Market Overview

As of 2024, the Indonesia advertising market is valued at USD ~ billion, with a growing CAGR of 4.7% from 2024 to 2030, due to factors like increased internet penetration and a robust e-commerce ecosystem. The market size reflects the expanding digital landscape and the rising influence of social media platforms as primary advertising channels, demonstrating strong potential for further development and investment in various sectors, including FMCG and technology.

Major cities such as Jakarta, Surabaya, and Bandung dominate the Indonesian advertising landscape. Jakarta serves as the central hub for businesses and media agencies, attracting considerable advertising spend due to its large population and economic significance. Surabaya, as the second-largest city, enjoys a growing consumer base, while Bandung offers a youthful demographic that appeals to brands targeting millennials and Gen Z consumers, further driving advertising activities in these regions.

Market Segmentation

By Advertising Channel

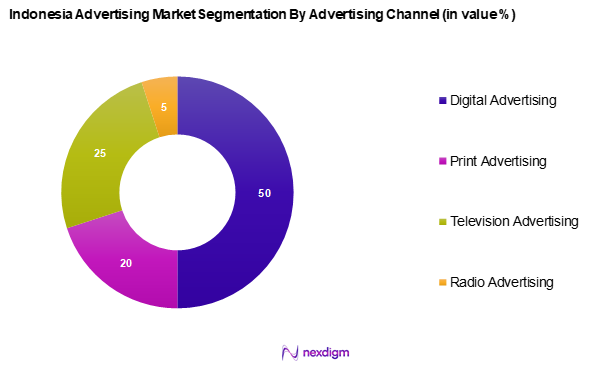

The Indonesia advertising market is segmented into digital advertising, print advertising, television advertising, and radio advertising. Digital advertising currently dominates the market, largely due to the rapid growth of social media and e-commerce platforms. With an increasing number of consumers engaging in online activities, brands are leveraging digital ads to reach targeted audiences more effectively. The interactive nature of digital marketing also allows for real-time engagement, improving return on investment for advertisers.

By Industry Vertical

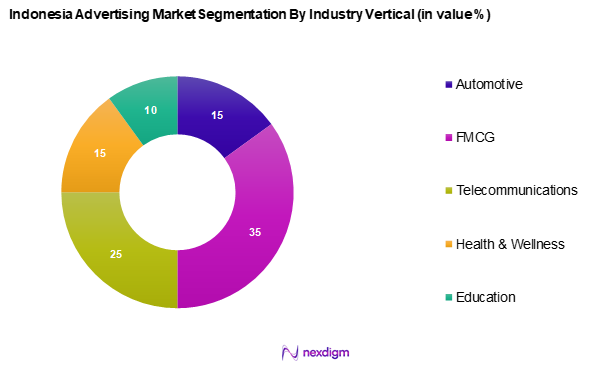

The Indonesia advertising market is segmented into automotive, FMCG, telecommunications, health & wellness, and education. The FMCG sector holds a significant portion of the market share, primarily because of Indonesia’s vast consumer base and the constant demand for daily essentials. Advertisements in this sector focus on achieving brand loyalty and increasing market penetration through various channels, particularly in urban regions, where consumer awareness and competition are high.

Competitive Landscape

The Indonesia advertising market is characterized by a competitive landscape, with several major players driving innovation and market dynamics. Key players include Google Indonesia, Facebook Indonesia, and local agencies like PT Wira Pamungkas Pariwara. This concentration of leading companies indicates a strong reliance on both global platforms and local expertise to maximize advertising effectiveness in a diverse market.

| Company | Establishment Year | Headquarters | Revenue (USD Bn) | Ad Channels | Market Focus | Market

Share (%) |

| Google Indonesia | 2011 | Jakarta, Indonesia | – | – | – | – |

| Facebook Indonesia | 2013 | Jakarta, Indonesia | – | – | – | – |

| PT Wira Pamungkas Pariwara | 1985 | Jakarta, Indonesia | – | – | – | – |

| PT Inter Pariwara Global | 1990 | Jakarta, Indonesia | – | – | – | – |

| WIR Group | 2009 | Jakarta, Indonesia | – | – | – | – |

Indonesia Advertising Market Analysis

Growth Drivers

E-commerce Trends

The rapid expansion of e-commerce in Indonesia has significantly influenced the advertising market. The growing reliance on digital platforms for shopping has led to increased investments in online advertising. Businesses are prioritizing digital channels, with a substantial portion of their marketing budgets dedicated to online advertising. The rise of major e-commerce platforms has set a benchmark for user engagement, prompting higher spending on digital campaigns.

Increased Internet Penetration

The widespread availability of the internet has created a strong foundation for digital advertising in Indonesia. With a continually increasing number of active internet users, businesses recognize the importance of reaching their audience online. The rise in internet access has fueled social media usage, leading to higher engagement on platforms like Instagram and Facebook. Additionally, ongoing efforts to expand broadband coverage into rural areas are expected to enhance advertising reach, further strengthening the digital advertising ecosystem.

Market Challenges

Regulatory Constraints

Indonesia’s advertising market faces challenges due to evolving regulatory frameworks. Stricter compliance requirements for digital advertising practices have been introduced, impacting how businesses allocate their marketing budgets. New transparency measures in digital ad spending have been implemented, leading to increased scrutiny. Non-compliance with these regulations can result in financial penalties or operational restrictions, compelling advertisers to adopt a cautious approach. These regulatory challenges can be particularly daunting for new entrants seeking to establish a foothold in the market.

Competition from Global Brands

The advertising landscape in Indonesia is highly competitive, with global brands establishing a strong presence. International companies with extensive marketing budgets and advanced analytical tools pose a significant challenge for local businesses. Their ability to execute large-scale campaigns often overshadows smaller domestic brands, which must adopt innovative strategies to differentiate themselves. The increasing influence of global players further intensifies competition, making it essential for local advertisers to leverage unique market insights and localized engagement tactics.

Opportunities

Growth of Social Media Advertising

Social media advertising is emerging as a dominant force in Indonesia’s advertising industry. Businesses are increasingly focusing on platforms such as TikTok and Instagram, where engagement levels are high. Consumers are discovering products through social media, prompting brands to invest in targeted advertising campaigns. Influencer marketing has become a crucial strategy, with businesses observing stronger consumer engagement when partnering with social media influencers. This trend represents a significant opportunity for advertisers to enhance their market presence and achieve higher returns on investment.

Expansion of Influencer Marketing

The rise of influencer marketing in Indonesia presents a lucrative growth avenue for advertisers. Businesses are actively collaborating with social media influencers to enhance brand trust and reach a wider audience. Influencers offer authenticity and relatability, making them highly effective for marketing campaigns. As influencer marketing continues to evolve across various digital platforms, brands can target niche markets more effectively. This trend is expected to drive increased investments in influencer partnerships, further strengthening the advertising industry’s effectiveness.

Future Outlook

The Indonesian advertising market is expected to undergo substantial growth in the coming years, fuelled by the rapid digitization of advertising channels and the increasing need for brands to connect with consumers through targeted digital campaigns. The proliferation of mobile devices and improvements in internet accessibility will also play a significant role in shaping advertising strategies, prompting businesses to invest more in innovative solutions and analytics-driven marketing approaches.

Major Players

- Google Indonesia

- Facebook Indonesia

- PT Wira Pamungkas Pariwara

- PT Inter Pariwara Global

- WIR Group

- Tokopedia

- Shopee

- Bukalapak

- Telkomsel

- Indosat Ooredoo

- XL Axiata

- Unilever Indonesia

- Procter & Gamble Indonesia

- Nestle Indonesia

- Djarum Group

- Others

Key Target Audience

- Advertisers and Brand Managers

- Digital Marketing Agencies

- E-commerce Retailers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Communications and Informatics)

- Media Buying Agencies

- Market Research Firms

- FMCG Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesian advertising market. This phase relies on extensive desk research using a combination of secondary and proprietary databases to gather comprehensive industry-level information. The objective here is to identify and define the critical variables that influence market dynamics, such as trends in consumer behaviour and the impact of digital transformation.

Step 2: Market Analysis and Construction

This phase focuses on compiling and analyzing historical data pertaining to the Indonesian advertising market. This includes assessing market penetration, the ratio of advertising expenditures across different channels, and the resultant revenue generation by sector. Evaluating service quality statistics will ensure the reliability and accuracy of the revenue estimates, providing a holistic view of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, market hypotheses will be developed and subsequently validated through consultations with industry experts representing various segments of the advertising sector. These interviews will provide operational and financial insights directly from practitioners, offering a deeper understanding of market trends and helping refine the collected data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple advertising agencies and brands to acquire detailed insights into advertising strategies, consumer preferences, and campaign effectiveness. This interaction is essential for verifying and complementing the quantitative data gathered from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Indonesian advertising market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

E-commerce Trends

Increased Internet Penetration - Market Challenges

Regulatory Constraints

Competition from Global Brands - Opportunities

Growth of Social Media Advertising

Expansion of Influencer Marketing - Trends

Personalization in Advertising

Rise of Video Content - Government Regulation

Advertising Standards

Data Protection Laws - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Channel Distribution, 2019-2024

- By Demographics, 2019-2024

- By Advertising Channel, (In Value %)

Digital Advertising

Print Advertising

Television Advertising

Radio Advertising - By Industry Vertical, (In Value %)

Automotive

FMCG

Telecommunications

Health & Wellness

Education - By Target Audience, (In Value %)

Youth (18-24)

Adults (25-34)

Middle-Aged (35-50)

Seniors (50+) - By Agency Type, (In Value %)

Full-Service Agencies

Digital Agencies

Creative Agencies

Media Buying Agencies - By Region, (In Value %)

Java

Sumatra

Bali

Kalimantan

Sulawesi

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Advertising Channel Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Channel, Number of Touchpoints, Distribution Channels, Market Reach, Digital Presence, and Competitive Strengths)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players in Indonesia Advertising Market

- Detailed Profiles of Major Companies

PT Wira Pamungkas Pariwara

Google Indonesia

Facebook Indonesia

PT Inter Pariwara Global

WIR Group

Tokopedia

Shopee

Bukalapak

Telkomsel

Indosat Ooredoo

XL Axiata

Unilever Indonesia

Procter & Gamble Indonesia

Nestle Indonesia

Djarum Group

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Channel Distribution, 2025-2030

- By Demographics, 2025-2030