Market Overview

The India Space Sensors and Actuators market current size stands at around USD ~ million, supported by steady satellite manufacturing and increasing launch activities across public and private sectors. In 2024 and 2025, production volumes increased steadily as mission frequency rose and indigenization mandates expanded. Demand is driven by satellite attitude control, navigation accuracy, and propulsion management requirements. Growing participation of private launch providers has accelerated component sourcing cycles. Technology localization and qualification programs continue to strengthen domestic supply capabilities.

Southern and western India dominate market activity due to the concentration of space research centers, launch facilities, and aerospace manufacturing clusters. Bengaluru, Hyderabad, and Pune form the primary industrial hubs due to access to skilled engineering talent and testing infrastructure. Strong government-backed programs and industrial corridors support component manufacturing and integration. Supply chains remain closely linked to defense electronics ecosystems. Regional policy support and startup incubation further enhance localized development.

Market Segmentation

By Application

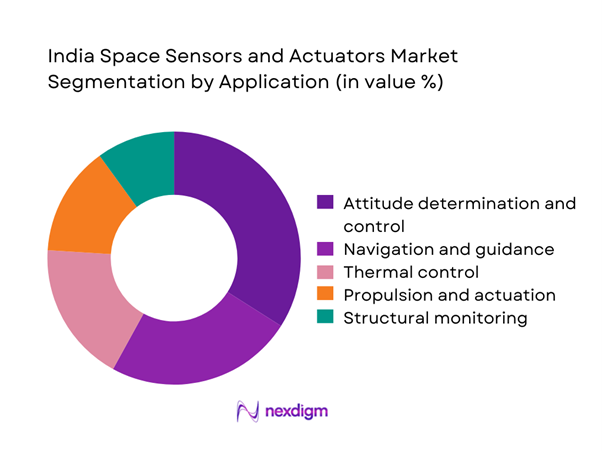

The application segment is dominated by attitude determination and control systems due to their essential role in satellite stability and mission accuracy. Navigation and guidance systems follow closely as payload precision requirements increase across observation and communication missions. Thermal control applications maintain consistent demand due to thermal cycling challenges in space environments. Propulsion-related actuator usage is expanding with the growth of small satellite launches. Structural health monitoring is gaining importance as satellite lifespan optimization becomes a priority. Together, these applications define procurement priorities across civil, defense, and commercial space programs.

By Technology Architecture

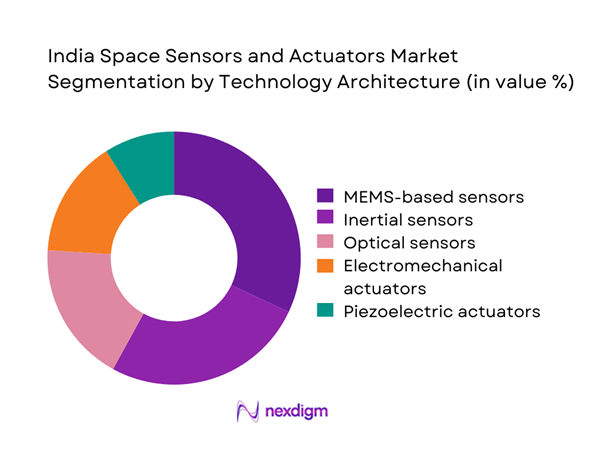

Technology adoption is led by MEMS-based sensors due to their compact size, low power consumption, and high reliability. Inertial sensors remain critical for navigation and stabilization functions across satellites and launch vehicles. Optical sensors are gaining prominence in earth observation and imaging payloads. Electromechanical actuators continue to dominate motion control applications, while piezoelectric technologies are increasingly adopted for precision control. The technology mix reflects a shift toward miniaturization and higher performance density.

Competitive Landscape

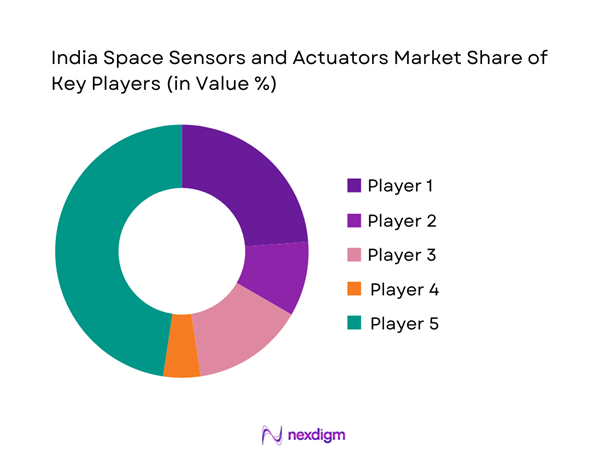

The India space sensors and actuators market features a mix of established aerospace suppliers and emerging domestic manufacturers. Competitive positioning is shaped by technological depth, qualification heritage, and long-term supply relationships with government agencies. Companies differentiate through reliability, customization capability, and compliance with space-grade standards.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Electronics & Defense | 1925 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Data Patterns India | 1985 | India | ~ | ~ | ~ | ~ | ~ | ~ |

India Space Sensors and Actuators Market Analysis

Growth Drivers

Rising satellite launch frequency

Satellite launch frequency increased significantly during 2024 and 2025, driving consistent demand for sensors and actuators. Each mission requires multiple redundant sensor systems for navigation and stabilization. Government missions and commercial launches both contributed to sustained production volumes. The increase in small satellite deployments expanded unit-level component requirements. Launch cadence stability improved supply predictability for manufacturers. Domestic launch vehicles increasingly rely on locally sourced subsystems. Qualification cycles shortened due to repeated mission configurations. This improved production planning and vendor confidence. Demand growth remained stable across civil and defense missions. Overall system complexity continued to rise steadily.

Expansion of private space startups

Private space startups accelerated subsystem demand through rapid satellite development programs during 2024 and 2025. These companies focused on small satellite platforms requiring compact sensors and actuators. Shorter development cycles increased procurement frequency. Startups emphasized modular designs and faster integration timelines. This boosted demand for standardized sensor packages. Private capital inflows supported higher manufacturing throughput. Increased competition improved innovation speed across component categories. Startups relied heavily on domestic supply chains. Collaboration with public agencies strengthened ecosystem maturity. Overall market participation widened significantly.

Challenges

High qualification and reliability requirements

Space-grade components require extensive qualification processes, extending development and validation timelines significantly. Environmental testing demands increase cost and complexity for manufacturers. Certification cycles often delay product deployment schedules. Reliability thresholds remain extremely stringent for orbital operations. Failure tolerance levels are minimal across mission profiles. Smaller firms face difficulties meeting qualification standards. Testing infrastructure availability remains limited domestically. Requalification requirements slow technology upgrades. Engineering resources are heavily constrained by compliance needs. These factors collectively restrict rapid innovation cycles.

Dependence on imported high-precision components

Several high-precision components remain dependent on international suppliers. Import dependencies create supply chain vulnerabilities during geopolitical disruptions. Lead times remain unpredictable for critical subcomponents. Currency fluctuations affect procurement planning stability. Indigenous alternatives remain under development for advanced sensors. Technology transfer limitations slow domestic capability building. Certification mismatches delay integration schedules. Cost optimization becomes challenging under import reliance. Strategic autonomy objectives remain partially unmet. These dependencies constrain large-scale deployment flexibility.

Opportunities

Growth of small satellite constellations

Small satellite constellations are expanding rapidly across communication and earth observation missions. This trend drives demand for lightweight, power-efficient sensors. High-volume manufacturing opportunities are emerging for standardized subsystems. Constellation deployment requires consistent component performance. Repeat orders improve supplier production efficiency. Integration timelines are becoming shorter. Modular architectures support faster market entry. Domestic firms gain opportunities for long-term supply contracts. Cost optimization improves adoption rates. This segment presents strong medium-term growth potential.

Indigenous development of space electronics

Government focus on indigenous space electronics development is creating long-term opportunities. Local manufacturing incentives support component-level innovation. Collaboration between research institutions and industry is increasing. Testing infrastructure investments are expanding domestically. Indigenous designs reduce dependency on foreign suppliers. Qualification capabilities are improving steadily. Domestic IP creation strengthens competitive positioning. Local sourcing improves supply chain resilience. Export potential increases with proven reliability. This trend supports sustainable industry growth.

Future Outlook

The India space sensors and actuators market is expected to witness sustained expansion through 2035, supported by increasing satellite missions and private sector participation. Policy support for domestic manufacturing and technology self-reliance will continue strengthening the ecosystem. Advancements in miniaturization and system integration will reshape product development strategies. Growing commercial launch activity is likely to enhance demand stability across multiple application areas.

Major Players

- Honeywell Aerospace

- Safran Electronics & Defense

- Collins Aerospace

- L3Harris Technologies

- Thales Group

- Moog Inc.

- Kongsberg Gruppen

- Bosch Sensortec

- Ananth Technologies

- Data Patterns India

- Alpha Design Technologies

- Centum Electronics

- Astra Microwave Products

- Northrop Grumman

- Lockheed Martin

Key Target Audience

- Satellite manufacturers

- Launch vehicle developers

- Defense and aerospace integrators

- Commercial space operators

- Component suppliers and OEMs

- Government space agencies such as ISRO and IN-SPACe

- Investments and venture capital firms

- Defense procurement and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined through application mapping, technology classification, and end-user segmentation. Core performance parameters and deployment patterns were identified. Supply chain structures were assessed to determine value contribution points.

Step 2: Market Analysis and Construction

Demand trends were analyzed using satellite launch activity and manufacturing output indicators. Technology adoption patterns were mapped across mission types. Regional production clusters were evaluated for capacity trends.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts and domain specialists validated assumptions regarding technology penetration and adoption drivers. Feedback loops refined segmentation logic and demand forecasts.

Step 4: Research Synthesis and Final Output

Data triangulation ensured consistency across qualitative and quantitative inputs. Final insights were structured to reflect industry dynamics, risks, and growth pathways.

- Executive Summary

- Research Methodology (Market Definitions and scope alignment for space-grade sensors and actuators, Payload and platform-based segmentation framework, Bottom-up market sizing using satellite production and launch data, Revenue attribution across sensor and actuator subsystems, Primary interviews with ISRO vendors and private space OEMs, Validation through launch manifests and procurement databases, Data triangulation using import-export and manufacturing capacity benchmarks)

- Definition and Scope

- Market evolution

- Usage across satellite and launch vehicle subsystems

- Ecosystem structure and value chain

- Supply chain and sourcing dynamics

- Regulatory and policy environment

- Growth Drivers

Rising satellite launch frequency

Expansion of private space startups

Government-backed space missions and funding

Miniaturization of satellite platforms

Growing demand for earth observation data - Challenges

High qualification and reliability requirements

Long development and certification cycles

Dependence on imported high-precision components

Limited domestic fabrication infrastructure

High cost of space-grade materials - Opportunities

Growth of small satellite constellations

Increasing private participation in launch services

Indigenous development of space electronics

Export potential for space subsystems

Defense space modernization programs - Trends

Adoption of MEMS-based sensors

Shift toward modular satellite architectures

Increased use of AI-enabled sensing systems

Radiation-hardened component development

Public-private collaboration in space manufacturing - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

LEO satellites

MEO satellites

GEO satellites

Launch vehicles

Deep space and interplanetary missions - By Application (in Value %)

Attitude determination and control

Thermal control

Propulsion and thrust vectoring

Structural health monitoring

Navigation and guidance - By Technology Architecture (in Value %)

MEMS-based sensors

Optical sensors

Inertial sensors

Electromechanical actuators

Piezoelectric actuators - By End-Use Industry (in Value %)

Civil and government space programs

Defense and strategic space systems

Commercial satellite operators

NewSpace startups

Academic and research institutions - By Connectivity Type (in Value %)

Wired onboard systems

Wireless and smart sensor networks

Hybrid communication architectures - By Region (in Value %)

Southern India

Western India

Northern India

Eastern India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio depth, technology readiness level, space qualification heritage, pricing competitiveness, manufacturing capability, R&D intensity, domestic content ratio, customer base diversity)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Honeywell Aerospace

Safran Electronics & Defense

Northrop Grumman

Collins Aerospace

Thales Group

Moog Inc.

Kongsberg Gruppen

Bosch Sensortec

L3Harris Technologies

Sensonor AS

Ananth Technologies

Data Patterns (India)

Alpha Design Technologies

Astra Microwave Products

Centum Electronics

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035