Market Overview

As of 2024, the India therapeutic apheresis market is valued at USD 250 million, with a growing CAGR of 5.1% from 2024 to 2030. This market is driven by an increasing prevalence of chronic diseases, coupled with advancements in apheresis technologies which enhance patient outcomes. As the healthcare sector prioritizes patient-cantered therapies, the demand for apheresis procedures is expected to rise significantly in the coming years.

Key cities that dominate the India therapeutic apheresis market include metropolitan regions such as Mumbai, Delhi, Bangalore, and Chennai. These cities are characterized by advanced healthcare infrastructure, a high concentration of skilled healthcare professionals, and significant investments in medical technology. Additionally, the presence of major research institutions and hospitals further boosts demand, making these urban hubs critical to the growth of the therapeutic apheresis segment.

Market Segmentation

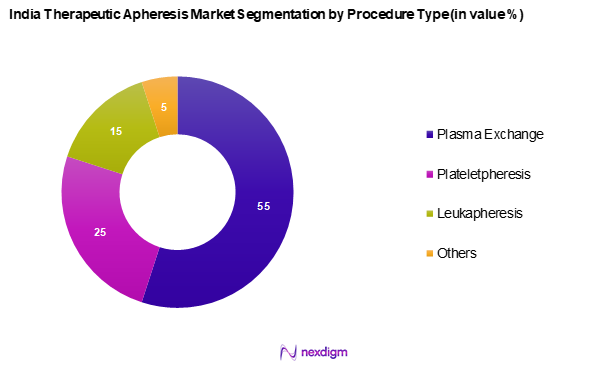

By Procedure Type

India therapeutic apheresis market is segmented into plasma exchange, plateletpheresis, leukapheresis, and others. Plasma exchange is the dominating sub-segment within the market. This is largely due to its wide adoption in the treatment of autoimmune disorders, such as Guillain-Barré syndrome and myasthenia gravis. Hospitals and clinics employ plasma exchange procedures to effectively remove harmful substances from the bloodstream, making it a pivotal procedure in critical care.

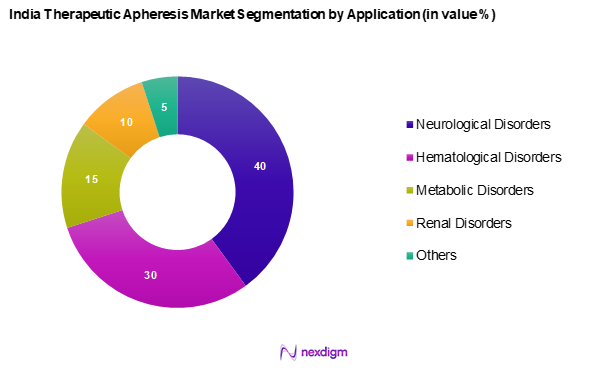

By Application

The India therapeutic apheresis market is segmented into neurological disorders, hematological disorders, metabolic disorders, renal disorders, and others. Neurological disorders, notably, lead this segment due to the growing awareness regarding apheresis as a treatment option for diseases such as multiple sclerosis and neurologic autoimmune conditions. The increasing incidence of these disorders pushes healthcare providers to adopt therapeutic apheresis techniques, thereby fostering growth in this application area.

Competitive Landscape

The India therapeutic apheresis market is characterized by the presence of several key players, including both multinational corporations and regional firms. The competitive landscape reveals a concentration of companies that have established strong footholds in therapeutic therapies through innovation and robust distribution networks. Key players include Fresenius Kabi, Haemonetics Corporation, Terumo BCT, and others, which together dominate a large portion of the market.

| Company | Establishment Year | Headquarters | Annual Revenue | Market

Share |

Total Employees | Market Presence |

| Fresenius Kabi | 1999 | Bad Homburg, Germany | – | – | – | – |

| Haemonetics Corporation | 1971 | Boston, MA, USA | – | – | – | – |

| Terumo BCT | 2002 | Lakewood, CO, USA | – | – | – | – |

| Grifols S.A. | 1930 | Barcelona, Spain | – | – | – | – |

| Cerus Corporation | 1991 | Concord, CA, USA | – | – | – | – |

India Therapeutic Apheresis Market Analysis

Growth Drivers

Rising Incidence of Chronic Diseases

The increasing incidence of chronic diseases in India is a significant growth driver for the therapeutic apheresis market. Reports indicate that approximately 60% of deaths in India are attributed to chronic diseases, with cardiovascular diseases, diabetes, and cancer being the leading causes. The prevalence of diabetes alone is expected to reach 134 million by 2025. Such a high burden of chronic illnesses necessitates advanced treatment options like apheresis, as patients require innovative therapies to manage their conditions effectively. The rising disease burden is driving demand for therapeutic procedures aimed at improving patient outcomes.

Increasing Awareness of Apheresis Procedures

There has been a noticeable increase in awareness regarding apheresis procedures among healthcare professionals and patients alike in India. With campaigns and educational programs organized by healthcare providers, the understanding of apheresis benefits for various conditions, including autoimmune disorders and blood-related diseases, has expanded. For instance, the number of apheresis procedures performed in India rose from 40,000 in 2022 to over 55,000 in 2024, as hospitals increasingly adopted these technologies for treatment. This awareness leads to higher patient referral rates for apheresis treatments, positively influencing market growth.

Market Challenges

High Cost of Procedures

Despite advancements and increasing demand for apheresis procedures, the high costs associated with these interventions remain a significant barrier. The average cost of a single apheresis session can range widely, often exceeding USD 581.3 which is unaffordable for a substantial portion of the Indian population, especially given that the country grapples with an estimated 22% of its residents living below the poverty line. This high financial burden limits patient access, creating a substantial challenge for market expansion as the affordability of such procedures directly impacts their overall adoption.

Regulatory Challenges

The therapeutic apheresis sector in India faces various regulatory challenges that could impede its growth. The approval process for apheresis devices and procedures is complex and time-consuming, as healthcare regulations in India require extensive clinical trials and compliance with stringent quality standards. Additionally, the enforcement of blood transfusion regulations poses operational hurdles for healthcare providers. Delays in regulatory approvals can hinder innovation and the timely introduction of new apheresis technologies in the Indian market, potentially limiting the options available to patients.

Opportunities

Growth in Geriatric Population

The expansion of the geriatric population in India presents a substantial opportunity for the therapeutic apheresis market. By 2024, the number of individuals aged 60 and above is expected to exceed 150 million, representing a significant portion of the population that often requires advanced healthcare solutions due to higher susceptibility to chronic illnesses. This demographic shift is driving healthcare providers to seek effective therapeutic options, including apheresis, which has shown positive outcomes in managing age-related ailments. Meeting the healthcare needs of this growing population will create significant opportunities for the therapeutic apheresis market to thrive and expand. Healthcare systems must adapt to accommodate this demographic, which will likely lead to increased investments in apheresis technologies and procedures.

Enhancements in Healthcare Infrastructure

Improvements in healthcare infrastructure across India are paving the way for the expansion of the therapeutic apheresis market. Government initiatives aimed to enhance healthcare facilities. As more hospitals enhance their capabilities, the adoption of advanced medical technologies will naturally increase, fostering integration of apheresis procedures into patient care routines. With a focus on upgrading healthcare facilities and technologies, this trend will contribute significantly to the growth trajectory of the therapeutic apheresis market.

Future Outlook

The India therapeutic apheresis market is anticipated to witness substantial growth in the forthcoming years, fuelled by continuous advancements in healthcare technologies and a growing emphasis on personalized medicine. The increasing prevalence of chronic disorders, combined with rising public awareness regarding the efficacy of therapeutic apheresis, is expected to propel market expansion. Additionally, government initiatives aimed at improving healthcare infrastructure will further support growth in this vital sector.

Major Players

- Fresenius Kabi

- Haemonetics Corporation

- Terumo BCT

- Grifols S.A.

- Cerus Corporation

- BloodCenter of Wisconsin

- Nissha Medical Technologies

- Biolife Plasma Services

- Aplago AG

- Mallinckrodt Pharmaceuticals

- CSL Behring

- Octapharma AG

- Sanofi S.A.

- Medtronic

- Baxter International Inc.

Key Target Audience

- Hospitals and Healthcare Networks

- Blood Banks and Donor Centers

- Pharmaceuticals and Biotechnology Companies

- Medical Device Manufacturers

- Research and Development Institutions

- Government and Regulatory Bodies (e.g., Ministry of Health and Family Welfare)

- Investors and Venture Capitalist Firms

- Healthcare Policy Makers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive ecosystem map that includes all stakeholder groups within the India therapeutic apheresis market. This is supported by extensive desk research, utilizing a combination of secondary data and proprietary databases to gather vital industry-level information. The key objective is to pinpoint and define the essential variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the India therapeutic apheresis market will be compiled and analysed. This includes evaluating market penetration, ratios of service providers to healthcare facilities, and resultant revenue generation. Moreover, an assessment of service quality metrics will be performed to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be drafted and subsequently validated through structured interviews with industry experts representing diverse companies in the apheresis domain. These consultations will provide operational and financial insights directly from practitioners, which will be crucial for refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple therapeutic apheresis equipment manufacturers to gather detailed insights into product segments, sales performances, consumer preferences, and other pertinent factors. This interaction will help verify and enhance the information obtained via the bottom-up approach, ensuring comprehensive, accurate, and validated analysis of the India therapeutic apheresis market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Incidence of Chronic Diseases

Increasing Awareness of Apheresis Procedures - Market Challenges

High Cost of Procedures

Regulatory Challenges - Opportunities

Growth in Geriatric Population

Enhancements in Healthcare Infrastructure - Trends

Rising Demand for Therapeutics

Integration of AI in Apheresis Procedures - Government Regulation

National Policy on Blood Transfusion Services

Guidelines for Apheresis Procedures - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Procedure Type (In Value %)

Plasma Exchange

Plateletpheresis

Leukapheresis

Others - By Application (In Value %)

Neurological Disorders

Hematological Disorders

Metabolic Disorders

Renal Disorders

Others - By End User (In Value %)

Hospitals

Blood Banks

Research Institutes

Others - By Region (In Value %)

North India

South India

East India

West India

Central India - By Service Provider (In Value %)

Private Healthcare Providers

Public Healthcare Providers

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Procedure Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Procedure Type, Number of Treatment Centers, Distribution Channels, Number of Trained Professionals, Margins, Production Plant, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis for Major Players

- Detailed Profiles of Major Companies

Fresenius Kabi

Haemonetics Corporation

Terumo BCT

Cerus Corporation

BloodCenter of Wisconsin

Nissha Medical Technologies

Grifols S.A.

Biolife Plasma Services

Aplago AG

Mallinckrodt Pharmaceuticals

CSL Behring

Octapharma AG

Sanofi S.A.

Medtronic

Baxter International Inc.

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030