Market Overview

The India vetronics Market outlook to 2035 market current size stands at around USD ~ million, reflecting steady deployment across armored, tactical, and support vehicle platforms. In 2024 and 2025, procurement volumes increased across ~ units of land-based platforms, supported by modernization programs and platform upgrades. Adoption intensity rose across ~ platforms due to higher electronic content per vehicle. System-level integration density expanded, driven by digital command architectures, embedded computing modules, and secure communication subsystems deployed across active fleets.

The market is geographically concentrated around key defense manufacturing and integration hubs including Bengaluru, Hyderabad, Pune, Chennai, and the National Capital Region. These locations benefit from established defense public sector units, private integrators, skilled engineering talent, and test infrastructure. Demand concentration aligns with nearby armored formations, vehicle depots, and integration facilities. Policy-driven indigenization, proximity to armed forces commands, and mature supplier ecosystems continue strengthening regional dominance without reliance on import-heavy supply chains.

Market Segmentation

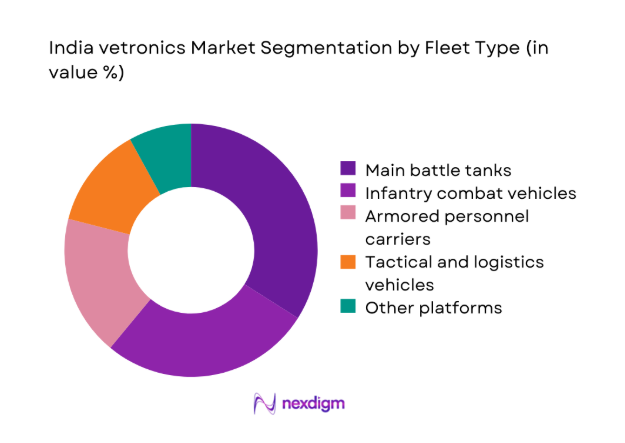

By Fleet Type

Armored fighting vehicles and main battle tanks dominate the India vetronics Market outlook to 2035 due to their high electronic density and continuous upgrade requirements. These platforms integrate advanced fire control, navigation, and battlefield management systems, significantly increasing vetronics value per unit. Infantry combat vehicles and armored personnel carriers follow closely, supported by mechanization initiatives. Logistics and tactical vehicles show rising adoption as digitization extends beyond combat roles. Fleet modernization programs in 2024 and 2025 reinforced demand across legacy retrofits and new-build platforms, sustaining multi-platform deployment momentum.

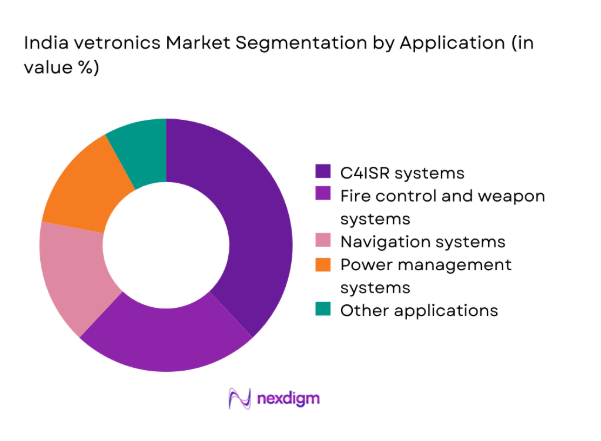

By Application

Command, control, communications, computers, intelligence, surveillance, and reconnaissance applications represent the largest application segment due to network-centric operational doctrines. Vetronics supporting situational awareness, real-time data sharing, and decision support are prioritized across combat formations. Fire control and weapon management systems remain critical, particularly for armored fleets. Navigation and power management applications show consistent growth as platform reliability requirements increase. In 2024 and 2025, application-level integration deepened, driven by modular mission systems and software-defined architectures across deployed vehicle fleets.

Competitive Landscape

The India vetronics Market outlook to 2035 is moderately consolidated, characterized by a mix of domestic defense electronics firms and global technology providers with localized operations. Competition is driven by system integration capability, platform coverage, and compliance with military-grade standards. Long-term contracts, upgrade programs, and service support capabilities play a critical role in competitive positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Bharat Electronics Limited | 1954 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2007 | Hyderabad | ~ | ~ | ~ | ~ | ~ | ~ |

| Larsen & Toubro Defence | 2011 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

| Alpha Design Technologies | 2003 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Data Patterns India | 1985 | Chennai | ~ | ~ | ~ | ~ | ~ | ~ |

India vetronics Market Analysis

Growth Drivers

Modernization of armored and combat vehicle fleets

Modernization of armored and combat vehicle fleets remains a primary growth driver for the India vetronics Market outlook to 2035. During 2024 and 2025, multiple vehicle upgrade initiatives expanded electronic subsystem integration across legacy and newly inducted platforms. Enhanced battlefield digitization requirements increased demand for embedded computing, displays, and vehicle networking components. Platform life extension programs further accelerated retrofitting activity across active fleets. Indigenous design mandates encouraged local integration of mission-critical vetronics subsystems. Higher survivability and situational awareness needs reinforced continuous electronic upgrades. Interoperability requirements across formations amplified system complexity and integration depth. Fleet commonality strategies favored standardized vetronics architectures across vehicle classes. Increased operational readiness targets drove accelerated deployment timelines. Collectively, these factors sustained strong demand momentum across armored fleet modernization cycles.

Rising adoption of network-centric warfare capabilities

Rising adoption of network-centric warfare capabilities significantly supports the India vetronics Market outlook to 2035 expansion trajectory. In 2024 and 2025, operational doctrines emphasized real-time information sharing across combat platforms. Vetronics systems enabling secure communications and data fusion gained prioritization. Integrated vehicle networks supported faster command decision loops and coordinated maneuver operations. Digital battle management systems increased electronic content per vehicle platform. Demand for interoperable architectures aligned with joint force operations intensified. Software-defined functionality allowed rapid capability upgrades without hardware replacement. Enhanced sensor integration required robust onboard processing capabilities. Secure data handling standards elevated system complexity requirements. Training and simulation integration further expanded vetronics deployment scope. Network-centric operational emphasis continues shaping sustained market growth fundamentals.

Challenges

Complex defense procurement and long approval cycles

Complex defense procurement and long approval cycles present a significant challenge within the India vetronics Market outlook to 2035. In 2024 and 2025, extended tender evaluations delayed contract finalizations across several vehicle programs. Multi-layered approval structures increased administrative lead times for system integration decisions. Frequent specification revisions affected supplier planning and production scheduling. Indigenous sourcing requirements introduced additional compliance validation stages. Offset obligations complicated commercial negotiations and partnership structures. Testing and certification timelines extended overall project durations. Budgetary phasing constraints impacted annual procurement consistency. Delays reduced predictability for component suppliers and integrators. Program rescoping introduced integration uncertainties during execution phases. These procurement complexities collectively constrained faster market realization.

High integration and qualification costs

High integration and qualification costs remain a persistent constraint for the India vetronics Market outlook to 2035. Military-grade reliability standards necessitate extensive environmental and endurance testing processes. In 2024 and 2025, qualification cycles lengthened due to platform-specific customization needs. Integration with legacy vehicle architectures increased engineering complexity. Software validation requirements expanded alongside cybersecurity mandates. Limited reuse of standardized modules elevated non-recurring engineering efforts. Testing infrastructure availability created scheduling bottlenecks for multiple programs. Certification documentation requirements increased project overheads. Smaller suppliers faced financial strain meeting qualification investments. Iterative testing cycles delayed deployment readiness. These cost-intensive processes continue limiting rapid technology adoption across platforms.

Opportunities

Upgradation programs for legacy armored vehicles

Upgradation programs for legacy armored vehicles offer a strong opportunity within the India vetronics Market outlook to 2035. A large installed base of vehicles remains operational beyond initial service timelines. In 2024 and 2025, retrofit initiatives focused on electronics replacement rather than full platform renewal. Vetronics upgrades deliver capability enhancement at lower lifecycle impact. Digital subsystems significantly improve survivability and combat effectiveness. Modular architectures enable phased modernization approaches. Indigenous solutions reduce dependency on imported electronics. Fleet-wide retrofits create repeat demand across multiple vehicle classes. Upgrade programs shorten deployment timelines compared to new acquisitions. Training commonality benefits further support retrofit strategies. This opportunity segment provides sustained medium-term market expansion potential.

Export potential to friendly foreign nations

Export potential to friendly foreign nations represents an emerging opportunity for the India vetronics Market outlook to 2035. Indigenous vetronics solutions matured across multiple platform deployments. In 2024 and 2025, export outreach increased toward nations operating similar vehicle platforms. Competitive pricing and customization flexibility enhanced export attractiveness. Government-to-government frameworks facilitated defense technology transfers. Combat-proven system performance strengthened international credibility. Adaptability to diverse operational environments supported export suitability. Integration experience across multiple platforms improved solution scalability. Long-term service support offerings enhanced export value propositions. Regional security partnerships expanded market access channels. Export-driven growth provides diversification beyond domestic procurement cycles.

Future Outlook

The India vetronics Market outlook to 2035 is expected to evolve toward software-defined, modular, and interoperable architectures through 2035. Continued modernization, indigenous development, and export orientation will shape demand. Integration depth per platform is likely to increase as digital warfare concepts mature. Policy support and private sector participation will further strengthen long-term market resilience.

Major Players

- Bharat Electronics Limited

- Tata Advanced Systems Limited

- Larsen & Toubro Defence

- Alpha Design Technologies

- Data Patterns India

- Astra Microwave Products

- Mahindra Defence Systems

- Kalyani Strategic Systems

- Tata Power Strategic Engineering Division

- HCL Defence

- Wipro Defence Solutions

- Thales India

- Elbit Systems India

- Saab India

- Honeywell India

Key Target Audience

- Indian Army procurement divisions

- Indian Navy systems integration units

- Indian Air Force platform modernization teams

- Ministry of Defence procurement agencies

- Defence Public Sector Undertakings

- Private defense system integrators

- Vehicle OEMs and subsystem suppliers

- Investments and venture capital firms focused on defense technologies

Research Methodology

Step 1: Identification of Key Variables

Identification of key variables focused on vetronics subsystems, platform types, and operational applications across Indian defense vehicles.

Step 2: Market Analysis and Construction

Market analysis and construction using program-level assessment of vehicle fleets, upgrade cycles, and integration depth.

Step 3: Hypothesis Validation and Expert Consultation

Hypothesis validation and expert consultation involving defense engineers, retired officers, and system integration specialists.

Step 4: Research Synthesis and Final Output

Research synthesis and final output development through triangulation of qualitative insights and deployment-level validation.

- Executive Summary

- Research Methodology (Market Definitions and Scope Delineation for Indian Vetronics Platforms, Platform-Level Taxonomy Across Land Naval and Airborne Systems, Program-Based Bottom-Up Market Sizing Using Defence Contracts, Value Attribution by Subsystem Integration and Indigenous Content, Primary Validation Through Armed Forces DPSUs and System Integrators, Data Triangulation Using Procurement Budgets and Offset Disclosures, Assumptions on Modernization Timelines and Platform Lifecycle)

- Definition and scope of vetronics within Indian defense platforms

- Evolution of vehicle electronics under network-centric warfare doctrine

- Operational usage across combat, support, and surveillance platforms

- Ecosystem structure involving DPSUs, private integrators, and OEMs

- Supply chain structure and indigenization pathways under Make in India

- Defense procurement and regulatory environment impact

- Growth Drivers

Modernization of armored and combat vehicle fleets

Rising adoption of network-centric warfare capabilities

Government push for indigenous defense electronics

Increased focus on battlefield situational awareness

Integration of AI-enabled and sensor-fusion systems - Challenges

Complex defense procurement and long approval cycles

High integration and qualification costs

Interoperability issues with legacy platforms

Dependence on imported critical electronic components

Stringent military-grade reliability requirements - Opportunities

Upgradation programs for legacy armored vehicles

Export potential to friendly foreign nations

Adoption of open architecture standards

Private sector participation under strategic partnership model

Integration of cyber-secure and autonomous systems - Trends

Shift toward software-defined vetronics

Increasing use of modular and scalable architectures

Higher focus on electronic warfare resilience

Growing role of private Indian system integrators

Convergence of vetronics with unmanned ground systems - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Main battle tanks and armored fighting vehicles

Infantry combat vehicles and APCs

Logistics and tactical support vehicles

Naval combat and support vessels

Airborne mission platforms - By Application (in Value %)

Command, control, communications, computers, intelligence, surveillance and reconnaissance

Navigation and positioning systems

Fire control and weapon management

Power management and energy distribution

Embedded computing and display systems - By Technology Architecture (in Value %)

Open systems architecture and MOSA-compliant platforms

Proprietary integrated vetronics suites

Modular and scalable architecture systems

Legacy architecture upgrade solutions - By End-Use Industry (in Value %)

Indian Army

Indian Navy

Indian Air Force

Paramilitary and border security forces

Homeland security and internal defense agencies - By Connectivity Type (in Value %)

Wired legacy interfaces

Ethernet-based high-speed networks

Controller area network and vehicle bus systems

Wireless tactical communications

Satellite-enabled connectivity - By Region (in Value %)

North India

South India

West India

East India

Central India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Platform coverage, Technology architecture, Indigenous content ratio, System integration capability, Program participation, R&D intensity, Aftermarket support, Export presence)

- SWOT Analysis of Key Players

Pricing and Commercial Model Benchmarking

Detailed Profiles of Major Companies

Bharat Electronics Limited

Tata Advanced Systems Limited

Larsen & Toubro Defence

Tata Power Strategic Engineering Division

Alpha Design Technologies

Data Patterns India

Astra Microwave Products

Mahindra Defence Systems

Kalyani Strategic Systems

HCL Defence

Wipro Defence Solutions

Thales India

Elbit Systems India

Saab India

Honeywell India

- Operational demand and deployment drivers

- Defense procurement and tendering mechanisms

- Technical and commercial buying criteria

- Budget allocation and lifecycle cost considerations

- Implementation risks and platform integration challenges

- Aftermarket support and long-term service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035