Market Overview

The India Thrust Vector Control market current size stands at around USD ~ million and reflects steady expansion supported by defense modernization and propulsion innovation. Activity levels during 2024 and 2025 indicate sustained program execution across missile and launch vehicle platforms, with increased emphasis on indigenous system development. Demand momentum is shaped by ongoing platform upgrades, higher test frequencies, and growing integration of advanced control mechanisms. The market continues to evolve with improving design maturity and localized manufacturing capabilities.

The market is primarily concentrated around major defense and aerospace hubs where testing infrastructure, research facilities, and manufacturing ecosystems are well established. Southern and central industrial corridors dominate due to proximity to propulsion laboratories, missile integration centers, and public sector production units. Policy support, defense procurement alignment, and ecosystem maturity further strengthen regional concentration, while emerging private clusters are gradually expanding capabilities through partnerships and technology transfer initiatives.

Market Segmentation

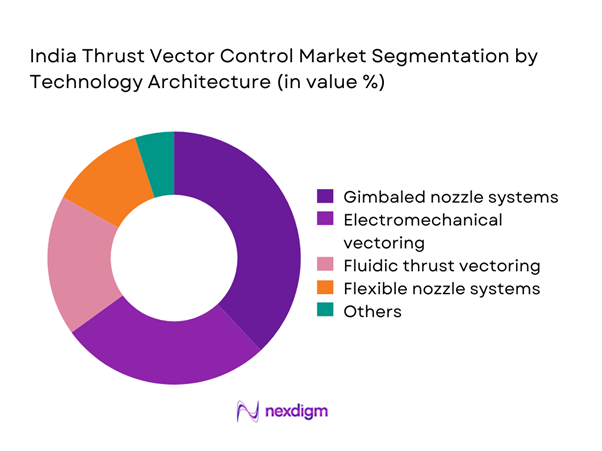

By Technology Architecture

The market is dominated by gimbaled nozzle and electromechanical thrust vectoring architectures due to their proven reliability and adaptability across missile and launch platforms. These systems are widely adopted in strategic and tactical programs where precise maneuverability and stability are essential. Fluidic and flexible nozzle systems are gradually gaining traction as research initiatives advance, especially for hypersonic and next-generation applications. Integration compatibility, control accuracy, and thermal performance continue to influence technology selection. Ongoing development programs increasingly favor modular architectures that enable scalability and easier integration with digital flight control systems. As indigenous design capabilities improve, technology diversification is expected to strengthen further.

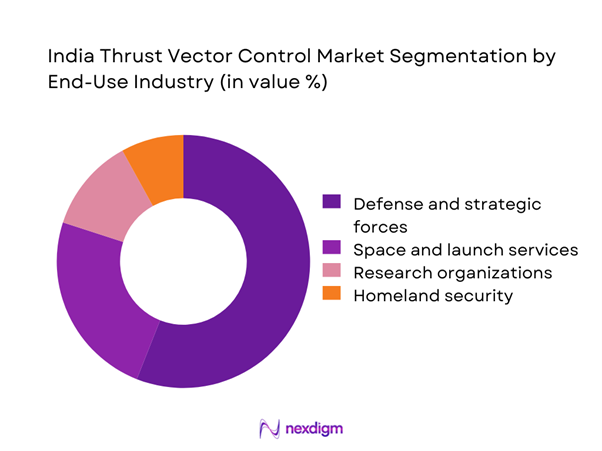

By End-Use Industry

Defense and strategic forces represent the dominant end-use segment due to continuous missile development, modernization initiatives, and operational readiness requirements. Space and launch service applications follow, supported by increasing launch frequency and indigenous vehicle development. Research and testing organizations contribute steadily through experimental programs and validation projects. Homeland security applications remain niche but are gradually expanding as precision guidance requirements increase. The demand pattern is shaped by long-term defense planning, technology absorption capacity, and the scale of indigenous manufacturing participation. End-user priorities increasingly emphasize reliability, lifecycle performance, and system interoperability.

Competitive Landscape

The competitive landscape is characterized by a mix of public sector enterprises and specialized private manufacturers engaged in propulsion and control system development. Competition is driven by technical capability, integration experience, and long-standing defense relationships. Companies focus on strengthening design depth, improving manufacturing precision, and aligning with long-term defense programs to secure recurring contracts.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Hindustan Aeronautics Limited | 1940 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Bharat Dynamics Limited | 1970 | Hyderabad | ~ | ~ | ~ | ~ | ~ | ~ |

| Larsen & Toubro Defence | 2011 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2001 | Hyderabad | ~ | ~ | ~ | ~ | ~ | ~ |

| Godrej Aerospace | 1989 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

India Thrust Vector Control Market Analysis

Growth Drivers

Indigenous missile development programs

Indigenous missile development programs continue expanding in 2024 through sustained government funding and programmatic prioritization nationwide across sectors. These programs drive consistent demand for advanced thrust vector control architectures across multiple missile categories and operational profiles. In 2024, several development cycles emphasized maneuverability improvements requiring precise directional control systems for strategic and tactical platforms. Government backed programs prioritize domestic capability creation to reduce reliance on imported propulsion subsystems across critical missile segments. This strategic emphasis increases long term procurement visibility for thrust vector control solution providers operating within India defense. Public sector design agencies collaborate closely with manufacturers to accelerate system validation timelines for critical missile programs nationwide. Such collaboration improves technology readiness levels and supports faster induction into active service across multiple defense formations nationally. Increasing test frequency during 2025 further reinforces adoption of advanced vectoring mechanisms within developmental and qualification phases programs. Policy support aligns research institutions and production entities toward common propulsion modernization goals defined by national defense roadmaps. Overall momentum sustains strong demand fundamentals for thrust vector control technologies across current and future missile development cycles.

Expansion of hypersonic research initiatives

Expansion of hypersonic research initiatives significantly elevates technical requirements for advanced thrust vector systems across high speed flight programs. These initiatives emphasize extreme maneuverability under thermal and aerodynamic stress conditions encountered during hypersonic test profiles regularly conducted. In 2024, dedicated hypersonic testing increased demand for responsive control actuation technologies within national research and defense programs. High speed regimes require precise vectoring to maintain stability and trajectory accuracy throughout complex flight envelopes under testing. Research agencies prioritize thrust modulation responsiveness as a critical system performance parameter for successful hypersonic mission execution consistently. This focus accelerates investments in advanced materials and actuator integration approaches supporting higher temperature and load tolerance requirements. Domestic laboratories increasingly collaborate with manufacturing partners to validate prototypes under simulated hypersonic operational conditions during development cycles. These collaborations shorten development timelines and reduce iteration risks associated with high speed flight control system integration efforts. Growing program maturity strengthens demand visibility for thrust vector control suppliers supporting capacity planning and long term investment. Overall, hypersonic initiatives remain a central catalyst for market expansion within India defense technology development ecosystem over time.

Challenges

High development and qualification costs

High development and qualification costs create significant entry barriers for new participants within the thrust vector control domain. Extensive testing requirements increase financial exposure during prolonged validation cycles associated with missile and launch vehicle programs nationally. Specialized infrastructure and tooling further elevate upfront investment obligations for manufacturers seeking qualification under defense standards and protocols. Qualification procedures demand repeated trials across varied environmental and performance conditions to meet operational reliability and safety benchmarks. Cost recovery timelines extend significantly due to low production volumes and limited platform deployment cycles across programs currently. Smaller suppliers face difficulty sustaining cash flows during long development phases without consistent contractual support from government agencies. This limits competitive diversity and slows innovation across the ecosystem by concentrating capabilities among few established entities only. High compliance costs further restrict rapid scaling of production capacities required for multi program deployment scenarios in India. Budget approvals often experience delays affecting supplier planning cycles and resource allocation decisions across development phases consistently observed. Overall cost intensity remains a critical restraint on faster market expansion despite strong program level demand signals nationwide.

Complex integration with guidance systems

Complex integration with guidance systems presents persistent engineering and coordination challenges across missile and launch vehicle platforms currently. Thrust vector control must synchronize precisely with navigation and control algorithms to ensure stable flight behavior under dynamic. Minor integration errors can cause instability or degraded mission performance during critical flight phases and maneuvering operations overall. Multiple subsystems must operate cohesively under extreme thermal and mechanical stress conditions experienced during high speed flight profiles. Integration complexity increases validation timelines and testing requirements significantly compared to conventional propulsion system development programs nationally observed. Coordination across avionics, propulsion, and software teams becomes increasingly critical to avoid interface conflicts during system integration activities. Any misalignment can lead to costly redesigns and schedule overruns affecting overall program delivery timelines and resource allocation. This challenge intensifies as systems adopt higher levels of autonomy and software driven control logic across defense applications. Integration testing requires extensive simulation and hardware-in-loop validation to ensure operational reliability under diverse mission profiles encountered regularly. Overall complexity remains a major technical barrier impacting deployment timelines for advanced thrust vector control systems across platforms.

Opportunities

Next-generation missile modernization programs

Next-generation missile modernization programs create substantial opportunities for advanced control technologies across strategic and tactical defense applications nationwide. Modernization efforts prioritize improved accuracy, agility, and survivability through enhanced propulsion and guidance system integration initiatives currently underway. Thrust vector control upgrades support these objectives effectively by enabling precise maneuvering and trajectory optimization capabilities during flight. Ongoing platform upgrades drive repeat demand for system enhancements across multiple missile variants and operational configurations over time. Legacy systems are increasingly retrofitted with advanced control mechanisms to extend service life and improve mission effectiveness significantly. This creates recurring upgrade cycles benefiting technology providers engaged in system integration and component supply roles nationally operating. Government focus on self-reliance accelerates adoption of indigenous solutions across missile modernization and upgrade programs being executed currently. Domestic suppliers gain long term visibility through structured procurement pipelines aligned with national defense capability development roadmaps today. Modernization programs also encourage adoption of modular system architectures supporting scalable integration across diverse platform requirements and missions. Overall, modernization initiatives represent a sustained growth avenue for thrust vector control technology providers operating within India defense.

Private sector participation in propulsion systems

Private sector participation in propulsion systems is steadily increasing nationwide through policy reforms and industrial collaboration frameworks implemented. Policy initiatives encourage private firms to enter defense manufacturing ecosystems with greater access to development contracts and testing. This broadens the supplier base for thrust vector control components across mechanical electronic and software subsystems supporting propulsion. Increased competition improves innovation and cost efficiency within the overall value chain supporting defense programs nationally today consistently. Private investment accelerates development cycles and technology maturation for advanced actuation and control mechanisms used in missile systems. Collaboration models enable knowledge transfer between public and private entities improving design capabilities and manufacturing efficiency across projects. Startups contribute agility and specialized engineering expertise to niche subsystems within thrust vector control development pipelines nationwide currently. Public-private partnerships reduce development risk and accelerate commercialization of indigenous control technologies for defense applications across platforms consistently. Such collaborations also enhance supply chain resilience by diversifying manufacturing capabilities and reducing dependency risks associated with imports. Overall participation trends support long term market sustainability through broader industrial engagement and capability development initiatives nationwide ongoing.

Future Outlook

The market is expected to maintain steady momentum driven by continued defense modernization and increasing technology localization. Advancements in propulsion control, testing infrastructure, and digital integration will shape future adoption patterns. Greater private sector involvement and policy stability are likely to strengthen long-term growth prospects. The market outlook remains positive through sustained investment and evolving operational requirements.

Major Players

- Hindustan Aeronautics Limited

- Bharat Dynamics Limited

- Larsen & Toubro Defence

- Tata Advanced Systems

- Godrej Aerospace

- BrahMos Aerospace

- MTAR Technologies

- VEM Technologies

- Alpha Design Technologies

- Data Patterns India

- Walchandnagar Industries

- Ananth Technologies

- Astra Microwave Products

- DRDO Laboratories

- Solar Industries India

Key Target Audience

- Ministry of Defence, Government of India

- Defence Research and Development Organisation

- Indian Armed Forces procurement divisions

- Aerospace and missile system manufacturers

- Tier-1 and Tier-2 propulsion component suppliers

- Investments and venture capital firms

- Defense public sector undertakings

- Strategic policy and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The study begins with identifying propulsion technologies, platform types, and application areas relevant to thrust vector control. Market boundaries and performance indicators are defined based on defense usage patterns.

Step 2: Market Analysis and Construction

Data is analyzed using program-level assessment, platform mapping, and technology adoption trends to construct market structure and segmentation logic.

Step 3: Hypothesis Validation and Expert Consultation

Findings are validated through discussions with industry professionals, engineers, and program stakeholders to ensure technical and commercial accuracy.

Step 4: Research Synthesis and Final Output

Insights are consolidated through triangulation, ensuring consistency across qualitative and quantitative inputs before final presentation.

- Executive Summary

- Research Methodology (Market Definitions and scope alignment for thrust vector control systems, Platform and propulsion-based segmentation framework, Bottom-up market sizing using program-level procurement data, Revenue attribution across development and production phases, Primary validation through defense OEMs and propulsion scientists, Triangulation using defense budgets and test program disclosures)

- Definition and Scope

- Market evolution

- Usage across missile and launch vehicle platforms

- Ecosystem structure

- Supply chain and manufacturing flow

- Regulatory and defense procurement environment

- Growth Drivers

Indigenous missile development programs

Expansion of hypersonic research initiatives

Increasing defense budget allocation to propulsion systems

Rising focus on precision strike capabilities

Growth of space launch and satellite programs

Technology transfer and indigenization mandates - Challenges

High development and qualification costs

Complex integration with guidance systems

Limited domestic supplier base

Stringent testing and validation requirements

Long procurement and approval cycles

Dependence on advanced materials and components - Opportunities

Next-generation missile modernization programs

Private sector participation in propulsion systems

Export potential to allied defense markets

Dual-use applications in space launch vehicles

Advancements in digital flight control systems - Trends

Shift toward electro-mechanical vector control

Miniaturization of actuation systems

Integration with AI-based guidance

Higher thrust-to-weight ratio designs

Increased ground and flight testing activities - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Ballistic missiles

Cruise missiles

Launch vehicles

Hypersonic test platforms

Unmanned strike systems - By Application (in Value %)

Attitude control

Trajectory correction

Terminal guidance

Stability augmentation

Launch phase maneuvering - By Technology Architecture (in Value %)

Gimbaled nozzle systems

Jet vane control

Fluidic thrust vectoring

Flexible nozzle systems

Electromechanical actuation - By End-Use Industry (in Value %)

Defense and strategic forces

Space and launch services

Research and testing organizations

Homeland security agencies - By Connectivity Type (in Value %)

Electromechanical control

Hydraulic actuation

Digital flight control integration

Autonomous control systems - By Region (in Value %)

North India

South India

West India

East India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology maturity, manufacturing capability, defense program participation, R&D intensity, integration capability, pricing competitiveness, delivery timelines, after-sales support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Hindustan Aeronautics Limited

Bharat Dynamics Limited

DRDO – Defence Research and Development Laboratory

DRDO – Liquid Propulsion Systems Centre

BrahMos Aerospace

Larsen & Toubro Defence

Tata Advanced Systems

Godrej Aerospace

MTAR Technologies

Walchandnagar Industries

Astra Microwave Products

Data Patterns India

Ananth Technologies

Alpha Design Technologies

VEM Technologies

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035