Market Overview

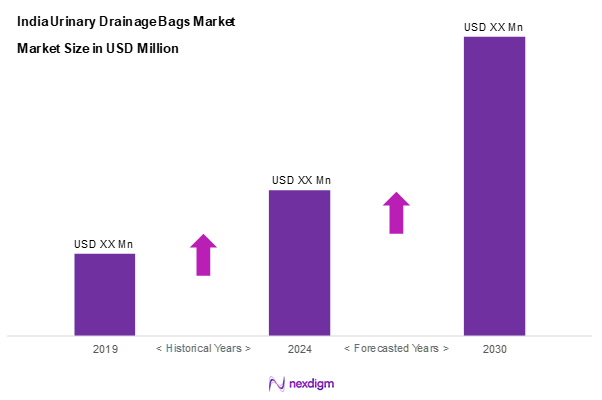

As of 2024, the India urinary drainage bags market is valued at USD 146.4 million, with a growing CAGR of 5.1% from 2024 to 2030, driven by a combination of factors including the increasing prevalence of urinary disorders and a growing geriatric population. With a focus on healthcare advancements and improving hospital infrastructure, the market stands robust, reflected by comprehensive data analysis. The market’s valuation is rooted in these dynamics alongside significant investments aimed at producing more efficient and patient-friendly products.

Within the landscape of India, urban regions such as New Delhi, Mumbai, and Bangalore emerge as significant contributors to the market’s growth. This dominance can be attributed to advanced healthcare facilities, higher patient footfalls in clinics and hospitals, and increased consumer awareness. Furthermore, these cities benefit from favourable governmental healthcare initiatives that enhance product accessibility and utilization across varied demographics.

Market Segmentation

By Product Type

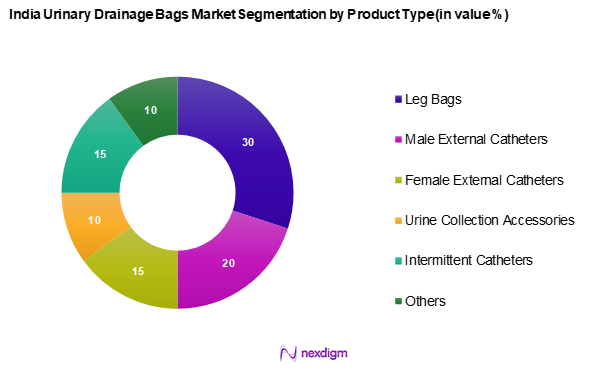

India urinary drainage bags market is segmented by into leg bags, male external catheters, female external catheters, urine collection accessories, intermittent catheters, and others. Currently, leg bags dominate the product type segmentation, primarily due to their convenience and the discreet nature of use that aligns with active patient lifestyles. They are favoured in home care settings for patients seeking mobility without compromising on comfort, providing a higher preference among both patients and caregivers.

By Material Type

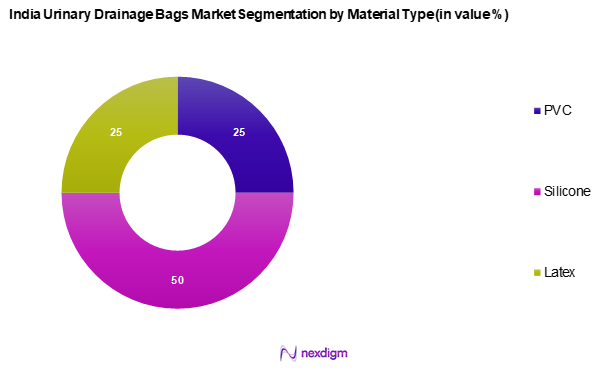

India urinary drainage bags market is segmented into PVC, silicone, and latex. Silicone leads the charge due to its biocompatibility and reduced risk of allergic reactions, making it a preferred choice among medical practitioners and institutions. This material ensures flexibility, strength, and durability, dictating its dominance as it effectively meets diverse patient needs in clinical environments.

Competitive Landscape

The India urinary drainage bags market is competitive, marked by notable companies innovating within their operational spaces. Key players demonstrate a blend of local expertise and international standards to maintain their market presence, ensuring redundancy in any single geographic market.

| Company | Establishment Year | Headquarters | Revenue | Distribution Channels | Innovation Index | Production Capacity |

| Coloplast | 1957 | Humlebæk, Denmark | – | – | – | – |

| B. Braun Melsungen AG | 1839 | Melsungen, Germany | – | – | – | – |

| Hollister Incorporated | 1921 | Illinois, USA | – | – | – | – |

| Medtronic | 1949 | Minnesota. USA | – | – | – | – |

| Smiths Medical | 1940 | Minnesota, UK | – | – | – | – |

India Urinary Drainage Bags Market Analysis

Growth Drivers

Increasing Geriatric Population

The aging population in India is a significant driver for the urinary drainage bags market, given that the elderly are more susceptible to urinary disorders. In 2022, 10.5% of India’s population was aged 60 years and above, projected to rise to 20.8% by 2050. This demographic shift escalates the demand for healthcare solutions tailored to age-related issues, thereby significantly impacting the urinary health market. As this population grows, healthcare systems will increasingly seek products that cater specifically to these individuals’ urinary management needs.

Rising Incidence of Urinary Disorders

The incidence of urinary disorders in India is rising, driven largely by lifestyle changes and increasing chronic diseases, including diabetes and cardiovascular conditions. Reports indicate that Urinary Tract Infections (UTIs) affect over 150 million people globally annually, with India experiencing a steep incline due to urbanization and changing dietary habits. This growing prevalence of urinary disorders highlights an increasing need for urinary drainage management solutions, fostering market growth and product innovation to address this healthcare challenge effectively.

Market Challenges

Product Price Sensitivity

The urinary drainage bags market faces challenges related to price sensitivity, particularly in cost-conscious regions where healthcare budgets are constrained. In 2024, nearly 20% of India’s population lives below the national poverty line, which affects healthcare spending capabilities and leads to a preference for low-cost alternatives. This creates downward pressure on product pricing, making it challenging for manufacturers to maintain quality while remaining competitive. The financial barriers amplify the risk of unmet healthcare needs, restricting product accessibility and adoption.

Competition from Local Manufacturers

Intense competition from local manufacturers poses significant challenges in the urinary drainage bags market. The presence of numerous domestic players leads to aggressive pricing strategies that can undermine profit margins for established multinational companies. In 2023, more than 60% of urinary care products in India were produced by local manufacturers, capitalizing on lower production costs and localized distribution channels. This saturation not only heightens competition but also demands innovative marketing and differentiation strategies to capture consumer attention effectively.

Opportunities

Technological Advancements in Catheters

The rapid pace of technological advancements in urinary medical devices represents a significant opportunity for growth in the urinary drainage bags market. In 2023, the adoption of smart catheters, integrated with sensors to monitor urinary output and bladder health, has been gaining momentum. Currently, over 30% of hospitals are piloting these technologies to enhance patient care and operational efficiency. With the continuous evolution of technology, there’s a scope for enhanced product offerings that can revolutionize urinary management, capturing a larger market share of health-conscious consumers.

Growing Awareness of Urinary Health

There’s a notable increase in public awareness regarding urinary health, largely due to educational campaigns and health initiatives by government and non-profit organizations. Recent surveys show that approximately 70% of urban adults are now more informed about urinary health issues and the availability of management solutions. This rise in awareness leads to increased demand for urinary products, pushing stakeholders to expand their offerings and tap into previously overlooked consumer segments, thus driving market expansion efficiently.

Future Outlook

Over the next five years, the India urinary drainage bags market is poised for substantial growth driven by advancements in medical technology, heightened healthcare spending, and increased consumer awareness of urinary health management. The push towards eco-friendly products and the rise of personalized healthcare options set the tone for innovative product offerings and competitive strategies that will define market contours in this evolving landscape.

Key Market Players

- Coloplast

- Braun Melsungen AG

- Hollister Incorporated

- Medtronic

- Smiths Medical

- Convatec Group

- Teleflex Incorporated

- Cardinal Health

- HARTMANN Group

- Stryker Corporation

- R. Bard, Inc.

- 3M Company

- Amsino International, Inc.

- Braun Medical

- Urocare Products, Inc.

Key Target Audience

- Hospitals and Healthcare Facilities

- Home Healthcare Solutions Providers

- Medical Equipment Distributors

- Specialty Clinics

- Online Retailers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Health and Family Welfare, Food and Drug Administration)

- Insurance Companies

Research Methodology

Step 1: Identification of Key Variables

This initial phase emphasizes building an exhaustive ecosystem map that covers all major stakeholders within the India urinary drainage bags market. The foundation involves extensive desk research, tapping into both secondary sources and proprietary databases to derive all-encompassing insights. It aims to outline and clarify the critical variables driving market dynamics and positions stakeholders effectively.

Step 2: Market Analysis and Construction

In this stage, historical data relating to the India urinary drainage bags market will be compiled and scrutinized. This encompasses analyzing market penetration rates and assessing the interplay between service providers and customer demands. Emphasis will be placed on revenue generation insights and service quality statistics to ascertain accuracy in the financial estimates presented.

Step 3: Hypothesis Validation and Expert Consultation

Post hypothesis development, the next step entails their validation via structured interviews with industry experts. Using Computer-Assisted Telephone Interviewing Systems (CATIS), diverse company representatives will provide critical operational and financial insights. This interaction is vital for refining assumptions and garnering validated data reflective of real-world conditions.

Step 4: Research Synthesis and Final Output

The concluding phase of the research methodology centers around engaging directly with multiple urinary drainage product manufacturers to gather in-depth insights. This engagement focuses on product segments, sales performance, and consumer preferences and perceptions. This step will ensure both the corroboration of prior data and an additional layer of detailed analysis reflective of the broader industry landscape.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Geriatric Population

Rising Incidence of Urinary Disorders - Market Challenges

Product Price Sensitivity

Competition from Local Manufacturers - Opportunities

Technological Advancements in Catheters

Growing Awareness of Urinary Health - Trends

Eco-Friendly Product Development

Increase in Home Healthcare Solutions - Government Regulation

Health and Safety Standards

Manufacturing Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Leg Bags

Male External Catheters

Female External Catheters

Urine Collection Accessories

Intermittent Catheters

Others - By Material Type (In Value %)

PVC

Silicone

Latex - By End User (In Value %)

Hospitals

Home Care

Clinics

Ambulatory Surgical Centers

Others - By Distribution Channel (In Value %)

Online

Offline - By Capacity (In Value %)

0-500 ml

500-1000 ml

1000-2000 ml

More than 2000 ml - By Usage (In Value %)

Reusable

Disposable - By Region (In Value %)

North India

South India

East India

West India

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Product Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Coloplast

B. Braun Melsungen AG

Hollister Incorporated

Medtronic

Smiths Medical

Convatec Group

Teleflex Incorporated

Cardinal Health

HARTMANN Group

Stryker Corporation

C. R. Bard, Inc.

3M Company

Amsino International, Inc.

Braun Medical

Urocare Products, Inc.

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030