Market Overview

The India tactical optics market current size stands at around USD ~ million, supported by sustained defense modernization initiatives and rising operational requirements. Procurement volumes increased steadily during the last two years due to border surveillance upgrades and infantry modernization programs. Demand growth remained stable across night vision, thermal imaging, and fire control optics categories. Domestic manufacturing participation expanded alongside offset-driven sourcing policies. Technology absorption accelerated through licensed production and joint development programs. Market activity reflected strong alignment with national defense readiness priorities.

The market is primarily concentrated across northern and western regions driven by military infrastructure density and strategic command presence. Southern regions contribute through manufacturing clusters and testing facilities supporting optics production. Eastern regions show gradual uptake through paramilitary deployments and border management needs. Ecosystem maturity remains strongest near defense corridors and public sector manufacturing hubs. Policy-driven localization has strengthened supplier ecosystems across multiple states. Long-term demand remains supported by sustained modernization planning cycles.

Market Segmentation

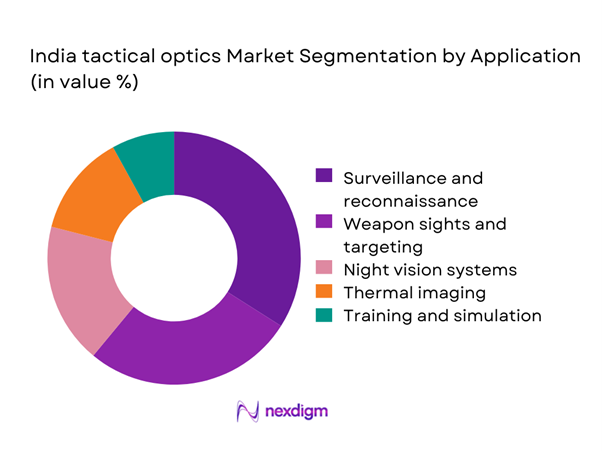

By Application

The application segment is dominated by surveillance, reconnaissance, and targeting systems deployed across infantry and armored units. Night vision and thermal imaging represent the highest utilization due to persistent border monitoring requirements. Weapon-mounted optics continue expanding through soldier modernization initiatives emphasizing situational awareness. Training and simulation optics are gaining importance for operational preparedness. Naval and airborne platforms maintain steady adoption due to platform-specific mission needs. The application landscape reflects increasing emphasis on integrated and multi-role optical solutions.

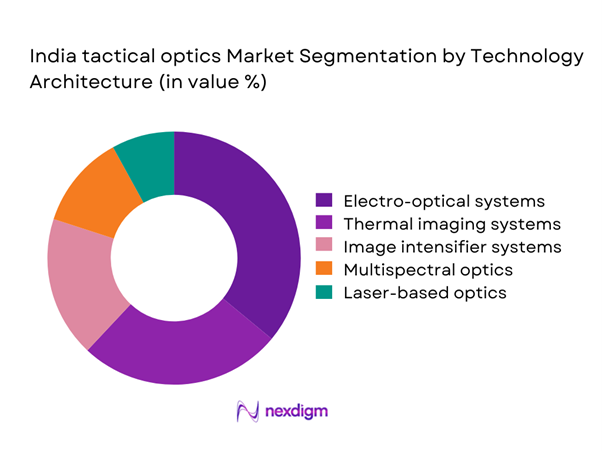

By Technology Architecture

Electro-optical systems dominate due to versatility across land, air, and naval platforms. Thermal imaging technologies are expanding rapidly because of enhanced detection capabilities under low visibility conditions. Image intensifier systems remain relevant for infantry deployments requiring lightweight solutions. Multispectral optics are gaining traction through advanced battlefield integration programs. Laser-based optics continue limited but strategic deployment for targeting applications. Technology adoption reflects growing emphasis on accuracy and real-time intelligence.

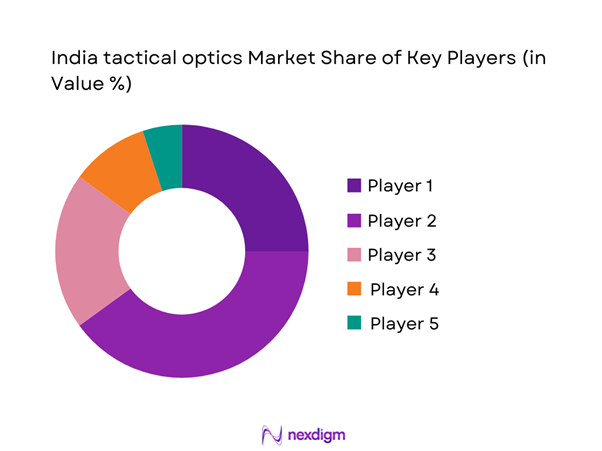

Competitive Landscape

The competitive landscape is characterized by a mix of global defense technology providers and emerging domestic manufacturers. Strategic partnerships, technology transfers, and localized production remain central to competitive positioning. Companies focus on certification readiness, lifecycle support, and platform compatibility to strengthen procurement success.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| L3Harris Technologies | 1895 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Electronics | 1924 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Bharat Electronics Limited | 1954 | India | ~ | ~ | ~ | ~ | ~ | ~ |

India tactical optics Market Analysis

Growth Drivers

Rising defense modernization and border surveillance needs

Modernization programs have increased deployment of advanced optics across infantry and surveillance units nationwide. Border security requirements intensified equipment upgrades to enhance detection and engagement accuracy. Strategic emphasis on real-time intelligence strengthened demand for electro-optical and thermal systems. Government modernization initiatives supported multi-year procurement pipelines. Increased surveillance intensity along sensitive regions sustained equipment replacement cycles. Interoperability requirements accelerated adoption of standardized optical platforms. Technology upgrades improved night operational effectiveness significantly. Tactical readiness objectives supported continuous procurement momentum. Indigenous manufacturing initiatives improved supply reliability across regions. These factors collectively reinforced sustained demand growth.

Increasing soldier modernization programs

Soldier modernization initiatives emphasized situational awareness and enhanced battlefield visibility. Optical upgrades became integral to personal combat system modernization plans. Increased allocation for individual soldier equipment supported optics procurement. Training modernization required advanced sighting and imaging solutions. Infantry effectiveness improvements prioritized lightweight and rugged optical systems. Deployment feedback reinforced the need for advanced targeting optics. Modern combat doctrines emphasized precision engagement capabilities. Equipment standardization programs increased procurement volumes. Operational effectiveness benchmarks influenced optics selection criteria. These programs consistently supported sustained market expansion.

Challenges

High cost of advanced electro-optics

Advanced electro-optical systems involve complex components increasing acquisition costs. Budget constraints limit large-scale procurement across all units. High technology dependency increases lifecycle maintenance expenditures. Cost sensitivity affects adoption of next-generation imaging technologies. Price fluctuations impact long-term procurement planning stability. Import reliance contributes to elevated system pricing structures. Limited domestic alternatives restrict cost optimization opportunities. Budget prioritization often delays optical system upgrades. Cost pressures influence phased deployment strategies. These challenges constrain rapid market expansion.

Dependence on imported components

Critical components continue to rely on foreign suppliers. Import dependency creates vulnerability to supply chain disruptions. Regulatory clearances extend procurement timelines significantly. Limited domestic manufacturing capability restricts component localization. Technology transfer constraints slow indigenous capability development. Foreign exchange exposure affects procurement cost stability. Compliance requirements increase sourcing complexity. Import reliance impacts long-term sustainability objectives. Localization programs require extended development timelines. These factors challenge supply chain resilience.

Opportunities

Expansion of domestic manufacturing and offsets

Government policies strongly encourage localized defense manufacturing initiatives. Offset obligations stimulate domestic component production growth. Private sector participation increases manufacturing ecosystem maturity. Technology transfer agreements accelerate local capability development. Indigenous production reduces dependency on foreign suppliers. Policy support enhances investment attractiveness in optics manufacturing. Export potential increases with improved domestic capabilities. Skill development programs strengthen production quality standards. Localized supply chains reduce lead times. These developments create long-term market expansion opportunities.

Rising demand for multi-sensor fusion optics

Modern warfare requires integration of multiple sensing technologies. Multi-sensor optics improve situational awareness and targeting accuracy. Network-centric operations drive demand for integrated optical platforms. Command systems increasingly rely on fused sensor data. Technological advancements enable compact multi-function devices. Operational efficiency improves through consolidated optical systems. Demand increases across infantry and armored units. Integration capabilities enhance battlefield coordination effectiveness. Procurement strategies favor multi-role optical solutions. These trends create strong growth potential.

Future Outlook

The India tactical optics market is expected to maintain steady growth through continued defense modernization initiatives. Increased localization and technology integration will reshape competitive dynamics. Adoption of advanced imaging solutions will accelerate across multiple defense platforms. Policy-driven manufacturing support will enhance domestic production capabilities. Long-term outlook remains positive with sustained government commitment.

Major Players

- L3Harris Technologies

- Elbit Systems

- Thales Group

- Safran Electronics

- Bharat Electronics Limited

- HENSOLDT

- Raytheon Technologies

- BAE Systems

- Carl Zeiss Optics

- Vortex Optics

- Aimpoint

- Steiner Optics

- Tonbo Imaging

- MKU Limited

- Bharat Dynamics Limited

Key Target Audience

- Ministry of Defence procurement divisions

- Indian Army modernization units

- Paramilitary and border security forces

- Defense public sector undertakings

- Private defense manufacturers

- System integrators and OEMs

- Investments and venture capital firms

- Government and regulatory bodies including DRDO

Research Methodology

Step 1: Identification of Key Variables

Market scope, application categories, and technology segments were defined through defense procurement analysis. Key performance indicators were mapped to operational requirements. Market boundaries were validated using deployment patterns.

Step 2: Market Analysis and Construction

Data was analyzed using bottom-up assessment of equipment deployment and modernization plans. Segmentation structures were aligned with operational usage trends. Cross-validation ensured consistency across datasets.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, defense analysts, and procurement specialists validated assumptions. Feedback refined technology adoption and demand projections. Validation ensured alignment with real-world procurement behavior.

Step 4: Research Synthesis and Final Output

Insights were consolidated into structured market narratives. Data triangulation ensured reliability and internal consistency. Final outputs were reviewed for strategic relevance and accuracy.

- Executive Summary

- Research Methodology (Market Definitions and operational scope of tactical optics systems, Platform and application-based market taxonomy development, Bottom-up market sizing using procurement and deployment data, Revenue attribution across OEMs and system integrators, Primary interviews with defense procurement officials and industry experts, Data triangulation using defense budgets and import-export statistics, Assumptions and limitations related to classified procurement)

- Definition and scope

- Market evolution and modernization trajectory

- Operational usage across land, air, and special forces

- Ecosystem structure and value chain

- Supply chain and domestic manufacturing landscape

- Regulatory and defense procurement environment

- Growth Drivers

Rising defense modernization and border surveillance needs

Increasing soldier modernization programs

Growing adoption of night vision and thermal imaging

Indigenization under Make in India initiatives

Rising asymmetric warfare and counter-terrorism operations - Challenges

High cost of advanced electro-optics

Dependence on imported components

Lengthy defense procurement cycles

Technology transfer and offset constraints

Harsh operating environment requirements - Opportunities

Expansion of domestic manufacturing and offsets

Rising demand for multi-sensor fusion optics

Exports to friendly foreign nations

Integration with AI-enabled battlefield systems

Modernization of paramilitary and police forces - Trends

Shift toward lightweight and ruggedized optics

Adoption of clip-on and modular systems

Increased use of thermal and fused imaging

Digital connectivity with command systems

Growing role of private Indian defense firms - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Infantry and soldier systems

Armored and mechanized platforms

Naval surveillance platforms

Airborne and UAV platforms

Special forces and law enforcement units - By Application (in Value %)

Weapon sights and aiming optics

Surveillance and reconnaissance

Target acquisition and fire control

Night vision and thermal imaging

Training and simulation - By Technology Architecture (in Value %)

Electro-optical systems

Thermal imaging systems

Image intensifier-based systems

Multispectral and fused optics

Laser-based optics - By End-Use Industry (in Value %)

Army and ground forces

Air force

Navy and coastal security

Homeland security and paramilitary forces - By Connectivity Type (in Value %)

Standalone optics

Network-enabled optics

Integrated battlefield management systems - By Region (in Value %)

North India

South India

West India

East India

Central India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product portfolio breadth, Technology maturity, Localization capability, Defense certifications, Pricing competitiveness, After-sales support, Government relationships, Export presence)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

L3Harris Technologies

Elbit Systems

Thales Group

Safran Electronics & Defense

RTX (Raytheon Technologies)

BAE Systems

HENSOLDT

Vortex Optics

EOTech

Aimpoint AB

Steiner Optics

Tonbo Imaging

MKU Limited

Bharat Electronics Limited

Carl Zeiss Optics

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035