Market Overview

The India Helicopter Market current size stands at around USD ~ million, supported by sustained demand across defense, civil, and government-operated rotary-wing fleets. The market reflects stable procurement activity, ongoing fleet replacement requirements, and expanding mission profiles such as emergency response, offshore transport, and utility operations. Demand remains structurally resilient due to helicopters’ critical role in inaccessible terrain, time-sensitive missions, and national security operations.

Operational concentration remains strongest in western and southern India, supported by offshore energy corridors, defense command centers, and mature maintenance ecosystems. Northern regions demonstrate sustained demand driven by border surveillance, disaster response, and government mobility requirements. Metropolitan hubs such as Mumbai, Delhi NCR, and Bengaluru anchor charter, emergency, and training operations due to heliport availability, skilled workforce density, and regulatory familiarity. Policy emphasis on regional connectivity and emergency preparedness continues shaping geographic demand distribution.

Market Segmentation

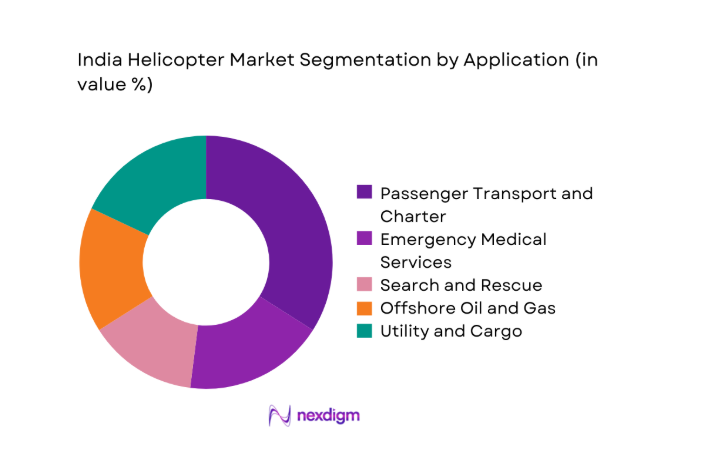

By Application

Passenger transport and charter operations dominate the India Helicopter market, supported by sustained demand for executive mobility, pilgrimage travel, and regional tourism connectivity. In 2024, charter utilization expanded across metro-to-tier-two corridors, driven by time-critical travel needs and limited fixed-wing alternatives. Emergency medical services and search and rescue missions showed consistent operational intensity, particularly in disaster-prone and remote regions. Offshore oil and gas logistics maintained stable demand, anchored by contractual flying hours and safety-driven fleet requirements. Training and utility applications continued gradual expansion, supported by pilot shortages and infrastructure development initiatives.

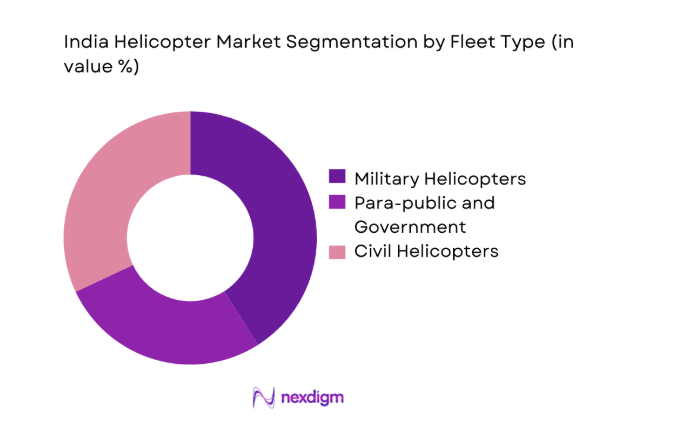

By Fleet Type

Military and para-public helicopters collectively represent the largest fleet value concentration in the India Helicopter market, reflecting mission complexity, higher payload capabilities, and specialized configurations. In 2024, defense and homeland security operators accounted for the majority of active multi-mission platforms, supported by modernization and replacement programs. Civil helicopters, while lower in fleet size, exhibited higher average utilization in charter and emergency roles. Government-owned non-military fleets continued expanding for disaster management and law enforcement. Fleet composition trends increasingly favor twin-engine platforms due to regulatory safety preferences and operational resilience requirements.

Competitive Landscape

The India Helicopter market features a mix of domestic manufacturing capabilities, global original equipment suppliers, and specialized service providers. Competitive differentiation is shaped by platform versatility, regulatory alignment, local support infrastructure, and long-term service commitments rather than pure fleet volumes.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Hindustan Aeronautics Limited | 1940 | India | ~ | ~ | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 1992 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Bell Textron | 1935 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo Helicopters | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Russian Helicopters | 2007 | Russia | ~ | ~ | ~ | ~ | ~ | ~ |

India Helicopter Market Analysis

Growth Drivers

Rising defense modernization and indigenization programs

India’s defense modernization programs accelerated platform replacement cycles during 2023 and 2024, increasing procurement focus on multi-mission rotary-wing assets. Indigenization policies encouraged domestic assembly, component localization, and technology transfer, improving long-term fleet sustainability and operational autonomy. Armed forces emphasized helicopters for logistics, surveillance, and troop mobility across diverse terrains and altitudes. Budget prioritization favored rotary platforms due to flexibility advantages over fixed-wing alternatives. Indigenous programs supported pilot training pipelines and maintenance ecosystem expansion nationwide. Mission diversity requirements increased demand for adaptable airframes with modular configurations. Border security considerations sustained continuous deployment intensity for utility helicopters. Lifecycle extension initiatives complemented new inductions, stabilizing overall fleet utilization. Inter-service standardization efforts improved procurement efficiency and operational interoperability. These combined factors reinforced helicopters as strategic assets within national defense planning frameworks.

Expansion of offshore oil and gas exploration

Offshore energy exploration activity sustained helicopter demand through consistent crew transport and emergency response requirements during 2023 and 2024. Helicopters remain operationally indispensable for offshore logistics due to distance, safety, and time-critical access constraints. Contractual flight hour commitments provided predictable utilization patterns for operators serving energy clients. Safety regulations mandated twin-engine configurations, influencing fleet composition toward higher capability platforms. Offshore operators prioritized reliability, weather resilience, and maintenance responsiveness. Coastal infrastructure investments improved heliport connectivity and turnaround efficiency. Energy sector stability supported long-term service agreements with aviation providers. Fleet operators optimized scheduling to maximize aircraft availability across multiple rigs. Specialized pilot training requirements increased simulator and training demand. Offshore exploration continuity thus reinforced stable baseline demand within the overall helicopter ecosystem.

Challenges

High acquisition and operating costs

High acquisition and operating costs constrained fleet expansion decisions across civil and government operators during 2023 and 2024. Import dependence for advanced platforms elevated capital exposure and foreign exchange sensitivity. Maintenance intensity increased with aging fleets, raising downtime risks and service complexity. Skilled manpower shortages amplified training and retention expenses for operators. Insurance and compliance costs remained elevated due to safety-critical operating environments. Smaller charter operators faced barriers achieving economies of scale. Financing limitations restricted access to newer generation platforms. Cost pressures influenced operators to extend service lives beyond optimal thresholds. Operating margins remained sensitive to utilization variability across seasons. These factors collectively limited rapid capacity additions despite underlying demand growth.

Limited heliport and supporting infrastructure

Limited heliport availability constrained operational flexibility and route expansion across multiple regions in 2023 and 2024. Urban congestion restricted new landing site approvals, particularly within metropolitan centers. Inadequate night-operation infrastructure reduced effective daily utilization windows. Remote regions lacked refueling and maintenance support, increasing ferry times and costs. Infrastructure gaps discouraged private investment in charter and emergency services. Regulatory approvals for temporary landing sites remained time-intensive. Weather monitoring and navigation aids were inconsistently deployed. Infrastructure limitations heightened operational risk profiles for smaller operators. Expansion into tier-two cities progressed slower than anticipated. Addressing infrastructure constraints remains critical for unlocking latent helicopter demand.

Opportunities

Indigenous helicopter manufacturing and localization

Indigenous helicopter manufacturing initiatives created opportunities for supply chain development and long-term cost rationalization during 2023 and 2024. Local production reduced dependency on imports and improved delivery timelines. Component localization fostered domestic supplier ecosystems and skilled employment generation. Indigenous platforms enabled customization aligned with regional operating conditions. Lifecycle support became more accessible through localized maintenance capabilities. Government procurement preferences favored domestically produced platforms. Export potential emerged for neighboring and similar terrain markets. Training ecosystems expanded alongside manufacturing programs. Technology absorption improved design and upgrade competencies. Localization therefore positioned the market for sustainable structural growth.

Growth of helicopter emergency medical services networks

Helicopter emergency medical services networks expanded steadily during 2023 and 2024, driven by healthcare accessibility priorities. Time-critical patient transport needs supported helicopter deployment across urban and remote regions. Public-private collaboration models improved service viability and coverage. Disaster response planning integrated air ambulances as core assets. Hospital partnerships enhanced landing infrastructure and operational coordination. Standardized medical interiors improved clinical effectiveness. Training requirements expanded for medical crew and pilots. Community awareness increased acceptance of aerial emergency services. Utilization intensity supported predictable mission profiles. This opportunity strengthened helicopters’ role within national healthcare resilience frameworks.

Future Outlook

The India Helicopter market is expected to evolve steadily through 2032, shaped by defense modernization continuity and expanding civil mission adoption. Infrastructure development, regulatory streamlining, and indigenous manufacturing will remain decisive factors. Growth will likely favor multi-mission and twin-engine platforms. Service-led business models and regional connectivity initiatives are anticipated to influence long-term market structure.

Major Players

- Hindustan Aeronautics Limited

- Airbus Helicopters

- Bell Textron

- Leonardo Helicopters

- Sikorsky Aircraft

- Russian Helicopters

- MD Helicopters

- Kawasaki Heavy Industries

- Enstrom Helicopter Corporation

- Boeing Defense Space & Security

- Safran Helicopter Engines

- Pratt & Whitney Canada

- Tata Advanced Systems

- Mahindra Aerospace

- Indamer Aviation

Key Target Audience

- Defense procurement agencies

- Ministry of Civil Aviation and DGCA

- Offshore oil and gas operators

- Emergency medical service providers

- Charter and tourism operators

- State disaster management authorities

- Investments and venture capital firms

- Public sector and private helicopter operators

Research Methodology

Step 1: Identification of Key Variables

Core variables included fleet composition, application intensity, regulatory constraints, and infrastructure readiness across civil and defense helicopter operations.

Operational roles, platform categories, and service models were defined to establish consistent analytical boundaries.

Step 2: Market Analysis and Construction

Demand drivers were mapped across applications, regions, and end-use sectors to structure the analytical framework.

Fleet activity, utilization behavior, and replacement dynamics were synthesized to construct a coherent market model.

Step 3: Hypothesis Validation and Expert Consultation

Operational assumptions were validated through structured interactions with operators, maintenance providers, and regulatory stakeholders.

Insights focused on utilization patterns, infrastructure limitations, and evolving mission requirements.

Step 4: Research Synthesis and Final Output

Findings were consolidated into a unified narrative aligning qualitative insights with structured analysis.

Cross-checks ensured internal consistency and relevance to decision-making stakeholders.

- Executive Summary

- Research Methodology (Market Definitions and India-specific rotary-wing scope alignment, fleet taxonomy across civil, military and para-public helicopters, bottom-up fleet and delivery-based market sizing, value attribution across OEM sales MRO and upgrades, primary validation with operators’ regulators and OEMs, triangulation using DGCA MoD and OEM disclosures, India-specific regulatory and utilization assumptions)

- Definition and Scope

- Market evolution

- Usage and mission profiles

- Ecosystem structure

- Supply chain and distribution framework

- Regulatory environment

- Growth Drivers

Rising defense modernization and indigenization programs

Expansion of offshore oil and gas exploration

Growth in emergency medical and disaster response services

Increasing demand for regional connectivity and tourism

Fleet replacement of aging rotary-wing platforms - Challenges

High acquisition and operating costs

Limited heliport and supporting infrastructure

Pilot and skilled maintenance workforce shortages

Complex regulatory approvals and airspace constraints

Dependence on imports for advanced platforms and components - Opportunities

Indigenous helicopter manufacturing and localization

Growth of helicopter emergency medical services networks

Rising demand for multi-mission and utility helicopters

Public-private partnerships in regional air mobility

Aftermarket MRO and lifecycle support expansion - Trends

Shift toward twin-engine platforms for safety compliance

Increased focus on indigenously developed helicopters

Digital avionics and mission system upgrades

Leasing and power-by-the-hour commercial models

Higher emphasis on lifecycle cost optimization - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Civil helicopters

Military helicopters

Para-public and government helicopters

- By Application (in Value %)

Passenger transport and charter

Emergency medical services

Search and rescue

Offshore oil and gas operations

Utility and cargo lifting

Training and pilot instruction

- By Technology Architecture (in Value %)

Single-engine helicopters

Twin-engine helicopters

Light helicopters

Medium helicopters

Heavy helicopters

- By End-Use Industry (in Value %)

Defense and armed forces

Oil and gas

Emergency and healthcare services

Tourism and charter services

Law enforcement and homeland security

- By Connectivity Type (in Value %)

Non-connected platforms

Basic avionics connectivity

Advanced mission and data-linked helicopters

- By Region (in Value %)

North India

South India

East India

West India

North-East India

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (fleet portfolio breadth, engine and payload capability, localization and offset compliance, pricing and lifecycle cost, MRO and support footprint, delivery timelines, government and defense relationships, technology and avionics sophistication)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Hindustan Aeronautics Limited

Airbus Helicopters

Bell Textron

Leonardo Helicopters

Sikorsky Aircraft

Russian Helicopters

MD Helicopters

Kawasaki Heavy Industries

Enstrom Helicopter Corporation

Boeing Defense Space & Security

Safran Helicopter Engines

Pratt & Whitney Canada

Tata Advanced Systems

Mahindra Aerospace

Indamer Aviation

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2032

- By Volume, 2025–2032

- By Installed Base, 2025–2032

- By Average Selling Price, 2025–2032