Market Overview

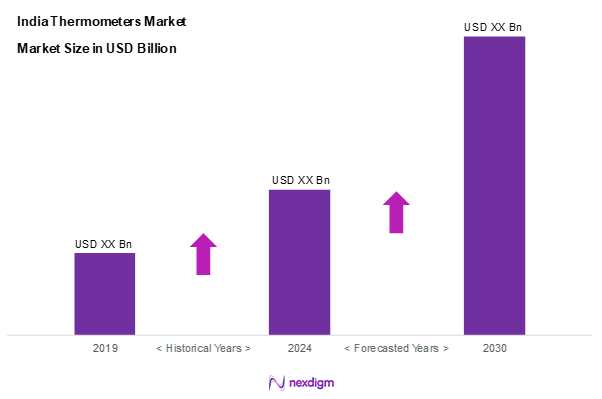

As of 2024, the India thermometers market is valued at USD 1.6 billion, with a growing CAGR of 8.4% from 2024 to 2030, reflecting significant growth influenced by an increasing focus on health awareness and a rising prevalence of chronic diseases. The shift towards home healthcare solutions has further propelled the market, increasing demand for various types of thermometers. Growing expectations around personal health monitoring during the ongoing health crises have also contributed to this robust market performance.

North India, particularly cities like Delhi and Chandigarh, and South India, with major hubs such as Bangalore and Hyderabad, dominate the market owing to higher healthcare spending and urban consumer awareness. The proliferation of hospitals and clinics in these regions further facilitates the demand for thermometers, driving sales and fostering market growth through higher consumer accessibility.

Market Segmentation

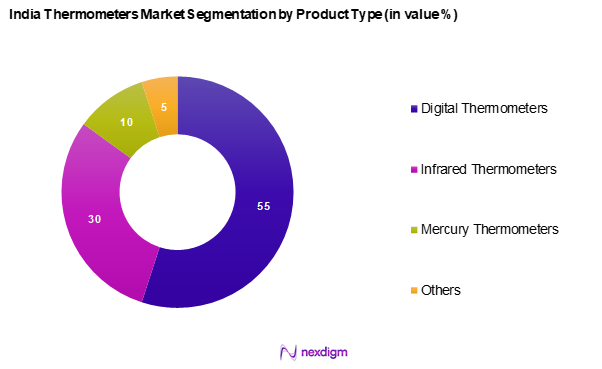

By Product Type

The India thermometers market is segmented into digital thermometers, infrared thermometers, mercury thermometers, and others. Currently, digital thermometers lead the segment, capturing a significant share of the market due to their ease of use, quick readings, and user-friendly features. Telemedicine’s rise has also enhanced acceptance as consumers look for reliable home health monitoring options, leading to increased sales of digital thermometers, even in urban and rural segments.

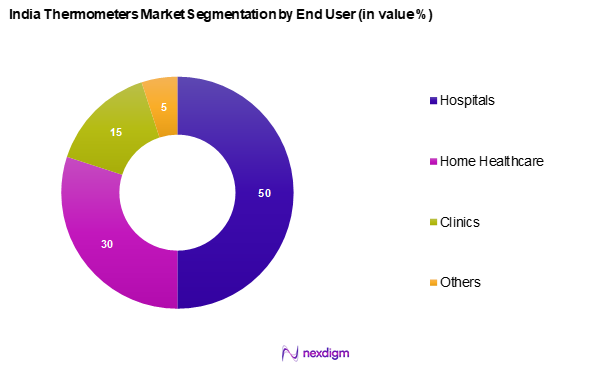

By End User

The India thermometers market is segmented into hospitals, home healthcare, clinics, and others. The hospital segment dominates the market as hospitals require multiple thermometers for various departments, including emergency and outpatient. The high volume of patient interactions necessitates reliable health monitoring tools, making hospitals a predominant user of thermometers to ensure patient care standards are upheld.

Competitive Landscape

The India thermometers market is dominated by a few major players, including prominent companies such as Thermo Fisher Scientific and OMRON Healthcare Inc. This consolidation highlights the significant influence of these key companies, which have established strong brand loyalty and extensive distribution networks.

| Company Name | Establishment Year | Headquarters | Market Presence | Product Range | R&D Investment | Distribution Channels |

| Thermo Fisher Scientific | 2006 | Massachusetts, USA | – | – | – | – |

| OMRON Healthcare Inc | 1933 | Kyoto, Japan | – | – | – | – |

| Braun GmbH | 1921 | Kronberg, Germany | – | – | – | – |

| Abbott | 1888 | Illinois, USA | – | – | – | – |

| Koninklijke Philips N.V. | 1891 | Amsterdam, Netherlands | – | – | – | – |

India Thermometers Market Analysis

Growth Drivers

Rising Health Awareness

India’s thermometer market is experiencing significant growth, driven by increasing health awareness among its population. The country has witnessed a steady rise in healthcare expenditure, reflecting a growing emphasis on health and wellness. This heightened health consciousness has led to a greater demand for medical devices, including thermometers, as individuals prioritize regular health monitoring. The COVID-19 pandemic further amplified this trend, underscoring the importance of temperature monitoring in disease prevention and control. Consequently, the thermometer market in India is poised for continued expansion, fuelled by a population increasingly invested in proactive health management.

Increase in Home Healthcare

The shift towards home-based healthcare solutions has notably influenced the demand for thermometers in India. With an increasing number of patients opting for home care, there is a heightened need for reliable medical devices to monitor health parameters, including body temperature. This trend is particularly evident among the elderly population, which is projected to constitute a significant portion of India’s demographic profile. The convenience and cost-effectiveness of home healthcare have led to a surge in the adoption of personal medical devices, thereby propelling the thermometer market forward.

Market Challenges

Regulatory Compliance Issues

Navigating the regulatory landscape poses a significant challenge for the thermometer market in India. The country has been actively updating its regulatory frameworks to ensure the safety and efficacy of medical devices. Manufacturers must adhere to stringent compliance requirements, which can be both time-consuming and resource-intensive. The emphasis on aligning domestic regulations with international standards necessitates continuous adaptation by industry players. Failure to comply can result in market entry barriers and legal repercussions, making regulatory adherence a critical aspect for companies operating in this sector.

Competition from Alternatives

The proliferation of multifunctional smart devices presents a competitive challenge to the traditional thermometer market in India. Consumers are increasingly gravitating towards wearable technology, such as smartwatches and fitness trackers, which offer integrated health monitoring features, including temperature measurement. This shift towards all-in-one devices is driven by the convenience of consolidating multiple health metrics into a single gadget. As a result, standalone thermometers face the challenge of differentiating themselves and demonstrating unique value propositions to maintain their market presence amidst the growing popularity of these versatile alternatives.

Opportunities

Expansion of E-commerce Platforms

The rapid growth of e-commerce in India offers a lucrative opportunity for the thermometer market. With a significant portion of the population embracing online shopping, medical device manufacturers can leverage digital platforms to reach a broader customer base. The convenience of online purchasing, coupled with the availability of a wide range of products, has led to increased sales of thermometers through e-commerce channels. This trend is further supported by the growing internet penetration and smartphone usage across the country, enabling consumers to access and purchase healthcare products with ease.

Growing Demand in Emerging Economies

India’s position as an emerging economy presents substantial growth opportunities for the thermometer market. The country’s expanding middle class and increasing disposable incomes have led to greater spending on healthcare products. Additionally, government initiatives aimed at improving healthcare infrastructure and accessibility have facilitated the proliferation of medical devices. The emphasis on preventive healthcare and the rising prevalence of diseases necessitating temperature monitoring further drive the demand for thermometers. These factors collectively create a favourable environment for market expansion within India’s dynamic economic landscape.

Future Outlook

Over the next five years, the India thermometers market is expected to experience significant growth driven by increased health awareness campaigns, advancements in digital health technologies, and a rising need for home healthcare solutions. The ongoing emphasis on preventive healthcare will further underscore the demand for reliable thermometers, enabling consumers to monitor their health proactively.

Major Players

- Thermo Fisher Scientific Inc.

- OMRON Healthcare Inc

- Braun GmbH

- Abbott

- Koninklijke Philips N.V.

- Honeywell International Inc.

- Sensoronics, Inc.

- Exergen

- Microlife Corporation

- Drtrust

- Citizen Systems Europe

- Medline Industries, Inc.

- NISSEI

- BPL Medical Technologies

- 3M

- Hicks Thermometers (India) Ltd

- IndoSurgicals Private Limited

- RAJ THERMOMETERS

Key Target Audience

- Healthcare Providers

- Hospitals and Clinics

- Home Healthcare Service Providers

- Industrial Enterprises

- Food Safety Agencies

- Regulatory Bodies (Central Drugs Standard Control Organization)

- Investments and Venture Capitalist Firms

- Medical Equipment Suppliers

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the ecosystem of major stakeholders in the India thermometers market. Through extensive desk research, including secondary and proprietary databases, the focus is to identify and define critical variables that drive market dynamics and understand consumer preferences.

Step 2: Market Analysis and Construction

In this step, historical data is compiled and analysed related to the India thermometers market. This involves assessing market penetration, evaluating the distribution channels, and understanding revenue generation patterns. An in-depth analysis of service quality and product performance metrics ensures the reliability and accuracy of the revenue estimates provided.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses surrounding market dynamics will be developed and validated through consultations with industry experts. These interviews, conducted via Computer-Assisted Telephone Interviews (CATI), involve professionals from various segments of the market to gather operational insights and validate the compiled data.

Step 4: Research Synthesis and Final Output

The concluding phase involves direct engagement with manufacturers and major stakeholders to acquire detailed insights concerning product segments, sales performance, and consumer preferences. By verifying and complementing the statistics derived from earlier phases, the final analysis presented will comprehensively encapsulate trends, challenges, and market opportunities within the India thermometers market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Health Awareness

Increase in Home Healthcare - Market Challenges

Regulatory Compliance Issues

Competition from Alternatives - Opportunities

Expansion of E-commerce Platforms

Growing Demand in Emerging Economies - Trends

Shift Towards Smart Thermometers

Increase in Telemedicine - Government Regulation

Medical Device Regulations

Quality Assurance Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Selling Price, 2019-2024

- By Product Type (In Value %)

Digital Thermometers

– Ear

– Oral

– Rectal

– Underarm

Infrared Thermometers

– Ear

– Forehead

– Surface

Mercury Thermometers

– Oral

– Rectal

– Underarm

Others - By End User (In Value %)

Hospitals

Home Healthcare

Clinics

Others - By Distribution Channel (In Value %)

Online Sales

Offline Sales - By Application (In Value %)

Medical

Industrial

Food

Laboratory

Others - By Type (In Value %)

Fixed

Portable

- By Region (In Value %)

North India

South India

East India

West India

Central India

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Market Penetration, Revenue Segmentation, Production Capabilities, Customer Service Strategies)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Thermo Fisher Scientific Inc.

OMRON Healthcare Inc

Braun GmbH

Abbott

Koninklijke Philips N.V.

Honeywell International Inc.

Sensoronics, Inc.

Exergen

Microlife Corporation

Drtrust

Citizen Systems Europe

Medline Industries, Inc.

NISSEI

BPL Medical Technologies

3M

Hicks Thermometers (India) Ltd

IndoSurgicals Private Limited

RAJ THERMOMETERS

- Market Demand and Utilization

- Purchasing Behaviour and Budget Allocations

- Regulatory and Compliance Requirements

- Customer Needs and Pain Points Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030