite Missions, Primary Validation Through ISRO Vendors and Private Launch Service Providers, Data Triangulation Using Contract Announcements and Mission Manifests, Assumptions Based on Launch Cadence and Indigenous Manufacturing Share)

- Definition and Scope

- Market evolution

- Usage across launch vehicles and satellite platforms

- Ecosystem structure

- Supply chain and vendor landscape

- Regulatory and institutional environment

- Growth Drivers

Rising number of satellite launches and constellations

Expansion of private space startups under IN-SPACe

Increasing demand for small satellite propulsion

Government funding for indigenous launch capabilities

Growth of commercial launch services

Technological advancements in electric propulsion - Challenges

High development and qualification costs

Dependence on limited domestic suppliers

Stringent reliability and safety requirements

Long development and certification cycles

Export control and technology transfer restrictions - Opportunities

Miniaturized propulsion for small satellites

Reusable launch vehicle programs

Private-public collaboration in propulsion R&D

Growing demand for green propulsion systems

Export opportunities for propulsion subsystems - Trends

Shift toward electric and hybrid propulsion

Increasing indigenization of propulsion components

Adoption of additive manufacturing

Growth of private launch startups

Focus on cost-efficient propulsion solutions - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Launch vehicle propulsion systems

Satellite propulsion systems

Orbital transfer and in-space propulsion systems - By Application (in Value %)

Launch and ascent

Orbital insertion

Attitude and orbit control

Station keeping

De-orbiting and mission termination - By Technology Architecture (in Value %)

Chemical propulsion

Electric propulsion

Hybrid propulsion

Cold gas propulsion - By End-Use Industry (in Value %)

Government and defense space programs

Commercial satellite operators

Launch service providers

Space research institutions

Emerging private space startups - By Connectivity Type (in Value %)

Standalone propulsion systems

Integrated propulsion and power modules

Digitally monitored propulsion systems - By Region (in Value %)

South India

West India

North India

East India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology portfolio, propulsion thrust class, mission heritage, manufacturing capability, R&D intensity, government contracts, cost competitiveness, scalability)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Indian Space Research Organisation (ISRO)

Hindustan Aeronautics Limited

Larsen & Toubro Defence

Godrej Aerospace

Skyroot Aerospace

Agnikul Cosmos

Bellatrix Aerospace

Ananth Technologies

Bharat Heavy Electricals Limited

MTAR Technologies

Alpha Design Technologies

Walchandnagar Industries

Solar Industries India

Data Patterns India

Tata Advanced Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035