Market Overview

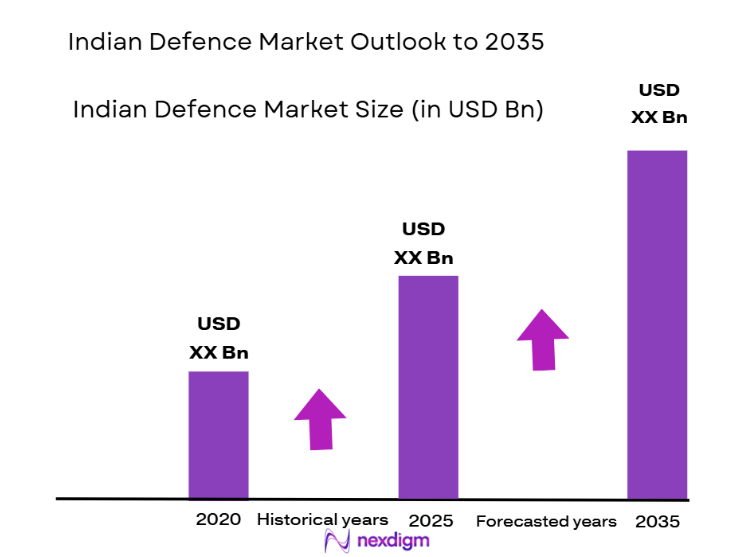

The Indian Defence Market is valued at approximately USD ~ billion, with projections indicating continued growth. This market is driven by increasing defence budgets, particularly under the government’s focus on enhancing indigenous capabilities through initiatives like the “Atmanirbhar Bharat” scheme. Moreover, substantial investments in upgrading defence technologies and infrastructure are key contributors. The expanding defence export sector, alongside strategic partnerships with global powers, further boosts market growth.

India’s defence market is largely concentrated in major hubs such as Delhi, Bengaluru, Hyderabad, and Pune. Delhi, being the capital, houses the Ministry of Defence (MoD) and key defence policy-making bodies. Bengaluru and Hyderabad are central to defence R&D, hosting major aerospace and defence manufacturing units like HAL and DRDO. Pune, with its proximity to key defence institutions, is critical for defence training and manufacturing. These regions benefit from government policies, a skilled workforce, and well-established defence ecosystems.

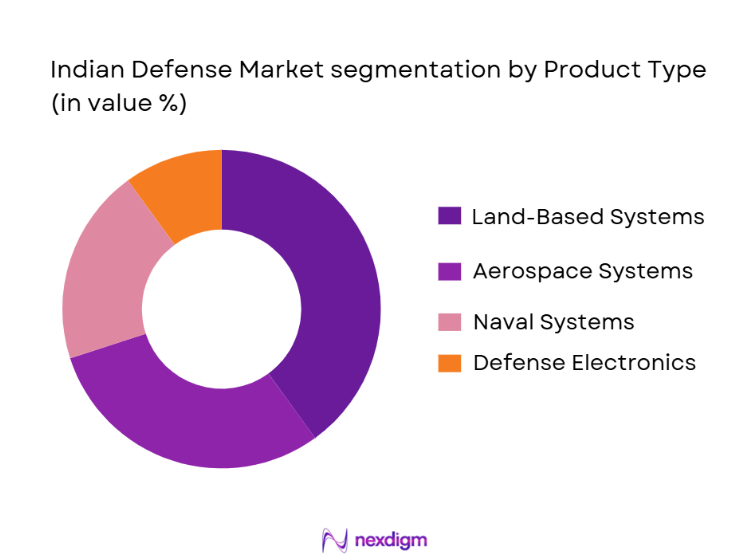

Market Segmentation

By Product Type

The Indian Defence Market is segmented into various product types, including land-based systems, aerospace systems, naval systems, and defence electronics. The land-based systems segment dominates the market, primarily driven by the growing demand for advanced artillery, tanks, and combat vehicles. India’s strategic military modernization, focusing on enhancing land capabilities and self-sufficiency, is a key driver. Additionally, the Indian Army continues to invest in modernizing its fleet of tanks and infantry combat vehicles, contributing to the growth of this segment.

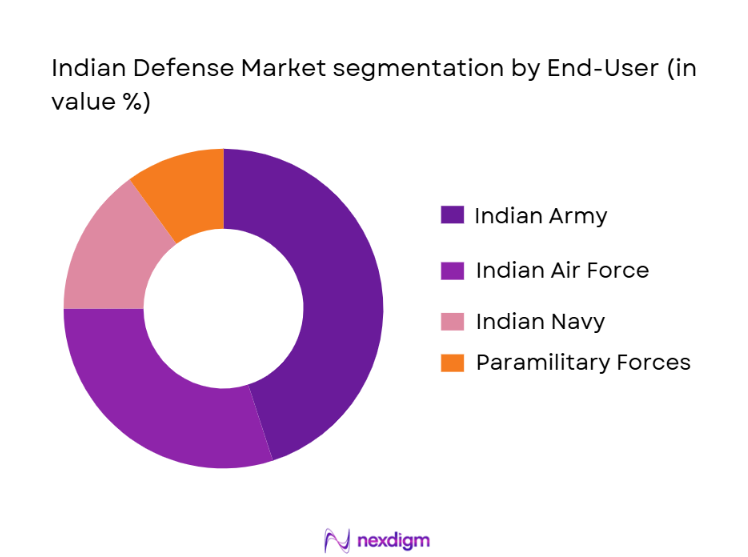

By End-User

The Indian Defence Market is also segmented based on end-users, including the Indian Army, Indian Air Force, Indian Navy, and Paramilitary forces. The Indian Army holds the dominant share due to the ongoing modernization programs and large-scale procurement of artillery, vehicles, and communications systems. The continuous need to strengthen ground forces, driven by border security concerns, fuels the high demand in this segment. Furthermore, the Indian Air Force and Navy are expanding their fleets, but the Army’s share remains the largest.

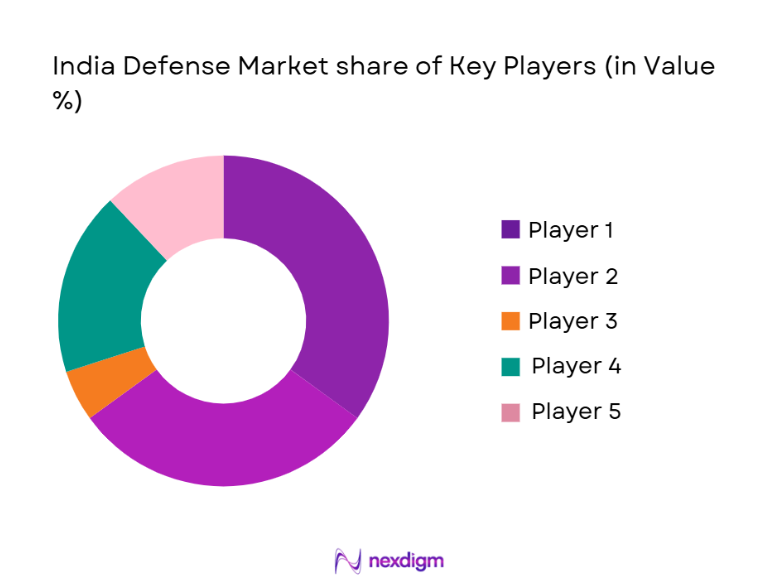

Competitive Landscape

The Indian Defence Market is highly competitive, with both domestic and international players vying for a share. The market is dominated by key players such as Hindustan Aeronautics Limited (HAL), Bharat Electronics Limited (BEL), and Bharat Dynamics Limited (BDL), alongside global firms like Lockheed Martin and Boeing. These companies play a crucial role in defence production, R&D, and supply chain integration, with strong government ties and an expanding focus on indigenization.

| Company | Establishment Year | Headquarters | R&D Investment | Product Portfolio | Key Contracts | Indigenization Contribution | Global Reach |

| Hindustan Aeronautics Limited (HAL) | 1940 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

| Bharat Electronics Limited (BEL) | 1954 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

| Bharat Dynamics Limited (BDL) | 1970 | Hyderabad, India | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1994 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

Indian Defense Market Analysis

Growth Drivers

Government Initiatives and Defence Budget Increases

The Indian government’s emphasis on modernizing its armed forces, particularly through initiatives like Atmanirbhar Bharat and increased defence budgets, is driving market growth. These policies aim to enhance indigenous production and reduce dependency on imports, thereby boosting the local defence industry.

Technological Advancements and Defence R&D

Continuous investments in research and development (R&D) are fostering technological advancements in the defence sector. The push for indigenization has accelerated the development of advanced weapon systems, radar technologies, and unmanned aerial vehicles (UAVs), further enhancing India’s strategic capabilities.

Market Challenges

Slow Procurement Processes and Bureaucracy

India’s defence procurement process is often slow due to complex regulations and bureaucratic hurdles. This leads to delays in acquiring new systems and technologies, which can hinder the market’s growth and the timely modernization of military equipment.

Dependency on Foreign Suppliers

Despite efforts to promote indigenization, India remains reliant on foreign suppliers for advanced technology and components. This dependency increases costs, complicates supply chains, and creates strategic vulnerabilities, particularly in times of geopolitical tension.

Opportunities

Defence Exports and Regional Demand

With increasing demand for Indian-made defence products in regions like Southeast Asia, Africa, and the Middle East, the market presents significant export opportunities. Expanding India’s defence exports can help establish it as a global player in the defence sector.

Public-Private Partnerships

The growing collaboration between the Indian government and private defence contractors offers opportunities for innovation, faster production, and scaling up manufacturing capabilities. These partnerships are expected to drive the growth of domestic manufacturing and technology transfer in the defence sector.

Future Outlook

Over the next 5 years, the Indian Defence Market is expected to experience significant growth, driven by continuous government support, advancements in technology, and increasing consumer demand for modern defence systems. With a strong emphasis on self-reliance and indigenization, India is set to expand its domestic production capacity while enhancing the export potential of its defence products. Policy initiatives such as “Make in India” and increased public-private partnerships will accelerate this transition, leading to more innovation and global competitiveness.

Major Players

- Hindustan Aeronautics Limited (HAL)

- Bharat Electronics Limited (BEL)

- Bharat Dynamics Limited (BDL)

- Mazagon Dock Shipbuilders Limited

- Tata Advanced Systems Limited

- Larsen & Toubro (L&T) Defence

- Adani Defence & Aerospace

- Reliance Defence & Engineering

- Garden Reach Shipbuilders & Engineers

- DRDO (Defence Research and Development Organisation)

- Data Patterns India

- Dynamatic Technologies

- Alpha Design Technologies

- Param Defence & Space Technologies

- Mahindra Defence Systems

Key Target Audience

- Defence Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Defence, DRDO)

- Defence Contractors

- Original Equipment Manufacturers (OEMs)

- Defence Exporters

- Private Military & Defence Service Providers

- Procurement Heads of Defence Forces

Research Methodology

Step 1: Identification of Key Variables

The first step involves constructing an ecosystem map, identifying all key stakeholders in the Indian Defence Market. This process includes thorough desk research, utilizing secondary and proprietary databases to map out major industry players, government entities, and key policies influencing the market.

Step 2: Market Analysis and Construction

In this phase, we will compile historical data to assess market trends and key drivers such as defence procurement budgets, modernization programs, and strategic partnerships. This data will be analyzed to understand market penetration and revenue generation across various product segments.

Step 3: Hypothesis Validation and Expert Consultation

We will develop market hypotheses and validate them through expert consultations with key players in the industry, including senior executives from government agencies, defence contractors, and defence technology firms. These interviews will provide insights into operational challenges, financial performance, and future market outlook.

Step 4: Research Synthesis and Final Output

In the final phase, direct engagements with manufacturers will be conducted to acquire detailed insights into product segments, consumer preferences, and operational performance. This will be followed by a final analysis, synthesizing primary and secondary research data to produce an accurate and actionable report.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Indian Defence Equipment Classification Framework, Data Sources & Validation, Market Sizing & Forecasting Models, Government Procurement Mapping, Primary Interview Panels, Limitations & Predictive Confidence)

- Macro Defence Market Landscape

- Defence Production Ecosystem

- Strategic Policy Architecture

- Defence Value Chain

- Import vs. Indigenous Production Dynamics

- Growth Drivers

Strategic Modernisation Programmes

Government Policy Push

Domestic R&D & Tech Upgradation

Defence Export Promotion & Foreign Partnerships

Enhanced Private Sector Participation - Market Challenges

Technology Transfer & Absorption

Complex Procurement Cycles

Supply Chain Fragmentation

Export Regulatory Barriers - Market Opportunities

UAV & Autonomous Systems

Defence Electronics & Cyber Solutions

Defence Infrastructure Modernisation

Maintenance, Repair & Overhaul (MRO)

Exports to Africa, Southeast Asia, Middle East - Market Trends

Indigenisation & Localisation Trajectory

PublicPrivate Joint Ventures

Digital Transformation (AI, IoT, Cyber)

Additive Manufacturing & Supply Chain Digitisation - Policy, Regulation & Compliance

Defence Procurement Policy

Defence Production & Export Regulations

Quality Assurance & Military Standards

Tax & Incentive Framework - Indian Defence Value Chain Analysis

Overall Value Chain Mapping

Tier Structure

Capability Gaps & Bottlenecks

Value Chain Scorecard

- Total Defence Production Value 2020-2025

- Defence Export Market Value & Growth 2020-2025

- Production Share: Public vs. Private 2020-2025

- Defence R&D Expenditure 2020-2025

- Defence Procurement Spend Trend 2020-2025

- By Product & System Type (In Value%)

Fighter & Trainer Aircraft

Armoured Combat Vehicles & Artillery

Naval Platforms & SubSystems

Missile & Guided Weapon Systems

UAVs & CounterUAV Systems

Electronic Warfare, Radars & Communication Systems

Defence Electronics & Sensors - By EndUser Segment (In Value%)

Indian Army

Indian Air Force

Indian Navy

Paramilitary & Central Armed Police Forces

Defence Export Clients - By Procurement Category (In Value%)

GovernmenttoGovernment Deals

Domestic Manufacture & Buy Indian

Foreign OEM with Local Partnership

OEM Import - By Value Chain Tier (In Value%)

DPSUs & Ordnance Factories

Private OEM Prime Contractors

Tier1 Strategic Suppliers

Tier2/3 Components & SubAssemblies

Service & MRO Providers - By Geographic Footprint (In Value%)

North India

South India

West & Eastern Industrial Base

Export Focus Regions

- Market Share Analysis – Production & Revenue

- CrossComparison Parameters (Company Footprint, Product & Platform Portfolio Breadth, Indigenous Capability Index, MoD & OEM Contract Win Rate, R&D Investments & Patents, Technology Partnerships & JVs, Export Footprint & Compliance, Supply Chain Integration & Tier Network)

- SWOT of Major Players

- Competitor Profiles

Hindustan Aeronautics Limited (HAL)

Bharat Electronics Limited (BEL)

Bharat Dynamics Limited (BDL)

Mazagon Dock Shipbuilders Limited

Tata Advanced Systems Limited

Larsen & Toubro (L&T) Defence

Adani Defence & Aerospace

Bharat Forge Defence

DRDO (Major R&D Entity)

Reliance Defence & Engineering

Garden Reach Shipbuilders & Engineers

Data Patterns India

Dynamatic Technologies

Alpha Design Technologies

Param Defence & Space Technologies

- Armed Forces Demand Profile

- Budget Allocation Framework

- Procurement Decision Drivers

- Retention, Lifecycle & Aftermarket Requirements

- CAGR Trajectories 2026-2035

- Indigenisation Impact Scenario 2026-2035

- Export Market Growth Path 2026-2035