Market Overview

The India vehicle intercom system market current size stands at around USD ~ million, supported by ~ units deployed across commercial, defense, and emergency fleets. In 2024, installations crossed ~ units, while 2025 witnessed incremental additions of ~ units driven by fleet modernization. Average system penetration per fleet reached ~ percent in organized transport segments. Replacement demand accounted for ~ percent of deployments. OEM-fitment ratios improved by ~ points between 2024 and 2025. System complexity levels increased steadily.

The market shows strong concentration across metropolitan regions including Delhi NCR, Mumbai, Bengaluru, Chennai, and Pune due to dense fleet operations. Southern and western corridors benefit from mature bus transport infrastructure and higher private operator participation. Defense manufacturing clusters support localized demand. Policy-led urban mobility programs accelerate adoption in tier-one cities. Supply ecosystems remain strongest near automotive hubs. Aftermarket networks remain fragmented across tier-two regions.

Market Segmentation

By Fleet Type

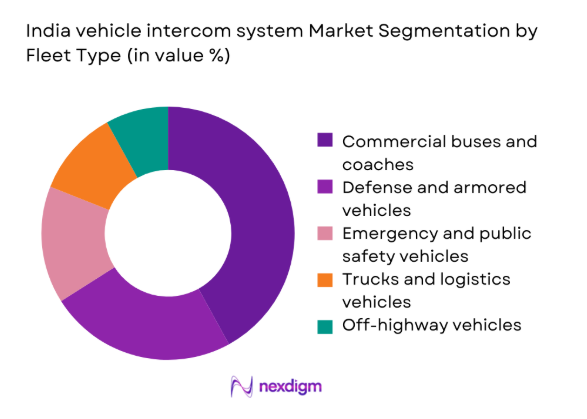

Commercial buses and coaches dominate demand due to continuous fleet expansion, higher passenger density, and mandatory communication requirements. Public transport undertakings increasingly prioritize driver-to-passenger communication to improve safety and service reliability. Defense and armored vehicles form a specialized segment with stringent specifications and longer procurement cycles. Emergency vehicles show steady uptake driven by operational coordination needs. Logistics vehicles remain an emerging segment, limited by cost sensitivity and lower perceived necessity. Overall dominance is shaped by utilization intensity, regulatory scrutiny, and system standardization levels across fleet categories.

By Technology Architecture

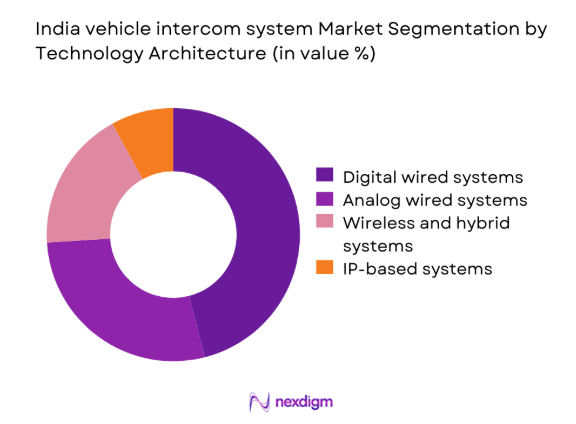

Digital wired intercom systems lead adoption due to reliability, noise management, and compatibility with existing vehicle electronics. Analog systems persist in cost-sensitive fleets, particularly in older buses. Wireless and hybrid systems gain traction in premium coaches and defense platforms where flexibility is prioritized. IP-based architectures remain limited but growing, supported by integration with telematics and infotainment systems. Technology choice is influenced by operating environment, lifecycle expectations, and maintenance capabilities. The transition reflects broader vehicle digitization trends and modular electronics strategies.

Competitive Landscape

The competitive landscape is moderately consolidated, characterized by a mix of global electronics suppliers and domestic defense-focused manufacturers. Competition centers on system reliability, customization capability, and long-term service support rather than aggressive pricing alone.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Bosch Limited | 1951 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Panasonic Automotive Systems | 1959 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Bharat Electronics Limited | 1954 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

India vehicle intercom system Market Analysis

Growth Drivers

Rising focus on passenger safety and communication compliance

Passenger safety regulations increasingly mandate clear in-vehicle communication, pushing operators to standardize intercom installations across public and private fleets. Urban transport authorities emphasize emergency announcements, influencing procurement specifications and accelerating adoption across organized bus networks. In 2024, compliance audits increased by ~ percent, reinforcing operator accountability for communication readiness. Intercom systems support incident response, reducing operational risk exposure for fleet owners. Safety-driven investments align with broader service quality benchmarks. Operators perceive communication systems as essential risk mitigation tools. Passenger expectations for real-time updates continue rising across metropolitan routes. Improved safety perception enhances ridership confidence and utilization. System reliability directly impacts compliance outcomes and penalties. These factors collectively sustain consistent baseline demand.

Expansion of public bus fleets under urban mobility programs

Government-backed urban mobility initiatives continue expanding bus fleets to address congestion and emissions challenges across major cities. New bus inductions increasingly include factory-fitted communication systems as standard specifications. In 2025, fleet additions exceeded ~ units under city transport programs. Intercom requirements are embedded within tender documentation and technical evaluations. Public transport corporations prioritize uniform passenger communication across routes. Budget allocations favor safety and accessibility features. Centralized procurement accelerates volume adoption. Fleet standardization reduces installation variability. Long-term maintenance contracts further support intercom vendors. This structural expansion anchors predictable demand growth.

Challenges

High price sensitivity among fleet operators

Fleet operators remain highly sensitive to upfront system costs, especially within privately owned and regional transport segments. Capital expenditure constraints limit adoption beyond mandatory compliance. Operators often prioritize visible vehicle upgrades over communication infrastructure. In 2024, deferred procurement affected ~ percent of planned installations. Return justification for intercom investments remains weak for low-density routes. Aftermarket pricing variability complicates budgeting decisions. Smaller fleets lack negotiation leverage. Financing options for auxiliary electronics remain limited. Cost concerns delay technology upgrades. This sensitivity restrains rapid penetration expansion.

Limited awareness in mid-scale transport fleets

Mid-scale fleet operators demonstrate limited awareness regarding operational benefits of advanced intercom systems beyond basic announcements. Decision-makers often underestimate productivity and safety improvements. Training gaps reduce perceived system value. In 2025, awareness-led adoption lagged by ~ percent compared to organized fleets. Marketing outreach remains concentrated on large operators. Technical complexity discourages engagement. Lack of demonstration deployments limits exposure. Peer benchmarking is minimal. Awareness gaps slow replacement cycles. Education remains a critical barrier.

Opportunities

Smart city driven demand for advanced bus communication systems

Smart city initiatives increasingly integrate public transport digitization, creating demand for advanced communication and passenger information systems. Intercom platforms align with real-time alerting and emergency response frameworks. City command centers emphasize integrated vehicle communication. Pilot deployments demonstrate improved service responsiveness. Multi-system integration opportunities expand scope beyond standalone intercoms. Urban authorities prioritize technology-enabled safety solutions. Interoperability requirements favor scalable architectures. Funding support reduces operator risk. Smart corridors accelerate adoption momentum. This environment creates sustained opportunity.

Localization and Make-in-India manufacturing potential

Localization policies encourage domestic manufacturing of vehicle electronics, including communication systems, to reduce import dependence. Local production improves cost competitiveness and supply reliability. Defense procurement strongly favors indigenized solutions. In 2024, localized component sourcing improved by ~ points. Shorter lead times benefit fleet operators. Customization for Indian operating conditions becomes feasible. Vendor partnerships with OEMs strengthen. Export potential to regional markets increases. Policy incentives enhance investment attractiveness. Localization supports long-term scalability.

Future Outlook

The market outlook remains positive through 2035, supported by sustained urban transport expansion and vehicle digitization. Public safety emphasis will continue shaping procurement priorities. Technology evolution toward integrated communication platforms will redefine competitive differentiation. Localization efforts are expected to strengthen domestic capabilities. Adoption will gradually deepen across mid-scale fleets as awareness improves.

Major Players

- Bosch Limited

- Panasonic Automotive Systems India

- Alpine Electronics

- Sena Technologies

- Thales Group

- Elbit Systems

- L3Harris Technologies

- Rheinmetall AG

- Saab AB

- Bharat Electronics Limited

- MKU Limited

- Cobham Limited

- Honeywell International

- Tata Advanced Systems

- Vocom Technologies

Key Target Audience

- Public transport undertakings and state road transport corporations

- Private bus and coach fleet operators

- Defense vehicle procurement agencies under Ministry of Defence

- Emergency and public safety service operators

- Automotive OEMs and body builders

- Tier-one automotive electronics suppliers

- Investments and venture capital firms focused on mobility technologies

- Government and regulatory bodies including Ministry of Road Transport and Highways

Research Methodology

Step 1 Identification of Key Variables

This step involved identifying core vehicle intercom system components, applications, and fleet categories relevant to Indian mobility platforms. Market boundaries were defined by distinguishing OEM-fitment and aftermarket retrofit use cases. Technology architectures and connectivity formats were mapped to establish analytical scope.

Step 2 Market Analysis and Construction

This phase focused on constructing the market using fleet parc analysis, system installation ratios, and technology penetration patterns. Demand assessment emphasized public transport, defense vehicles, and emergency fleets. Adoption intensity was evaluated across organized and unorganized operator segments.

Step 3 Hypothesis Validation and Expert Consultation

Market assumptions were validated through consultations with fleet managers, OEM engineers, system integrators, and procurement officials. Insights helped refine adoption timelines, deployment challenges, and system specification preferences. Feedback loops ensured alignment with real-world operational practices.

Step 4 Research Synthesis and Final Output

Quantitative findings were synthesized with qualitative insights to develop coherent market narratives. Cross-validation ensured internal consistency across segments and use cases. The final output integrates structural analysis with forward-looking perspectives to support strategic decision-making.

- Executive Summary

- Research Methodology (Market Definitions and vehicle intercom system scope delineation for Indian mobility platforms, Product and application taxonomy mapping across commercial and defense vehicles, Bottom-up market sizing using OEM fitment and retrofit shipment data, Revenue attribution across hardware modules software and services, Primary interviews with fleet operators OEM engineers and defense procurement officials)

- Definition and Scope

- Market evolution

- Usage and in-vehicle communication workflows

- Ecosystem structure

- Supply chain and distribution channels

- Regulatory and safety environment

- Growth Drivers

Rising focus on passenger safety and communication compliance

Expansion of public bus fleets under urban mobility programs

Modernization of defense vehicle communication systems

Growth in long-haul logistics and fleet digitization

Increased adoption of premium coaches and tourism transport

Integration of intercoms with telematics and infotainment - Challenges

High price sensitivity among fleet operators

Limited awareness in mid-scale transport fleets

Complex retrofitting in older vehicle models

Interoperability issues across vehicle platforms

Dependence on imported components

Lengthy defense procurement cycles - Opportunities

Smart city driven demand for advanced bus communication systems

Localization and Make-in-India manufacturing potential

Aftermarket retrofit solutions for legacy fleets

Integration with ADAS and driver monitoring systems

Growth of electric buses and next-gen platforms

Export opportunities to neighboring South Asian markets - Trends

Shift from analog to digital and IP-based intercoms

Wireless intercom adoption in premium and defense vehicles

Bundling of intercoms with infotainment systems

Voice clarity enhancement using noise cancellation

Use of modular and scalable architectures

Increased OEM-factory fitment rates - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Commercial buses and coaches

Trucks and logistics vehicles

Emergency and public safety vehicles

Defense and armored vehicles

Off-highway and construction vehicles - By Application (in Value %)

Driver to passenger communication

Crew to crew coordination

Driver to control room communication

Emergency announcement and alert systems

Training and simulation use - By Technology Architecture (in Value %)

Analog wired intercom systems

Digital wired intercom systems

Wireless and hybrid intercom systems

IP-based intercom platforms - By End-Use Industry (in Value %)

Public transportation

Logistics and freight

Defense and homeland security

Mining and construction

Tourism and luxury transport - By Connectivity Type (in Value %)

Wired point-to-point

CAN and vehicle bus integrated

Wireless RF based

Cellular and LTE enabled - By Region (in Value %)

North India

South India

West India

East India

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (product portfolio breadth, technology architecture, OEM partnerships, pricing strategy, localization level, service network strength, defense certifications, innovation roadmap) - SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Bosch Limited

Panasonic Automotive Systems India

Alpine Electronics

Sena Technologies

Vocom Technologies

Thales Group

Elbit Systems

L3Harris Technologies

Rheinmetall AG

Saab AB

Bharat Electronics Limited

MKU Limited

Cobham Limited

Honeywell International

Tata Advanced Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service and maintenance expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035