Market Overview

The India Unmanned Aerial Systems market current size stands at around USD ~ million, reflecting sustained demand across defense, agriculture, infrastructure inspection, logistics, and disaster response missions. Procurement pipelines remain active across central and state agencies, while commercial operators continue to expand service coverage. Domestic manufacturing capacity is scaling through localization of airframes, avionics, and mission software, supported by policy incentives and procurement preferences. Platform diversity across fixed wing, rotary wing, and hybrid VTOL configurations enables mission-specific deployment across varied terrains and operational contexts.

Operational concentration is strongest around Delhi NCR, Bengaluru, Hyderabad, Pune, and Chennai due to proximity to defense establishments, aerospace clusters, testing corridors, and software engineering talent. Border states with challenging terrain exhibit higher operational density driven by surveillance needs, while agrarian belts show rapid uptake for precision agriculture. Coastal cities host growing maritime surveillance and port inspection activities. Policy clarity, corridor-based flight permissions, and maturing maintenance ecosystems further anchor demand in regions with established drone testing infrastructure and logistics connectivity.

Market Segmentation

By Platform Type

Fixed-wing platforms dominate long-range surveillance and mapping due to superior endurance and coverage efficiency, while rotary-wing systems retain relevance for vertical operations in constrained urban and mountainous environments. Hybrid VTOL adoption is accelerating as users seek runway-independent deployment with fixed-wing endurance benefits. Micro and nano platforms are increasingly preferred for close-range inspection, training, and rapid reconnaissance, supported by simplified operational approvals and portability. Platform choice is shaped by mission endurance requirements, payload integration complexity, terrain accessibility, and recovery constraints, with operators optimizing mixed fleets to balance coverage, responsiveness, and lifecycle reliability across diverse mission profiles.

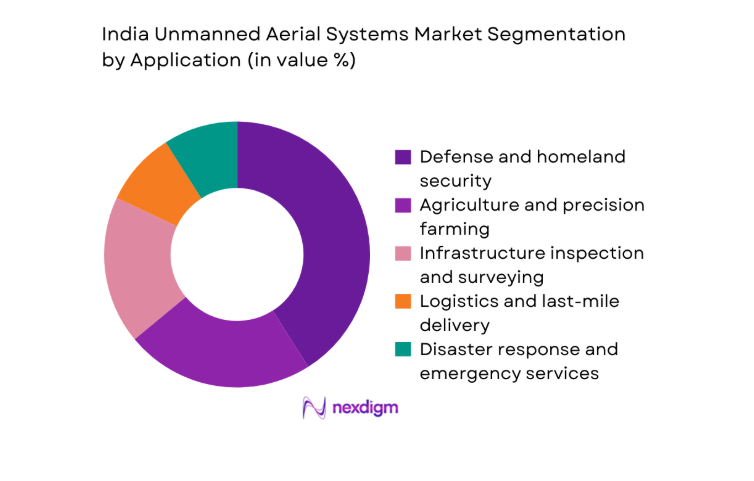

By Application

Defense and homeland security account for sustained demand due to persistent border monitoring and ISR missions, while agriculture shows rapid scaling driven by input optimization and crop health monitoring. Infrastructure inspection benefits from accelerating transport and energy corridor development, requiring repeatable aerial surveys. Logistics remains in early operational pilots but exhibits strong future relevance for time-critical deliveries. Disaster response adoption is supported by institutional protocols for rapid damage assessment and situational awareness. Media and aerial imaging maintain niche demand, primarily in urban development visualization and compliance documentation for infrastructure projects.

Competitive Landscape

The competitive landscape reflects a mix of defense-aligned manufacturers, dual-use platform developers, and service-centric operators with integrated mission software capabilities. Competitive differentiation centers on platform reliability, indigenous content depth, regulatory readiness, and service responsiveness across diverse mission environments.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| ideaForge Technology | 2007 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

| Garuda Aerospace | 2015 | Chennai | ~ | ~ | ~ | ~ | ~ | ~ |

| Asteria Aerospace | 2011 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| NewSpace Research & Technologies | 2016 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2010 | Hyderabad | ~ | ~ | ~ | ~ | ~ | ~ |

India Unmanned Aerial Systems Market Analysis

Growth Drivers

Rising defense modernization and ISR requirements

Sustained defense modernization programs expanded surveillance coverage across border sectors and maritime zones, increasing platform deployments across multiple commands. Between 2022 and 2025, annual border surveillance sorties exceeded 120000 across northern and western corridors, while coastal monitoring missions surpassed 18000 per year. Institutional focus on persistent ISR strengthened requirements for endurance above 24 hours and sensor fusion across electro optical and infrared payloads. Government approvals for indigenous trials accelerated field evaluations at over 30 testing ranges. Integration with satellite communications supported beyond line of sight missions across 12 notified corridors. Training throughput rose with 420 certified operators added annually, enabling higher operational tempo.

Government incentives for domestic drone manufacturing and PLI schemes

Policy incentives accelerated localization of airframes, avionics, and ground control systems, reducing import dependence for critical subsystems. From 2022 to 2025, notified manufacturing clusters expanded from 5 to 14 across aerospace corridors, enabling higher throughput for composite fabrication and electronics assembly. Certification approvals increased for 96 indigenous platforms, improving procurement eligibility. Export clearance volumes rose across 22 destination markets, strengthening manufacturing scale utilization. Testing and certification labs expanded from 6 to 11 facilities, shortening validation cycles by 40 days on average. Skill development programs certified 3800 technicians, supporting maintenance readiness and supply chain resilience across tier 2 cities.

Challenges

Stringent airspace and BVLOS approval constraints

Operational scaling remains constrained by airspace classification complexity and limited beyond line of sight corridors. Between 2022 and 2025, notified BVLOS corridors increased from 3 to 12, while approved flight hours per operator averaged 1400 annually, limiting fleet utilization. Urban airspace restrictions around 28 controlled zones reduce inspection productivity for infrastructure operators. Clearance processing cycles average 21 days for sensitive corridors, delaying mission scheduling for time critical deployments. Interoperability with air traffic management systems remains limited across 9 major airports, constraining mixed airspace operations. Training syllabi for BVLOS certification expanded, yet only 640 pilots qualified, slowing operational scaling.

High dependence on imported critical components

Localization gaps persist across propulsion electronics, navigation sensors, and secure communication modules. During 2022 to 2025, imported components accounted for 7 out of 10 critical bill of materials categories for mid endurance platforms. Lead times for inertial navigation modules averaged 14 weeks, exposing delivery schedules to supply disruptions. Certification delays for alternative components extended validation cycles by 60 days across multiple platform variants. Customs clearance processing for sensitive electronics averaged 9 days per consignment, affecting assembly cadence. Limited domestic testing capacity for RF modules across 4 accredited labs constrains rapid substitution, elevating operational risk for large fleet deployments.

Opportunities

Indigenization of propulsion, avionics, and sensors

Accelerated indigenization can reduce dependency risk while improving lifecycle support. From 2022 to 2025, domestic suppliers validated 18 propulsion variants and 27 avionics modules suitable for medium endurance platforms. Qualification of locally produced electro optical payloads across 9 test ranges reduced integration cycles by 35 days. Component localization improves repair turnaround times from 21 days to 9 days, improving fleet availability. Establishment of 14 electronics manufacturing clusters supports rapid prototyping for RF modules and flight controllers. Government procurement preferences for indigenous content across 6 categories create predictable demand signals for suppliers, supporting scale investment and supplier ecosystem maturation.

BVLOS corridors for logistics and medical delivery

Expansion of BVLOS corridors unlocks time critical delivery use cases across remote districts and coastal belts. Between 2022 and 2025, pilot routes connected 26 medical hubs with 74 peripheral clinics, enabling routine sample transport within 45 minutes across 80 kilometer stretches. Corridor density increased across 12 notified zones, supporting scheduled flights with 6 daily rotations per route. Integration with hospital logistics systems improved dispatch accuracy by 18 incidents per month reduction in misrouting. Weather resilience trials across 9 monsoon windows validated operations in wind speeds up to 28, supporting year round service viability and institutional adoption across emergency response networks.

Future Outlook

The market outlook reflects steady institutional adoption across defense, agriculture, and infrastructure services, supported by corridor-based operational expansion and deeper localization of components. Policy stability, BVLOS scaling, and mission software maturity will shape deployment intensity through the late 2020s. Integration with geospatial platforms and autonomous operations is expected to widen addressable use cases across logistics and emergency response.

Major Players

- ideaForge Technology

- Garuda Aerospace

- Asteria Aerospace

- NewSpace Research & Technologies

- Tata Advanced Systems

- Adani Defence & Aerospace

- Paras Defence and Space Technologies

- Hindustan Aeronautics Limited

- Zen Technologies

- Throttl Aerospace Systems

- Marut Drones

- Dhaksha Unmanned Systems

- Raphe mPhibr

- Skylark Drones

- Aerodyne India

Key Target Audience

- Defense procurement agencies within the Ministry of Defence

- State police and paramilitary procurement divisions

- National Disaster Management Authority and state disaster response forces

- Agricultural cooperatives and agritech service operators

- Logistics and last mile delivery service providers

- Infrastructure owners in energy, transport, and utilities

- Investments and venture capital firms

- Government and regulatory bodies including DGCA and Ministry of Civil Aviation

Research Methodology

Step 1: Identification of Key Variables

Platform categories, payload classes, mission profiles, regulatory pathways, certification stages, and service delivery models were mapped to structure the analytical framework. Supply chain nodes, localization depth, and maintenance readiness indicators were identified to assess ecosystem maturity. Operational corridors, pilot certification throughput, and testing capacity were included to reflect deployment constraints and scalability factors.

Step 2: Market Analysis and Construction

Demand vectors were constructed across defense, agriculture, infrastructure, logistics, and emergency response missions. Deployment intensity, corridor coverage, and platform utilization metrics were used to build activity baselines. Localization readiness, testing throughput, and certification cadence informed supply-side capability assessment.

Step 3: Hypothesis Validation and Expert Consultation

Operational assumptions were validated through practitioner insights across mission planning, maintenance operations, and regulatory compliance. Scenario testing assessed corridor expansion, localization substitution, and autonomy adoption impacts. Feedback loops refined deployment constraints, integration risks, and service delivery bottlenecks.

Step 4: Research Synthesis and Final Output

Findings were synthesized across demand, supply, regulation, and ecosystem readiness to form coherent market narratives. Cross-validation ensured consistency across operational indicators and policy pathways. Outputs were structured to support strategic planning, investment prioritization, and deployment road mapping.

- Executive Summary

- Research Methodology (Market Definitions and platform classification for UAS categories, Primary interviews with Indian UAS OEMs and subsystem suppliers, MoD and civil aviation procurement data analysis, DGCA regulatory and certification dataset review)

- Definition and Scope

- Market evolution

- Usage and mission pathways

- Ecosystem structure

- Supply chain and channel structure

- Growth Drivers

Rising defense modernization and ISR requirements

Government incentives for domestic drone manufacturing and PLI schemes

Expansion of precision agriculture and crop monitoring use cases - Challenges

Stringent airspace and BVLOS approval constraints

High dependence on imported critical components

Limited certified pilot and maintenance workforce - Opportunities

Indigenization of propulsion, avionics, and sensors

BVLOS corridors for logistics and medical delivery

Export potential to Southeast Asia, Africa, and Middle East - Trends

Rapid shift toward indigenous OEMs and localization

Adoption of drone-as-a-service business models

Growth of swarm and autonomous mission capabilities - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Platform Type (in Value %)

Fixed-wing UAVs

Rotary-wing UAVs

Hybrid VTOL UAVs

Micro and nano drones - By Range and Endurance Class (in Value %)

Short-range UAVs

Medium-range UAVs

Long-range UAVs

High-altitude long endurance UAVs - By Payload and Capability (in Value %)

ISR payloads

Electro-optical and infrared sensors

LiDAR and mapping payloads

Delivery and logistics payloads

Combat and strike payloads - By Application (in Value %)

Defense and homeland security

Agriculture and precision farming

Infrastructure inspection and surveying

Logistics and last-mile delivery

Disaster response and emergency services

Media and aerial imaging - By End User (in Value %)

Armed forces and paramilitary

Government and public agencies

Commercial enterprises

- Market share snapshot of major players

Cross Comparison Parameters (platform portfolio breadth, indigenous content ratio, regulatory approvals and certifications, price competitiveness, mission software maturity, after-sales service network, manufacturing scalability, government contract track record)

SWOT Analysis of Key Players

Pricing and Commercial Model bench marketing - Detailed Profiles of Major Companies

ideaForge Technology

Garuda Aerospace

Asteria Aerospace

NewSpace Research & Technologies

Tata Advanced Systems

Adani Defence & Aerospace

Paras Defence and Space Technologies

Hindustan Aeronautics Limited

Zen Technologies

Throttl Aerospace Systems

Marut Drones

Dhaksha Unmanned Systems

Raphe mPhibr

Skylark Drones

Aerodyne India

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035