Market Overview

As of 2024, the India warehousing market is valued at USD ~ billion, with a growing CAGR of 15.7% from 2024 to 2030, and continues to grow due to rising demand from e-commerce, manufacturing, and retail sectors, along with significant investments in logistics infrastructure. Government initiatives such as the Gati Shakti and Make in India programs support this growth by enhancing logistics efficiency and reducing bottlenecks in supply chains. Furthermore, technological advancements and increased consumer demand for timely deliveries drive innovations in warehousing solutions.

North India, particularly regions like Delhi NCR and Punjab, dominate the warehousing market due to their strategic location and robust transportation infrastructure, facilitating easy access to major markets. Additionally, cities such as Mumbai and Chennai in South India are vital due to their ports and connections to international logistics networks. This concentration of warehousing facilities in economically active regions allows for efficient distribution and supports the rapid growth of the e-commerce sector.

Market Segmentation

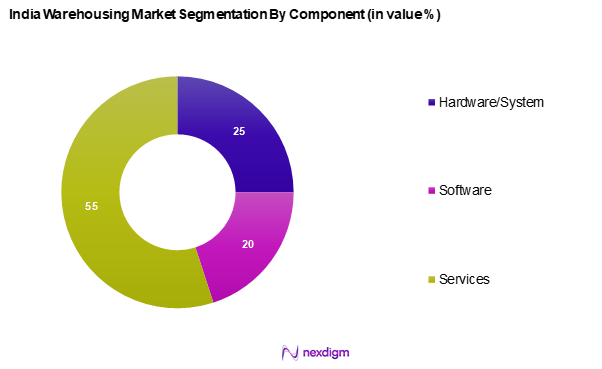

By Component

The India warehousing market is segmented into hardware/system, software, and services. The services segment is projected to dominate the market due to its ability to offer customized logistics solutions tailored to individual business needs. As companies increasingly look for efficiencies in their supply chain operations, demand for third-party logistics providers (3PL) and value-added services such as inventory management, order fulfillment, and last-mile delivery solutions is on the rise. This trend is propelled by the significant growth in e-commerce and retail sectors, where speed and reliability in logistics are critical.

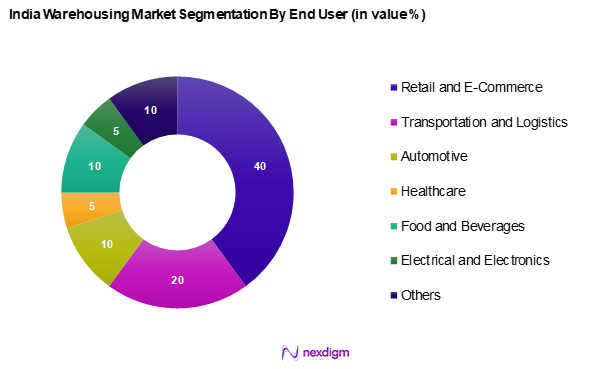

By End User

The India warehousing market is segmented into retail and e-commerce, transportation and logistics, automotive, healthcare, food and beverages, electrical and electronics, and others. The retail and e-commerce segment holds a dominant position due to the explosion of online shopping, compelling businesses to invest heavily in warehousing solutions to meet consumer expectations for rapid delivery. As e-commerce platforms expand their product offerings and geo-capacity, efficient warehousing becomes a key enabler of growth, resulting in increased allocation of space and resources towards this segment.

Competitive Landscape

The India warehousing market is dominated by several major players, which include local and international companies. Their strong presence and extensive operational networks give them a competitive edge in servicing various industrial sectors. As a result, they play a pivotal role in shaping market trends and consumer demands.

| Company | Establishment Year | Headquarters | Service Offerings | Market Strategy | Technology Utilization | Revenue (est.) |

| Container Corporation of India Ltd. | 1988 | New Delhi, India | – | – | – | – |

| Gati Ltd. | 1989 | Haryana, India | – | – | – | – |

| Mahindra Logistics Limited | 2007 | Maharastra, India | – | – | – | – |

| TCI Express Limited | 1996 | Haryana, India | – | – | – | – |

| Central Warehousing Corporation | 1957 | New Delhi, India | – | – | – | – |

India Warehousing Market Analysis

Growth Drivers

Government Initiatives (Make in India, Gati Shakti)

Government initiatives such as Make in India and Gati Shakti are pivotal in bolstering the warehousing market by enhancing infrastructure and promoting manufacturing. The Make in India initiative aims to increase the manufacturing sector’s contribution to GDP from 16% to 25% by 2025. In parallel, Gati Shakti aims to integrate infrastructure projects and improve logistics efficiency, with an investment planed over next 5 years drive growth in the warehousing sector by enabling better connectivity and reducing lead time, thus encouraging businesses to expand their operations.

Rising E-commerce Adoption

The rapid expansion of the e-commerce sector has become a major catalyst for the warehousing market. Increased internet accessibility and smartphone usage have transformed consumer purchasing behaviour, resulting in a surge in online retail. This shift demands extensive, technology-enabled warehousing facilities capable of supporting fast-moving, high-volume inventory flows. E-commerce companies are increasingly investing in their logistics capabilities, including setting up fulfilment centres and last-mile delivery hubs, which is stimulating the development of specialized warehouse infrastructure tailored to high-speed distribution models.

Market Challenges

Supply Chain Disruptions

Supply chain disruptions have emerged as a significant challenge for the warehousing market, exacerbated by global incidents such as the COVID-19 pandemic and geopolitical tensions. According to the World Bank, global supply chain disruptions contributed to a 7% increase in shipping costs in 2022, impacting the logistics and warehouse sectors significantly. In India, delays at ports, lack of adequate infrastructure, and insufficient manpower are ongoing issues. These disruptions lead to inventory shortages and increased logistics costs, hampering the effectiveness of warehousing operations and overall market growth.

High Operational Costs

Operational cost pressures remain a critical concern for warehouse operators. Factors such as escalating land prices in urban and industrial hubs and rising labor expenses due to talent shortages are straining profit margins. Maintaining high service standards while navigating these cost challenges is a growing concern for companies. The difficulty in balancing cost-efficiency with service quality is compelling warehousing players to explore automation, optimization, and strategic location planning, although the initial investment for such improvements can also be substantial.

Opportunities

Investment in Logistics Infrastructure

Significant public and private sector investment in logistics infrastructure is opening new avenues for warehousing development. Government emphasis on expanding roadways, rail connectivity, and the creation of multimodal logistics parks is laying the groundwork for a more integrated logistics ecosystem. Additionally, private investments are focusing on modernizing warehousing through automation, real-time inventory tracking, and smart storage systems. These enhancements are set to dramatically improve operational efficiency, reduce lead times, and support the rising complexity of supply chains, creating a strong foundation for long-term market growth.

Growth of Cold Storage Solutions

The rising demand for temperature-controlled warehousing, particularly from the pharmaceutical and food sectors, is emerging as a key opportunity. Increasing consumer demand for perishable goods and the evolving requirements of healthcare logistics—especially in terms of vaccine distribution and biological products—are driving the need for advanced cold chain facilities. Innovations in refrigeration technology and supply chain digitization are enabling more reliable and scalable cold storage solutions, positioning this segment as a high-growth area within the broader warehousing market.

Future Outlook

Over the next 5 years, the India warehousing market is expected to witness robust growth driven by the increasing adoption of e-commerce, advancements in technology, and ongoing governmental support for logistics and infrastructure improvement. With a projected growth trajectory, companies are likely to enhance their warehousing capabilities, focusing on automation, sustainable practices, and the integration of smart technologies to optimize processes. This trajectory is bolstered further by the growing demand for cold storage and efficient inventory management.

Major Players

- Container Corporation of India Ltd.

- Gati Ltd.

- Mahindra Logistics Limited

- TCI Express Limited

- Central Warehousing Corporation

- DHL International GmbH

- FIT 3PL Warehousing Private Limited

- JICS Logistics Ltd.

- Spear Logistics Private Limited

- Ecom Express Limited

- Holisol Logistics

- TVS Supply Chain Solutions

- Quickshift

- Shiprocket

- Warehouse Now

- AAJ Supply Chain Management

- Warehousing Express

- Prozo

- Others

Key Target Audience

- Logistics and Supply Chain Managers

- E-commerce Companies

- Retail Chains and Outlets

- Manufacturers and Distributors

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Commerce and Industry)

- Cold Storage Solution Providers

- Real Estate Developers focusing on Industrial Properties

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India warehousing market. This step is underpinned by extensive desk research, utilizing a combination of secondary resources and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the crucial variables that influence market dynamics, ensuring a robust analytical foundation.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India warehousing market. This includes assessing market penetration, the ratio of warehouses to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates, forming the basis for projected growth figures.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies within the market. These consultations provide valuable operational and financial insights directly from industry practitioners, instrumental in refining and corroborating the market data collected in prior phases.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple warehousing service providers to acquire detailed insights into product segments, market performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India warehousing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Data Sources, Consolidated Research Approach, Understanding Market Dynamics Through Expert Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Government Initiatives (Make in India, Gati Shakti)

Rising E-commerce Adoption - Market Challenges

Supply Chain Disruptions

High Operational Costs - Opportunities

Investment in Logistics Infrastructure

Growth of Cold Storage Solutions - Trends

Shift towards Automated Warehousing

Emphasis on Sustainability Practices - Government Regulation

Warehousing Development and Regulatory Authority (WDRA) - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Component, (In Value %)

Hardware/System

Software

Services - By Function, (In Value %)

Inventory Control and Management

Asset Tracking

Yard & Dock Management

Order Fulfilment

Workforce & Task (Process) Management

Shipping

Predictive Maintenance

Others - By Type, (In Value %)

Insource Warehousing

Outsource Warehousing - By Size, (In Value %)

Small

Medium

Large - By Model, (In Value %)

Shared Warehousing

Dedicated Warehousing

On Demand Warehousing

Managed Warehousing - By Warehousing Storage Nature, (In Value %)

Ambient Warehousing (Around 80°F)

Air Conditioned (56°F and 75°F)

Refrigerated (33°F and 55°F)

Cold/Frozen (Of or Below 32°F)

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Component Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Revenue Analysis, Operational Efficiency, Technology Utilization, Geographic Reach, Client Base)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Container Corporation of India Ltd.

Gati Ltd.

Mahindra Logistics Limited

TCI Express Limited

Central Warehousing Corporation

DHL International GmbH

FIT 3PL Warehousing Private Limited

JICS Logistics Ltd.

Spear Logistics Private Limited

Ecom Express Limited

Holisol Logistics

TVS Supply Chain Solutions

Quickshift

Shiprocket

Warehouse Now

AAJ Supply Chain Management

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030