Market Overview

The India Target Acquisition Systems market current size stands at around USD ~ million, supported by sustained defense modernization programs and operational modernization priorities. Adoption increased across land, naval, and airborne platforms during 2024 and 2025 due to enhanced surveillance requirements. Procurement volumes expanded steadily as armed forces emphasized accuracy, situational awareness, and integration with digital battlefield systems. Indigenous manufacturing participation increased, reducing dependency on imports for selected subsystems. Technology upgrades focused on electro-optical, thermal imaging, and laser-based solutions. Modernization initiatives aligned with long-term defense readiness objectives and platform survivability enhancement strategies.

Demand concentration remains highest across northern and western regions due to border security priorities and infrastructure density. Southern regions contribute through manufacturing ecosystems and defense electronics clusters supporting integration activities. Urban defense corridors host system testing, calibration, and integration facilities enabling faster deployment cycles. Policy-driven localization incentives have strengthened domestic supplier networks and component sourcing. Procurement activity aligns closely with centralized acquisition bodies and service-specific modernization plans. Ecosystem maturity continues improving through collaboration between public entities and private defense manufacturers.

Market Segmentation

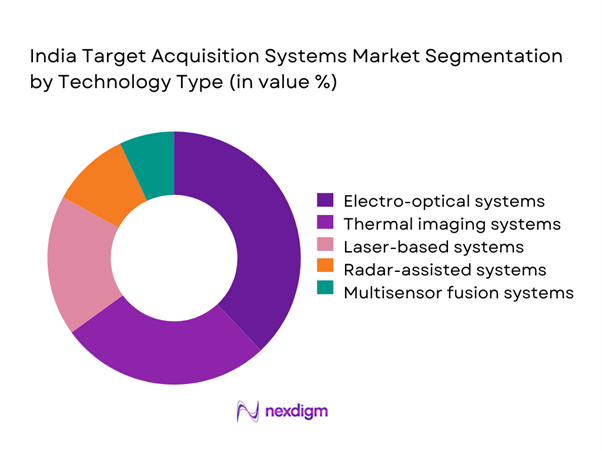

By Technology Type

Electro-optical and thermal-based systems dominate deployment due to operational reliability and adaptability across terrains. During 2024 and 2025, multi-sensor fusion platforms gained traction as forces emphasized precision engagement. Laser-based systems witnessed rising adoption for range finding and target designation. Radar-assisted targeting remains niche but growing in high-value platforms. Indigenous technology development supported gradual replacement of imported subcomponents. Integration flexibility and real-time processing capabilities significantly influenced purchasing preferences across defense branches.

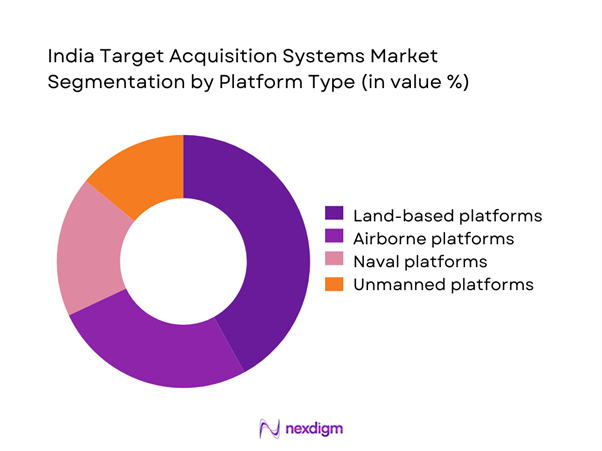

By Platform Type

Land-based platforms represent the largest share due to extensive deployment across armored and artillery units. Airborne platforms showed accelerated integration driven by surveillance modernization programs. Naval platforms adopted advanced targeting solutions for coastal and maritime security roles. Unmanned platforms experienced increasing installations due to reconnaissance requirements. Cross-platform interoperability became a decisive factor in procurement decisions. Platform-specific customization influenced system selection and integration timelines significantly.

Competitive Landscape

The competitive landscape is characterized by a mix of domestic defense manufacturers and global technology providers. Local players benefit from procurement preferences and manufacturing incentives, while international firms contribute advanced sensor technologies. Strategic collaborations and technology transfer agreements shape competitive positioning. Emphasis on lifecycle support and system integration capabilities differentiates market participants.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Bharat Electronics Limited | 1954 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2010 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Larsen and Toubro Defence | 2011 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

India Target Acquisition Systems Market Analysis

Growth Drivers

Rising defense modernization and indigenization initiatives

Defense modernization programs accelerated equipment upgrades during 2024 and 2025 across multiple operational commands. Indigenous development policies encouraged domestic production of targeting and surveillance technologies. Government focus on self-reliance supported technology absorption and local manufacturing capabilities. Increased budget allocation toward modernization enabled accelerated system replacement cycles. Platform upgrade programs prioritized precision targeting and enhanced battlefield awareness. Procurement frameworks favored locally manufactured subsystems over imported alternatives. Technology demonstrations improved confidence in indigenous solution performance. Defense modernization emphasized interoperability across platforms and command systems. Integration of digital battlefield networks increased demand for advanced targeting solutions. Long-term modernization roadmaps continue influencing procurement volumes and technology selection decisions.

Increasing border surveillance and threat detection needs

Heightened border surveillance requirements drove adoption of advanced target acquisition solutions. Increased monitoring along sensitive regions necessitated continuous situational awareness capabilities. Surveillance intensity expanded during 2024 and 2025 due to evolving threat perceptions. Advanced sensors improved detection accuracy across varied terrains and weather conditions. Deployment of mobile surveillance units increased operational flexibility. Integration with command networks improved response time and threat assessment. Border security initiatives prioritized precision detection over conventional monitoring tools. Enhanced night-vision and thermal systems supported round-the-clock operations. Surveillance modernization supported strategic deterrence objectives. Continuous upgrades remain essential for maintaining operational readiness.

Challenges

High cost of advanced targeting technologies

Advanced targeting systems require sophisticated components that significantly increase acquisition costs. High-performance sensors involve complex manufacturing and calibration processes. Budget constraints often delay large-scale deployment across platforms. Maintenance expenses add long-term operational burden for defense agencies. Import dependency for critical components escalates total system costs. Cost overruns occur during customization and integration phases. Smaller defense units face limitations adopting advanced solutions. Cost optimization remains a persistent challenge across procurement cycles. Balancing performance and affordability influences purchasing decisions. Financial constraints impact upgrade frequency and technology refresh timelines.

Dependence on imported critical components

Critical subsystems still rely heavily on foreign suppliers and specialized technologies. Import dependencies expose procurement programs to geopolitical uncertainties. Delays in component availability affect deployment schedules significantly. Technology transfer limitations restrict full localization potential. Currency fluctuations impact acquisition and lifecycle costs. Regulatory clearances slow import timelines for sensitive components. Indigenous alternatives require extended validation and testing cycles. Supply chain disruptions affect project execution consistency. Dependence reduces flexibility during urgent operational requirements. Strategic autonomy remains constrained by component import reliance.

Opportunities

Make in India and Atmanirbhar Bharat defense programs

National manufacturing initiatives promote domestic production of defense technologies. Policy incentives encourage private sector participation in system development. Localization requirements increase opportunities for indigenous component suppliers. Technology partnerships support capability enhancement and knowledge transfer. Procurement preferences favor locally produced solutions. Defense corridors facilitate infrastructure development and testing facilities. Long-term contracts improve investment confidence among manufacturers. Policy stability encourages sustained research and development investments. Export potential improves through standardized indigenous platforms. Government backing strengthens market entry opportunities.

Rising demand for indigenous thermal and imaging systems

Thermal imaging demand increased due to night operation requirements. Indigenous imaging systems gained acceptance across operational platforms. Local manufacturing improved customization and after-sales support. Reduced dependency on imports enhanced supply reliability. Performance improvements boosted confidence in domestic technologies. Integration with digital fire control systems expanded applications. Development programs focused on compact and energy-efficient designs. Cost advantages supported wider adoption across units. Innovation pipelines accelerated product development cycles. Indigenous imaging solutions strengthened operational self-sufficiency.

Future Outlook

The market outlook remains positive with sustained modernization initiatives and expanding indigenous manufacturing capacity. Technological integration across platforms will continue driving adoption. Policy support and defense reforms are expected to enhance domestic capabilities. Collaboration between public and private entities will shape future developments. Long-term demand will be influenced by evolving security requirements and technological advancements.

Major Players

- Bharat Electronics Limited

- Tata Advanced Systems

- Larsen and Toubro Defence

- Mahindra Defence Systems

- Alpha Design Technologies

- Tonbo Imaging

- MKU Limited

- Paras Defence and Space Technologies

- Thales Group

- Elbit Systems

- Leonardo

- Saab

- Rheinmetall Defence

- BAE Systems

- Safran Electronics

Key Target Audience

- Ministry of Defence procurement divisions

- Indian Army modernization units

- Indian Navy acquisition departments

- Indian Air Force capability development teams

- Homeland security and border forces

- Defense public sector undertakings

- Private defense manufacturers

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Market parameters were identified based on platform usage, technology integration levels, and procurement patterns. Demand indicators were mapped across service branches and operational requirements.

Step 2: Market Analysis and Construction

Data was structured using platform-wise and technology-based segmentation models. Analytical frameworks evaluated adoption trends and system deployment patterns.

Step 3: Hypothesis Validation and Expert Consultation

Industry insights were validated through consultations with defense engineers, procurement specialists, and system integrators. Observations were aligned with operational practices.

Step 4: Research Synthesis and Final Output

Findings were consolidated using triangulation techniques to ensure consistency. Final outputs reflect realistic market behavior and technology evolution trends.

- Executive Summary

- Research Methodology (Market Definitions and operational scope of target acquisition systems, platform-wise and application-wise segmentation framework, bottom-up and top-down market sizing methodology, revenue attribution across OEMs and system integrators, primary interviews with defense OEMs and procurement stakeholders, triangulation using defense budgets and procurement data, assumptions and limitations related to classified defense programs)

- Definition and Scope

- Market evolution

- Usage and operational deployment across defense platforms

- Ecosystem structure

- Supply chain and procurement channels

- Regulatory and defense procurement environment

- Growth Drivers

Rising defense modernization and indigenization initiatives

Increasing border surveillance and threat detection needs

Growing adoption of network-centric warfare systems

Expansion of armored and artillery modernization programs

Rising procurement of electro-optical and thermal imaging systems - Challenges

High cost of advanced targeting technologies

Dependence on imported critical components

Lengthy defense procurement and approval cycles

Integration complexity with legacy platforms

Technology transfer and IP restrictions - Opportunities

Make in India and Atmanirbhar Bharat defense programs

Rising demand for indigenous thermal and imaging systems

Upgrades of legacy platforms with modern targeting solutions

Export potential to friendly and developing nations

Integration of AI and sensor fusion technologies - Trends

Shift toward multisensor and fused targeting systems

Increased use of AI-enabled target recognition

Growth in unmanned and remote weapon station integration

Miniaturization and weight reduction of systems

Rising adoption of night-fighting and all-weather capabilities - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land-based platforms

Naval platforms

Airborne platforms

Unmanned platforms - By Application (in Value %)

Surveillance and reconnaissance

Target detection and identification

Fire control and weapon guidance

Border and perimeter security

ISR operations - By Technology Architecture (in Value %)

Electro-optical systems

Infrared and thermal imaging systems

Laser range finders and designators

Multispectral and fused sensor systems

Radar-integrated targeting systems - By End-Use Industry (in Value %)

Army

Navy

Air Force

Homeland security and paramilitary forces - By Connectivity Type (in Value %)

Standalone systems

Network-enabled systems

C4ISR-integrated systems - By Region (in Value %)

North India

South India

East India

West India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio depth, technology maturity, indigenous content level, system integration capability, pricing competitiveness, defense certifications, after-sales support, export footprint)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Bharat Electronics Limited

Tata Advanced Systems

Larsen & Toubro Defence

Mahindra Defence Systems

Alpha Design Technologies

Tonbo Imaging

MKU Limited

Paras Defence and Space Technologies

Thales Group

Safran Electronics & Defense

Elbit Systems

Leonardo S.p.A.

Rheinmetall Defence

Saab AB

BAE Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035