Market Overview

The India Sudan Satellite Transponder market current size stands at around USD ~ million, reflecting growing utilization across broadcasting, telecom, and secure communication applications. During the recent assessment period, demand expansion has been supported by rising cross-border connectivity requirements, increasing reliance on satellite-based infrastructure, and sustained investments in communication resilience. Capacity utilization levels improved during this period as satellite operators optimized bandwidth allocation and service coverage. Growth momentum has been supported by steady service adoption, evolving regulatory clarity, and increasing digital transmission requirements across multiple user segments.

The market demonstrates stronger activity concentration in regions with established satellite ground infrastructure and higher demand for international connectivity. Urban centers in India contribute significantly due to broadcasting hubs and telecom gateways, while Sudan’s demand is driven by coverage expansion needs. Policy frameworks supporting satellite communication, availability of uplink facilities, and government-backed connectivity programs influence regional dominance. Mature ecosystem participation, defense communication requirements, and cross-border data traffic flows further shape regional demand dynamics.

Market Segmentation

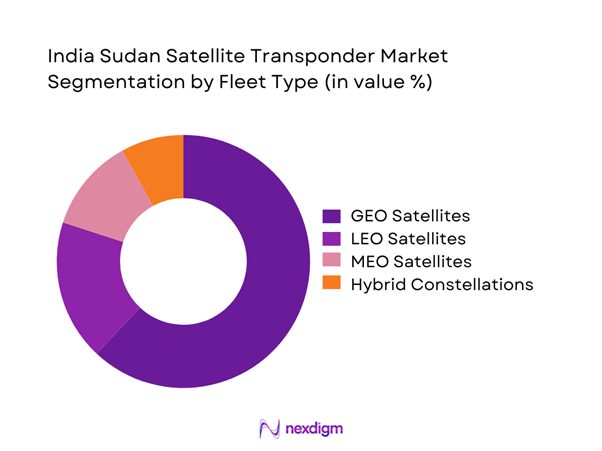

By Fleet Type

Geostationary satellites dominate the market due to their wide coverage and suitability for broadcasting and fixed communication links. Medium and low earth orbit systems are gradually gaining interest as latency-sensitive applications increase. Fleet diversification is supported by improved satellite payload efficiency and multi-band compatibility. Operators prefer established fleet types for reliability, while hybrid deployments are emerging for specialized applications. The dominance of geostationary fleets remains strong due to proven performance and existing ground infrastructure compatibility.

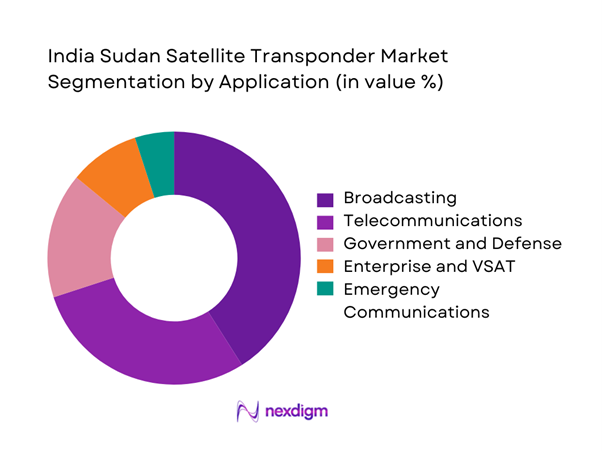

By Application

Broadcasting remains the largest application segment, driven by television distribution and content delivery needs. Telecommunications usage is expanding steadily due to growing data transmission requirements and rural connectivity initiatives. Government and defense communication continues to represent a stable demand base. Enterprise connectivity and emergency communication applications are also expanding as reliance on resilient networks increases. Application diversity is strengthening overall market stability.

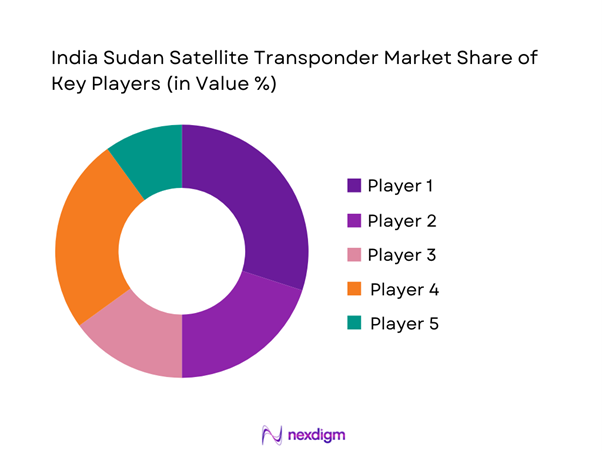

Competitive Landscape

The competitive landscape is characterized by a mix of regional satellite operators, global fleet owners, and service integrators. Market participants compete on capacity availability, service reliability, regulatory alignment, and long-term leasing flexibility. Strategic partnerships with ground infrastructure providers and government agencies play a critical role in competitive positioning. Technological capability and network reach remain key differentiators in securing long-term contracts.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| ISRO | 1969 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| NewSpace India | 2019 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Intelsat | 1964 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| SES | 1985 | Luxembourg | ~ | ~ | ~ | ~ | ~ | ~ |

| Eutelsat | 1977 | France | ~ | ~ | ~ | ~ | ~ | ~ |

India Sudan Satellite Transponder Market Analysis

Growth Drivers

Rising cross-border broadcasting demand

Rising cross-border broadcasting demand is strengthening satellite transponder utilization between India and Sudan. Content distribution networks increasingly rely on stable satellite capacity for uninterrupted signal delivery. Television broadcasters prefer satellite infrastructure for wide-area coverage across diverse geographies. Growth in regional content consumption has supported higher transponder leasing volumes. Media organizations continue investing in satellite distribution for reliability. Expansion of multilingual content further drives sustained transmission demand. Broadcasting partnerships between regional networks increase transponder occupancy rates. Satellite systems ensure consistent quality where terrestrial networks remain constrained. Demand stability is reinforced by long-term broadcasting contracts. Overall market confidence benefits from predictable broadcasting requirements.

Expansion of telecom backhaul in underserved regions

Expansion of telecom backhaul in underserved regions significantly drives satellite transponder utilization. Rural connectivity initiatives depend on satellite links where fiber deployment remains limited. Telecom operators increasingly rely on satellite backhaul to extend coverage footprints. Network reliability improvements support mobile and data service expansion. Satellite links provide rapid deployment advantages over terrestrial infrastructure. Backhaul demand continues growing with mobile data consumption. Government-backed connectivity programs further accelerate satellite adoption. Network resilience requirements increase reliance on satellite redundancy. Operators prefer scalable transponder solutions for traffic growth. This driver sustains consistent long-term capacity demand.

Challenges

High transponder leasing costs

High transponder leasing costs remain a significant challenge impacting market adoption rates. Operators face budget constraints when securing long-term satellite capacity agreements. Cost sensitivity affects smaller service providers and emerging connectivity projects. Pricing rigidity limits flexibility for short-term or seasonal demand. Capital-intensive satellite operations contribute to elevated leasing charges. Financial planning becomes complex for multi-year service commitments. Cost pressure restricts entry of new service providers. Competitive pricing negotiations often extend procurement cycles. High costs influence technology selection decisions. Overall market expansion faces moderation due to pricing constraints.

Spectrum allocation and regulatory complexity

Spectrum allocation and regulatory complexity create operational uncertainty across cross-border satellite services. Differing national regulations complicate frequency coordination and licensing processes. Approval timelines often delay service deployment and capacity utilization. Regulatory compliance requirements increase administrative overhead for operators. Spectrum harmonization challenges affect service scalability. Policy revisions introduce operational risk for long-term planning. Licensing costs impact commercial feasibility assessments. Coordination between multiple regulatory bodies remains complex. Compliance delays influence service rollout schedules. Regulatory clarity remains essential for sustained market development.

Opportunities

Expansion of broadband access in rural Sudan

Expansion of broadband access in rural Sudan presents significant growth opportunities. Limited terrestrial infrastructure creates strong reliance on satellite connectivity solutions. Government digital inclusion initiatives support satellite-based broadband deployment. Education and healthcare connectivity demand continues increasing steadily. Rural enterprise digitization encourages data connectivity expansion. Satellite platforms enable rapid service rollout without extensive ground infrastructure. Connectivity projects attract public and private collaboration opportunities. Service providers can leverage universal service mandates. Demand growth improves long-term transponder utilization rates. Market participants can establish early-mover advantages.

Growth of Ka-band and HTS adoption

Growth of Ka-band and HTS adoption offers enhanced capacity utilization opportunities. Higher throughput capabilities improve bandwidth efficiency and service quality. Operators increasingly adopt advanced payload technologies for cost optimization. Ka-band supports data-intensive applications with improved spectral efficiency. HTS deployment reduces cost per bit for operators. Demand for high-speed connectivity supports technology migration. Adoption accelerates with decreasing terminal costs. Network performance improvements attract enterprise users. Advanced payloads enable flexible capacity allocation. Technology evolution strengthens long-term market competitiveness.

Future Outlook

The market outlook remains positive as connectivity requirements continue expanding across broadcasting, telecom, and government applications. Increasing collaboration between regional stakeholders and satellite operators is expected to enhance service availability. Technology advancements in high-throughput satellites will improve efficiency and coverage. Regulatory alignment and infrastructure investments will further support sustained growth through the forecast period.

Major Players

- ISRO

- NewSpace India Limited

- Intelsat

- SES

- Eutelsat

- Telesat

- Yahsat

- Arabsat

- Inmarsat

- Viasat

- Hughes Communications

- OneWeb

- Telespazio

- Speedcast

- Thaicom

Key Target Audience

- Satellite fleet operators

- Telecommunications service providers

- Broadcasting companies

- Defense and security agencies

- Government and regulatory bodies including space and telecom authorities

- Infrastructure and connectivity service providers

- Enterprise network operators

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Market scope, service categories, application areas, and regional linkages were defined using industry frameworks and operational mapping.

Step 2: Market Analysis and Construction

Data was structured through capacity mapping, utilization trends, and service demand assessment across relevant user segments.

Step 3: Hypothesis Validation and Expert Consultation

Industry inputs were validated through expert consultations focusing on operational dynamics and technology adoption trends.

Step 4: Research Synthesis and Final Output

Findings were consolidated through triangulation and consistency checks to ensure analytical accuracy and logical coherence.

- Executive Summary

- Research Methodology (Market Definitions and boundary alignment for satellite transponder services across India–Sudan corridors, segmentation framework based on orbit type and service bandwidth, bottom-up capacity and revenue estimation using transponder lease rates, operator-level revenue attribution and utilization mapping, primary interviews with satellite operators and ground service providers, triangulation using regulatory filings and satellite fleet databases)

- Definition and scope

- Market evolution and bilateral satellite cooperation context

- Role of satellite transponders in cross-border connectivity and broadcasting

- Ecosystem structure including operators, ground stations, and service providers

- Supply chain and capacity leasing structure

- Regulatory and spectrum governance environment

- Growth Drivers

Rising cross-border broadcasting demand

Expansion of telecom backhaul in underserved regions

Government-backed satellite cooperation initiatives

Growth in disaster management and emergency connectivity

Increasing defense and secure communication needs

Rising demand for high-throughput satellite capacity - Challenges

High transponder leasing costs

Spectrum allocation and regulatory complexity

Limited ground infrastructure in remote regions

Latency and capacity constraints of GEO satellites

Currency and geopolitical risks

Dependence on foreign satellite operators - Opportunities

Expansion of broadband access in rural Sudan

Growth of Ka-band and HTS adoption

Public-private satellite infrastructure partnerships

Defense and secure communication modernization

Integration with IoT and remote monitoring services

Emerging demand for mobility connectivity - Trends

Shift toward high-throughput satellites

Increasing use of hybrid GEO-LEO architectures

Rising preference for flexible bandwidth leasing

Digitization of broadcast and telecom services

Growing role of regional satellite operators

Adoption of software-defined payloads - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

GEO satellites

LEO satellites

MEO satellites

Hybrid constellation usage - By Application (in Value %)

Broadcasting and DTH

Telecommunications and backhaul

Government and defense communication

Enterprise VSAT services

Disaster recovery and emergency communications - By Technology Architecture (in Value %)

C-band transponders

Ku-band transponders

Ka-band transponders

High-throughput satellite payloads - By End-Use Industry (in Value %)

Media and broadcasting

Telecom operators

Government and defense

Maritime and aviation

Enterprise and energy sectors - By Connectivity Type (in Value %)

One-way broadcast

Two-way data communication

Broadband connectivity

Secure communication links - By Region (in Value %)

Northern India

Southern India

Eastern India

Western India

Sudan urban regions

Sudan remote and rural regions

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (satellite fleet size, transponder capacity, frequency band portfolio, geographic coverage, pricing model, service reliability, government contracts, technology adoption)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

ISRO

NewSpace India Limited

Intelsat

SES

Eutelsat

Telesat

Yahsat

Arabsat

Thaicom

Inmarsat

Hughes Communications

Viasat

OneWeb

Telespazio

Speedcast

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035