Market Overview

The India Turret Systems market current size stands at around USD ~ million, reflecting sustained defense modernization and platform upgrade programs across land and naval forces. Demand during 2024 and 2025 was supported by increased procurement of armored platforms, modernization of legacy combat vehicles, and higher integration of remotely operated weapon stations. The market continues to witness rising system integration intensity, driven by evolving battlefield doctrines and the growing emphasis on survivability, accuracy, and crew protection across operational environments.

The market is primarily concentrated across northern and western regions due to the presence of major defense manufacturing clusters, testing facilities, and operational commands. Southern India plays a key role through naval shipbuilding and system integration activities, while eastern regions support component manufacturing and testing ecosystems. Policy-driven indigenization, expanding private sector participation, and infrastructure modernization initiatives continue to strengthen domestic supply chains and accelerate technology adoption.

Market Segmentation

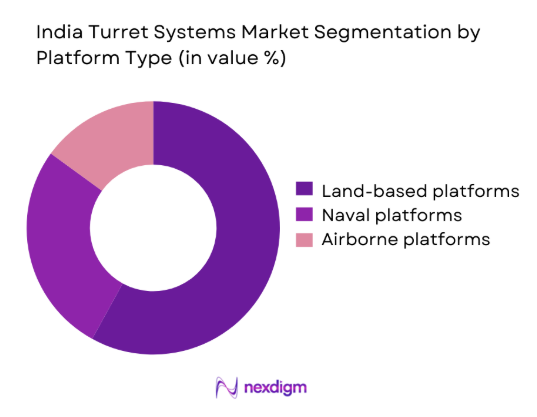

By Platform Type

The platform-based segmentation is dominated by land-based turret systems due to continuous modernization of armored fleets and infantry combat vehicles. High deployment density, replacement of aging assets, and integration of advanced fire control systems sustain strong demand across this segment. Naval turret systems represent the second-largest share, driven by coastal security upgrades and fleet expansion initiatives. Airborne and special mission platforms hold a smaller share, primarily focused on surveillance, counter-drone, and lightweight weapon integration roles. Increasing interoperability requirements and modular turret designs continue to influence platform-level demand patterns across defense forces.

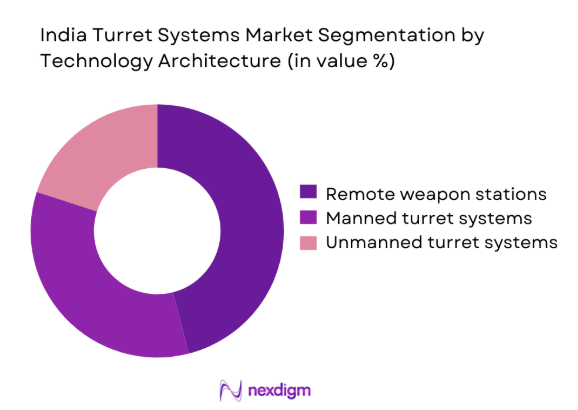

By Technology Architecture

Technology architecture segmentation is led by remote weapon stations, reflecting the shift toward crew survivability and network-enabled warfare. These systems benefit from enhanced situational awareness and reduced exposure risks. Manned turret systems continue to maintain relevance in heavy armor platforms due to firepower requirements and operational familiarity. Unmanned and autonomous turret systems are witnessing accelerating adoption driven by advancements in sensors, stabilization technologies, and battlefield automation. Hybrid architectures combining manual override and digital controls are gaining traction across multiple deployment environments.

Competitive Landscape

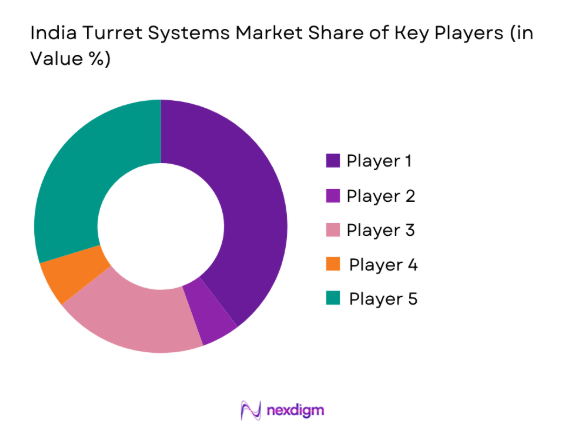

The competitive landscape of the India turret systems market is characterized by a mix of domestic defense manufacturers and international technology providers operating through partnerships and licensed production models. Competition is driven by technology depth, system reliability, compliance with defense procurement norms, and long-term support capabilities.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Bharat Electronics Limited | 1954 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Larsen & Toubro Defence | 2011 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2007 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Kalyani Strategic Systems | 2017 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Mahindra Defence Systems | 2001 | India | ~ | ~ | ~ | ~ | ~ | ~ |

India Turret Systems Market Analysis

Growth Drivers

Rising armored vehicle modernization programs

Modernization programs accelerated during 2024 and 2025 as armed forces prioritized upgrading legacy armored platforms. Procurement focus shifted toward enhanced firepower, mobility, and survivability through advanced turret integration. Indigenous development initiatives supported localized manufacturing of turret subsystems and components. Integration of stabilized weapon platforms improved operational readiness across multiple terrains. Increased cross-border security concerns reinforced the demand for advanced turret solutions. Government-backed modernization timelines sustained consistent procurement activity. Enhanced digital fire control systems improved targeting precision under dynamic conditions. System standardization improved logistics and maintenance efficiency. Platform upgrades extended lifecycle usability of existing armored fleets. These factors collectively reinforced sustained market expansion momentum.

Increasing focus on indigenous defense manufacturing

Indigenization policies strengthened domestic turret system production during 2024 and 2025. Local manufacturing reduced dependency on imports and improved supply chain resilience. Technology transfer programs enabled domestic firms to enhance system integration capabilities. Public-private partnerships accelerated design validation and production scalability. Local sourcing mandates encouraged investment in component manufacturing ecosystems. Indigenous development improved lifecycle support and maintenance responsiveness. Domestic testing facilities improved certification timelines. Policy continuity reinforced long-term production planning. Skill development initiatives enhanced engineering capabilities. These developments collectively improved competitiveness of domestically produced turret systems.

Challenges

High development and integration costs

Advanced turret systems require complex integration of sensors, fire control, and stabilization technologies. Development costs increased due to rising material and testing expenses. Integration with existing platforms often requires extensive customization efforts. Long validation cycles delay deployment timelines. Cost overruns remain a concern during prototype development phases. Budget constraints impact large-scale fleet modernization programs. Indigenous component sourcing sometimes increases initial production costs. Testing and certification processes add additional financial burdens. Technology obsolescence risks affect long-term investment planning. These factors collectively restrain rapid market scalability.

Long defense procurement cycles

Procurement timelines remain extended due to multi-stage approval mechanisms. Tender evaluation processes require extensive technical and field validations. Delays in contract finalization impact production planning stability. Changing operational requirements often lead to specification revisions. Budgetary approvals may extend across multiple fiscal periods. Vendor qualification processes are highly stringent. Compliance with offset obligations adds procedural complexity. Decision-making involves multiple defense stakeholders. Slow contracting impacts cash flow predictability for manufacturers. These structural challenges affect overall market momentum.

Opportunities

Make in India and indigenization initiatives

National manufacturing initiatives continue to expand opportunities for domestic turret system suppliers. Local content mandates encourage development of indigenous subsystems. Defense corridors support infrastructure and testing facility development. Export promotion policies open access to emerging defense markets. Collaboration with research institutions enhances technology readiness. Increased funding supports prototype development and trials. Indigenous production improves cost competitiveness over imports. Policy stability encourages long-term investment planning. Domestic demand visibility supports capacity expansion decisions. These factors create sustained growth opportunities.

Upgradation of legacy armored platforms

Large fleets of aging armored vehicles require capability upgrades to remain operationally relevant. Retrofit programs drive demand for modern turret systems. Upgrades focus on firepower, optics, and stabilization improvements. Retrofitting is cost-effective compared to new platform acquisition. Modular turret designs simplify integration with older platforms. Upgrades extend service life and operational utility. Domestic integration capabilities reduce dependency on foreign suppliers. Retrofit demand remains consistent across multiple service branches. This creates recurring revenue opportunities for system providers.

Future Outlook

The India turret systems market is expected to maintain steady growth through 2035, supported by defense modernization programs and indigenization priorities. Continued investments in armored platforms, naval assets, and autonomous systems will shape demand trends. Technological advancements in sensors and fire control will further redefine system capabilities across future deployments.

Major Players

- Bharat Electronics Limited

- Larsen & Toubro Defence

- Tata Advanced Systems

- Kalyani Strategic Systems

- Mahindra Defence Systems

- Bharat Dynamics Limited

- Advanced Weapons and Equipment India Limited

- Elbit Systems

- Rafael Advanced Defense Systems

- Saab AB

- Rheinmetall Defence

- KNDS

- Leonardo S.p.A.

- ASELSAN

- John Cockerill Defense

Key Target Audience

- Indian Army procurement divisions

- Indian Navy weapons acquisition units

- Indian Air Force modernization teams

- Ministry of Defence procurement agencies

- Defence public sector undertakings

- Private defense manufacturers

- System integrators and OEM partners

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Market scope, platform categories, technology types, and deployment environments were identified through industry mapping and defense procurement analysis.

Step 2: Market Analysis and Construction

Data was compiled using procurement trends, production patterns, and deployment activity across defense segments to construct market structure.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through consultations with defense engineers, system integrators, and former procurement officials.

Step 4: Research Synthesis and Final Output

Findings were consolidated, cross-verified, and structured to reflect market dynamics, risks, and growth opportunities.

- Executive Summary

- Research Methodology (Market Definitions and operational scope of turret systems in Indian defense platforms, segmentation framework by platform and weapon integration, bottom-up market sizing using procurement and induction data, revenue attribution by OEM contracts and retrofit programs, primary validation through defense OEMs and retired armed forces experts, triangulation using MoD budgets and import-export data, assumptions based on indigenization and modernization timelines)

- Definition and Scope

- Market evolution

- Usage and deployment architecture

- Ecosystem structure

- Supply chain and sourcing dynamics

- Regulatory and defense procurement environment

- Growth Drivers

Rising armored vehicle modernization programs

Increased focus on indigenous defense manufacturing

Border security and asymmetric warfare requirements

Naval fleet expansion and weapon upgrades

Adoption of remote and autonomous combat systems - Challenges

High development and integration costs

Long defense procurement cycles

Technology transfer and IP restrictions

Dependence on imported sub-systems

Complex certification and testing processes - Opportunities

Make in India and Atmanirbhar Bharat initiatives

Upgradation of legacy armored platforms

Export potential to emerging defense markets

Integration of AI and electro-optics

Rising demand for remote weapon stations - Trends

Shift toward unmanned and remotely operated turrets

Increased modular turret designs

Integration with battlefield management systems

Lightweight composite materials adoption

Enhanced stabilization and targeting accuracy - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land-based armored platforms

Naval combat vessels

Airborne and special mission platforms - By Application (in Value %)

Main battle tanks

Infantry fighting vehicles

Armored personnel carriers

Naval gun systems

Air defense and counter-UAS systems - By Technology Architecture (in Value %)

Manned turret systems

Remote weapon stations

Unmanned and autonomous turrets

Hybrid stabilization systems - By End-Use Industry (in Value %)

Indian Army

Indian Navy

Indian Air Force

Homeland security and paramilitary forces - By Connectivity Type (in Value %)

Standalone fire control systems

Network-enabled and C4ISR-integrated systems

AI-assisted targeting systems - By Region (in Value %)

North India

South India

West India

East India

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (product portfolio breadth, technology maturity, indigenous content level, contract wins, manufacturing capability, system integration strength, aftersales support, export presence)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Tata Advanced Systems

Larsen & Toubro Defence

Mahindra Defence Systems

Kalyani Strategic Systems

Advanced Weapons and Equipment India Limited

Bharat Dynamics Limited

Elbit Systems

Rafael Advanced Defense Systems

Saab AB

Rheinmetall Defence

KNDS (Nexter Systems)

Leonardo S.p.A.

ASELSAN

John Cockerill Defense

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035