Market Overview

The India Targeting Pods market current size stands at around USD ~ million, reflecting strong defense modernization momentum and fleet upgrades. Operational deployment levels expanded steadily during 2024 and 2025, driven by increasing precision engagement requirements across air platforms. Procurement volumes grew in alignment with new aircraft inductions and midlife upgrade programs. Indigenous manufacturing participation increased during this period, supporting technology absorption and lifecycle autonomy. Demand was primarily influenced by tactical modernization needs rather than fleet expansion alone. Platform integration complexity remained a defining feature shaping procurement decisions across services.

Northern and western regions dominate demand due to concentration of airbases, training commands, and operational squadrons. Southern regions contribute through manufacturing, integration, and testing ecosystems supporting avionics development. The eastern region shows gradual uptake driven by border surveillance requirements. Ecosystem maturity varies by region based on maintenance infrastructure, skilled workforce availability, and policy-driven defense corridors. Regulatory facilitation and indigenous production incentives significantly shape deployment patterns. Regional demand reflects operational readiness priorities rather than purely geographic distribution.

Market Segmentation

By Platform Type

The fighter aircraft segment dominates the India targeting pods market due to continuous upgrades of frontline combat fleets. Modernization programs emphasize enhanced precision targeting and sensor fusion capabilities across multirole platforms. Attack helicopters represent a growing segment, driven by tactical strike and reconnaissance missions. Unmanned aerial vehicles are gaining traction as operational doctrines increasingly incorporate persistent surveillance and strike roles. Trainer aircraft adoption remains limited but relevant for pilot familiarization and system testing. Platform diversification continues to influence integration complexity and customization requirements.

By Application

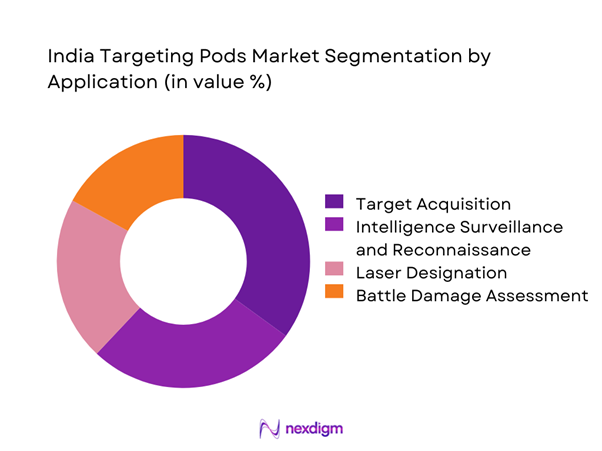

Target acquisition remains the dominant application due to its central role in precision-guided operations. Intelligence, surveillance, and reconnaissance applications have expanded with increased emphasis on situational awareness. Laser designation continues to be critical for guided munitions integration across multiple platforms. Battle damage assessment usage has grown with network-centric warfare adoption. Multi-mission capability demand is driving integration of multiple application functions within single pod systems. Operational flexibility remains a key procurement determinant across application segments.

Competitive Landscape

The competitive landscape is characterized by a mix of global defense technology providers and domestic aerospace manufacturers. Market participants compete on integration capability, platform compatibility, and long-term support readiness. Localization initiatives influence competitive positioning, particularly for government-linked procurement programs.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| L3Harris Technologies | 1895 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Bharat Electronics Limited | 1954 | India | ~ | ~ | ~ | ~ | ~ | ~ |

India Targeting Pods Market Analysis

Growth Drivers

Modernization of combat aircraft fleets

Modernization programs accelerated significantly during 2024 as legacy aircraft required compatibility with advanced mission systems. Fleet upgrades emphasized enhanced targeting accuracy to meet evolving operational doctrines and engagement requirements. Increased induction of multirole platforms created sustained demand for advanced targeting solutions. Air force modernization budgets prioritized avionics integration over platform expansion during this period. Indigenous upgrade programs supported domestic integration and testing capabilities. Fleet readiness goals emphasized precision strike effectiveness across diverse mission profiles. Operational doctrines increasingly required multi-sensor targeting support for complex scenarios. Integration of digital cockpits further increased demand for compatible targeting pods. Fleet modernization initiatives continued through 2025 with structured upgrade timelines. These factors collectively strengthened demand consistency across procurement cycles.

Rising emphasis on precision strike capability

Precision strike capability became central to air combat strategy during recent operational planning cycles. Advanced targeting systems enable improved accuracy with reduced collateral impact during missions. Strategic doctrines increasingly favored precision engagement over conventional strike approaches. Enhanced sensor resolution supported real-time targeting decisions during dynamic operations. Cross-platform interoperability further reinforced the need for standardized targeting solutions. Training programs increasingly emphasized precision-guided engagement effectiveness. Improved situational awareness enhanced mission success probabilities significantly. Integration with network-centric systems supported coordinated strike execution. Operational exercises during 2024 highlighted the importance of advanced targeting technologies. These developments reinforced sustained investment momentum across defense aviation programs.

Challenges

High procurement and lifecycle costs

High acquisition complexity continues to constrain rapid adoption across multiple platforms. Integration requirements increase total ownership burdens beyond initial procurement phases. Maintenance and calibration demands add to operational expenditure pressures. Upgrade cycles require specialized infrastructure and trained technical personnel. Budget allocations often prioritize platform acquisition over subsystem enhancements. Cost optimization remains challenging due to limited supplier alternatives. Long-term sustainment planning impacts fleet readiness scheduling. Lifecycle management complexity affects deployment timelines across services. Financial planning constraints influence procurement phasing decisions. These challenges collectively slow market penetration rates.

Dependence on foreign OEMs

Dependence on foreign suppliers impacts technology access and delivery timelines. Import reliance introduces vulnerabilities related to geopolitical and regulatory constraints. Technology transfer limitations restrict domestic capability development pace. Integration approvals often require extended coordination with overseas partners. Supply chain disruptions affect availability of critical components. Localization efforts face challenges in achieving full system indigenization. Testing and certification dependencies slow deployment schedules. Intellectual property restrictions limit modification flexibility. Policy-driven localization mandates require gradual implementation. These factors continue influencing procurement risk assessments.

Opportunities

Indigenization under Atmanirbhar Bharat

Government initiatives promote domestic manufacturing of critical defense subsystems. Indigenous development programs gained momentum during 2024 through public-private collaboration. Local production enhances supply security and lifecycle management control. Domestic testing infrastructure expansion supports faster certification cycles. Skill development initiatives strengthen long-term technological capability. Local sourcing reduces dependency on external suppliers. Policy incentives encourage investment in sensor and avionics development. Collaborative programs enhance technology absorption capabilities. Indigenous solutions improve customization for operational requirements. These factors create sustained growth opportunities for domestic manufacturers.

Upgrades of legacy fighter fleets

Legacy fleet upgrades remain a priority due to extended service life requirements. Retrofit programs focus on enhancing targeting and surveillance capabilities. Cost-effective modernization offers alternatives to new aircraft acquisition. Compatibility upgrades improve operational relevance of aging platforms. Modular integration approaches reduce downtime during upgrades. Fleet standardization improves training and maintenance efficiency. Retrofit demand increased steadily during 2024 and 2025. Upgraded systems enhance mission effectiveness significantly. Operational continuity drives consistent upgrade investments. This trend supports sustained demand for advanced targeting pods.

Future Outlook

The India targeting pods market is expected to witness steady advancement driven by modernization and indigenization priorities. Technological upgrades will increasingly focus on sensor fusion and network-enabled operations. Domestic manufacturing capabilities are expected to expand through collaborative programs. Demand will remain aligned with fleet upgrades and operational readiness objectives. Policy support and procurement reforms will continue shaping long-term market direction.

Major Players

- L3Harris Technologies

- Lockheed Martin

- Rafael Advanced Defense Systems

- Thales Group

- Bharat Electronics Limited

- Elbit Systems

- Israel Aerospace Industries

- HENSOLDT

- Leonardo

- Northrop Grumman

- Safran Electronics & Defense

- Collins Aerospace

- ASELSAN

- Teledyne FLIR

- Hindustan Aeronautics Limited

Key Target Audience

- Indian Air Force procurement divisions

- Indian Navy aviation command

- Army Aviation Corps

- Ministry of Defence procurement agencies

- Defense public sector undertakings

- Private aerospace and avionics manufacturers

- System integrators and MRO providers

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined through platform types, applications, and deployment environments. Key operational and technological parameters were identified. Data boundaries were established based on active and planned defense programs.

Step 2: Market Analysis and Construction

Demand patterns were analyzed using platform induction and upgrade timelines. Segmentation logic was applied based on operational usage and integration complexity. Regional and application-level dynamics were assessed systematically.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through discussions with defense analysts and industry specialists. Operational feasibility and adoption timelines were cross-verified. Feedback loops ensured alignment with current defense planning priorities.

Step 4: Research Synthesis and Final Output

Findings were consolidated through triangulation of qualitative and quantitative inputs. Insights were structured to reflect market dynamics and future outlook. Final outputs were reviewed for consistency and analytical integrity.

- Executive Summary

- Research Methodology (Market Definitions and operational scope mapping, platform and fleet-level segmentation framework, bottom-up demand estimation from aircraft induction and upgrade cycles, value attribution through contract pricing and lifecycle costs, primary validation with defense procurement and avionics experts, triangulation across OEM disclosures MoD data and fleet readiness indicators)

- Definition and Scope

- Market evolution

- Operational role in precision strike and ISR missions

- Ecosystem structure and value chain

- Supply chain and localization dynamics

- Regulatory and defense procurement environment

- Growth Drivers

Modernization of combat aircraft fleets

Rising emphasis on precision strike capability

Increasing indigenous defense production

Border surveillance and tactical ISR demand

Integration of advanced avionics and sensors - Challenges

High procurement and lifecycle costs

Dependence on foreign OEMs

Integration complexity with legacy aircraft

Export control and technology transfer limitations

Lengthy defense procurement cycles - Opportunities

Indigenization under Atmanirbhar Bharat

Upgrades of legacy fighter fleets

Growing UAV and loitering munition programs

Public-private partnerships in avionics

Export potential to friendly nations - Trends

Shift toward multi-sensor targeting pods

AI-enabled image processing

Modular and open-architecture systems

Increased interoperability with network-centric warfare platforms

Lifecycle support and MRO localization - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Fighter aircraft

Unmanned aerial vehicles

Attack and utility helicopters

Trainer and light combat aircraft - By Application (in Value %)

Target acquisition and tracking

Laser designation

Intelligence surveillance and reconnaissance

Battle damage assessment - By Technology Architecture (in Value %)

Electro-optical and infrared systems

Multi-spectral targeting pods

Laser-guided targeting systems

AI-enabled and sensor-fused pods - By End-Use Industry (in Value %)

Indian Air Force

Indian Navy aviation

Army aviation corps

Paramilitary and special operations forces - By Connectivity Type (in Value %)

Standalone targeting pods

Data-linked and network-enabled pods

Integrated mission system pods - By Region (in Value %)

North India

South India

East India

West India

Central India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product range, technology maturity, platform compatibility, localization level, pricing strategy, contract track record, after-sales support, indigenous content share)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

L3Harris Technologies

Lockheed Martin

Rafael Advanced Defense Systems

Thales Group

Elbit Systems

ASELSAN

HENSOLDT

Northrop Grumman

Bharat Electronics Limited

Hindustan Aeronautics Limited

Leonardo S.p.A.

Safran Electronics & Defense

Israel Aerospace Industries

Collins Aerospace

Teledyne FLIR

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase support and upgrade expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035