Market Overview

The Indonesia Aspherical Lens Market is valued at USD 10 billion in 2024, based on a rigorous analysis of industry data and market trends. This growth is driven by the increasing demand for high-quality vision correction products, advancements in lens manufacturing technologies, and a growing preference for lightweight and aesthetically pleasing eyewear solutions. Moreover, the rising prevalence of vision-related ailments coupled with a broader awareness of eye health significantly contributes to market expansion.

Key cities in Indonesia driving the aspherical lens market include Jakarta, Surabaya, and Bandung. Jakarta, being the capital, serves as a major business hub with a high concentration of optical retailers and healthcare providers, leading to increased consumer access to advanced lens options. Surabaya and Bandung are also pivotal due to their growing middle-class population and increased disposable incomes, fostering a greater demand for premium eyewear products. The urbanized population in these regions often seeks trendy and fashionable eyewear as a lifestyle choice, pushing market growth further.

Technological advancements in lens manufacturing are significantly enhancing the quality and performance of aspherical lenses. Innovations in digital surfacing techniques and photometric adjustments have improved the production of lenses, resulting in higher precision and better visual clarity. In 2022, the value of the global optical lens machinery market reached USD 4.2 billion, and it’s poised for steady growth as manufacturers adopt cutting-edge technologies to create sophisticated lens products.

Market Segmentation

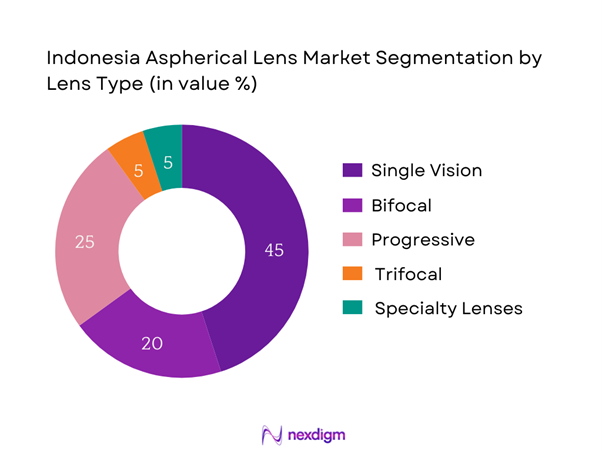

By Lens Type

The Indonesia Aspherical Lens Market is segmented by lens type into single vision, bifocal, progressive, trifocal, and specialty lenses. Among these, single vision lenses dominate market share due to their widespread availability and applicability for most vision correction needs. This segment primarily caters to consumers with either near-sightedness or farsightedness, making it the most practical and sought-after option for everyday use. The simplicity and effectiveness of single vision lenses, combined with tailored options for different user lifestyles, contribute to their leading position within the market.

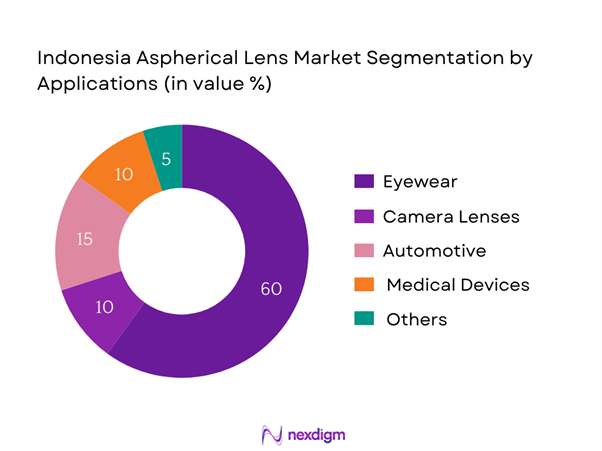

By Application

The market for aspherical lenses is further segmented by application into eyewear, camera lenses, automotive, medical devices, and others. The eyewear segment leads the market due to the growing need for corrective eyewear driven by a rising incidence of vision problems among the aging population and increased screen time among younger demographics. Eyewear not only serves a functional purpose but also provides aesthetic appeal, further driving its consumption. The proliferation of eyewear brands and online shopping platforms has also made acquiring these products more accessible, solidifying its dominant market position.

Competitive Landscape

The Indonesian aspherical lens market is dominated by a few major players, including Essilor, Hoya, and Nikon. These companies hold significant influence over product quality and pricing strategies, establishing themselves as trusted brands within the market. The consolidation of key players enhances competitive dynamics and fosters innovation, ensuring that consumers have access to advanced lens technology and contemporary designs.

| Company | Establishment Year | Headquarters | Market Share (%) | Product Range | R&D Investment (%) | Distribution Channels |

| Essilor | 1849 | Paris, France | – | – | – | – |

| Hoya | 1941 | Tokyo, Japan | – | – | – | – |

| Nikon | 1917 | Tokyo, Japan | – | – | – | – |

| Carl Zeiss | 1846 | Oberkochen, Germany | – | – | – | – |

| Bausch + Lomb | 1856 | Rochester, USA | – | – | – | – |

Indonesia Aspherical Lens Market Analysis

Growth Drivers

Increasing Demand for High-Quality Vision Correction

The increasing demand for high-quality vision correction in Indonesia is driven by a growing prevalence of visual impairment, with approximately 20 million people suffering from vision-related issues as of 2022. This trend correlates with the rise in the urban population, estimated to reach 56.9% by the end of 2024, leading to greater exposure to eye strain from digital screens. Furthermore, the gross national income per capita is anticipated to increase to USD 5,000 in 2024, enabling more consumers to invest in quality eyewear options. As disposable income rises, consumers are more inclined to seek premium lens solutions.

Rising Consumer Awareness Regarding Eye Health

In recent years, there has been a marked increase in consumer awareness regarding eye care in Indonesia, partly driven by health campaigns and a surge in social media information. Reports indicate that around 70% of Indonesians are now aware of the importance of regular eye check-ups, a significant increase from previous years. Public health initiatives by the Indonesian Ministry of Health emphasize the importance of eye care, especially as the population ages, with an estimated 10% of the Indonesian population over 60 years old expected by end of 2025. This rising awareness translates into higher demand for corrective lenses among consumers.

Market Challenges

Competition from Standard Lenses

The Indonesian aspherical lens market faces significant competition from standard lenses, which continue to dominate due to their affordability and broad availability. As of 2023, the value of the global standard lens market reached USD 6 billion, reflecting a strong consumer preference for lower-cost options. Even with the benefits of aspherical lenses, many consumers prioritize budget constraints over performance, causing market players to navigate pricing strategies carefully. The challenge lies in converting cost-sensitive customers to opt for premium lenses that enhance visual comfort and quality, which remains a hurdle in market penetration.

Pricing Pressure

Pricing pressure is a significant challenge for the Indonesian aspherical lens market, exacerbated by economic fluctuations and increasing raw material costs. In 2023, the inflation rate in Indonesia was approximately 4.5%, which has contributed to increased operational costs for manufacturers. Furthermore, the devaluation of Rupiah against major currencies has adversely affected import costs for essential components in lens production. As prices rise, consumers might opt for cheaper alternatives, intensifying competition among manufacturers to maintain their market shares while ensuring product quality.

Opportunities

Growth in E-commerce Platforms

The rapid expansion of e-commerce platforms in Indonesia presents a significant growth opportunity for the aspherical lens market. In 2023, e-commerce sales were valued at USD 53.3 billion, up from USD 43 billion in 2022. Online retailers are increasingly providing a wider variety of eyewear options, including aspherical lenses. This growing digital marketplace allows manufacturers to reach consumers beyond their geographic reach, enhancing product accessibility while catering to the evolving shopping preferences of a tech-savvy population.

Expansion in Automotive Sector

The automotive sector in Indonesia is another key opportunity for aspherical lens manufacturers. With an anticipated increase in vehicle ownership, projected to rise from 12 million in 2022 to over 15 million by end of 2025, the demand for high-performance lenses in automotive displays and headlamps is increasing. Innovations in safe-driving technology are also driving up the requirement for advanced optical solutions in vehicle manufacturing. As automotive companies look for high-quality materials to enhance safety and performance, there is significant potential for growth in aspherical lenses used in vehicle applications. This trend aligns with the government’s commitment to improving transportation safety, which also supports a thriving automotive market.

Future Outlook

Over the next few years, the Indonesia Aspherical Lens Market is expected to experience substantial growth, driven by expanding consumer awareness of eye care, technological advancements in lens production, and an increasing inclination towards fashionable eyewear. The market is also anticipated to benefit from the rising trend of online eyewear shopping, making it easier for consumers to access a variety of lens options. Importantly, as urbanization continues to rise and consumer preferences evolve, market players will need to innovate continually to meet the demands of increasingly quality-conscious customers.

Major Players

- Essilor

- Hoya

- Nikon

- Carl Zeiss

- Bausch +

- Lomb

- Safilo

- Rodenstock

- Marcolin

- Charmant

- De Rigo

- CIBA Vision

- Vision Express

- JINS

- Maui Jim

Key Target Audience

- Optical Retail Chains

- Wholesale Distributors

- Eyecare Professionals (Optometrists and Ophthalmologists)

- E-commerce Platforms

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health, Ministry of Industry)

- Manufacturers of Optical Products

- Marketing and Advertising Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an ecosystem map encompassing all major stakeholders in the Indonesia Aspherical Lens Market. This process relies on comprehensive desk research, incorporating a blend of secondary data and proprietary databases to collect pivotal industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

During this phase, historical data pertaining to the Indonesia Aspherical Lens Market will be compiled and analyzed. This includes evaluating market penetration, the ratio of product types in use, and the resultant revenue generation. Additionally, an assessment of service quality metrics will be conducted to ensure the reliability and accuracy of the revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated by conducting computer-assisted telephone interviews (CATIs) with industry experts who represent a diverse array of companies. These consultations will provide valuable operational insights and financial metrics directly from industry practitioners, which will significantly aid in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase will involve direct engagement with leading aspherical lens manufacturers to derive comprehensive insights into product segments, sales performance, consumer preferences, and other relevant factors. This interaction will serve to confirm and complement the statistics generated from the bottom-up approach, thereby ensuring a thorough, accurate, and validated analysis of the Indonesia Aspherical Lens Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for High-Quality Vision Correction

Technological Advancements in Lens Manufacturing

Rising Consumer Awareness regarding Eye Health - Market Challenges

Competition from Standard Lenses

Pricing Pressure - Opportunities

Growth in E-commerce Platforms

Expansion in Automotive Sector - Trends

Development of Smart Lenses

Sustainability in Lens Manufacturing - Government Regulation

Import Tariffs and Duties

Quality Standards and Certification - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Lens Type (In Value %)

Single Vision

– For Near Vision

– For Distance Vision

Bifocal

– Flat-top Bifocal

– Round Segment Bifocal

Progressive

– Standard Progressive

– Digital Freeform Progressive

Trifocal

– Executive Style

– E-line Trifocal

Specialty Lenses

– Photochromic Aspherical Lenses

– Polarized Aspherical Lenses

– Blue Light Filtering Lenses - By Application (In Value %)

Eyewear

– Prescription Glasses

– Sunglasses

Camera Lenses

– DSLR Camera Lenses

– Smartphone Camera Modules

Automotive

– Head-Up Display (HUD) Lenses

– Advanced Driver Assistance System (ADAS) Cameras

Medical Devices

– Intraocular Lenses (IOL)

– Endoscopic Lenses

Others

– Projectors

– Optical Instruments - By Distribution Channel (In Value %)

Online Retail

Optical Stores

Supermarkets/Hypermarkets - By Region (In Value %)

Java

Sumatra

Bali and Nusa Tenggara

Kalimantan

Sulawesi - By Material Type (In Value %)

Glass

– High-Refractive Index Glass

– Mineral Glass Lenses

Plastic

– CR-39 Plastic

– Lightweight Standard Resin

Polycarbonate

– Impact-Resistant Polycarbonate

– UV-Coated Polycarbonate

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Lens Type Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Lens Type, Distribution Channels, Number of Dealers and Distributors, Production Plant, Capacity, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Essilor

Zeiss

Hoya

Nikon

Carl Zeiss

Bausch + Lomb

Luxottica

Rodenstock

JINS

Marcolin

Safilo

Charmant

De Rigo

CIBA Vision

Vision Express

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030