Market Overview

The India terrain awareness and warning system market current size stands at around USD ~ million, reflecting steady adoption across civil and defense aviation platforms during 2024 and 2025. Fleet deliveries increased, with ~ units integrated with certified warning systems, while retrofit activity remained consistent across rotary and fixed wing segments. Operational deployment expanded through regulatory alignment, safety modernization programs, and fleet renewal cycles. System penetration improved due to avionics upgrades and mandatory compliance checks across commercial and military fleets.

Market activity is concentrated in regions hosting major airports, defense airbases, and helicopter operations, with strong demand across western and southern aviation corridors. Urban air traffic density, terrain complexity, and expanding regional connectivity continue supporting system deployment. Mature maintenance ecosystems and availability of certified integrators strengthen adoption in metropolitan hubs. Policy emphasis on flight safety, airworthiness compliance, and indigenous avionics development further shapes regional uptake patterns across the country. Infrastructure readiness varies by state and operational intensity.

Market Segmentation

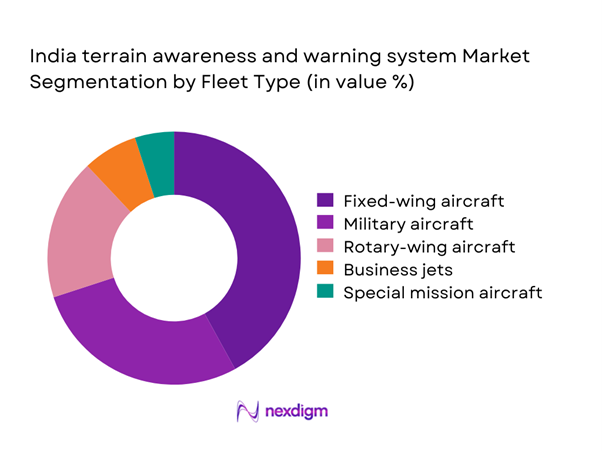

By Fleet Type

The fleet type segmentation is dominated by fixed wing commercial and military aircraft, driven by mandatory terrain awareness installations and continuous fleet modernization. Commercial aircraft contribute significant adoption volumes due to regulatory compliance requirements and increasing domestic flight operations. Military fleets account for strong demand through transport, surveillance, and mission aircraft upgrades. Rotary wing platforms show steady integration owing to terrain sensitive operations and safety mandates. Business jets and special mission aircraft represent a smaller but consistent share, supported by private aviation growth and charter activity. Fleet age profile and retrofit cycles remain critical factors influencing adoption intensity across all categories.

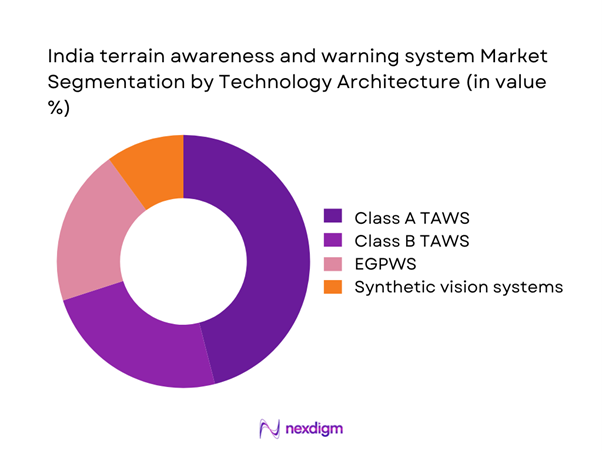

By Technology Architecture

Technology architecture segmentation is led by enhanced ground proximity warning systems integrated with advanced avionics suites across modern aircraft. Class A systems dominate large commercial and military platforms due to comprehensive terrain databases and alert capabilities. Class B systems maintain relevance within regional and rotary segments where simplified configurations are sufficient. Synthetic vision enabled architectures are gaining traction, driven by improved situational awareness and pilot assistance features. Integration with flight management systems and digital cockpits accelerates adoption. Architecture selection depends on aircraft certification class, mission profile, and compatibility with onboard navigation and sensor systems. Standardization initiatives further influence long term deployment decisions across operators.

Competitive Landscape

The competitive landscape is characterized by a mix of global avionics suppliers and domestic aerospace manufacturers supporting defense and civil aviation requirements. Market positioning depends on certification depth, system integration capability, and long term service support across diverse aircraft platforms.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Garmin Ltd. | 1989 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

India terrain awareness and warning system Market Analysis

Growth Drivers

Rising aircraft fleet size and modernization programs

India continues expanding its aircraft fleet during 2024 and 2025 across commercial, military, and utility aviation segments nationwide. Fleet modernization programs prioritize avionics upgrades, creating sustained demand for certified terrain awareness systems across platforms nationally and regionally. Airline fleet renewal cycles increasingly integrate advanced warning technologies to align with operational safety expectations across expanding route networks. Military aviation modernization emphasizes terrain avoidance capabilities for low altitude operations and mission reliability across diverse geographic environments. Helicopter fleet expansion for emergency, offshore, and surveillance roles drives consistent system adoption across varied terrain conditions nationally. Fleet growth trends directly increase installation volumes of certified warning solutions annually across commercial and defense aviation segments. Aircraft deliveries recorded during 2024 and 2025 supported steady integration of safety avionics across multiple fleet categories nationwide. Modernization budgets increasingly allocate resources toward compliance driven cockpit system upgrades for operational reliability and certification adherence. Operational efficiency objectives further reinforce adoption of terrain awareness technologies within new aircraft platforms across varied mission profiles. Overall fleet expansion remains a primary structural driver shaping sustained market demand across India’s evolving aviation ecosystem nationwide.

Increasing focus on aviation safety compliance

Regulatory emphasis on aviation safety strengthened during 2024 and 2025 across civil and defense sectors through updated operational standards. Compliance requirements increasingly mandate certified terrain awareness systems for multiple aircraft categories across domestic operations and training fleets. Safety oversight bodies continue tightening monitoring frameworks to reduce controlled flight incidents across varied geographic environments nationally. Operator accountability has increased, encouraging proactive adoption of warning systems during upgrades and certification renewals processes. Incident analysis frameworks emphasize terrain awareness as a critical mitigation layer within aviation safety management systems. Regulatory audits increasingly verify functional performance of installed terrain warning equipment across commercial and government operated aircraft. Safety compliance investments influence procurement decisions during aircraft acquisition and retrofit planning across fleet lifecycle management processes. Training protocols integrate terrain awareness usage into pilot operational standardization programs to enhance situational awareness levels. Regulatory clarity improves supplier confidence and accelerates deployment timelines across operators within structured compliance environments. Overall safety compliance momentum remains a core catalyst supporting sustained market expansion across aviation segments nationally during recent years.

Challenges

High system and integration costs

High system acquisition costs remain a significant constraint for smaller operators across regional aviation segments with limited capital availability. Integration expenses increase when retrofitting older aircraft with modern avionics requiring structural and software modifications across diverse fleet types. Certification associated costs further elevate total implementation burden for operators operating under strict regulatory frameworks across civil and defense aviation. Limited budget flexibility restricts widespread adoption among regional and charter fleets with constrained financial planning cycles. Cost sensitivity affects procurement timelines and prioritization of safety upgrades across competing operational investment needs. Maintenance and calibration expenses add to lifecycle cost considerations influencing long term budgeting decisions. Imported system dependence contributes to higher ownership and servicing expenditures due to limited domestic alternatives. Cost pressures can delay compliance timelines for smaller aviation operators operating in cost sensitive environments. Budget approvals often require extended justification cycles for advanced avionics investments within organizational procurement structures. Overall cost intensity remains a primary barrier affecting market penetration rates across multiple aircraft categories during recent procurement cycles.

Certification and regulatory complexity

Certification processes for terrain awareness systems involve rigorous testing and documentation requirements across regulatory jurisdictions and authorities. Approval timelines often extend due to multilayered compliance verification procedures involving civil aviation regulators and defense agencies. Aircraft specific certification increases complexity when deploying across mixed fleets with varying avionics baselines. Software validation and database updates require recurring regulatory oversight to maintain operational compliance levels. Cross compatibility issues complicate approval for integrated avionics architectures across different aircraft manufacturers. Certification delays can postpone deployment schedules and impact operational readiness for both civil and defense fleets. Regulatory changes require frequent documentation updates and revalidation processes increasing administrative workload for operators. Limited harmonization across standards adds complexity for multinational operations involving cross border certification requirements. Compliance management demands specialized expertise and dedicated organizational resources increasing operational overhead burdens. Overall regulatory complexity remains a critical challenge affecting market scalability across evolving aviation ecosystems in emerging and mature segments.

Opportunities

Indigenization under defense and aerospace initiatives

Government focus on domestic manufacturing creates opportunities for indigenous terrain awareness solutions within defense and civil aviation programs. Policy frameworks encourage localization of avionics development and production capabilities supporting technology transfer initiatives. Indigenous programs reduce dependency on imported systems and enhance supply resilience across strategic aviation segments. Defense procurement policies increasingly favor locally developed safety technologies under national aerospace initiatives. Domestic manufacturing enables cost optimization and customized system integration aligned with operational requirements. Local engineering capabilities support faster certification and aftersales support for fleet operators nationwide. Indigenization efforts stimulate innovation in software and sensor integration across aviation electronics ecosystems. Collaborations between public and private entities strengthen development pipelines for advanced safety systems. Domestic capability growth improves export potential for regional aviation markets through competitive technology offerings. Overall indigenization momentum supports long term market sustainability across aviation value chains within national aerospace development objectives.

Growing helicopter emergency and offshore operations

Expansion of helicopter emergency services increases demand for terrain awareness systems across remote and urban regions. Offshore operations require enhanced safety systems for low altitude flight profiles in challenging environmental conditions. Medical evacuation growth supports adoption of reliable warning technologies for mission critical operations. Search and rescue missions increasingly rely on accurate terrain alerting during low visibility scenarios. Helicopter fleet expansion in energy and infrastructure sectors drives installations across coastal and inland zones. Operational risk mitigation priorities strengthen adoption of advanced warning systems for rotary wing operations. Government supported emergency programs increase procurement of compliant avionics for disaster response fleets. Private operators also invest in safety upgrades to meet operational standards across commercial helicopter services. Rising utilization rates amplify need for reliable terrain awareness capabilities across intensive flight operations. Overall helicopter activity growth creates sustained opportunity for system suppliers within national aviation safety programs over the medium term.

Future Outlook

The market outlook remains positive as aviation safety compliance, fleet modernization, and indigenous development programs continue advancing. Adoption of integrated avionics and digital cockpit technologies will strengthen system penetration across aircraft categories. Regulatory harmonization and domestic manufacturing initiatives are expected to improve affordability and accessibility. Continued growth in helicopter operations and regional aviation will further reinforce long term demand momentum.

Major Players

- Honeywell International

- Garmin Ltd.

- Collins Aerospace

- Thales Group

- L3Harris Technologies

- Elbit Systems

- Safran Electronics & Defense

- Leonardo S.p.A.

- Bharat Electronics Limited

- Hindustan Aeronautics Limited

- Tata Advanced Systems

- Astra Microwave Products

- Indra Sistemas

- Mahindra Defence Systems

- GE Aerospace

Key Target Audience

- Commercial airline operators

- Military anddefense aviation authorities

- Helicopter service operators

- Aircraft maintenance and overhaul providers

- Civil aviation regulatory bodies

- Ministry of Defence and DGCA

- Airport operators and infrastructure agencies

- Investment firms and venture capital funds

Research Methodology

Step 1: Identification of Key Variables

Key parameters influencing terrain awareness system adoption were identified through aircraft fleet data, regulatory frameworks, and operational safety requirements across civil and defense aviation sectors.

Step 2: Market Analysis and Construction

Segmentation structures were developed based on fleet type, technology architecture, and deployment environment, supported by trend analysis and operational mapping.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, aviation engineers, and regulatory professionals were consulted to validate assumptions and assess deployment dynamics across platforms.

Step 4: Research Synthesis and Final Output

Findings were consolidated through structured triangulation to ensure consistency, accuracy, and relevance to current and emerging market conditions.

- Executive Summary

- Research Methodology (Market Definitions and operational scope mapping, platform-level segmentation logic for TAWS categories, bottom-up market sizing using aircraft fleet and retrofit rates, revenue attribution through OEM and MRO contract analysis, primary validation through avionics OEMs and defense aviation experts, triangulation using DGCA data and defense procurement disclosures)

- Definition and Scope

- Market evolution

- Usage and operational deployment landscape

- Ecosystem structure

- Supply chain and value chain flow

- Regulatory and certification environment

- Growth Drivers

Rising aircraft fleet size and modernization programs

Increasing focus on aviation safety compliance

Expansion of military aviation and helicopter fleets

Growth in regional air connectivity

Mandated installation of TAWS for specific aircraft classes - Challenges

High system and integration costs

Certification and regulatory complexity

Limited domestic manufacturing capability

Retrofitting constraints in legacy aircraft

Dependence on imported avionics - Opportunities

Indigenization under defense and aerospace initiatives

Growing helicopter emergency and offshore operations

Integration with next-generation avionics suites

Expansion of civil aviation infrastructure

Export potential for indigenous systems - Trends

Shift toward integrated avionics platforms

Adoption of synthetic vision technology

Increased use of digital terrain databases

AI-enabled alert optimization

Growing retrofit market demand - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Fixed-wing commercial aircraft

Military transport and combat aircraft

Rotary-wing aircraft

Business jets and turboprops

Unmanned aerial platforms - By Application (in Value %)

Commercial aviation safety

Military mission safety and navigation

Helicopter terrain avoidance

Search and rescue operations

Training and simulation - By Technology Architecture (in Value %)

Class A TAWS

Class B TAWS

Enhanced Ground Proximity Warning Systems

Synthetic vision integrated systems - By End-Use Industry (in Value %)

Commercial aviation

Defense and homeland security

Charter and business aviation

Aerial services and special missions - By Connectivity Type (in Value %)

Standalone systems

Integrated avionics suites

Satellite-enabled systems

Ground-linked systems - By Region (in Value %)

North India

South India

West India

East India

Central India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio depth, certification coverage, platform compatibility, pricing strategy, local manufacturing presence, aftermarket support, technology integration level, contract wins)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Honeywell International

Garmin Ltd.

Collins Aerospace

Thales Group

L3Harris Technologies

Elbit Systems

Safran Electronics & Defense

BAE Systems

Leonardo S.p.A.

Bharat Electronics Limited

Hindustan Aeronautics Limited

Tata Advanced Systems

Astra Microwave Products

Indra Sistemas

Mahindra Defence Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035