Market Overview

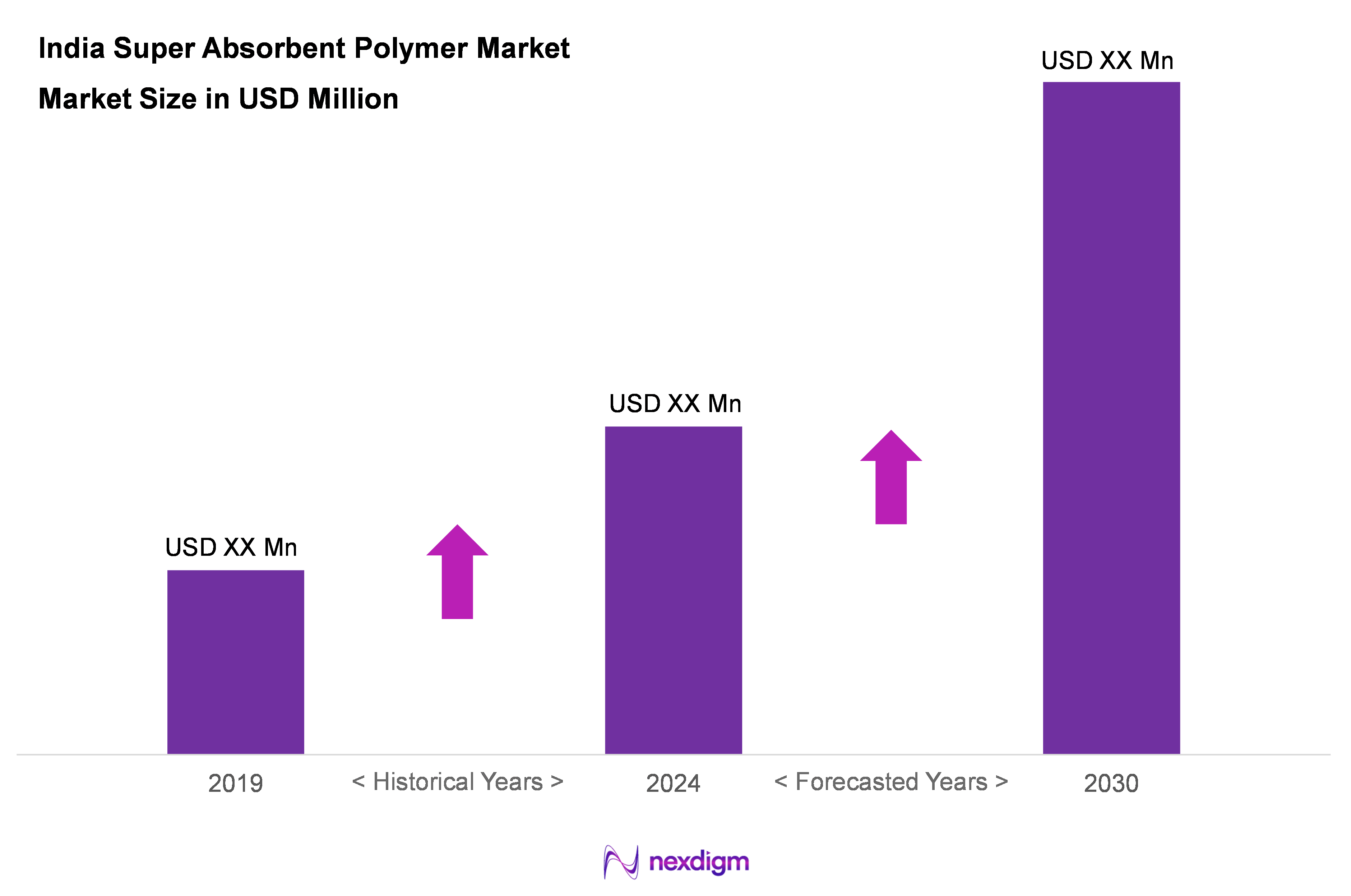

As of 2024, the India super absorbent polymer market is valued at USD 715.4 million, with a growing CAGR of 8.4% from 2024 to 2030, driven by the increasing application of these materials in personal hygiene products and agricultural practices. The surge in demand for high-quality absorbent materials, especially in diapers and feminine hygiene products, has propelled the market’s growth. Additionally, advancements in production technology and a focus on product innovation contribute significantly to the market’s expansion.

The regional market is dominated by urban centres such as Mumbai, Delhi, and Bengaluru due to their robust industrial infrastructure and high consumer purchasing power. These cities are the hubs of major manufacturers and distributors, facilitating easier access to super absorbent polymers. Furthermore, increased awareness regarding hygiene and agricultural efficiency in these areas has positioned them as leaders in market consumption.

Market Segmentation

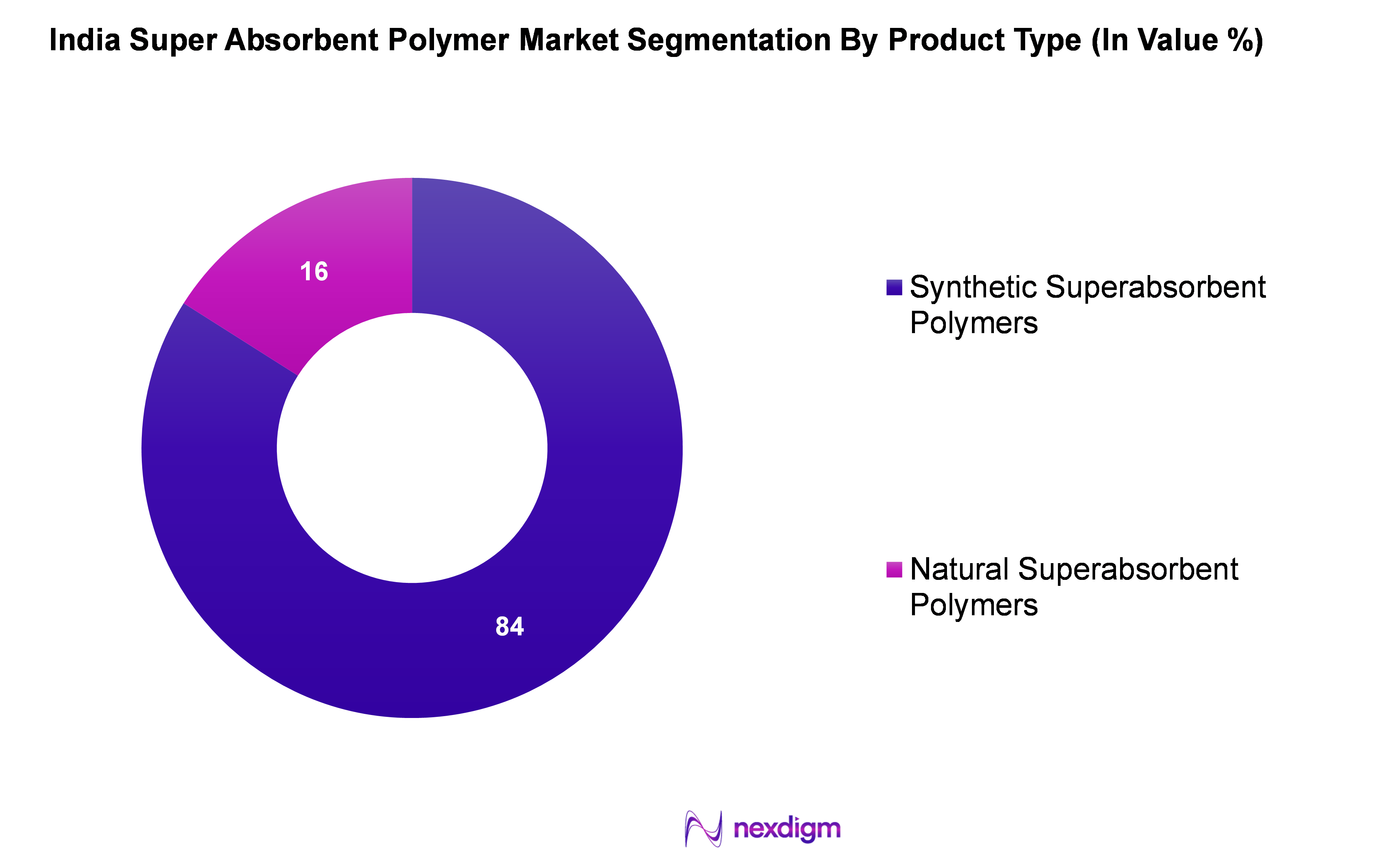

By Product Type

The India super absorbent polymer market is segmented into synthetic, and natural superabsorbent polymers. Synthetic superabsorbent polymers dominate market due to their exceptional absorbency and retention capabilities, critical for high-performance hygiene products such as baby diapers, adult incontinence, and feminine hygiene items. They are cost-effective, readily scalable in production, and benefit from mature supply chains and established applications. In contrast, natural SAPs remain niche due to higher costs, limited performance under load, and slower industrial adoption despite growing interest in biodegradable alternatives.

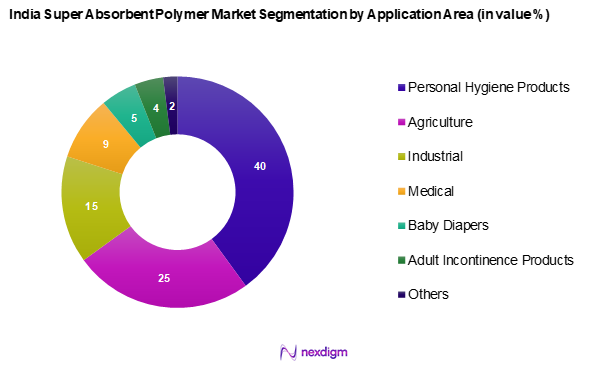

By Application

The India super absorbent polymer market is segmented into personal hygiene products, agriculture, industrial, medical, baby diapers, adult incontinence products, and others. The personal hygiene products segment dominates the market, primarily due to the growing consumer awareness around health and hygiene. The demand for absorbent materials in diapers and adult incontinence products is notably high, which has led to this segment’s strong performance and increased innovation in product development.

Competitive Landscape

The India super absorbent polymer market is dominated by a handful of key players. Notable companies include BASF SE, Nippon Shokubai Co., Ltd., LG Chem Ltd., and Evonik Industries AG. This consolidation reflects the significant influence and strong presence of these companies in the industry, ensuring a competitive market environment.

| Company | Establishment Year | Headquarters | Revenue (USD Bn) | Product Focus | Key Markets |

| BASF SE | 1865 | Ludwigshafen, Germany | – | – | – |

| LG Chem Ltd. | 1947 | Seoul, South Korea | – | – | – |

| Evonik Industries AG | 2007 | Essen, Germany | – | – | – |

| Sumitomo Seika Chemicals Co. | 1944 | Osaka, Japan | – | – | – |

| Sanyo Chemical Industries Ltd. | 1949 | Kyoto, Japan | – | – | – |

India Super Absorbent Polymer Market Analysis

Growth Drivers

Rising Demand for Hygiene Products

The growing need for personal hygiene products is a major factor driving the super absorbent polymer market in India. With increasing urbanization and heightened awareness of personal hygiene, the demand for products such as diapers and feminine hygiene items continues to rise. The expansion of the baby care sector and improved access to hygiene products are further fueling the consumption of super absorbent polymers. Additionally, government initiatives promoting sanitation and hygiene awareness contribute to market growth.

Advancements in Agricultural Applications

Innovations in agriculture are playing a crucial role in boosting the demand for super absorbent polymers. Given the challenges posed by water scarcity, these polymers are being increasingly adopted to enhance soil moisture retention, thereby improving crop yields. Sustainable farming initiatives and government programs aimed at promoting efficient irrigation methods are further accelerating the adoption of super absorbent polymers in agriculture.

Market Challenges

Competition from Alternative Materials

The super absorbent polymer market faces competition from alternative materials such as cotton, pulp, and bio-based products, which are gaining popularity due to their perceived environmental benefits. The increasing preference for biodegradable and natural alternatives is pressuring manufacturers to explore more sustainable solutions. The shift in consumer preference toward eco-friendly products is a significant challenge for companies in this sector.

Regulatory Restrictions

Stringent regulations regarding plastic usage and waste management are posing challenges for manufacturers in the super absorbent polymer industry. Government policies aimed at reducing plastic waste and encouraging sustainable practices are impacting production processes. Compliance with these regulations is essential to avoid penalties and maintain market credibility. Companies are required to adapt by developing environmentally responsible solutions to align with evolving regulatory frameworks.

Opportunities

Expansion into Emerging Markets

The growing purchasing power in developing regions presents a significant opportunity for the super absorbent polymer market. With rising disposable incomes and increasing awareness of hygiene products in regions such as Southeast Asia and Africa, the demand for these materials is expected to grow. Manufacturers looking to expand into these emerging markets can capitalize on new consumer segments and enhance their global presence.

Development of Biodegradable Alternatives

The demand for sustainable and biodegradable super absorbent polymers is creating new growth opportunities in the market. As consumers become more environmentally conscious, there is an increasing focus on research and innovation in eco-friendly materials. Companies investing in sustainable product development can gain a competitive advantage and align with the growing trend of green solutions.

Future Outlook

Over the next five years, the India super absorbent polymer market is expected to demonstrate substantial growth, driven by the rising demand for hygiene products, advancements in agricultural technology, and increasing investments in biodegradable alternatives. The heightened focus on product innovation and sustainability will likely shape market development, as consumers become more environmentally conscious.

Major Players

- BASF SE

- Nippon Shokubai Co., Ltd.

- LG Chem Ltd.

- Evonik Industries AG

- Sumitomo Seika Chemicals Co., Ltd.

- Sanyo Chemical Industries Ltd.

- Formosa Plastics Corporation

- Kao Corporation

- Yixing Danson Technology

- SDP Global Co., Ltd.

- Zhejiang Satellite Petrochemical Co., Ltd.

- Archer Daniels Midland Company

- Ashland Global Holdings Inc.

- The Dow Chemical Company

- San-Dia Polymers Co., Ltd.

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Chemicals and Fertilizers)

- Manufacturers of Personal Care Products

- Agricultural Product Companies

- Medical Equipment Manufacturers

- Industrial Product Distributors

- Retail and E-commerce Companies

- Environmental Organizations

Research Methodology

Step 1: Identification of Key Variables

The research process begins by constructing an ecosystem map that encompasses all major stakeholders within the India super absorbent polymer market. This initial step involves extensive desk research, leveraging secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as product demand and regulatory factors.

Step 2: Market Analysis and Construction

In this phase, historical data related to the India super absorbent polymer market is compiled and analysed. This involves assessing market penetration rates, the ratio of manufacturers to end-users, and resultant revenue generation. Additionally, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates derived from market activities.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed in the previous steps are validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing various segments within the super absorbent polymer sector. These consultations provide valuable operational and financial insights directly from practitioners in the field, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple super absorbent polymer manufacturers and distributors to acquire detailed insights into product segments, sales performance, market trends, and consumer preferences. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive and accurate analysis of the India super absorbent polymer market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Comprehensive Research Techniques, Industry Insights Through Expert Interviews, Primary Research Approach, Limitations and Future Directions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Demand in Hygiene Products

Agricultural Advancements - Market Challenges

Competition from Alternatives

Regulatory Compliance - Opportunities

Expansion in Emerging Markets

Development of Biodegradable Alternatives - Market Trends

Increased Investment in R&D

Customization of Products - Regulatory Environment

Government Regulations on Polymer Usage

Safety and Environmental Standards

Impact of Trade Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Synthetic Superabsorbent Polymers

– Sodium Polyacrylate

– Polyacrylamide Copolymer

– Polyacrylic Acid (PAA)

– Polyacrylonitrile

– Polyvinyl Alcohol (PVA)

Natural Superabsorbent Polymers

– Cellulose-based

– Starch-based

– Chitosan

– Alginate

– Proteins and amino acids

– Polysaccharides - By Application (In Value %)

Personal Hygiene Products

Agriculture

Industrial

Medical

Baby Diapers

Adult Incontinence Products

Others - By Region (In Value %)

North

South

East

West - By Sales Channel (In Value %)

Direct Sales

Indirect Sales

- Market Share of Key Players by Value and Volume

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Models, Recent Innovations, Core Strengths, Weaknesses in Market Positioning, Organizational Structure, Revenue Streams, Distribution Networks, Production Capacity, and Unique Selling Propositions)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Profiles of Key Competitors

BASF SE

Nippon Shokubai Co., Ltd.

LG Chem Ltd.

Evonik Industries AG

Sumitomo Seika Chemicals Co., Ltd.

Sanyo Chemical Industries Ltd.

Nippon Shokubai Co., Ltd.

Formosa Plastics Corporation

Kao Corporation

Yixing Danson Technology

SDP Global Co., Ltd.

Zhejiang Satellite Petrochemical Co., Ltd.

Archer Daniels Midland Company

Ashland Global Holdings Inc.

The Dow Chemical Company

San-Dia Polymers Co., Ltd.

- Market Demand Dynamics

- Budget Allocations

- Regulatory Compliance Requirements

- Consumer Insights and Preferences

- Decision-Making Process

- By Value Forecast, 2025-2030

- By Volume Forecast, 2025-2030

- By Average Price Forecast, 2025-2030