Market Overview

The India UXO Detection Market market current size stands at around USD ~ million, driven by increased clearance activities across 28 states and multiple high-risk corridors. Operational demand is supported by more than 300 identified legacy contamination zones, over 40 active infrastructure clusters, and expanding offshore projects. Detection deployments increased across army engineering units and civilian contractors, with over 120 multi-sensor systems operational. Technological upgrades accelerated, including wider use of electromagnetic induction and ground-penetrating radar platforms across varied terrains and climatic conditions.

Northern and eastern regions dominate activity due to historical conflict exposure, dense infrastructure expansion, and border-focused security priorities. Coastal states show growing demand linked to port modernization, offshore energy, and shipping lane safety. Metropolitan regions act as operational hubs because of mature contractor ecosystems, skilled workforce availability, and proximity to defense procurement centers. Policy emphasis on infrastructure safety, combined with centralized clearance approvals, further concentrates demand in regions with established regulatory coordination mechanisms.

Market Segmentation

By Application

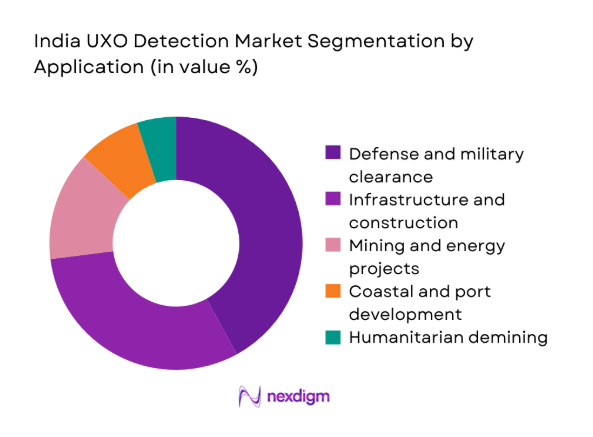

Defense and military clearance applications dominate due to persistent border security operations, training ground safety requirements, and routine clearance of legacy ammunition zones. Infrastructure-led applications follow closely, supported by highway expansion, rail corridor modernization, and urban redevelopment projects intersecting historically sensitive land. Mining, energy, and coastal development contribute steadily, particularly where environmental clearances mandate pre-construction surveys. Humanitarian demining remains limited but structured, driven by rehabilitation needs and state-led land recovery initiatives. Application dominance reflects risk exposure, regulatory enforcement, and operational funding continuity.

By Technology Architecture

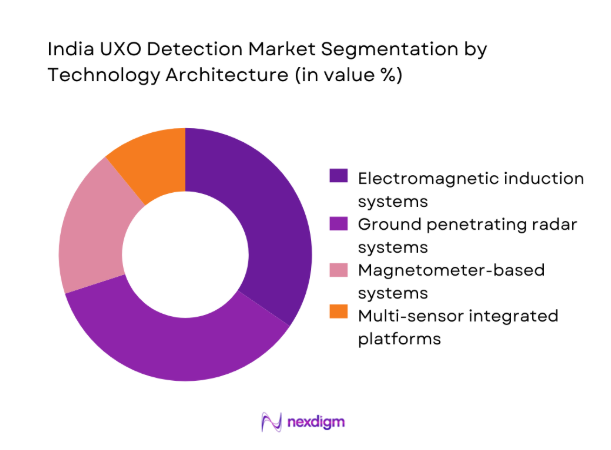

Electromagnetic induction systems lead adoption due to reliability, ease of deployment, and suitability across soil conditions. Ground penetrating radar systems are increasingly preferred for complex terrains requiring deeper subsurface visibility and object differentiation. Magnetometer-based systems maintain relevance in rapid scanning and low-interference environments. Integrated multi-sensor platforms are gaining momentum as agencies prioritize detection accuracy, data fusion, and reduced false positives. Technology choices are influenced by terrain complexity, clearance depth requirements, and operational time constraints.

Competitive Landscape

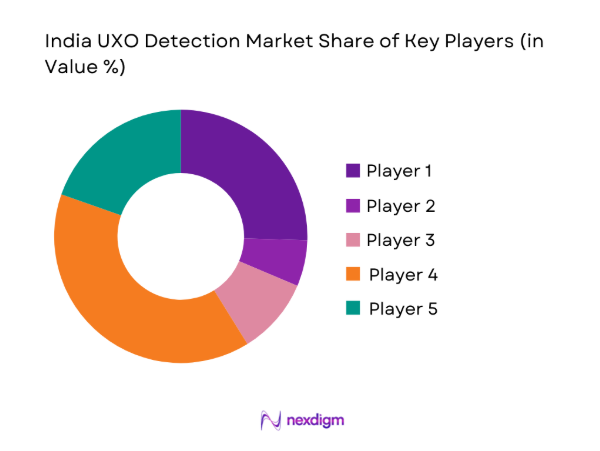

The competitive landscape is moderately consolidated, with global defense technology providers coexisting alongside domestic manufacturers and specialized service contractors. Market participation is shaped by certification readiness, ability to support field operations, and alignment with government procurement frameworks.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Saab AB | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Bharat Electronics Limited | 1954 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

India UXO Detection Market Analysis

Growth Drivers

Rising defense modernization and border security focus

Defense modernization programs increased operational deployments across multiple border sectors during 2024, driving sustained demand for advanced unexploded ordnance detection capabilities. Army engineering units expanded clearance exercises supporting mobility corridors, logistics nodes, and forward bases requiring continuous terrain validation. Technology upgrades emphasized improved detection depth, faster scanning, and reduced false alarms under diverse soil conditions. Procurement cycles favored systems compatible with existing command architectures and standardized training protocols. Domestic manufacturing initiatives encouraged partial localization of components supporting strategic autonomy objectives. Joint exercises increased exposure to advanced detection practices. Training intensity expanded across more than 20 specialized engineering regiments nationwide. Operational readiness benchmarks tightened inspection frequency. Field trials validated multi-sensor performance. Defense-led demand remains structurally resilient.

Expansion of infrastructure projects in legacy conflict zones

Infrastructure expansion intersecting historically sensitive land parcels intensified survey requirements across highways, railways, and industrial corridors during 2025. Project authorities mandated pre-construction clearance to mitigate safety risks and project delays. Detection contractors engaged earlier within planning cycles, expanding service scope beyond reactive interventions. Urban redevelopment increased subsurface investigations in previously restricted zones. State agencies coordinated clearance schedules with construction milestones. Multilateral funding programs emphasized safety compliance. Remote and difficult terrains demanded adaptable detection platforms. Project timelines compressed operational windows. Data documentation standards strengthened accountability. Infrastructure-driven demand diversified end-user participation.

Challenges

High capital cost of advanced detection systems

Advanced detection platforms require substantial upfront investment, limiting adoption among smaller contractors during 2024 operational cycles. Budget constraints influence procurement decisions toward refurbished or lower-specification systems. Import dependency for specialized components increases financial exposure. Maintenance and calibration requirements add ownership complexity. Tender evaluations prioritize cost compliance alongside performance benchmarks. Smaller projects defer comprehensive surveys. Leasing models remain underdeveloped. Financial planning uncertainties delay technology upgrades. Capital barriers restrict rapid fleet expansion. Cost sensitivity shapes competitive dynamics.

Limited skilled EOD personnel availability

Availability of certified explosive ordnance disposal personnel remains constrained, affecting operational scalability across regions during 2025. Training pipelines require extended certification timelines. Experienced operators are concentrated within defense organizations. Civilian contractors face retention challenges. High-risk operational conditions increase workforce attrition. Skill gaps limit deployment of advanced multi-sensor platforms. Scheduling conflicts delay project execution. Regional imbalances persist. Knowledge transfer remains fragmented. Human capital constraints cap utilization efficiency.

Opportunities

Growth in smart infrastructure and urban redevelopment

Smart city initiatives expanded subsurface mapping and safety validation requirements across redevelopment zones in 2024 and 2025. Integrated planning frameworks favor early-stage detection integration. Digital documentation enhances clearance traceability. Municipal agencies allocate dedicated safety budgets. Brownfield redevelopment increases risk exposure awareness. Technology-enabled workflows improve coordination. Public-private partnerships facilitate service engagement. Data-driven planning reduces rework. Urban density necessitates precision detection. Infrastructure digitization strengthens long-term demand.

Adoption of UAV-based and autonomous detection platforms

Unmanned aerial and ground platforms gained pilot-level acceptance for rapid surveys across difficult terrains during recent operational cycles. Autonomous systems reduce personnel exposure risks. Data collection efficiency improves coverage rates. Sensor miniaturization supports airborne integration. Regulatory frameworks gradually accommodate unmanned operations. Defense trials validate tactical applications. Civilian agencies explore hybrid deployment models. Automation lowers long-term operating burdens. Technology maturation accelerates vendor innovation. Adoption potential remains significant.

Future Outlook

The India UXO Detection Market outlook through 2035 reflects sustained defense requirements, infrastructure-led demand, and gradual technology modernization. Policy alignment, localization initiatives, and unmanned systems adoption are expected to reshape operational models. Capacity building and workforce development will remain central to long-term market stability and performance improvement.

Major Players

- Saab AB

- L3Harris Technologies

- Thales Group

- Rheinmetall AG

- Bharat Electronics Limited

- Elbit Systems

- Leonardo S.p.A.

- Raytheon Technologies

- BAE Systems

- Chemring Group

- Vallon GmbH

- Minelab

- Safran Group

- Schiebel Group

- DRDO

Key Target Audience

- Ministry of Defence procurement departments

- Indian Army Corps of Engineers

- National Highways Authority of India

- Port authorities and maritime boards

- State urban development agencies

- Mining and energy project developers

- Infrastructure-focused EPC contractors

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Focused on identifying operational definitions, clearance scope boundaries, and technology classifications specific to unexploded ordnance detection activities.

Step 2: Market Analysis and Construction

Involved constructing the market framework through application mapping, deployment patterns, and technology usage assessment across defense and civilian domains.

Step 3: Hypothesis Validation and Expert Consultation

Emphasized hypothesis validation through consultations with field operators, engineering units, and project authorities.

Step 4: Research Synthesis and Final Output

Synthesized findings into coherent insights, aligning qualitative validation with structured analytical outputs.

- Executive Summary

- Research Methodology (Market Definitions and operational UXO scope delineation, Defense and infrastructure-linked segmentation framework design, Bottom-up estimation using system deployments and survey coverage, Revenue attribution across hardware systems and service contracts, Primary validation through defense agencies and EOD experts, Triangulation using procurement data and field activity reconciliation, Assumptions on classified programs and regional clearance intensity)

- Definition and Scope

- Market evolution

- Usage and clearance pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory and safety environment

- Growth Drivers

Rising defense modernization and border security focus

Expansion of infrastructure projects in legacy conflict zones

Increased offshore and coastal development activities

Stricter safety compliance in mining and construction

Government-backed clearance programs and funding

Technological advancements in multi-sensor detection - Challenges

High capital cost of advanced detection systems

Limited skilled EOD personnel availability

Operational complexity in diverse terrains

Data accuracy limitations in legacy contamination zones

Procurement delays and lengthy tender cycles

Restrictions linked to classified defense programs - Opportunities

Growth in smart infrastructure and urban redevelopment

Adoption of UAV-based and autonomous detection platforms

Public–private partnerships for clearance operations

Export potential for India-based service providers

Integration of AI-driven data interpretation

Expansion of humanitarian clearance initiatives - Trends

Shift toward multi-sensor and fused detection systems

Increasing use of unmanned ground and aerial vehicles

Localization of manufacturing under defense indigenization

Service-based contracts and long-term maintenance models

Digital mapping and GIS-enabled clearance planning

Focus on faster survey-to-clearance turnaround - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Ground-based detection systems

Airborne detection platforms

Marine and underwater detection systems - By Application (in Value %)

Defense and military clearance

Infrastructure and construction surveys

Mining and energy projects

Coastal and port development

Humanitarian demining operations - By Technology Architecture (in Value %)

Electromagnetic induction systems

Ground penetrating radar systems

Magnetometer-based systems

Multi-sensor integrated platforms - By End-Use Industry (in Value %)

Defense and homeland security

Construction and infrastructure

Oil, gas, and energy

Ports, shipping, and marine engineering

Humanitarian and NGO-led programs - By Connectivity Type (in Value %)

Standalone systems

Networked and integrated command systems - By Region (in Value %)

North India

South India

West India

East India

Northeast India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Technology capability, Detection depth and accuracy, Platform mobility, Compliance and certification, Pricing structure, Service and training support, Localization presence, Contracting model)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Saab AB

L3Harris Technologies

Elbit Systems

Thales Group

Raytheon Technologies

BAE Systems

Rheinmetall AG

Leonardo S.p.A.

Safran Group

Chemring Group

Vallon GmbH

Minelab

Schiebel Group

Bharat Electronics Limited

DRDO

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035