Market Overview

The India Tactical Communication market current size stands at around USD ~ million and reflects sustained defense modernization momentum. Demand is driven by secure battlefield networking, modernization programs, and increased deployment of digital command systems. Procurement activity remained consistent across land, air, and naval platforms, supported by ongoing indigenization policies. Adoption of software-defined communication and encrypted data exchange continued to expand. Integration of tactical radios with surveillance platforms strengthened operational interoperability. Growth momentum remained stable across multiple deployment environments and operational doctrines.

The market is primarily concentrated across northern and western regions due to higher defense infrastructure density. Strategic command centers, border management zones, and naval bases account for significant system deployment. Urban defense corridors benefit from better connectivity and testing infrastructure. Southern regions support manufacturing and system integration activities. Policy-backed domestic production has strengthened regional ecosystems. The presence of defense research facilities further enhances localized development capabilities.

Market Segmentation

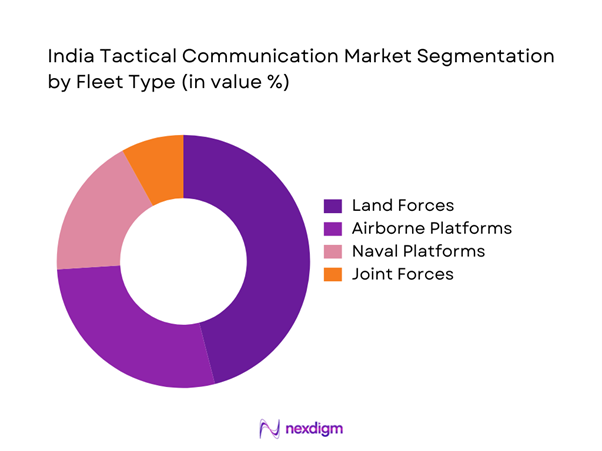

By Fleet Type

Land-based tactical communication systems dominate due to extensive deployment across infantry, armored units, and border forces. These systems support voice, data, and situational awareness functions across varied terrains. Airborne platforms follow closely, driven by integration needs in surveillance aircraft and helicopters. Naval communication systems maintain steady adoption through fleet modernization programs. Joint-force interoperability requirements further support balanced adoption across all fleet categories.

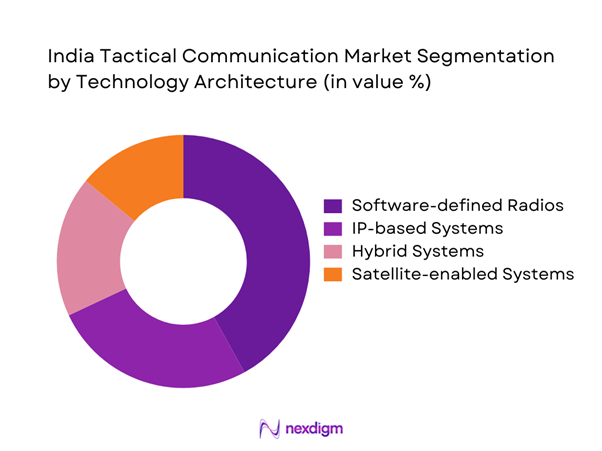

By Technology Architecture

Software-defined radios lead adoption due to flexibility and upgrade capabilities. IP-based communication architectures are expanding with network-centric warfare strategies. Hybrid systems continue serving legacy platforms undergoing gradual upgrades. Satellite-enabled tactical communication supports beyond-line-of-sight missions and remote operations. Technology convergence remains central to procurement decisions.

Competitive Landscape

The competitive environment is shaped by domestic defense manufacturers and global system integrators operating under regulated procurement frameworks. Market participants focus on indigenous development, system integration capability, and long-term service contracts. Competitive differentiation depends on technology depth, compliance standards, and lifecycle support capabilities.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Bharat Electronics Limited | 1954 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Larsen & Toubro Defence | 2015 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2007 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Data Patterns India | 1985 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Rohde & Schwarz India | 1999 | India | ~ | ~ | ~ | ~ | ~ | ~ |

India Tactical Communication Market Analysis

Growth Drivers

Modernization of armed forces communication infrastructure

Modernization programs emphasize replacing legacy systems with digital communication platforms across operational units nationwide. Defense allocations supported technology refresh initiatives during 2024 and 2025 across multiple tactical environments. Interoperability requirements increased adoption of unified communication architectures among different defense branches. Digital battlefield concepts encouraged procurement of advanced radios and encrypted data transmission solutions. Standardization efforts improved compatibility between legacy and next generation communication systems. Training modernization programs reinforced demand for simulation compatible tactical networks. Operational readiness benchmarks encouraged consistent equipment upgrades across field units. Mission critical communication reliability remained a core procurement priority for defense agencies. Integration of command platforms enhanced situational awareness and response coordination. Sustained modernization focus continued driving long term system procurement pipelines.

Rising focus on network-centric warfare

Network-centric doctrine adoption increased demand for integrated voice and data communication solutions. Battlefield digitization initiatives emphasized seamless connectivity between sensors and command centers. Secure data transmission became essential for real-time decision support operations. Interoperable networks improved coordination across air, land, and naval forces. Operational transparency requirements drove investment in resilient communication backbones. Advanced networking capabilities supported faster response cycles during tactical operations. Multi-domain integration encouraged scalable communication architecture deployment. Reliability under contested environments became a key evaluation criterion. Network resilience gained prominence amid electronic warfare considerations. Doctrinal evolution sustained continuous demand for advanced tactical communication platforms.

Challenges

High procurement and lifecycle costs

Acquisition of advanced communication systems involves significant upfront capital commitments. Lifecycle maintenance expenses add long-term financial pressure on defense budgets. Frequent technology upgrades increase overall ownership costs for deployed systems. Complex certification requirements extend development and approval timelines. Integration costs escalate when replacing heterogeneous legacy platforms. Sustainment logistics require specialized technical expertise and infrastructure. Training costs rise due to evolving system complexity. Budgetary prioritization sometimes delays modernization programs. Cost rationalization remains critical for large-scale deployments. Financial constraints influence phased procurement approaches.

Interoperability and integration limitations

Legacy platforms present compatibility challenges with modern communication standards. Diverse vendor ecosystems complicate seamless system integration. Standardization gaps affect joint force operational efficiency. Interoperability testing cycles extend deployment timelines significantly. System integration complexity increases with multi-vendor deployments. Hardware-software synchronization remains technically demanding. Data exchange protocols vary across operational platforms. Network reliability testing requires extensive field validation. Integration failures may impact mission effectiveness. Standard harmonization efforts remain ongoing across services.

Opportunities

Indigenous manufacturing and localization initiatives

Domestic manufacturing policies encourage local development of tactical communication systems. Technology transfer programs enhance indigenous design capabilities. Local sourcing reduces dependency on imported subsystems. Domestic production supports faster customization for operational needs. Government incentives promote private sector participation. Export potential increases for indigenously developed solutions. Local supply chains improve system availability and maintenance. Skill development programs strengthen technical workforce capacity. Indigenization enhances long-term strategic autonomy. Policy support continues expanding manufacturing opportunities.

Upgradation of legacy communication systems

Existing platforms require modernization to support digital warfare environments. Retrofit programs offer significant upgrade opportunities for vendors. Software upgrades extend operational life of legacy systems. Hardware refresh improves performance reliability and security. Incremental modernization reduces full replacement costs. Upgrade programs align with phased defense procurement strategies. Backward compatibility remains essential during transition phases. Legacy system upgrades improve interoperability standards. Modernization enhances data throughput and encryption capabilities. Sustained upgrade cycles create recurring demand opportunities.

Future Outlook

The market is expected to evolve through increased digitization and system interoperability across defense platforms. Continued policy support for indigenous manufacturing will strengthen domestic capabilities. Integration of secure networking, AI-driven analytics, and resilient communication architectures will shape future deployments. Demand will remain stable as modernization programs progress steadily through the forecast period.

Major Players

- Bharat Electronics Limited

- Larsen & Toubro Defence

- Tata Advanced Systems

- Data Patterns India

- Alpha Design Technologies

- Astra Microwave Products

- HFCL Limited

- Paras Defence

- Bharat Dynamics Limited

- Saab India

- Thales India

- Rohde & Schwarz India

- L3Harris Technologies

- Collins Aerospace

- Elbit Systems India

Key Target Audience

- Ministry of Defence procurement divisions

- Indian Army, Navy, and Air Force procurement units

- Defense public sector undertakings

- Private defense manufacturers

- System integrators and OEMs

- Homeland security agencies

- Defense modernization planners

- Investment and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Market boundaries were defined through platform classification, application mapping, and operational deployment scope assessment. Primary variables included system type, end use, and procurement pathways.

Step 2: Market Analysis and Construction

Data modeling incorporated procurement trends, platform modernization rates, and system replacement cycles. Historical deployment patterns guided structural market formation.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through discussions with defense experts, system integrators, and procurement specialists. Feedback loops refined segmentation logic.

Step 4: Research Synthesis and Final Output

All data points were consolidated through triangulation, ensuring consistency, reliability, and alignment with observed defense communication trends.

- Executive Summary

- Research Methodology (Market Definitions and operational scope for tactical communication systems, platform-based segmentation logic across land air and naval forces, bottom-up market sizing using procurement and modernization data, revenue attribution by program lifecycle and contract value, primary interviews with defense procurement officials and system integrators, triangulation using budget documents and OEM shipment data, assumptions linked to indigenous procurement and offset policies)

- Definition and scope

- Market evolution

- Operational and mission-critical usage landscape

- Defense communication ecosystem structure

- Procurement and supply chain framework

- Regulatory and defense acquisition environment

- Growth Drivers

Modernization of armed forces communication infrastructure

Rising focus on network-centric warfare

Increased defense spending and indigenization initiatives

Border security and internal security modernization

Integration of AI and digital battlefield systems - Challenges

High procurement and lifecycle costs

Interoperability issues across platforms

Long defense procurement cycles

Dependence on imported subsystems

Cybersecurity and data integrity risks - Opportunities

Make in India and Atmanirbhar Bharat initiatives

Expansion of indigenous SDR development

Upgradation of legacy communication systems

Rising demand for secure battlefield networks

Export potential to friendly foreign nations - Trends

Shift toward software-defined and IP-based radios

Integration of satellite and terrestrial communication

Adoption of encrypted and jam-resistant systems

Use of AI-enabled situational awareness

Growing emphasis on interoperability standards - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land forces communication systems

Naval tactical communication systems

Airborne and airborne platform communication systems

Joint and network-centric battlefield systems - By Application (in Value %)

Command and control

Intelligence, surveillance, and reconnaissance

Situational awareness and battlefield management

Secure voice and data transmission

Electronic warfare support - By Technology Architecture (in Value %)

Software-defined radios

IP-based tactical communication systems

Legacy analog and hybrid systems

Satellite-enabled tactical communication - By End-Use Industry (in Value %)

Army

Navy

Air Force

Paramilitary and border security forces - By Connectivity Type (in Value %)

Line-of-sight communication

Beyond line-of-sight communication

Satellite communication

Mesh and ad-hoc networking - By Region (in Value %)

North India

South India

East India

West India

Central India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio depth, technology readiness level, defense certifications, indigenous content percentage, pricing strategy, integration capability, after-sales support, government contract exposure)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Bharat Electronics Limited

Bharat Dynamics Limited

Larsen & Toubro Defence

Tata Advanced Systems

Data Patterns India

Astra Microwave Products

Paras Defence and Space Technologies

HFCL Limited

Alpha Design Technologies

Saab India

Thales India

Rohde & Schwarz India

L3Harris Technologies

Elbit Systems India

Collins Aerospace

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035