Market Overview

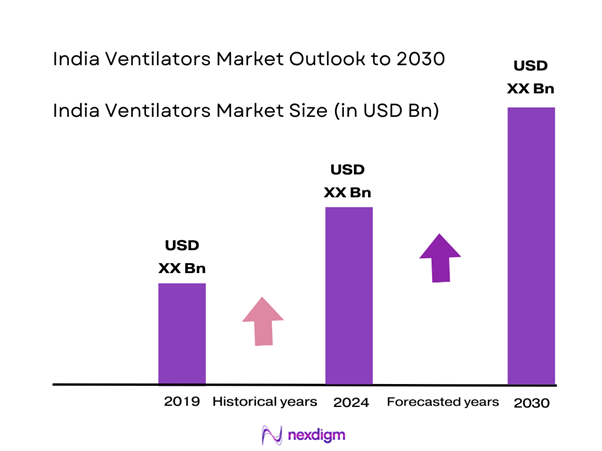

The India Ventilators Market is valued at USD 400 million in 2024 with an approximated compound annual growth rate (CAGR) of 8.12% from 2024-2030, based on a five-year historical analysis. This growth is driven primarily by an increasing prevalence of respiratory diseases, heightened awareness of patient care requirements in healthcare facilities, and advancements in ventilator technologies offering enhanced functionality. The COVID-19 pandemic significantly accelerated the demand for ventilators, leading to a surge in both domestic production capabilities and imports to meet urgent healthcare needs.

Major cities such as Mumbai, Delhi, and Bengaluru exhibit significant market dominance due to their well-established healthcare infrastructure and concentration of hospitals and medical facilities. Additionally, these regions benefit from the presence of key state and regional government initiatives aimed at improving healthcare services. Consequently, the demand for ventilators continues to rise, facilitating the expansion of the market in this prominent urban landscape.

Advancements in medical technology are revolutionizing the ventilators sector. According to a report by the Medical Device Rules in India, the introduction of smart ventilators equipped with advanced algorithms and artificial intelligence capabilities has significantly improved patient outcomes and operational efficiency in critical care settings.

Market Segmentation

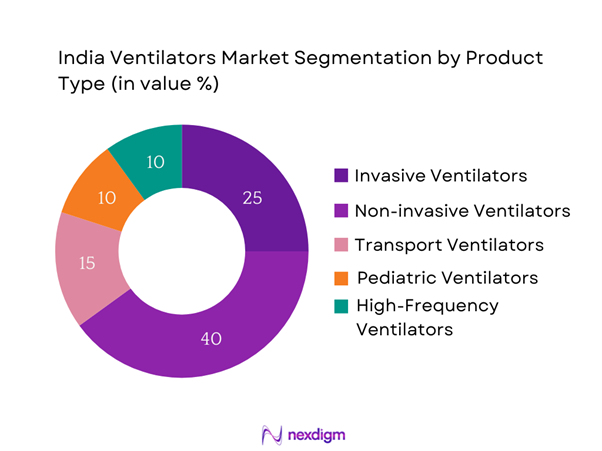

By Product Type

The India Ventilators Market is segmented by product type into invasive ventilators, non-invasive ventilators, transport ventilators, pediatric ventilators, and high-frequency ventilators. Among these, non-invasive ventilators dominate the segment due to their growing use in home care settings and critical care units. Their popularity stems from their ability to provide effective respiratory support with minimal discomfort for patients, thereby improving compliance and quality of life. Furthermore, advancements in technology have led to the development of compact, easy-to-use devices that cater to a wide range of patient needs, enhancing their market position.

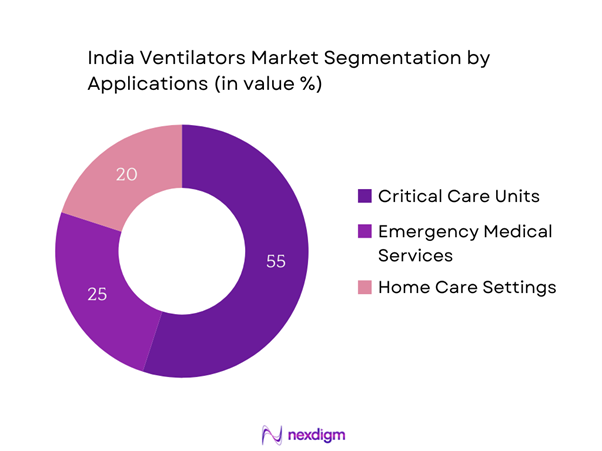

By Application

The India Ventilators Market is also segmented by application into critical care units, emergency medical services, and home care settings. Critical care units hold a dominant share, driven by the increasing number of intensive care beds, the rising incidence of chronic respiratory diseases, and the swift growth in neonatology departments across hospitals. Enhanced funding for healthcare infrastructure has further bolstered this segment’s growth, as hospitals upgrade their facilities to offer better patient outcomes, thereby increasing the demand for advanced ventilatory support in critical conditions.

Competitive Landscape

The India Ventilators Market is dominated by a few major players, including local manufacturers and international brands. This consolidation highlights the significant influence of these key companies, which play a crucial role in shaping the market landscape through innovation and competitive pricing strategies.

| Company Name | Establishment Year | Headquarters | Market Cap | Key Products | Key Markets | Distribution Channels |

| Philips Healthcare | 1891 | Amsterdam, Netherlands | – | – | – | – |

| Medtronic | 1949 | Dublin, Ireland | – | – | – | – |

| Siemens Healthineers | 1847 | Erlangen, Germany | – | – | – | – |

| Drägerwerk | 1889 | Lübeck, Germany | – | – | – | – |

| GE Healthcare | 1892 | Chicago, USA | – | – | – | – |

India Ventilators Market Analysis

Growth Drivers

Rising Incidence of Respiratory Diseases

The increasing prevalence of respiratory diseases in India significantly fuels the demand for ventilators. According to the Global Burden of Disease Study, approximately 147 million individuals in India suffer from chronic respiratory diseases, including chronic obstructive pulmonary disease (COPD) and asthma, which accounts for a substantial number of hospital admissions every year. Furthermore, the World Health Organization (WHO) reported that approximately 1.2 million deaths were caused by COPD alone in India in 2022. This alarming health crisis necessitates increased investment in respiratory care technologies, including ventilators, to support affected populations effectively.

Increasing Geriatric Population

India’s geriatric population is on a steep rise, with projections estimating that individuals aged 60 and above will reach approximately 316 million by 2030. This increase directly impacts the demand for healthcare services tailored for age-related conditions, which often include respiratory issues. Statistically, around 35% of the elderly population is expected to suffer from at least one chronic health condition, necessitating interventions such as mechanical ventilation. The growing need for ventilatory support in elder care facilities illustrates a critical driver for the ventilator market.

Market Challenges

Chain Disruptions

Significant supply chain challenges are currently impacting the ventilators market in India. The COVID-19 pandemic exposed vulnerabilities in the manufacturing and supply chain of essential medical devices, leading to constraints in both domestic production and imports. The Ministry of Commerce and Industry highlighted in 2022 that disruptions caused by global shipping delays and increased raw material costs have led to a production backlog of over 30%, impacting timely access to ventilators for healthcare providers. These challenges necessitate strategic planning to enhance supply chain resilience in this critical sector.

High Costs of Advanced Ventilators

The increasing complexity of advanced ventilators has escalated their costs, presenting a notable challenge for healthcare providers, particularly in less developed regions. The average cost of high-tech ventilators in 2023 ranges from INR 100,000 to INR 300,000 depending on the features. Many secondary healthcare facilities may find it challenging to invest in these technologies due to budget constraints exacerbated by the rising cost of healthcare provision. The financial burden associated with acquiring ventilatory support can restrict the availability of essential services in critical care settings.

Opportunities

Growing Demand for Home Care Ventilation

There is a burgeoning demand for home care ventilation solutions as healthcare trends move toward more patient-centric care approaches. The increasing preference for home-based care reflects a shift in patient management strategies, with the Indian healthcare system emphasizing the reduction of hospital stay durations. In 2022, it was reported that around 25% of patients requiring ventilatory support were transitioned to home care settings, aided by advancements in portable ventilator technologies. This trend in shifting care to the home environment signifies a robust opportunity for manufacturers to develop versatile and affordable home care ventilators tailored to individual patient needs.

Expanding Healthcare Infrastructure

The expansion of healthcare infrastructure, driven by increased government investments, presents a ripe opportunity for the ventilators market. The Indian government’s commitment to enhancing healthcare access is evident, with allocations expected to surpass INR 1.2 trillion in 2023. This investment aims to bolster critical care facilities across rural and urban areas. As new hospitals and health centers are established, the demand for ventilators is anticipated to rise correspondingly, providing manufacturers with a significant opportunity to cater to emerging healthcare facilities.

Future Outlook

Over the next five years, the India Ventilators Market is expected to exhibit significant growth, driven by continuous government support for improving healthcare infrastructure, innovations in ventilator technology, and an increasing consumer demand for patient-centric solutions. As awareness of respiratory diseases amplifies among the population, along with the necessity for effective medical devices, the market will likely evolve and expand. Furthermore, a shift towards home healthcare solutions is anticipated to play a crucial role in shaping future demand dynamics.

Major Players

- Philips Healthcare

- Medtronic

- Siemens Healthineers

- Drägerwerk

- GE Healthcare

- ResMed

- Hamilton Medical

- Nihon Kohden

- Breathe Technologies

- Airvo

- Mindray Medical International

- Zoll Medical Corporation

- Fisher & Paykel Healthcare 14

- ConvaTec

- Aujan Group

Key Target Audience

- Hospitals and Healthcare Providers

- Home Care Providers

- Emergency Medical Services

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Central Drugs Standard Control Organization, Ministry of Health and Family Welfare)

- Medical Device Distributors

- Research Institutions and Laboratories

- Healthcare Consultants

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an ecosystem map that encompasses all major stakeholders within the India Ventilators Market. This comprehensive approach relies on extensive desk research, utilizing secondary data sources, industry reports, and proprietary databases to gather relevant information. The objective here is to identify and define the key variables and metrics that influence market dynamics, ensuring that all aspects are considered.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical and current data pertaining to the India Ventilators Market. This includes assessing market dynamics, the ratio of ventilator usage across different healthcare settings, as well as revenue generation. Evaluating service quality metrics also takes place to ensure the accuracy and reliability of revenue estimates, providing a sound foundation for the analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through quantitative and qualitative interviews with industry experts. These consultations are conducted via computer-assisted telephone interviews (CATIs) with specialists from diverse companies in the sector. Insights gathered from these experts contribute significantly to refining market data and validating assumptions.

Step 4: Research Synthesis and Final Output

The final phase engages with various ventilator manufacturers to gain deeper insights regarding product segments, sales performance, consumer preferences, and other pertinent factors. This interaction aims to corroborate the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated understanding of the India Ventilators Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Industry Background and Evolution

- Regulatory Landscape

- Supply Chain and Value Chain Analysis

- Key Market Drivers and Restraints

- Growth Drivers

Rising Incidence of Respiratory Diseases

Increasing Geriatric Population

Technological Advancements - Market Challenges

Supply Chain Disruptions

High Costs of Advanced Ventilators - Opportunities

Growing Demand for Home Care Ventilation

Expanding Healthcare Infrastructure - Trends

Integration of IoT in Ventilators

Focus on Patient-Centric Designs - Government Regulation

Quality Control Measures

Standards for Ventilator Manufacturing - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Selling Price, 2019-2024

- By Product Type (In Value %)

Invasive Ventilators

– ICU Invasive Ventilators

– Anesthesia Ventilators

Non-invasive Ventilators

– Bi-level Positive Airway Pressure (BiPAP)

– Continuous Positive Airway Pressure (CPAP)

Transport Ventilators

– Ambulance Ventilators

– Intra-hospital Transfer Ventilators

Pediatric Ventilators

– Neonatal Ventilators

– Pediatric ICU Ventilators

High-Frequency Ventilators

– High-Frequency Oscillatory Ventilators (HFOV)

– High-Frequency Jet Ventilators (HFJV) - By Application (In Value %)

Critical Care Units

– Intensive Care Units (ICUs)

– High Dependency Units (HDUs)

Emergency Medical Services

– Ambulance Services

– Trauma Centers

Home Care Settings

– Chronic Respiratory Illness Management

– Post-Surgical Recovery Support - By End User (In Value %)

Hospitals and Clinics

– Government Hospitals

– Private Multispecialty Hospitals

– Single-Specialty Clinics

Home Care Providers

– Medical Device Rental Companies

– Specialized Home ICU Service Providers

Nursing Facilities

– Long-Term Care Centers

– Geriatric Care Homes - By Region (In Value %)

North India

South India

East India

West India

Central India - By Technology (In Value %)

Mechanical Ventilators

– Manually Controlled

– Electrically Powered with Mechanical Control

Electronic Ventilators

– Microprocessor-Controlled Ventilators

– Smart Ventilators with AI Algorithms

Portable Ventilators

– Battery-Operated Devices

– Compact Emergency Use Ventilators

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenues by Product Category, Distribution Channels, Number of Dealers and Distributors, Production Capacity, Installed Base & Global Market Reach, R&D Investment & Innovation Focus, Regulatory Approvals & Certifications, After-Sales Service & Technical Support Network, Product Portfolio Breadth, Technological Integration, Customer Segments Targeted, Unique Value Offering, Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Philips Healthcare

Medtronic

Siemens Healthineers

ResMed

Drägerwerk

GE Healthcare

Breathe Technologies

Hamilton Medical

Nihon Kohden

Airvo

Fisher & Paykel Healthcare

Zoll Medical Corporation

Mindray Medical International

ConvaTec

Becton Dickinson

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030